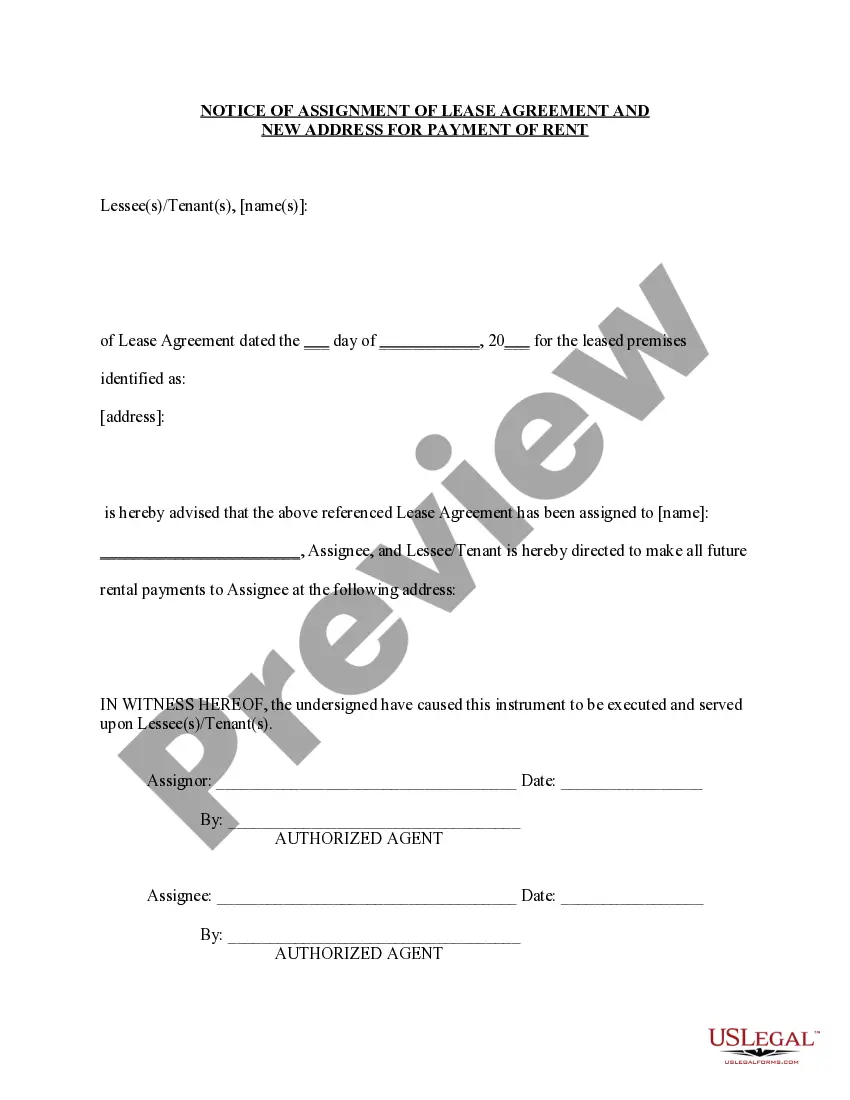

Lease Assignment Of

Description

How to fill out California Assignment Of Lease From Lessor With Notice Of Assignment?

It’s clear that you cannot transform into a legal specialist instantly, nor can you determine how to swiftly create a Lease Assignment Of without possessing a specific set of talents.

Assembling legal documents is a labor-intensive process that demands unique education and expertise. So why not entrust the creation of the Lease Assignment Of to the experts.

With US Legal Forms, which has one of the most extensive legal document collections, you can locate anything from courtroom papers to templates for internal business communication.

You can regain access to your documents from the My documents tab at any time.

If you’re a current client, you can simply Log In and locate and download the template from the same tab.

- Search for the needed document using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if Lease Assignment Of is what you’re looking for.

- Start your search again if you require any additional template.

- Create a free account and choose a subscription plan to acquire the template.

- Click Buy now. After the payment is completed, you can obtain the Lease Assignment Of, fill it out, print it, and send it or mail it to the relevant individuals or organizations.

Form popularity

FAQ

Call Us. To speak to a Citizen Service Representative, call our Call Center: Phone. (406) 444-6900.

The Individual Income Tax Rebate amount depends on a taxpayer's 2021 filing status and the amount of tax paid for 2021, which can be found on line 20 of the 2021 Montana Form 2.

How to apply for your Montana Property Tax Rebate on TAP YouTube Start of suggested clip End of suggested clip Click on apply for the property tax rebate. Fill out your social security number fill out yourMoreClick on apply for the property tax rebate. Fill out your social security number fill out your geocode. Your geocode is a 17 digit code that identifies your Montana property. Read the Declaration.

The amount of your Montana income tax liability on line 20 of your 2021 Montana tax return, OR. $1,250 for single, married filing separately, or head of household filing statuses; and $2,500 for married filing jointly.

Your rebate is not subject to Montana's state income tax.

It can take up to 90 days to issue your refund and we may need to ask you to verify your return. Please check your refund status using Where's My Refund in our TransAction Portal (TAP).

The Montana Property Tax Rebate provides qualifying Montanans up to $675 of property tax relief on a primary residence in both 2023 and 2024. The qualifications to claim the rebate are at GetMyRebate.mt.gov.

The rebate amount will be the lesser of: The amount of your Montana income tax liability on line 20 of your 2021 Montana tax return, OR. $1,250 for single, married filing separately, or head of household filing statuses; and $2,500 for married filing jointly.