California Termination Tenancy Ca Form 100 Instructions

Description

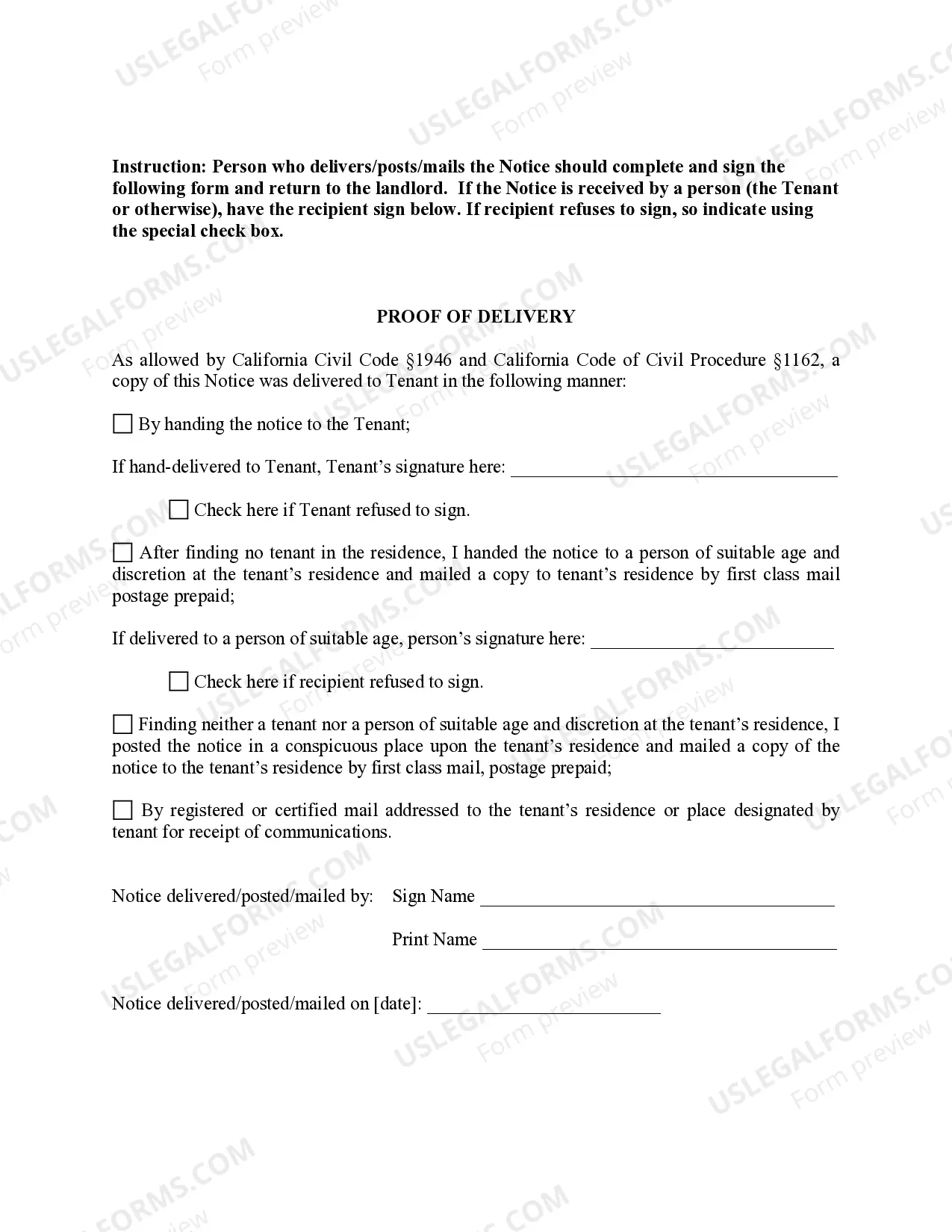

How to fill out California 60 Day Notice Of Termination - Residential Month-to-Month Tenancy?

Managing legal documents can be perplexing, even for the most experienced experts.

