Retroactive Rent Abatement Form Canada

Description

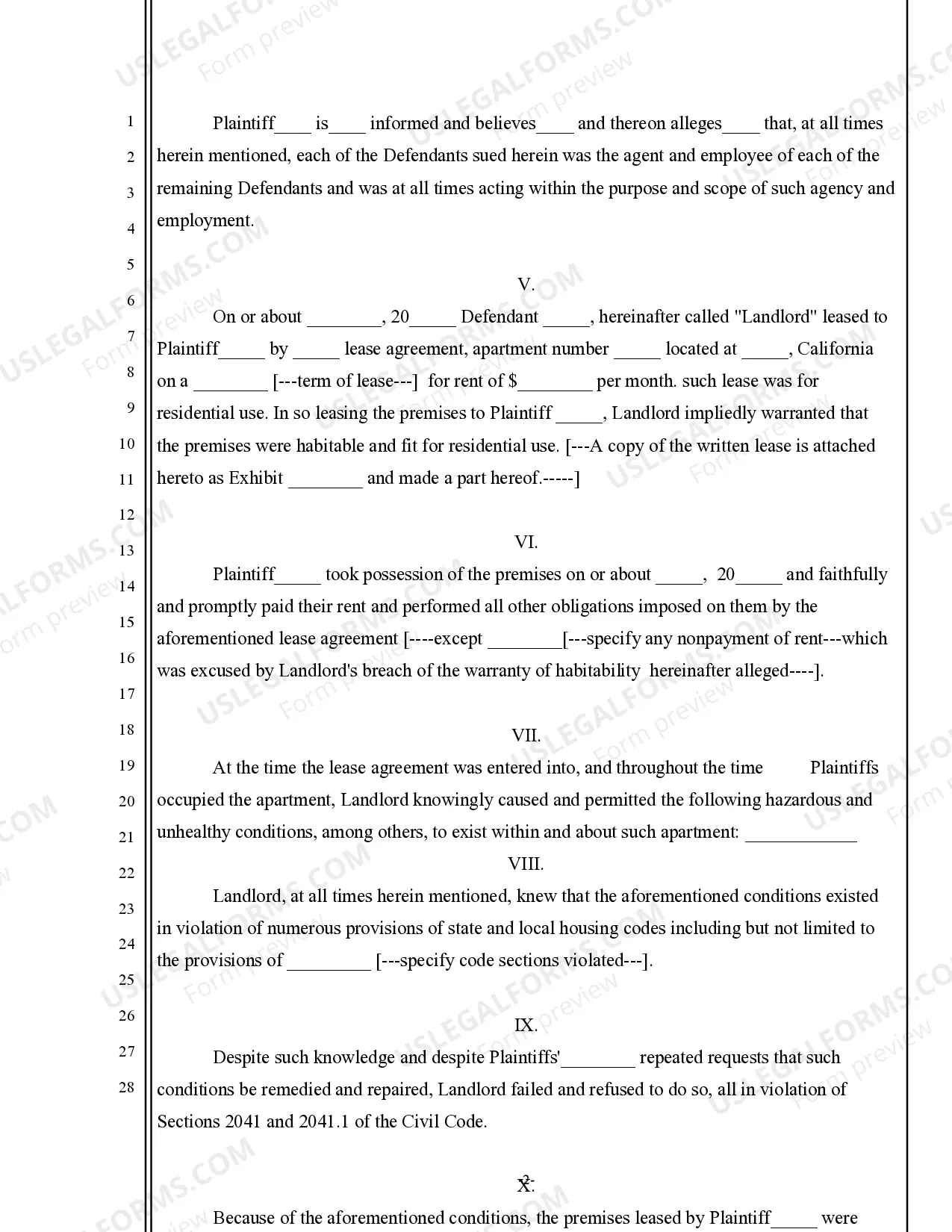

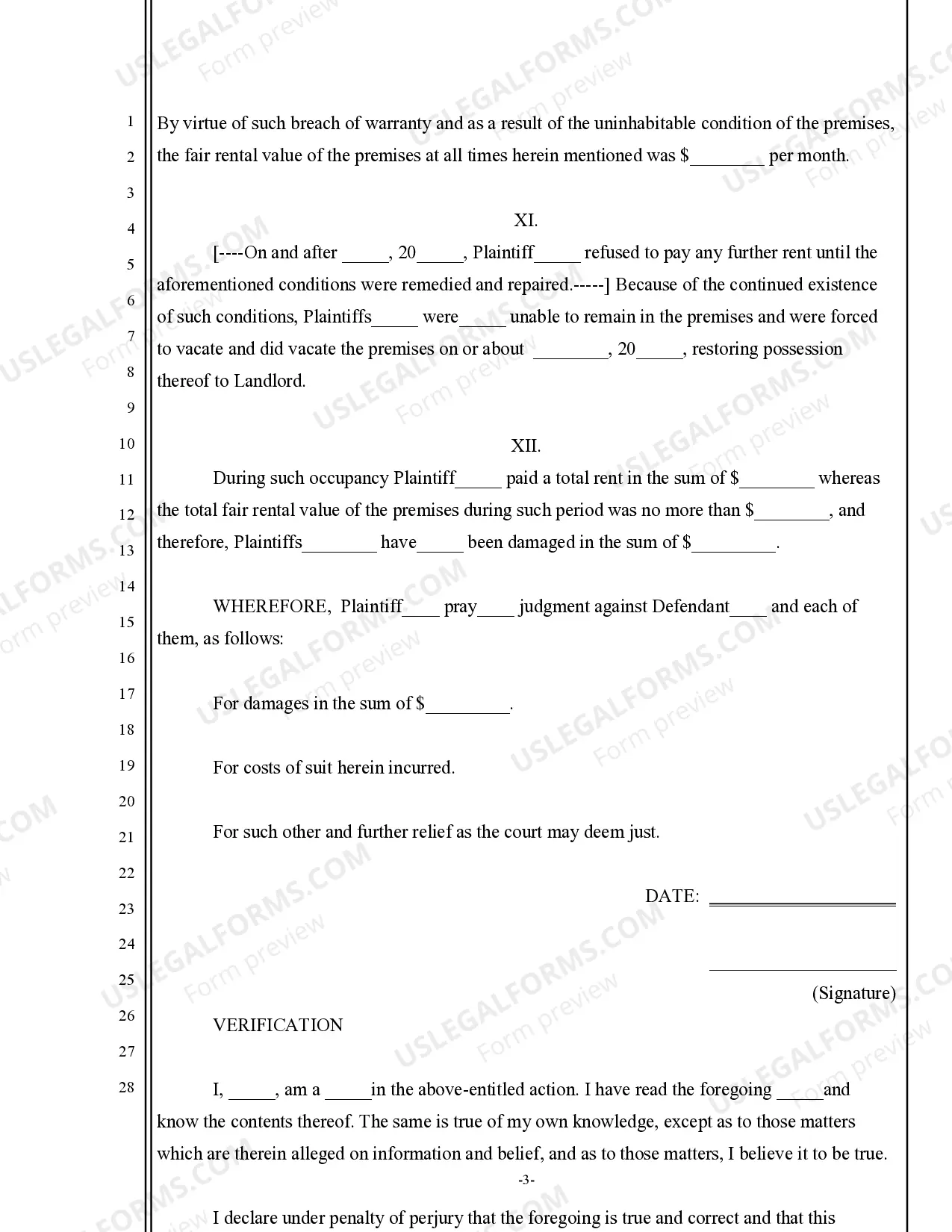

How to fill out California Complaint For Retroactive Rent Abatement?

The Retroactive Rent Abatement Form Canada displayed on this page is a versatile legal document created by experienced attorneys in accordance with national and local laws and regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal professionals with more than 85,000 validated, state-specific documents for various business and personal circumstances. It is the fastest, most straightforward, and most reliable method to acquire the forms you require, as the service assures the utmost level of data protection and anti-malware safety.

Re-download your documents whenever necessary. Access the My documents tab in your profile to retrieve any previously purchased forms.

