Check Stop On Payment

Description

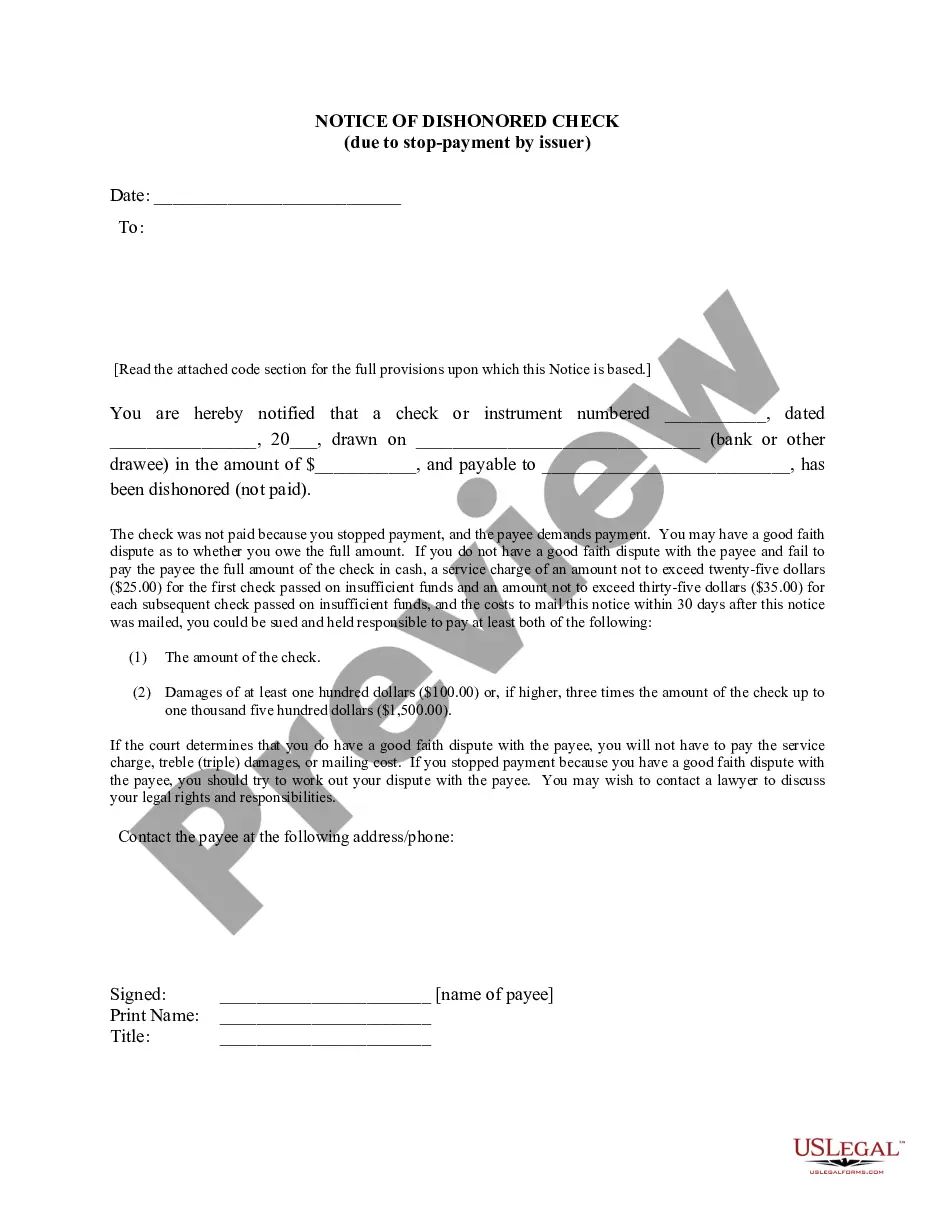

How to fill out California Notice Of Dishonored Check - Civil - Only For Stopped Payment - Keywords: Bad Check, Bounced Check?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and substantial financial investment.

If you seek a simpler and more budget-friendly approach to preparing Check Stop On Payment or any other documents without navigating through obstacles, US Legal Forms is always available for you.

Our online library of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-compliant documents meticulously crafted for you by our legal experts.

Review the document preview and descriptions to verify that you have located the document you seek. Ensure the template you select meets your state and county requirements. Choose the most appropriate subscription plan to acquire the Check Stop On Payment. Download the file, then complete, certify, and print it out. US Legal Forms takes pride in its impeccable reputation and over 25 years of expertise. Join us today and make form execution a straightforward and efficient process!

- Utilize our platform whenever you require trusted and dependable services through which you can effortlessly locate and download the Check Stop On Payment.

- If you are familiar with our services and have previously registered an account, simply Log In to your account, choose the form and download it or re-download it at any time later in the My documents section.

- Don’t have an account? No worries. It takes minimal time to create one and explore the library.

- Before diving straight into downloading Check Stop On Payment, adhere to these suggestions.

Form popularity

FAQ

Once a check is deposited and the funds are cleared, it cannot typically be retrieved or taken back. However, if you have valid reasons, such as fraud, you should contact your bank immediately for assistance. They may guide you through the process of disputing the transaction. Understanding the implications of a check stop on payment can help you manage your finances more effectively.

Yes, you can block a payment from your checking account by initiating a check stop on payment. This process allows you to prevent a specific check from being cashed or deposited. You may also consider placing a hold on your account for a more comprehensive approach to managing unauthorized transactions. Using platforms like uslegalforms can help you find the necessary forms and guidance to easily manage these requests.

Stopping payment on a check that has already been deposited can be challenging. Once a check is cleared and funds are withdrawn, it is generally too late to halt the payment. However, you can inquire with your bank about potential options if you suspect fraud or an error. It's crucial to act quickly and communicate with your bank to explore possible solutions.

To place a check stop on payment, start by contacting your bank or financial institution. You can usually do this online, via phone, or by visiting a local branch. Provide the necessary details, such as the check number and amount, to ensure accurate processing. US Legal Forms offers resources that guide you through this process, making it easier for you to safeguard your finances.

You should consider placing a check stop on payment if you believe your check has been lost or stolen. Additionally, if you realize you made an error and want to prevent the check from being cashed, a stop payment is a wise choice. It can also be beneficial if you suspect fraud or if the payee has not fulfilled their end of the agreement. By acting quickly, you can protect your funds and minimize potential losses.

A check stop on payment is a request made to your bank to prevent the processing of a specific check. When you initiate this request, your bank will put a hold on the check, ensuring that it cannot be cashed or deposited. This process protects you from unauthorized transactions or errors. To initiate a check stop on payment, you will typically need to provide details like the check number, amount, and recipient.

Generally, state law provides that if you make your stop-payment request in time and in writing, the bank or credit union won't be able to cash the check for six months. If you make the request by phone and do not follow up in writing, it won't be able to cash the check for fourteen days.

Generally, a customer cannot order a stop payment on a cashier's check, and the bank must honor a cashier's check when it is presented for payment. This is because a cashier's check is drawn directly on the bank that issues the check, not on your account.

Generally, banks honor a stop payment request for a check drawn on your account. If you stop payment properly and the bank cashes the check, the bank may be liable for the cashed check. you fail to provide sufficient notice to implement the stop payment order.

The good news is that placing a stop payment on a check or transaction does not directly affect your credit score. Credit reporting agencies do not include stop payments in their calculations when determining credit scores.