Limited Partners

Description

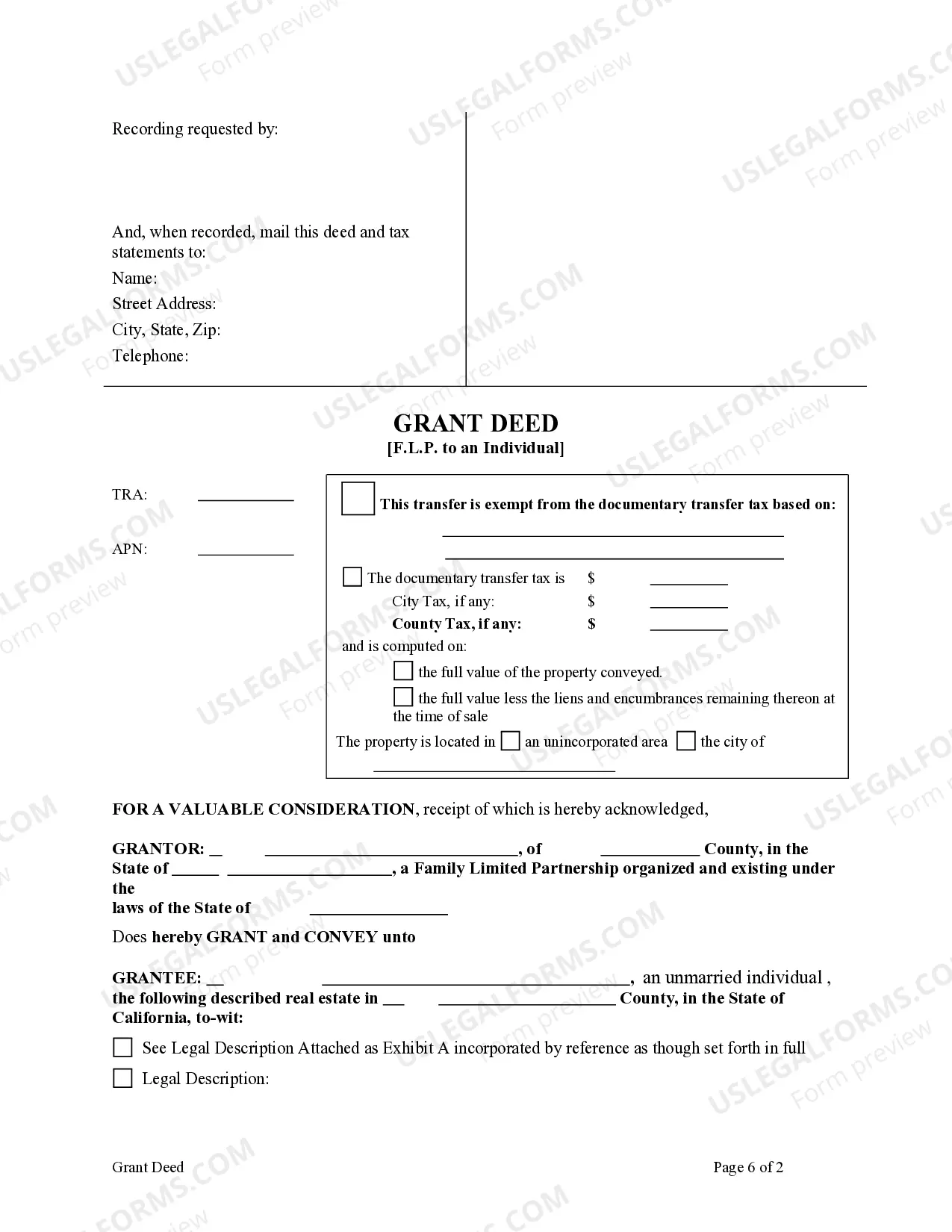

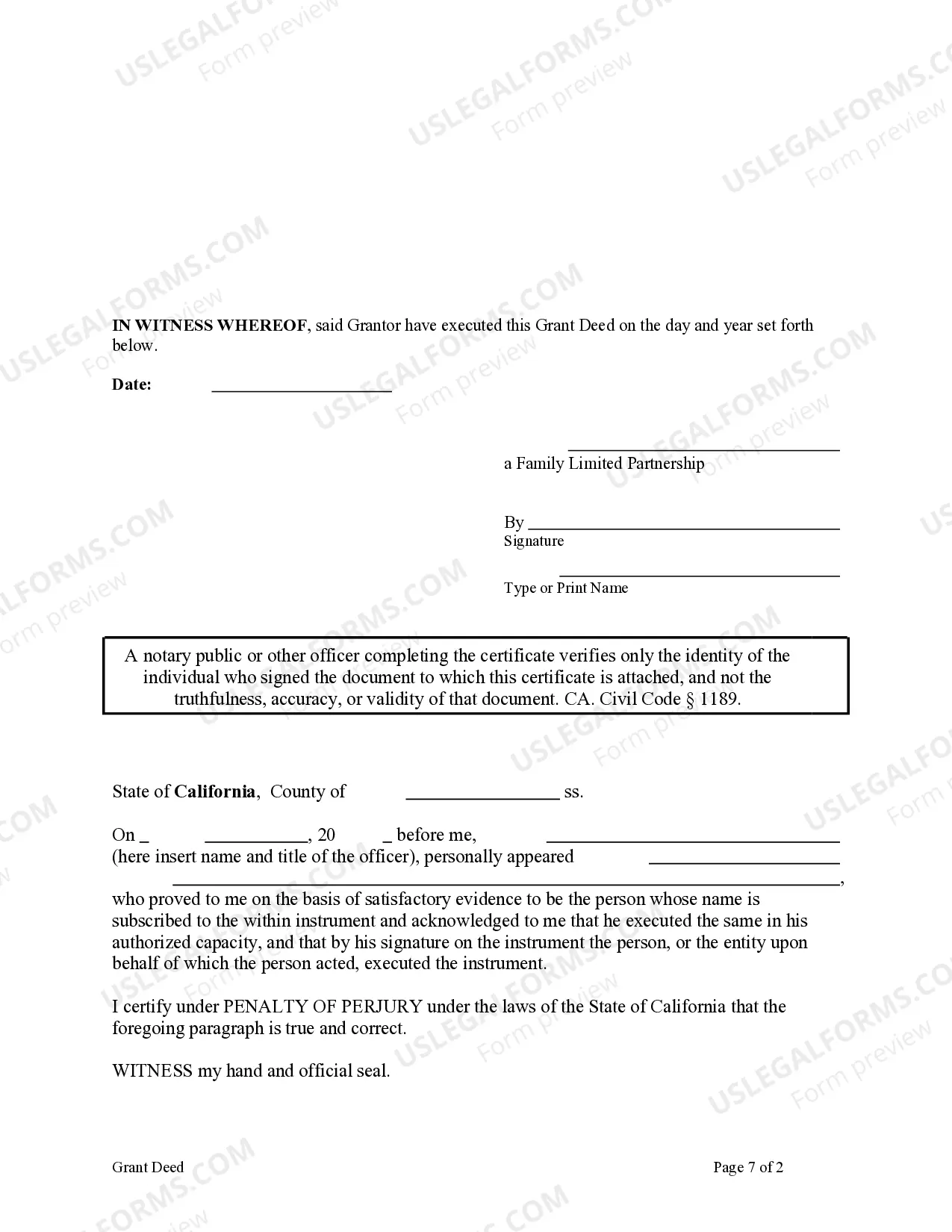

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

- Log into your account if you have previously used US Legal Forms, ensuring your subscription is active. If not, consider renewing it based on your plan.

- Preview the legal form to confirm it meets your specific needs and adheres to your jurisdiction's regulations. Make adjustments as necessary.

- If the form doesn't match your requirements, utilize the search function to locate a more suitable template.

- Select the document you need and click on the Buy Now button, followed by choosing your desired subscription plan.

- Complete your transaction by entering your payment details, either through credit card or PayPal.

- Finally, download the form to your device so you can fill it out and access it later from your My Forms section.

In conclusion, utilizing US Legal Forms provides limited partners with a streamlined approach to accessing vital legal templates. With a vast library of over 85,000 forms and expert assistance, you're guaranteed to find what you need efficiently.

Start your journey to hassle-free legal documentation today by visiting US Legal Forms!

Form popularity

FAQ

Limited partnerships are generally straightforward to form, especially when you have a clear plan. While they require filing specific documents and creating a partnership agreement, the necessities are not overly complex. Platforms like uslegalforms can help simplify the process by providing useful templates and step-by-step guidance, making it easier for you to establish your limited partnership.

Setting up a limited partnership fund requires careful planning and legal consideration. Start by drafting a comprehensive investment strategy and partnership agreement that defines the roles of general and limited partners. You should also consult with legal professionals to ensure compliance with securities regulations as you move forward.

To form a limited partnership, start by selecting a business name that complies with state regulations. After that, prepare your partnership agreement and file the necessary forms with your state's Secretary of State. This clear process ensures that all limited partners are protected and informed about their responsibilities.

