Deed Partnership To Withdraw

Description

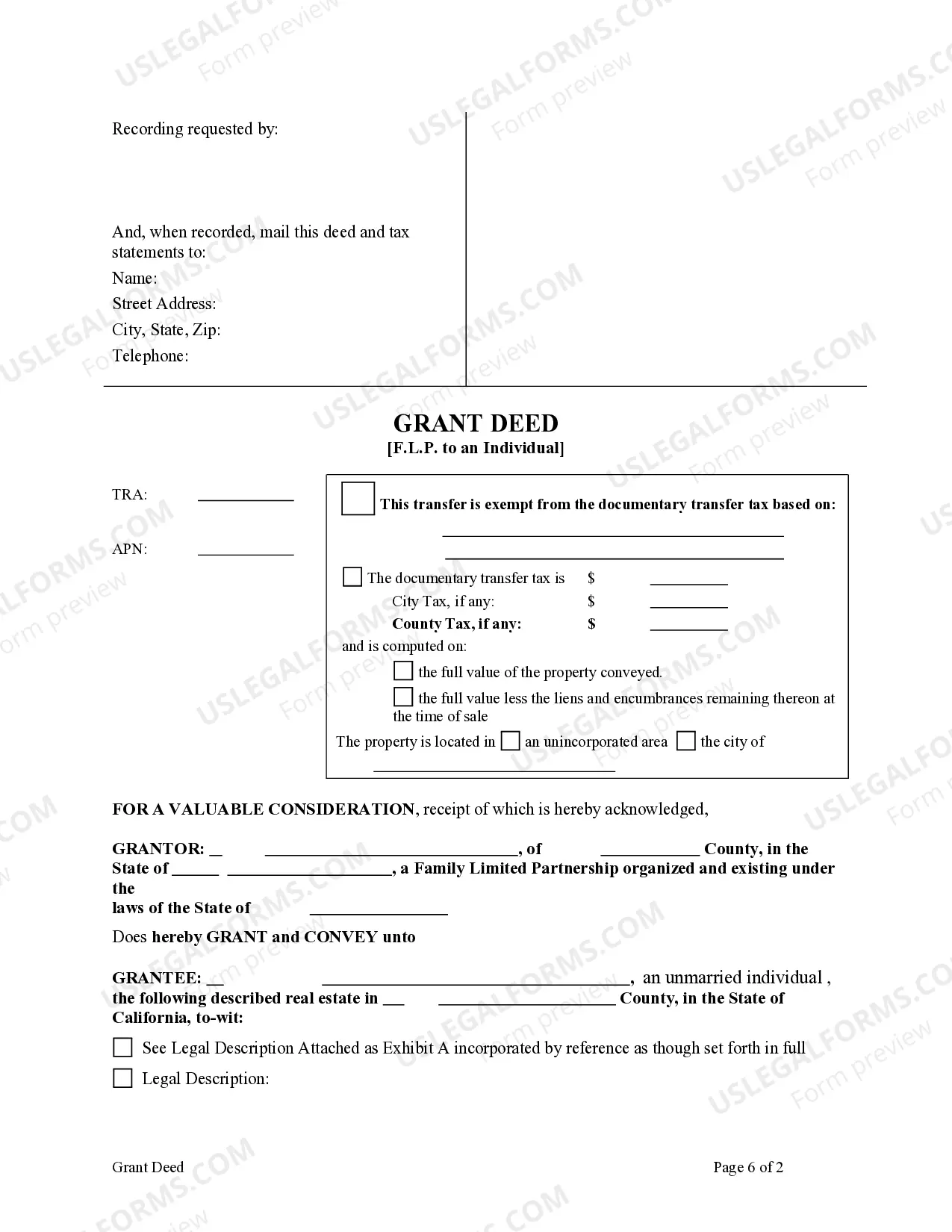

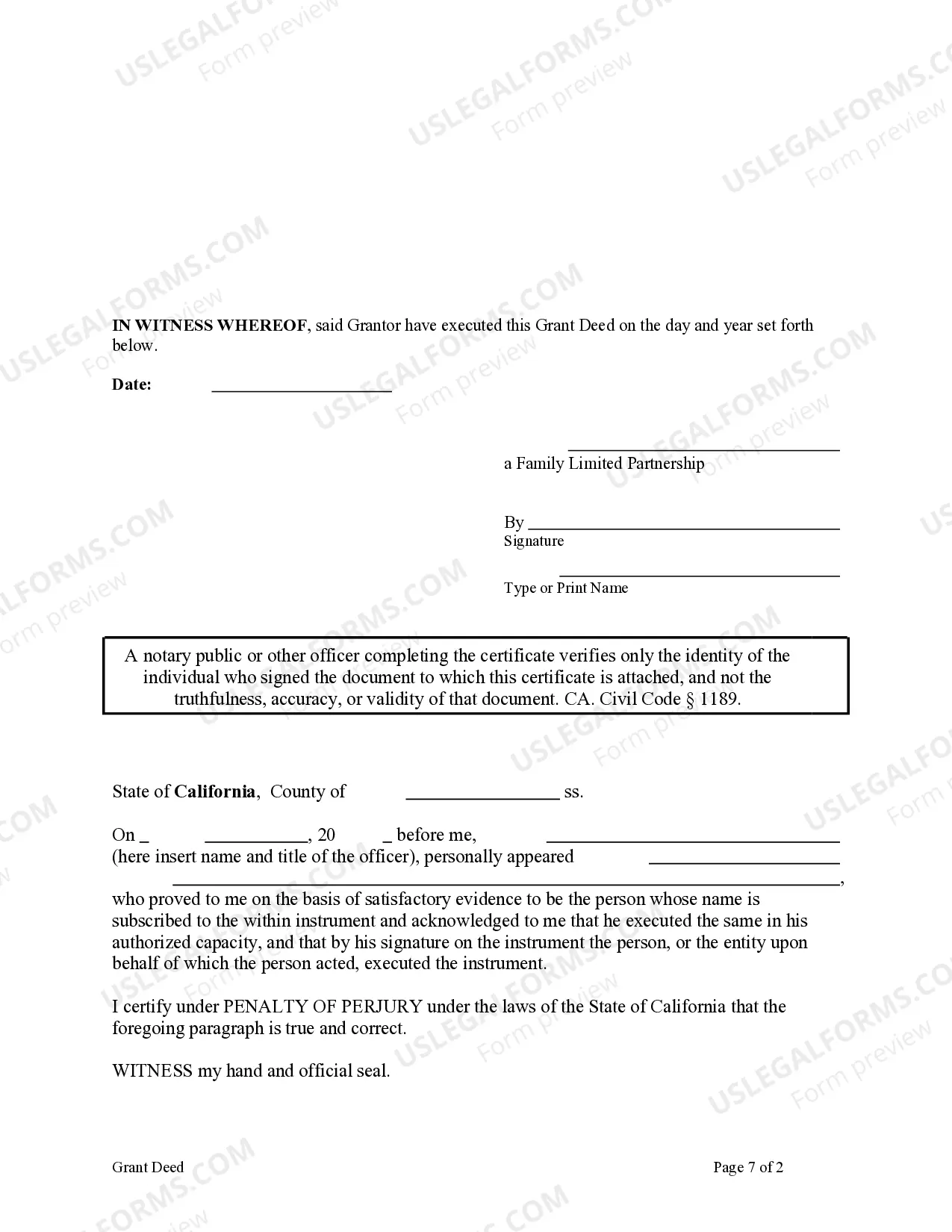

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

Legal administration can be perplexing, even for the most informed professionals.

When you are looking for a Deed Partnership To Withdraw and do not have the time to spend searching for the correct and updated version, the procedures might be overwhelming.

US Legal Forms addresses all requirements you may have, ranging from personal to corporate paperwork, all in one place.

Utilize innovative tools to complete and manage your Deed Partnership To Withdraw.

Here are the steps to follow after obtaining the form you need: Confirm it is the correct form by previewing it and reviewing its details, ensure that the template is approved in your state or county, click Buy Now when you are ready, select a subscription plan, choose the format you prefer, and Download, complete, eSign, print, and submit your documents. Take advantage of the US Legal Forms online catalog, supported by 25 years of experience and reliability. Streamline your routine document management into a seamless and user-friendly process today.