If you're in need of California Termination Tenancy Ca Form 100 Instructions and lack the time to find the right and current version, the process can be overwhelming.

Leverage a valuable repository of articles, guides, and materials related to your situation and requirements.

Save time and effort searching for the documents you need, and utilize US Legal Forms’ advanced search and Review tool to find California Termination Tenancy Ca Form 100 Instructions and obtain it.

Take advantage of the extensive US Legal Forms online library, backed by 25 years of expertise and dependability. Transform your daily document management into a seamless and user-friendly experience today.

- If you're a current subscriber, Log Into your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to see the documents you've previously saved and manage your folders as necessary.

- If this is your first experience with US Legal Forms, create an account to enjoy unlimited access to all platform benefits.

- After obtaining the form you need, make sure to verify it is the correct version by previewing it and reviewing its details.

- Ensure that the template is valid in your state or county.

- Hit Buy Now when you're ready to proceed.

- Select a subscription plan.

- Choose the desired file format and Download, complete, eSign, print, and send your documents.

- Possess access to legal and business forms that are state- or county-specific.

- US Legal Forms caters to all your needs, whether they pertain to personal or business documentation, in one convenient place.

- Utilize sophisticated tools to complete and manage your California Termination Tenancy Ca Form 100 Instructions.

Form popularity

FAQ

Filing form 100S involves completing the necessary sections of the form and submitting it to the California Franchise Tax Board. You can file online for faster processing or mail a completed paper form. To ensure a smooth filing process, making use of the California termination tenancy CA form 100 instructions can guide you through each step.

CA 100S must be filed by S corporations that conduct business in California, including those with income from various sources. It is critical for these corporations to comply with state tax regulations to avoid penalties. Being well-versed with the California termination tenancy CA form 100 instructions will help ensure that your filing is accurate and timely.

Form 100S must be filed with the California Franchise Tax Board, similar to form 100. Depending on your preference, you can file electronically or by mailing in the paper form. Referencing the California termination tenancy CA form 100 instructions can provide clarity on the best submission method for your situation.

Yes, it is possible to file an S Corporation yourself, but it requires attention to detail and understanding of the relevant tax laws. Utilizing online platforms like uslegalforms can simplify the process, providing clear guidelines and resources. Following the California termination tenancy CA form 100 instructions can further assist you in completing the filing accurately.

Form 100 should be filed with the California Franchise Tax Board. You can choose to file either electronically or via mail, depending on your preference and the resources available to you. Following the California termination tenancy CA form 100 instructions will make the filing process smoother and more manageable.

Claiming 0 allowances typically results in more tax being withheld from your paycheck, which may lead to a refund when you file your taxes. However, claiming 1 allowance may allow you to keep more of your income throughout the year. Evaluating your personal financial situation alongside the California termination tenancy CA form 100 instructions can help you determine the best option for your circumstances.

CA form 100W is a tax form used by S corporations in California to report income, deductions, and credits. This form helps S corporations comply with state tax laws and provides important information for tax calculations. Familiarizing yourself with the California termination tenancy CA form 100 instructions can help you navigate the filing process effectively.

Individuals and businesses that operate in California must file CA form 100 if they meet certain income thresholds. Specifically, corporations conducting business in California, including S corporations, are required to file this form. Understanding the California termination tenancy CA form 100 instructions is essential to ensure compliance and avoid penalties.

CA form 100 should be filed with the California Franchise Tax Board, either electronically or by mail. Make sure to keep copies for your records, as this form is essential for corporations operating in California. It's crucial to follow the filing instructions closely to avoid any issues. For comprehensive California termination tenancy ca form 100 instructions and other related forms, explore the resources on uslegalforms.

You should mail your California 1040 tax return to the address specified in the form's instructions. Depending on whether you are receiving a refund or making a payment, there are different addresses provided for your convenience. Always double-check that you have filled everything correctly before sending it. For related issues, our website offers easy-to-follow California termination tenancy ca form 100 instructions that can assist you with various state forms.