Establishing a limited partnership begins with drafting a partnership agreement, which outlines each partner's roles, contributions, and profit distribution. Next, you file a certificate of limited partnership with your state. This document officially registers your limited partnership and provides legal recognition.

Filing taxes for a limited partnership involves reporting the income and losses on Form 1065. This form allows you to report income from all sources while providing each partner with a Schedule K-1 that outlines their share. It’s wise to stay updated on regulations and consider using resources like uslegalforms to guide you through your tax filing process.

Choosing a limited partnership over an LLC can provide strategic benefits. Limited partners can contribute capital without taking on management duties, which protects them from liability beyond their investment. This structure is attractive for investors who seek passive involvement while enjoying limited risk.

You typically do not need to issue a 1099 to a limited partnership if it is treated as a separate entity for tax purposes. However, if the limited partnership earns income as part of your business, you may have to issue one depending on your arrangement. To clarify this requirement and ensure compliance, consider consulting a tax professional or legal expert.

To form a limited partnership, you must draft and file a certificate of limited partnership with your state. This document typically includes the partnership's name, business address, and details of both general and limited partners. Afterward, creating a partnership agreement will clarify roles, responsibilities, and profit-sharing for all partners involved.

A limited partner is an investor in a limited partnership who contributes capital but does not participate in daily management. This partner enjoys the benefits of limited liability, meaning their financial risk is capped at their investment amount. Identifying as a limited partner allows individuals to invest in ventures without extensive involvement in operational decisions.

Limited Liability Partnerships (LLP) are popular among professionals like lawyers, accountants, and architects who work together while protecting personal assets from partnership liabilities. Examples of LLP include law firms or accounting firms where each partner manages the business while limiting their personal liability. These entities combine elements of a corporation and a partnership, making them attractive for certain professions.