- Access a valuable resource library of articles, guides, and manuals related to your situation and needs.

- Save time and energy searching for the documents you require, and utilize US Legal Forms’ advanced search and Review feature to locate Deed Partnership To Withdraw and download it.

- If you hold a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view the documents you have previously downloaded and to organize your folders as desired.

- If it’s your first experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the library.

- A robust online form repository can be a game changer for anyone who wishes to manage these matters effectively.

- US Legal Forms is a leading provider in online legal documents, offering over 85,000 state-specific legal forms available at any time.

- With US Legal Forms, you can gain access to state- or county-specific legal and business documentation.

Form popularity

FAQ

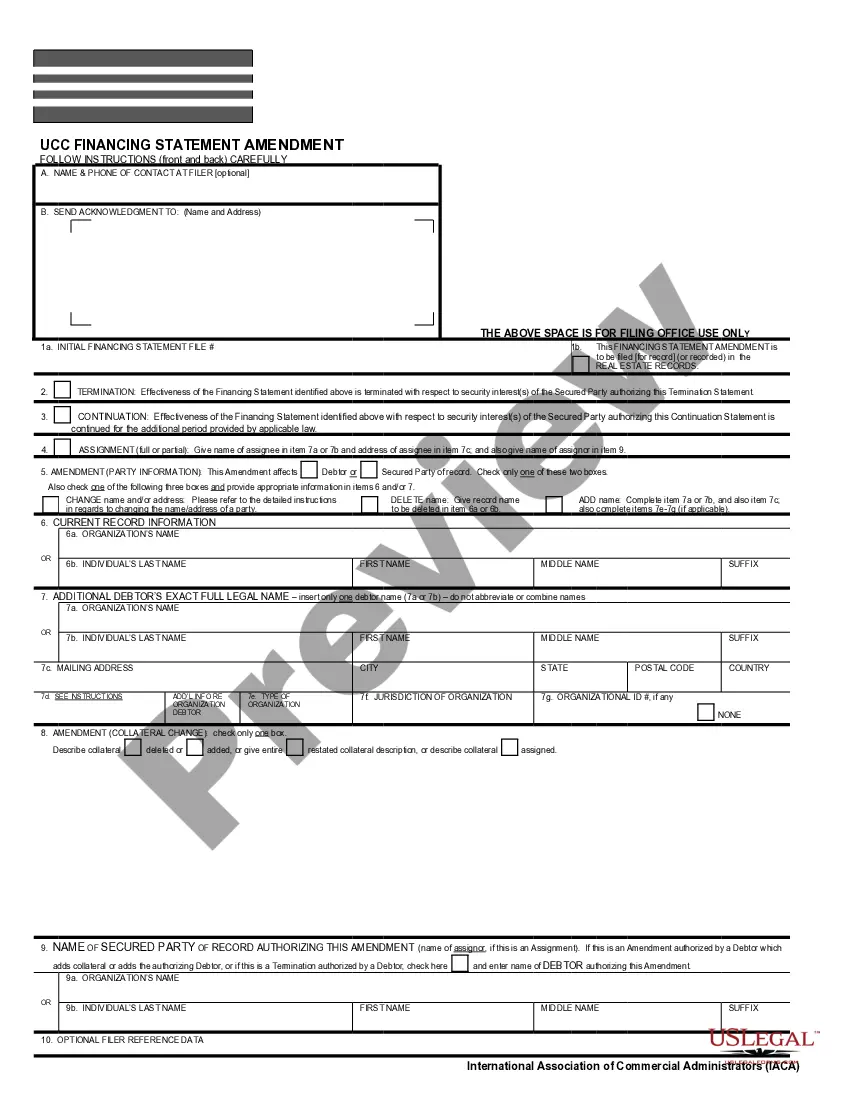

Withdrawals from the partnership by a partner are debited to the respective drawing account. The net income for a partnership is divided between the partners as called for in the partnership agreement. The income summary account is closed to the respective partner capital accounts.

