Default Notice Format

Description

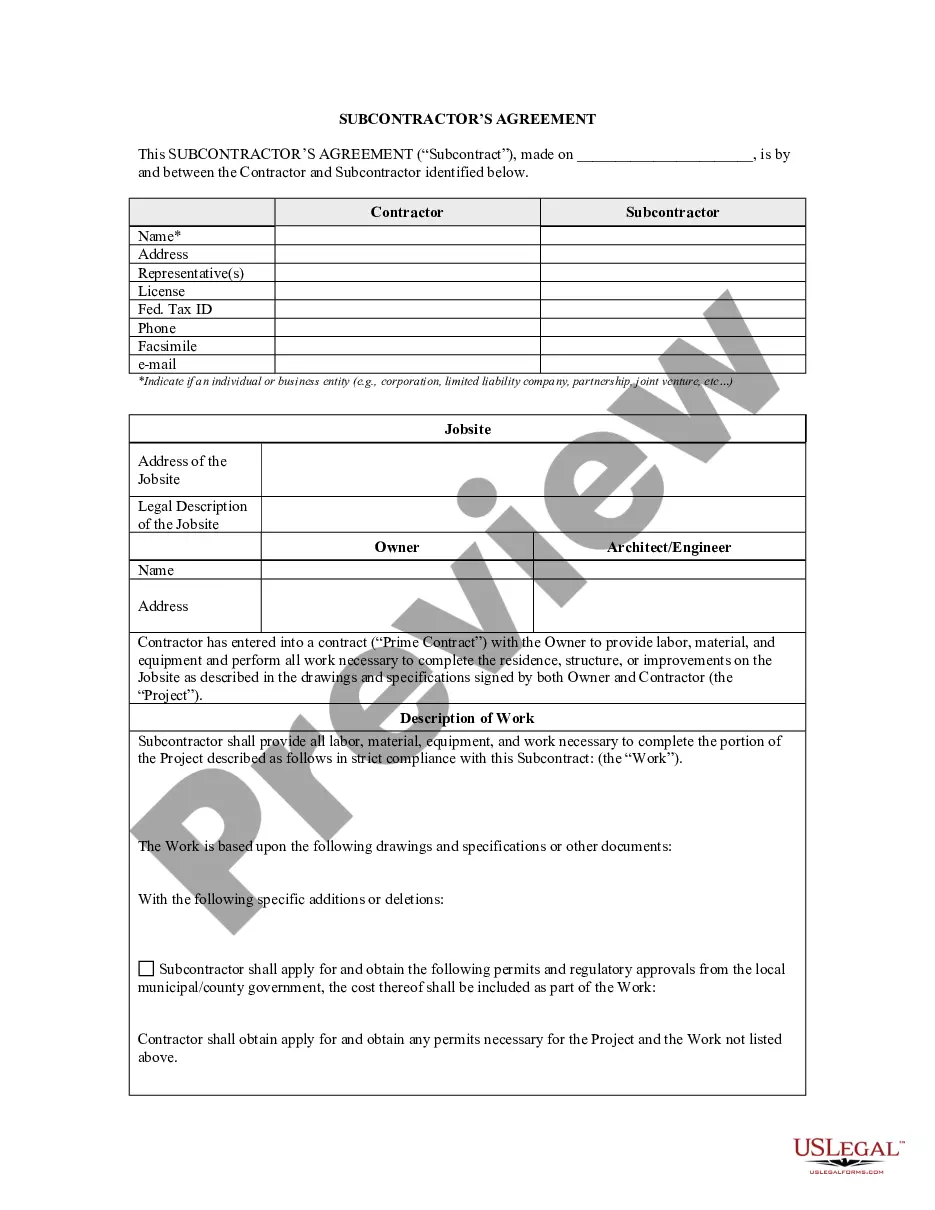

How to fill out California Letter From Landlord To Tenant As Notice Of Default On Commercial Lease?

Finding a go-to place to take the most current and relevant legal samples is half the struggle of working with bureaucracy. Finding the right legal documents calls for precision and attention to detail, which is the reason it is vital to take samples of Default Notice Format only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and view all the information about the document’s use and relevance for the circumstances and in your state or county.

Take the following steps to finish your Default Notice Format:

- Use the library navigation or search field to locate your sample.

- View the form’s description to see if it fits the requirements of your state and region.

- View the form preview, if available, to make sure the form is the one you are looking for.

- Return to the search and find the proper template if the Default Notice Format does not match your requirements.

- When you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Choose the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by picking a transaction method (bank card or PayPal).

- Choose the file format for downloading Default Notice Format.

- Once you have the form on your device, you may change it with the editor or print it and finish it manually.

Get rid of the inconvenience that accompanies your legal paperwork. Explore the extensive US Legal Forms collection where you can find legal samples, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

The first thing you want to do is send out a number of letters. Whoever is attempting to foreclosure on you, on that person you should send a debt validation letter (DVL). Often, a debt validation letter (DVL) will stall the foreclosure.

Receiving a default notice is serious and can result in your creditor passing on your debt to a debt collection agency, or even starting legal proceedings against you to recover the debt.

You are hereby notified that you have defaulted to pay the instalment amount of $_____________ due on _____________________________. I hereby make demand on you for full payment of the entire balance due on said note, including interest accrued till date.

Information That Will Be in the Notice of Default A Notice of Default will include the following: Name and address of the borrower. Name and address of the lender. The property address and description of the property.

A default notice should show the following information: Your name and address (as the borrower) and the name and address of the creditor who is issuing the default notice. The type of agreement and details of how the agreement was broken. The action you need to take to pay the arrears in full by a certain date.