California Payment Property With Tax

Description

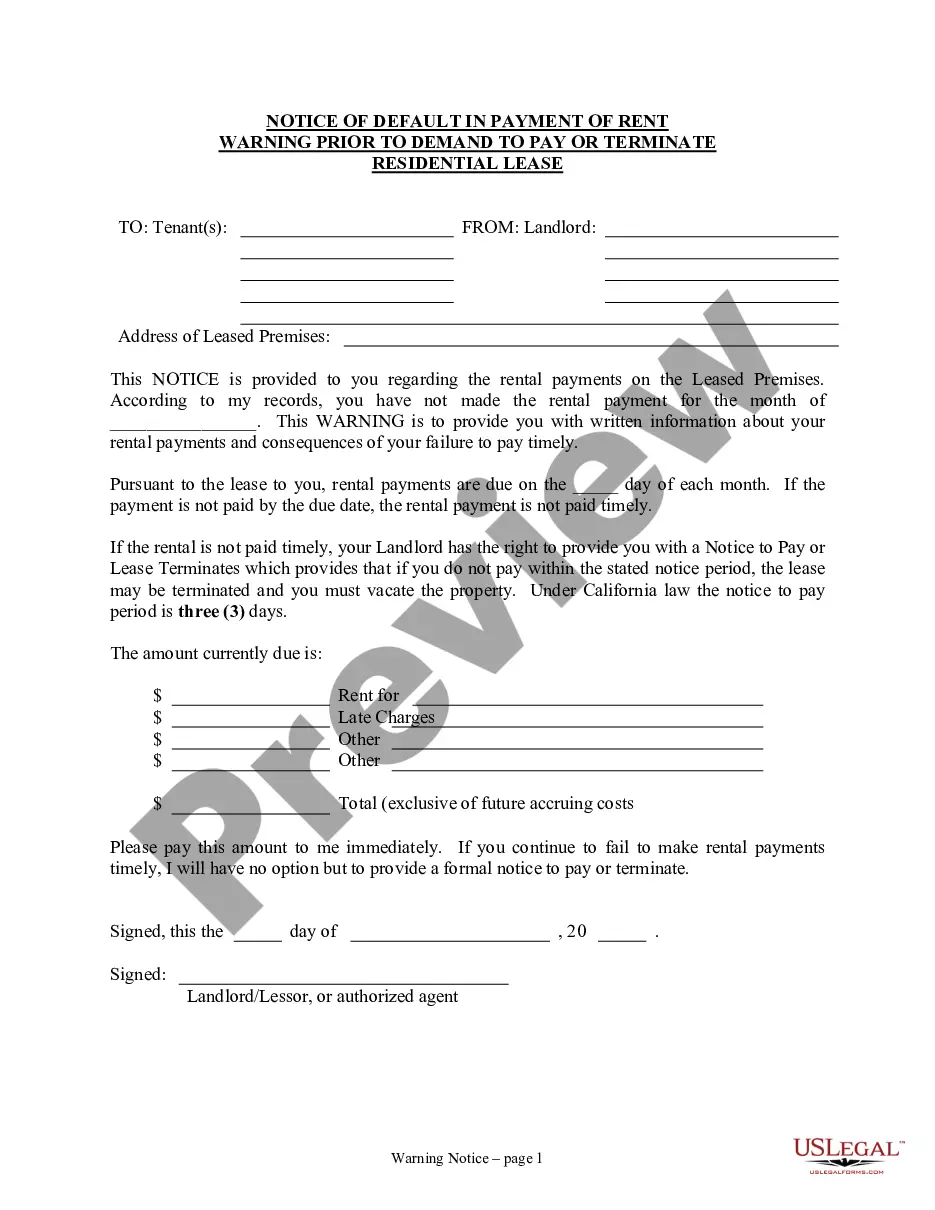

How to fill out California Notice Of Default In Payment Of Rent As Warning Prior To Demand To Pay Or Terminate For Residential Property?

Whether for enterprise objectives or for individual matters, everyone has to handle legal issues at some point in their life.

Filling out legal paperwork requires meticulous focus, starting from selecting the appropriate form template.

Once it is saved, you can fill out the form with the aid of editing software or print it and complete it by hand. With an extensive US Legal Forms catalog available, you no longer need to waste time searching for the suitable template online. Utilize the library's straightforward navigation to locate the right template for any occasion.

- Locate the example you require using the search bar or catalog navigation.

- Review the form's information to confirm it aligns with your situation, state, and county.

- Click on the form's preview to inspect it.

- If it is the wrong form, return to the search function to find the California Payment Property With Tax template you need.

- Download the document when it satisfies your requirements.

- If you possess a US Legal Forms account, click Log in to access previously stored templates in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate payment option.

- Complete the account registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the document format you prefer and download the California Payment Property With Tax.

Form popularity

FAQ

California Form 593 is typically filled out by the seller of real estate when a property sale occurs. This form is used to report the withholding of tax on the sale of California property, ensuring compliance with state tax laws. If you are selling property and want to ensure accurate reporting and payment of taxes, using platforms like USLegalForms can simplify the process. They provide guidance tailored to California payment property with tax, making your transaction smoother.

Yes, you can write off your property taxes on your income tax return if you itemize your deductions. This can significantly affect the amount of taxable income you report. Understanding the California payment property with tax allows you to take full advantage of this write-off. For more detailed help, uslegalforms can provide the necessary tools and resources.

To claim your California property tax refund, you typically need to file a claim form with your county assessor's office. Make sure to provide all necessary documentation to support your claim. This process ties into the California payment property with tax system, ensuring you receive any refunds due. If you need assistance, uslegalforms can guide you through the steps.

CA form 593 is filed by individuals who sell real estate and need to report withholding on the sale. This form is primarily for sellers who are not residents of California and must ensure compliance with California tax laws. Understanding the implications of California payment property with tax can help streamline this process. If you have questions about filing, uslegalforms offers valuable insights.

Yes, property taxes are generally deductible from California state income tax. However, there are specific limitations and rules that you must follow to claim this deduction. Knowing these nuances can help you take full advantage of the California payment property with tax opportunity. If you need assistance, uslegalforms can provide the necessary resources.

In California, property owners can generally claim property tax on their taxes. This includes individuals who own their home or other real estate. It's important to note that only the property owner can claim the deduction, so if you are renting, you cannot claim property tax. Understanding how California payment property with tax works can help you maximize your benefits.

Yes, you can arrange to make monthly payments for your property taxes in California, but this typically requires setting up an agreement with your local tax authority. Many counties offer payment plans to help residents manage their tax obligations without overwhelming financial strain. Ensuring you stay current with your payments is essential to avoid penalties. For guidance on setting up these payments, US Legal Forms offers helpful resources for understanding California payment property with tax.

In California, paying property tax does not automatically grant ownership of a property. Ownership is established through the deed, which is a legal document that transfers property rights. However, consistent payment of property taxes is crucial for maintaining ownership rights and preventing foreclosure. If you seek clarity on property ownership and taxes, consider using resources like US Legal Forms to navigate the complexities of California payment property with tax.