Notice For Default

Description

How to fill out California Letter From Landlord To Tenant As Notice Of Default On Commercial Lease?

Whether for business purposes or for individual matters, everybody has to handle legal situations at some point in their life. Completing legal paperwork needs careful attention, beginning from picking the proper form sample. For instance, if you select a wrong version of a Notice For Default, it will be turned down when you submit it. It is therefore essential to get a reliable source of legal files like US Legal Forms.

If you have to get a Notice For Default sample, stick to these easy steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Examine the form’s information to make sure it matches your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect document, go back to the search function to find the Notice For Default sample you need.

- Download the file when it matches your needs.

- If you already have a US Legal Forms profile, simply click Log in to access previously saved files in My Forms.

- In the event you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the proper pricing option.

- Finish the profile registration form.

- Select your transaction method: use a credit card or PayPal account.

- Select the file format you want and download the Notice For Default.

- After it is downloaded, you are able to fill out the form by using editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not have to spend time searching for the appropriate sample across the internet. Make use of the library’s simple navigation to get the right template for any situation.

Form popularity

FAQ

1You will be sent a default notice and will usually have 30 days to amend the default by repaying the amount you've missed and any late fees. A home loan default will be recorded in your credit file and can impact your ability to refinance and borrow money. It will likely remain on your credit report for 5 years.

Contact the creditor who has registered the default - you'll need to present documentary evidence to support your case, such as credit card statements, bank statements, or receipts. If the creditor argues the default marker is correct, get in touch with the credit reference agencies.

They payment due on ____Date____ , for $ ______________ has not been paid. Consequently, you are now in default on the said note. Please pay the amount due within the next seven days. If payment is not made within the specified period, we shall proceed to enforce our rights to collect the entire balance.

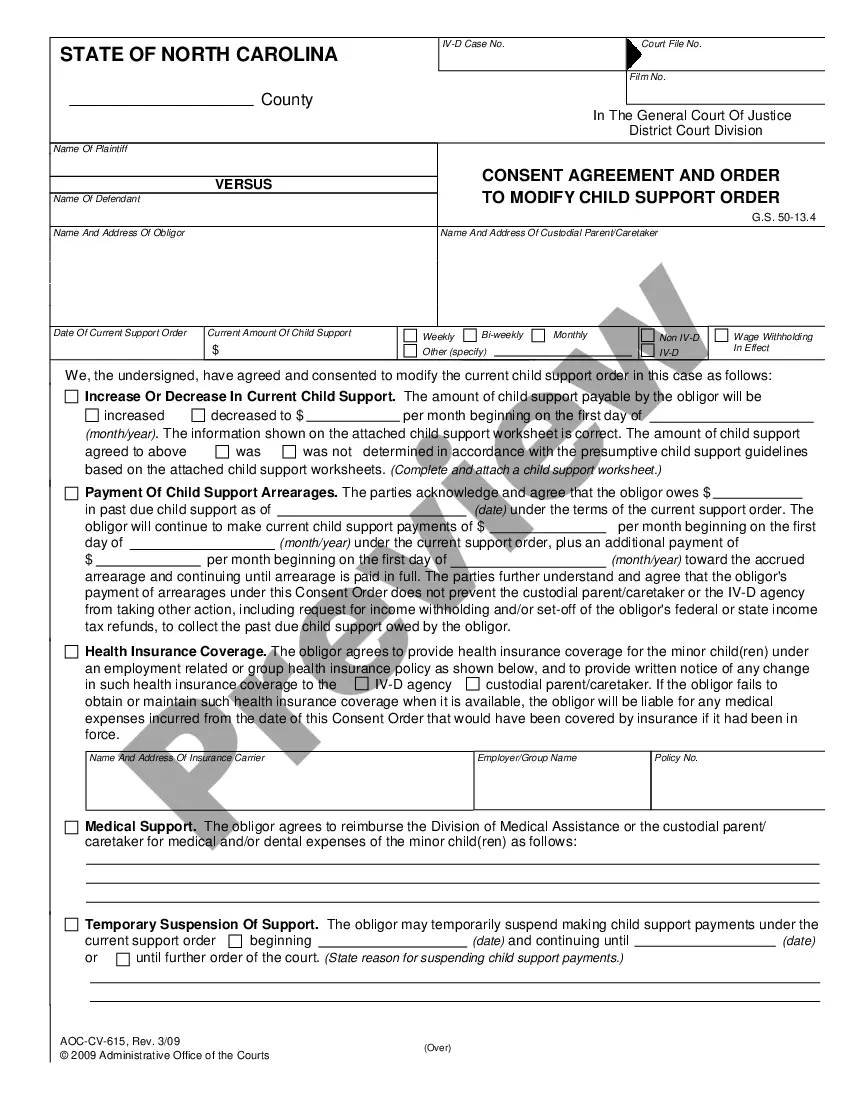

How Notices of Default Work The name and address of the borrower. The name and address of the lender. The legal address of the property. Full details on the nature of the default. What action is required to cure the default. The deadline and the intentions of the lender if the deadline is passed without a cure.

The default notice you receive will usually be written up as a formal letter, explaining that you've broken the terms of your agreement with your creditor. It should include the following information: Details of your name and address, as well as the name and address of the company you owe money to.