California Payment Property For Foreigners

Description

How to fill out California Notice Of Default In Payment Of Rent As Warning Prior To Demand To Pay Or Terminate For Residential Property?

Legal documents handling can be perplexing, even for seasoned professionals.

If you're searching for a California Payment Property For Foreigners and lack the time to seek the correct and current version, the process can become overwhelming.

Gain access to a valuable collection of articles, guides, manuals, and resources pertinent to your situation and requirements.

Save time and exertion searching for the documents you require, utilizing US Legal Forms’ sophisticated search and Preview feature to locate California Payment Property For Foreigners and acquire it.

Benefit from the US Legal Forms online library, backed by 25 years of expertise and credibility. Transform your routine document management into a seamless and user-friendly experience today.

- If you hold a membership, Log In to your US Legal Forms account, search for the document, and obtain it.

- Visit the My documents section to view the documents you have previously saved and manage your folders as needed.

- If it's your initial experience with US Legal Forms, create a free account and gain limitless access to all the advantages of the library.

- After acquiring the form you desire, follow these steps.

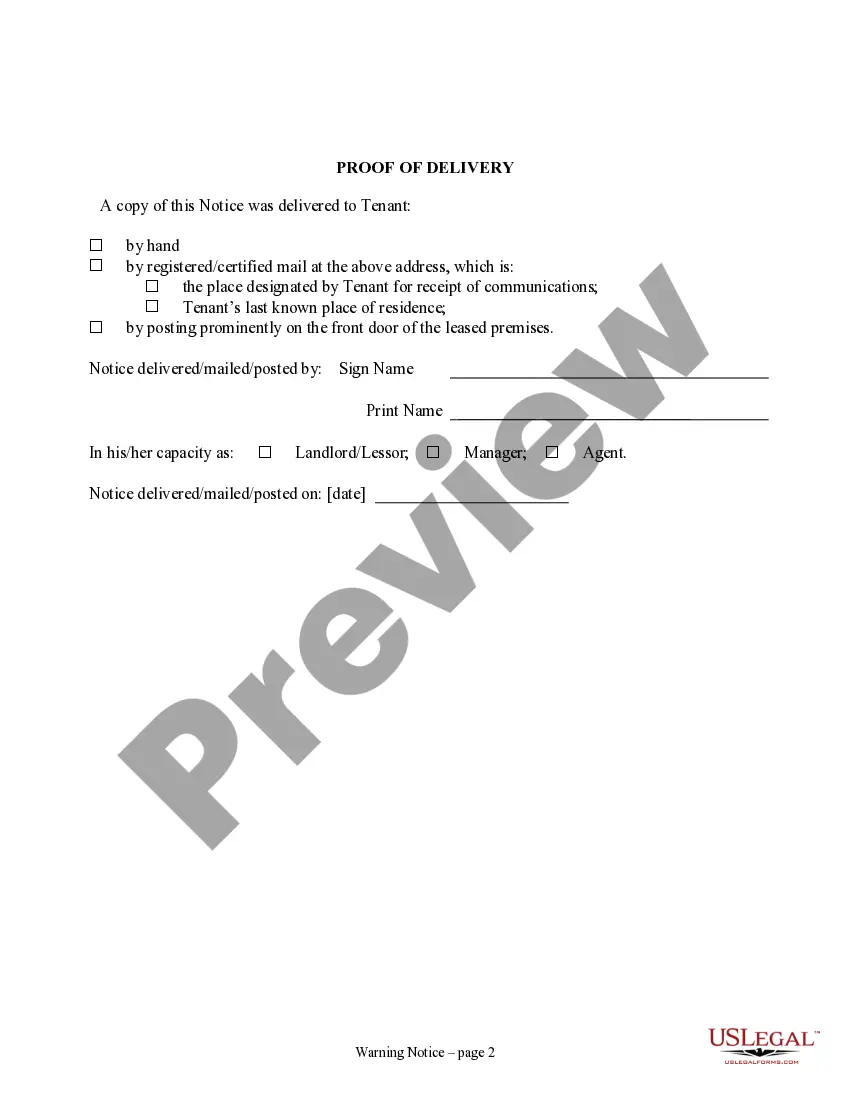

- Verify that this is the correct form by previewing it and reviewing its description.

- Ensure that the template is recognized in your state or county.

- Click Buy Now when you're prepared.

- Choose a subscription plan.

- Select your preferred format, then Download, complete, eSign, print, and dispatch your document.

- Leverage state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you may encounter, from personal to corporate paperwork, all consolidated in one platform.

- Employ sophisticated tools to finalize and manage your California Payment Property For Foreigners.

Form popularity

FAQ

To afford a $400,000 house in California, your income should ideally be around $100,000 to $120,000 annually. This estimate includes factors like mortgage payments, property taxes, and insurance. When exploring California payment property for foreigners, consider additional costs such as maintenance and utilities. It's wise to create a budget to ensure your investment aligns with your financial capabilities.

You can definitely buy a house in California without being a citizen. The process is straightforward, allowing you to invest in the property market just like any citizen. When considering California payment property for foreigners, it is essential to consult with real estate experts who can guide you through the buying process. This way, you can ensure a smooth transaction and protect your investment.

Non-citizens are allowed to buy property in California without legal barriers. Many foreigners invest in California real estate, making it an attractive market for international buyers. As a non-citizen, you can explore various options for California payment property for foreigners, ensuring you find a property that meets your needs. Just be sure to understand the local real estate laws and regulations.

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.

If you are a nonresident with a business, trade, or profession that conducts business both within and outside California, the income generated from business you conduct within California is California source-income and is taxable in the state.

As a nonresident, you pay tax on your taxable income from California sources. Sourced income includes, but is not limited to: Services performed in California.

FTB Form 588, Nonresident Withholding Waiver Request Nonresident payee who qualifies can use Form 588 to get a waiver from withholding based generally on California tax filing history. Form 588 must be submitted at least 21 business days before payment is made.

During escrow, the remitter would be the REEP as they are the one submitting the payment and Form 593. The remitter is the person who will remit the tax withheld on any disposition from the sale or exchange of CA real estate and file the prescribed forms on the buyer's/transferee's behalf.