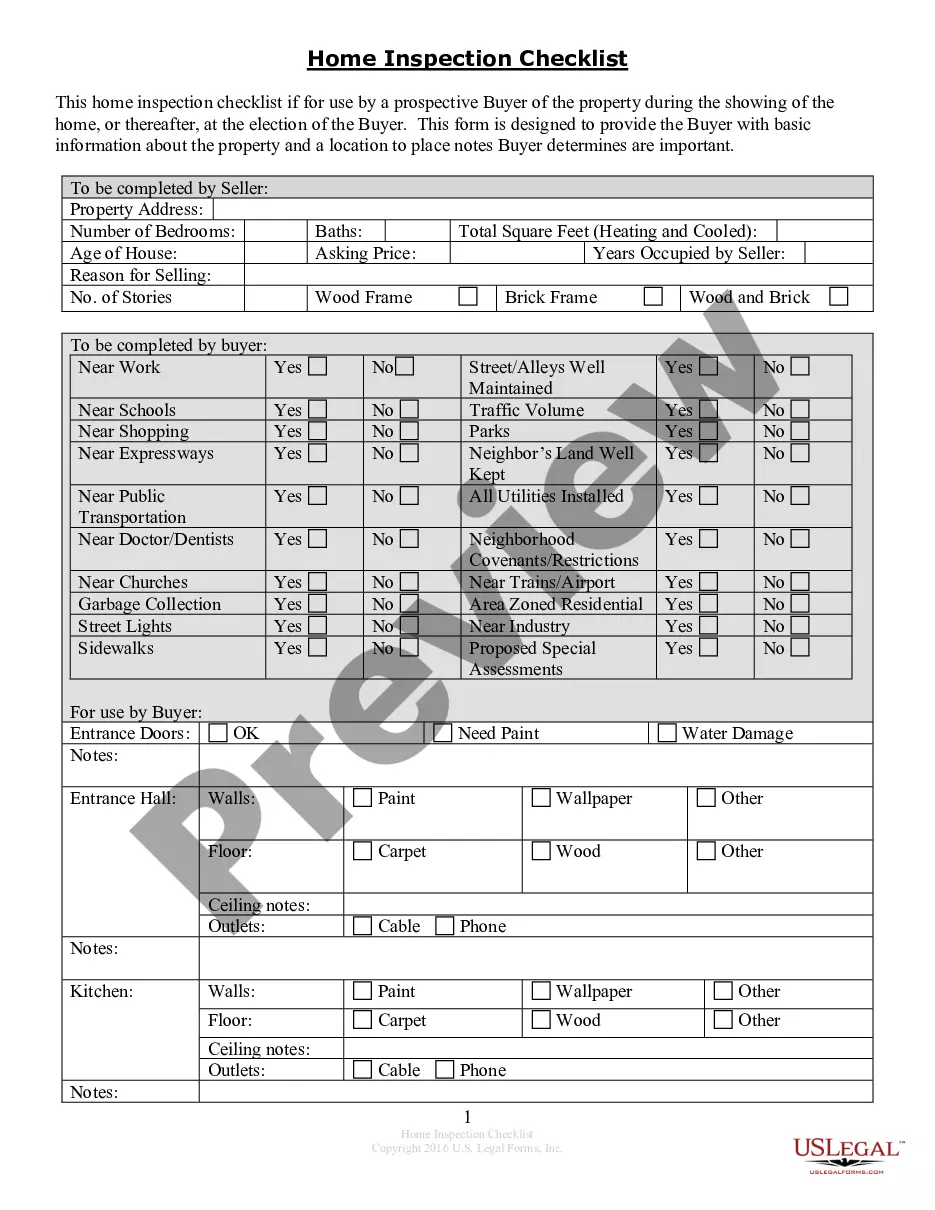

- Search for the document you need and examine it.

- Browse through the file you found and preview it or check the form description to make sure it meets your requirements. If it doesn’t, use the search feature to find the appropriate one. Click Buy Now once you have located the template that you require.

- Choose and Log In.

- Pick the subscription plan that fits you best and create an account. Use PayPal or a credit card for a swift transaction. If you already have an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Retroactive Rent Abatement Form Canada (PDF, Word, RTF) and store the sample on your device.

- Complete and sign the document.

- Print out the template to fill it in by hand. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with a valid signature.

Form popularity

FAQ

N10 is used when a landlord and tenant agree to increase the rent by more than the rent guideline. You can file Form L1 and Form L2 applications using e-File.

Adjusted gross income is gross income less deductions from a business or rental activity and 21 other specific items. Several deductions (e.g. medical expenses and miscellaneous itemized deductions) are limited based on a percentage of AGI.

An AGI allows the landlord to transfer the costs incurred onto their tenants. The landlord must file an L5 application with the LTB, where they document all of the costs incurred in order to justify the requested rent increase.

Unlike a fine, a rent abatement is intended to compensate a tenant for a contravention of a tenant's rights or a breach of the landlord's obligations. An administrative fine should not be confused with costs.

You can use this application to apply to the Landlord and Tenant Board (LTB) for an. order allowing a rent increase of more than the guideline for any or all of the rental. units in the residential complex in any or all of the following cases: ? The municipal taxes and charges for the residential complex increased by ...