Retro Hra Meaning

Description

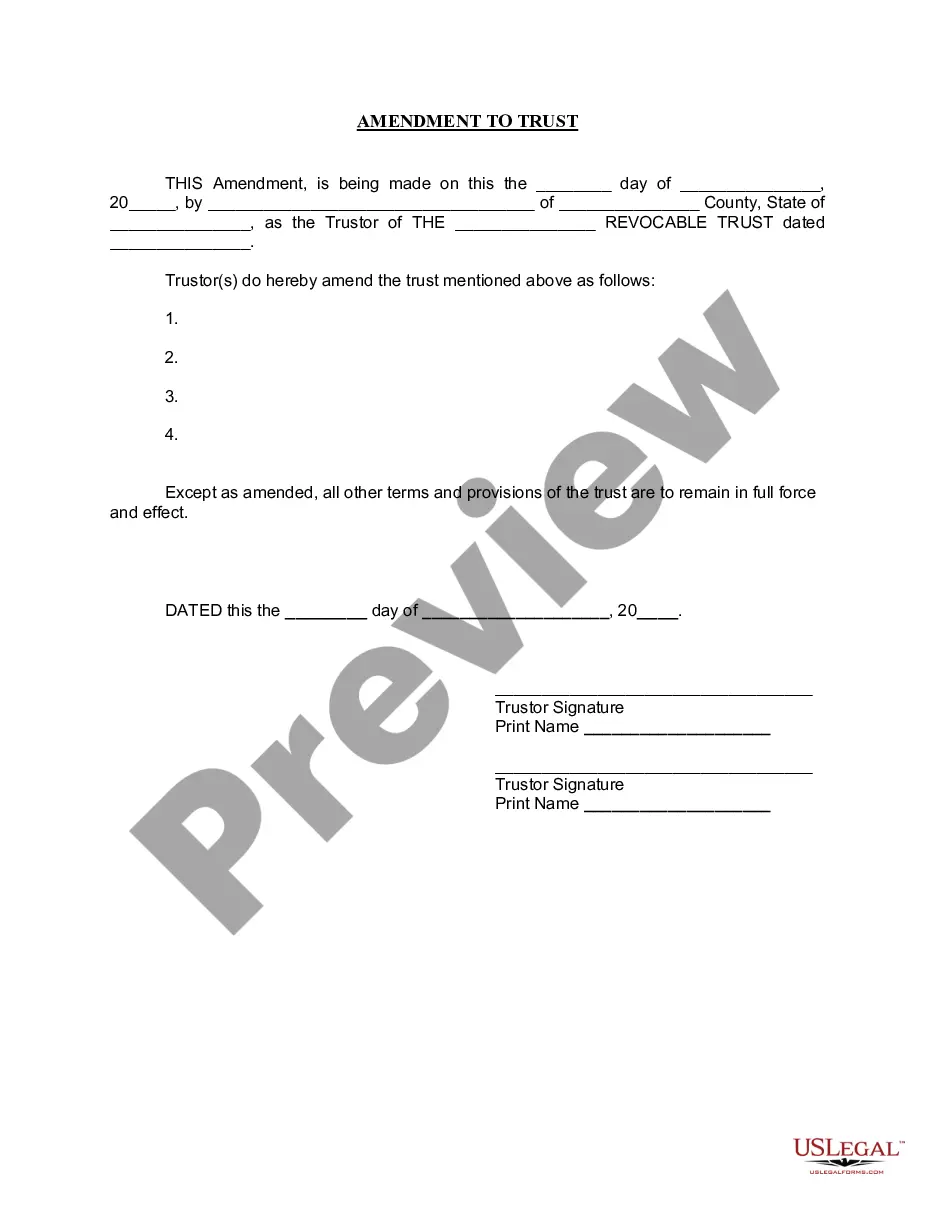

How to fill out California Complaint For Retroactive Rent Abatement?

Managing legal documents can be daunting, even for proficient professionals.

When seeking a Retro Hra Meaning and lacking the time to dedicate to finding the accurate and current version, the procedures can become stressful.

US Legal Forms accommodates all your requirements, from personal to corporate documents, all in one place.

Utilize cutting-edge tools to complete and oversee your Retro Hra Meaning.

Here are the steps to follow after downloading the form you require: Confirm it is the correct form by previewing it and reviewing its details. Ensure that the template is accepted in your state or county. Select Buy Now when you are prepared. Choose a monthly subscription option. Select the format you need, and Download, complete, sign, print, and send your document. Take advantage of the US Legal Forms online library, backed by 25 years of expertise and reliability. Transform your everyday document management into a straightforward and user-friendly process today.

- Access a resource pool of articles, guides, handbooks, and materials that are highly pertinent to your circumstances and requirements.

- Conserve effort and time searching for the documents you need, and leverage US Legal Forms’ advanced search and Preview tool to locate Retro Hra Meaning and download it.

- If you hold a membership, Log In to your US Legal Forms account, look for the form, and download it.

- Check the My documents tab to review the documents you've previously downloaded and manage your folders as desired.

- If this is your first experience with US Legal Forms, create a complimentary account to enjoy unrestricted access to all platform benefits.

- A robust online form repository could be a transformative solution for anyone looking to handle these matters effectively.

- US Legal Forms is a leading provider in online legal documents, offering over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can access legal and business forms specific to your state or county.

Form popularity

FAQ

Your payslip will have paid you too little because it won't include that overtime shift. If so, you'll see 'Retro pay' appear on your next payslip, correcting the amount by which you'd previously been under-paid.

To calculate retro pay, subtract what you paid the employee from what you should have paid the employee. Use their gross pay when calculating, then withhold taxes after.

Retroactive pay, more often shortened to retro pay, is a type of compensation. Typically, retro pay is owed to an employee for any work commenced from a previous pay period, such as the month before. It essentially defines a shortfall in an employee's pay history.

Here are a few examples: Overtime: forgetting to multiply overtime hours by 1.5. Shift differentials: failing to pay an increased rate for hours worked outside an employee's normally scheduled shift. Commissions: with some accounting methods, a late-paying client may delay funds for paying out commissions.

Retroactive pay or ?retro pay? is a name used by some payroll systems to describe the process by which employers reimburse employees who were either not paid or underpaid during a previous payroll cycle.