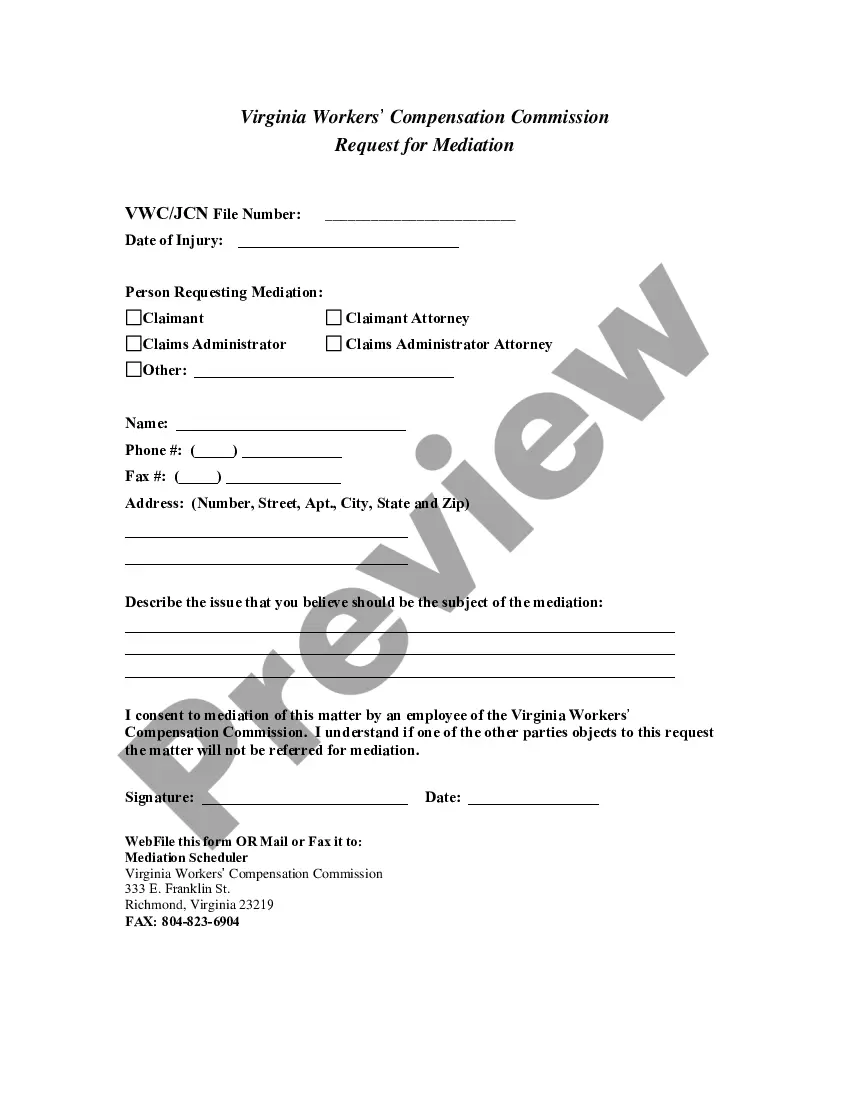

How do I create a Notice of Withdrawal From Partnership? Specify who is leaving the partnership. ... Provide your location. ... Provide the partnership's and the withdrawing partner's details. ... Include details about the withdrawal. ... Include any additional clauses. ... Specify the signing details.

How to Withdraw From a Limited Partnership Determine if you can withdraw from the partnership. ... Provide notice to the other partners, if necessary. ... Create and sign a partnership withdrawal agreement. ... Sell your partnership share. ... Remove your name from any business documents or contracts, if necessary.

How do you write a partnership deed? Name and address of the firm as well as all the partners. Nature of business to be carried out by the firm. Date of commencement of business. Duration of partnership (whether for a fixed period/project) Capital contribution by each partner. Profit sharing ratio among the partners.

A partner needs to give notice to the partnership if they wish to leave the partnership. The notice will indicate whether the partner wishes to be bought out by the remaining partners, there is a third party offer or they just want to dissolve the partnership.