This is a notice provided by the Landlord to Tenant explaining that once the lease term has expired. Tenant has the option of vacating the premises or remaining on the premises provided that they abide by the posted rent increase.

Carta Para Subir La Renta Formal

Description

How to fill out California Letter From Landlord To Tenant About Intent To Increase Rent And Effective Date Of Rental Increase?

The Formal Notice to Increase Rent you find on this site is a versatile legal template crafted by expert lawyers in accordance with national and local regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal professionals with more than 85,000 validated, state-specific documents suitable for any professional and personal need. It’s the quickest, easiest, and most reliable method to acquire the documents you require, as the service ensures the utmost level of data security and malware protection.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances readily available.

- Search for the document you require and examine it. Browse through the file you searched for and preview it or review the description to confirm it meets your needs. If it doesn’t, use the search function to find the correct one.

- Register and Log In. Choose the payment plan that best fits you and create an account. Utilize PayPal or a credit card for a swift purchase. If you already have an account, Log In and check your membership to proceed.

- Get the editable template. Select the format you prefer for your Formal Notice to Increase Rent (PDF, Word, RTF) and save the document on your device.

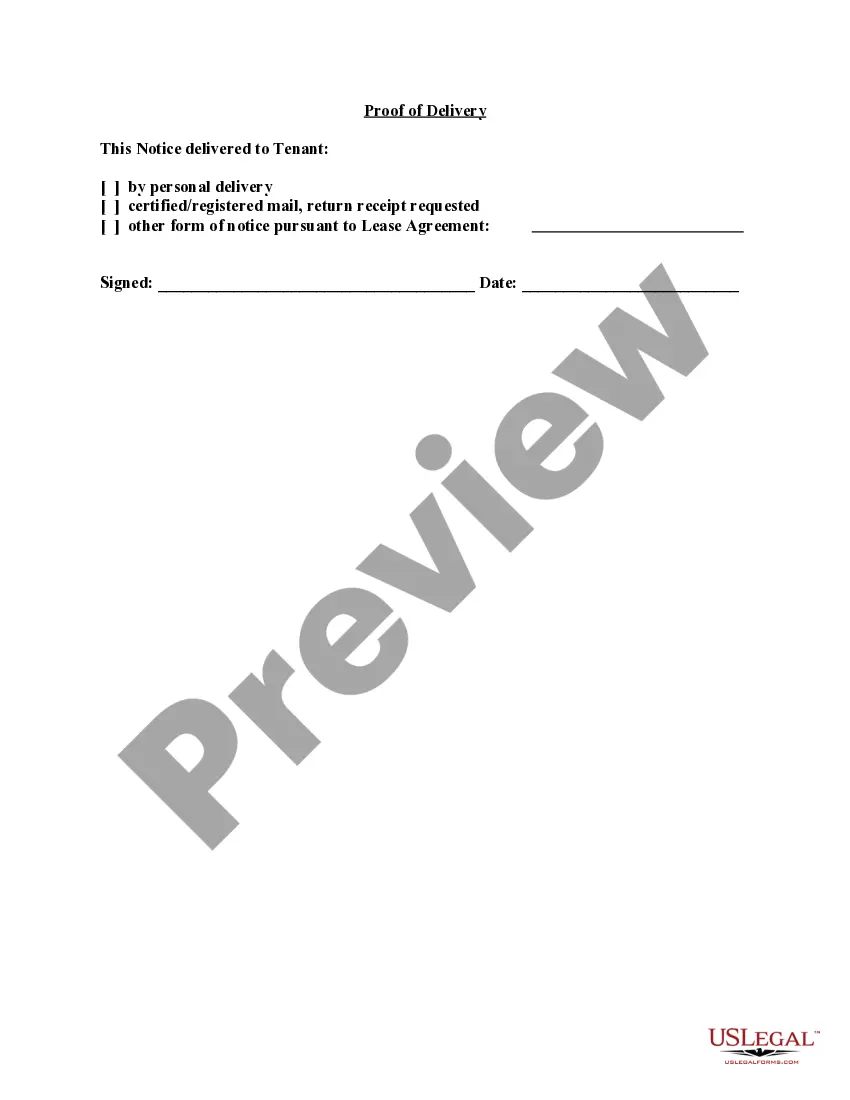

- Fill out and sign the document. Print the template to complete it manually. Alternatively, use an online versatile PDF editor to swiftly and accurately fill in and sign your form electronically.

- Redownload your documents as needed. Access the same document anytime you need it. Go to the My documents section in your account to redownload any previously acquired forms.

Form popularity

FAQ

You can verify the EIN with the IRS TIN Match system or use Tax1099's super fast real-time TIN match program (more on this as you scroll). If the EIN and the legal name of the entity match the records of the IRS, it's an EIN match.

Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online. The IRS will not email or fax the letter, they will send it via mail within eight to ten weeks of issuing your company a Federal Tax ID Number.

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

You can apply online Monday through Friday from 7 AM to 10 PM Eastern Standard Time. Your EIN is issued immediately upon submitting your application. You can complete and fax the EIN application (Form SS-4). For Washington businesses, you should fax your application to: 855-641-6935.

This EIN confirmation letter is called CP 575, and the IRS only mails the letter to the mailing address listed on line 4 of the SS-4 application. Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

An EIN is always in the following format. XX-X and never has letters. You may be looking at a control number or your employer may have made a mistake.

Here are the steps to take if you misplace your IRS EIN confirmation letter: Call the IRS: If you need to contact the IRS, it'll have to be over the phone. To get a copy of your verification letter, you can call them toll-free at 1-800-829-4933. This is the ?business and specialty tax line.?