Lease Transfer Form Vic

Description

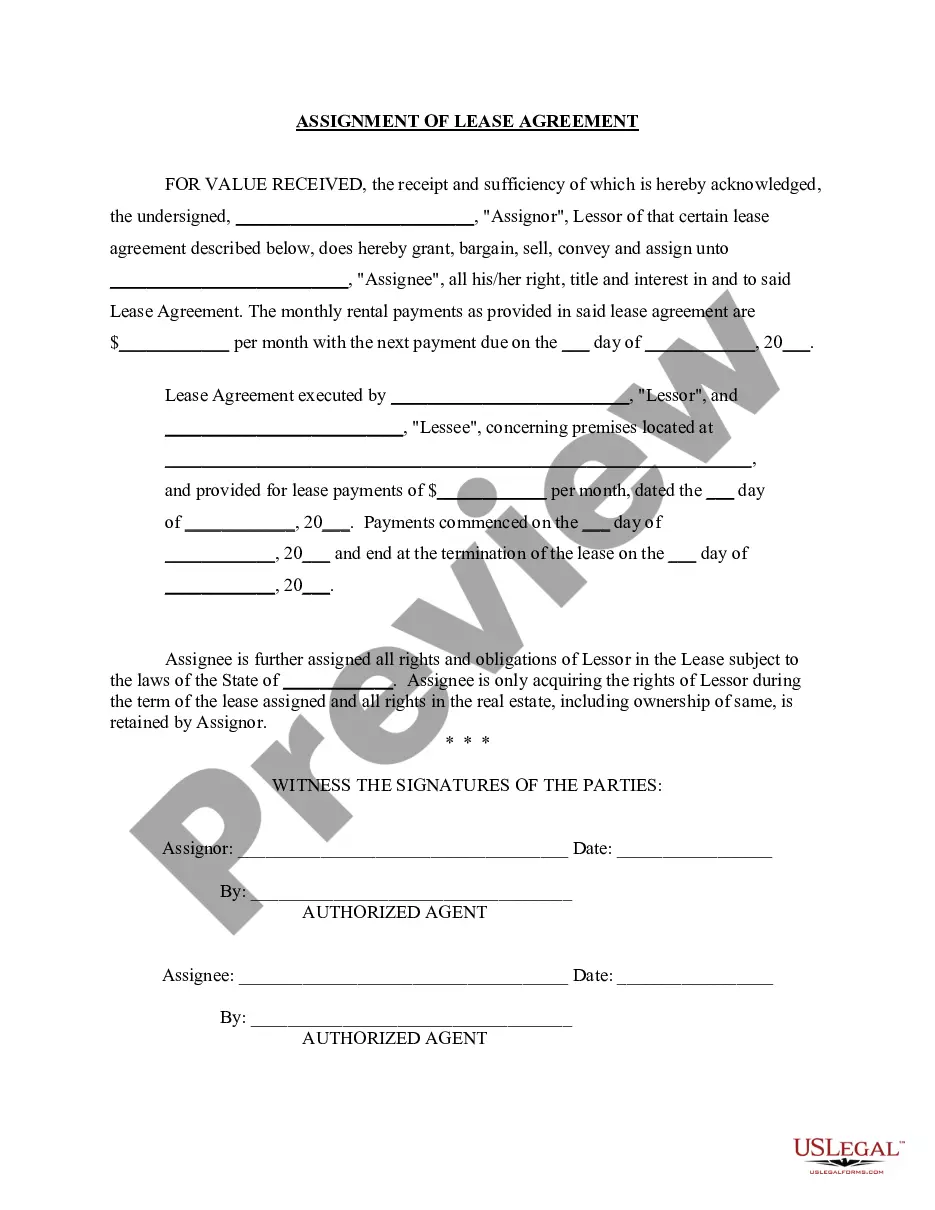

How to fill out California Assignment Of Lease From Lessor With Notice Of Assignment?

Creating legal documents from the ground up can occasionally be daunting.

Some situations may require extensive research and significant financial investment.

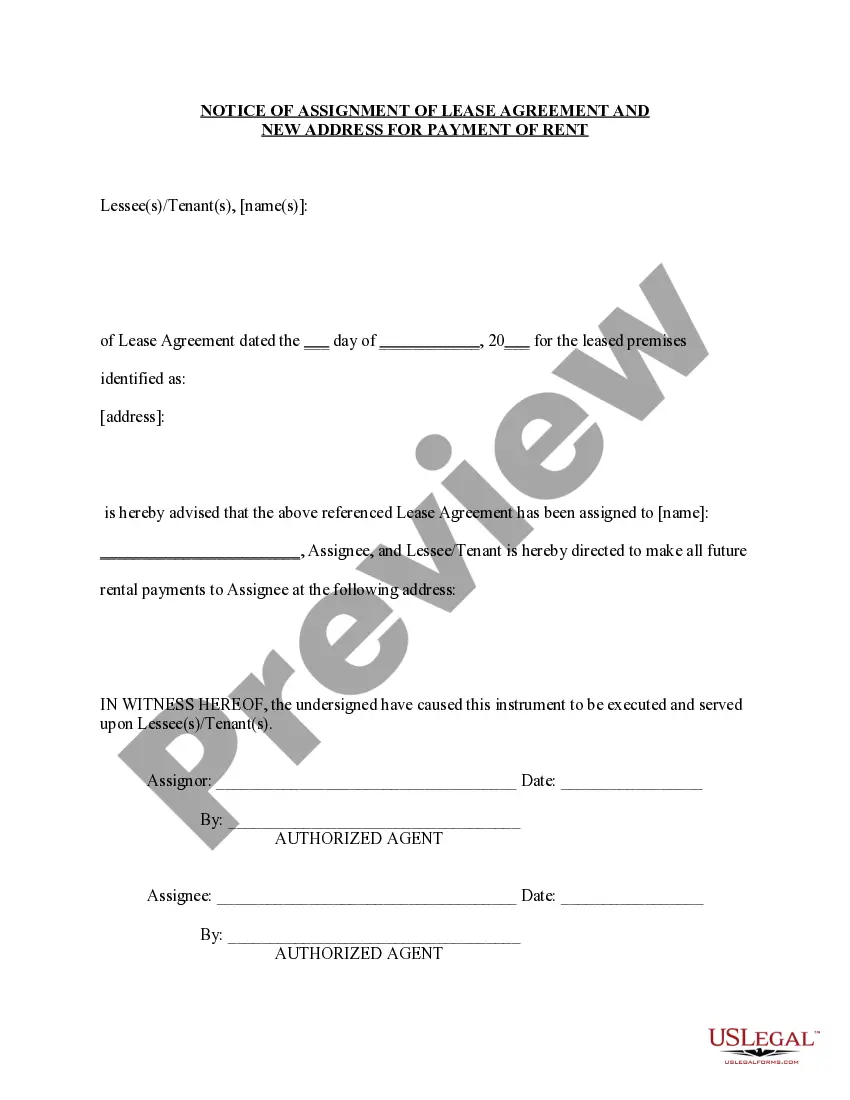

If you are looking for a more straightforward and economical method of preparing the Lease Transfer Form Vic or any other documents without unnecessary complications, US Legal Forms is readily accessible.

Our digital collection of over 85,000 current legal templates covers nearly all facets of your financial, legal, and personal affairs.

However, before proceeding to download the Lease Transfer Form Vic, consider these suggestions: Review the form preview and descriptions to confirm that you have located the document you need. Ensure that the template you choose adheres to the regulations and laws of your specific state and county. Select the appropriate subscription option to obtain the Lease Transfer Form Vic. Download the file, fill it out, sign it, and print it. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us today and make document completion an effortless and efficient process!

- With just a few clicks, you can immediately obtain state- and county-specific forms carefully crafted by our legal experts.

- Utilize our platform whenever you require dependable and trustworthy services to easily find and download the Lease Transfer Form Vic.

- If you are familiar with our services and have already established an account, all you need to do is Log In to your account, pick the template, and download it, or re-download it later in the My documents section.

- Don’t have an account? Not an issue. Registering one is a quick process that allows you to browse the catalog.

Form popularity

FAQ

You are considered a Montana resident after having lived 180 consecutive days in Montana. After establishing Montana residency, you must live in the state of Montana a minimum of 120 days a year. Your principal home must be located in Montana.

Phone bill. School transcript or report card. Voter registration card. If you do not have a permanent address, please obtain a written statement of letterhead from a Mondana Social Services Agency verifying residency status and a descriptive address.

Call Us. To speak to a Citizen Service Representative, call our Call Center: Phone. (406) 444-6900.

Residency Requirements have been physically living in Montana for at least 180 consecutive days immediately prior to purchasing a resident license; register your vehicle(s) in Montana; be registered to vote in Montana if you're registered to vote at all;

The amount of your Montana income tax liability on line 20 of your 2021 Montana tax return, OR. $1,250 for single, married filing separately, or head of household filing statuses; and $2,500 for married filing jointly.

Montana Income Taxation of a Nonresident. The taxpayer would compute the Montana income tax on the total income, typically at a marginal 6.9% rate, and then pay 10% of that tax to Montana since Montana source income is 10% of the total income.

We will begin issuing Individual Income Tax Rebates in July 2023. Individual Income Tax Rebates will be issued in the order that a 2021 tax return was filed. All Individual Income Tax Rebates will be issued by December 31, 2023.

Changing your address is easy. You can download and complete a change-of-address form at revenue.mt.gov. (Click on ?Forms? and then on form ADD-CH; or just click here: .) Or, call our Help Desk at (406) 444-6900.