Limited Business

Description

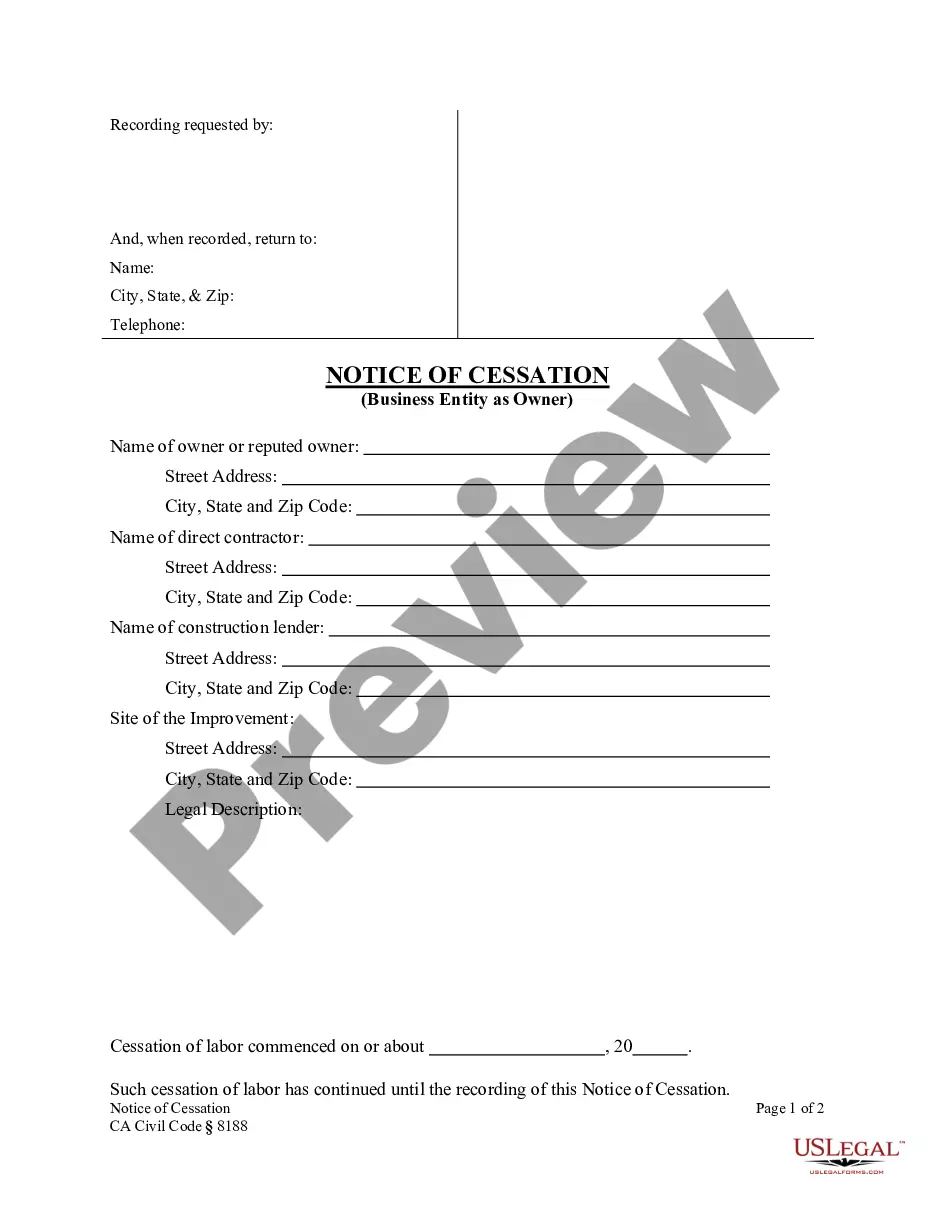

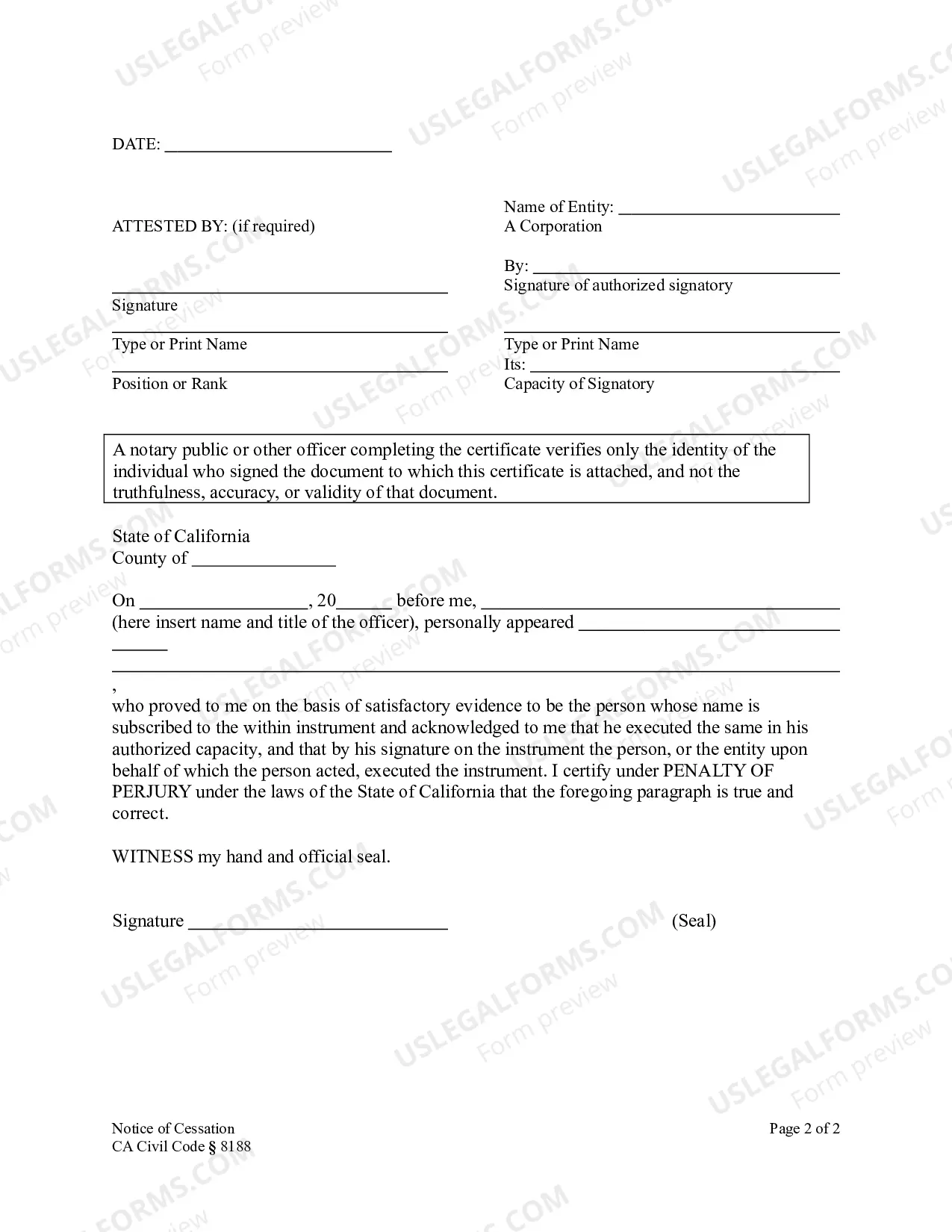

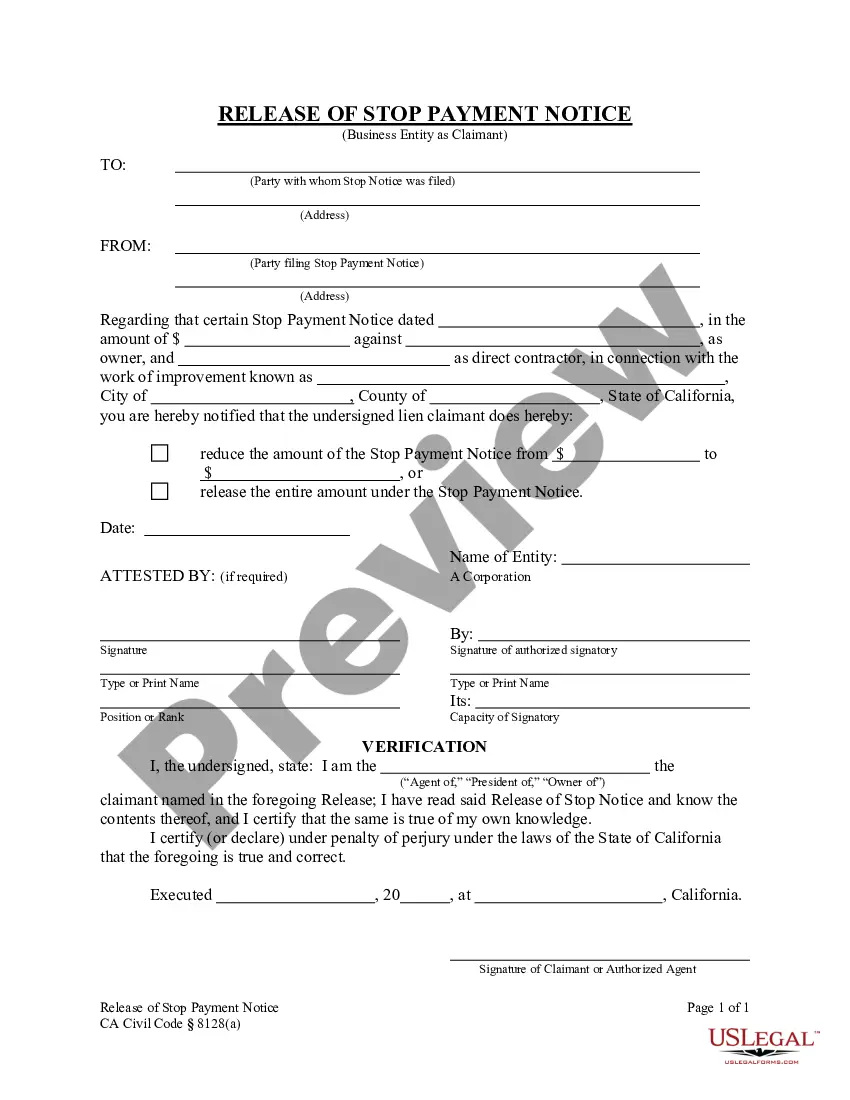

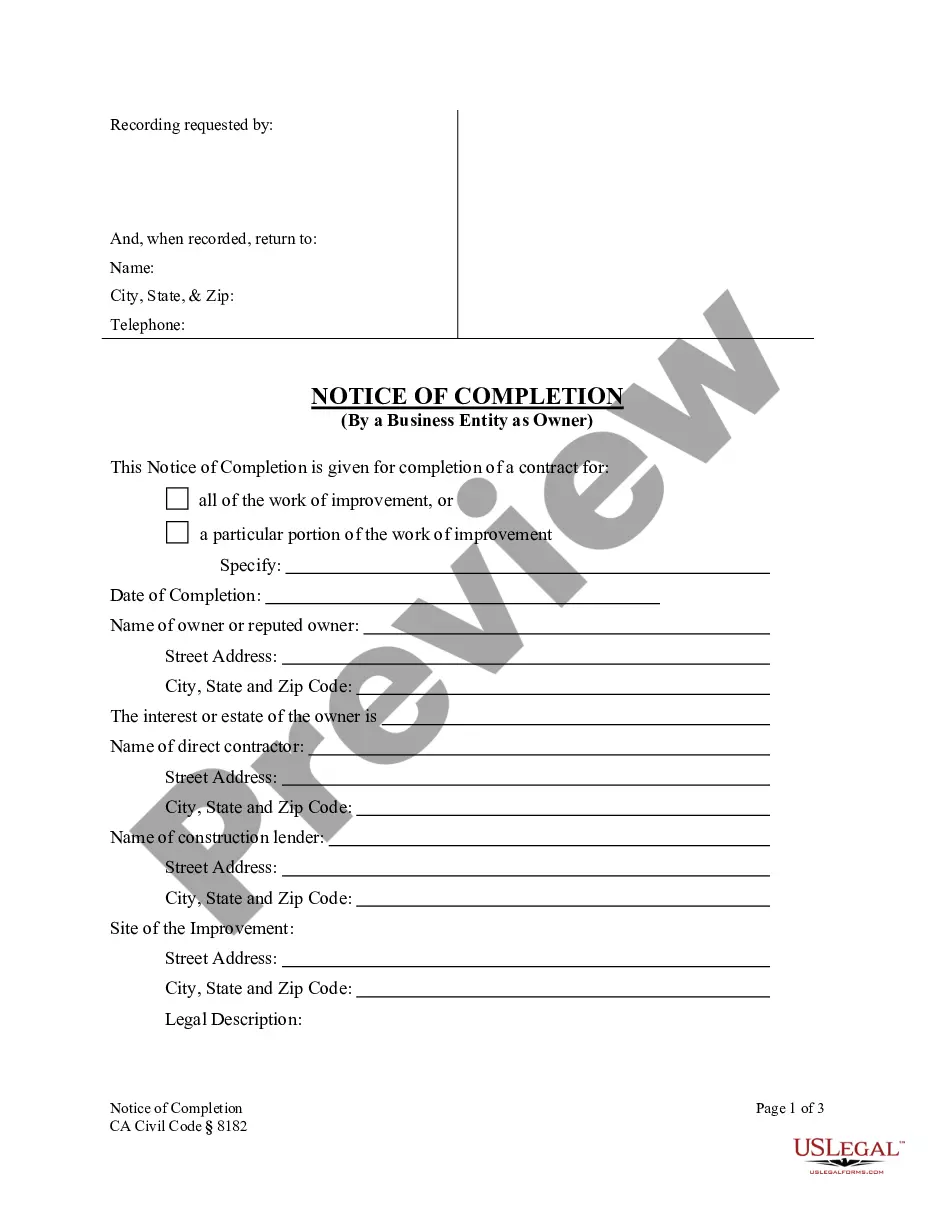

How to fill out California Notice Of Cessation - Construction Liens - Business Entity (LLC Or Corp) - CA Civil Code Section 8188?

- If you are a returning user, log in to your account to access your saved forms. Ensure that your subscription is active; if not, renew it based on your payment plan.

- For first-time users, start by checking the Preview mode and description of the needed form. Confirm that it aligns with your requirements and adheres to your local jurisdiction.

- If the selected form doesn’t meet your needs, use the Search tab at the top to find an alternative template.

- Once you find the right document, click on the Buy Now button and select your preferred subscription plan, which requires account registration for full access.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- Finally, download your form. Save it to your device and access it anytime via the My Forms section of your profile.

In conclusion, using US Legal Forms simplifies the process of obtaining legal documents for your limited business. With over 85,000 forms accessible, you're equipped with the resources to ensure your documents are accurate and legally binding.

Start your journey today and experience the efficiency of US Legal Forms!

Form popularity

FAQ

While an LLC offers advantages such as personal liability protection, it is not strictly necessary to operate a small business. You can run a sole proprietorship or partnership without formal registration. However, setting up an LLC can enhance your credibility and provide tax benefits, making it a smart choice for many small business owners.

A limited business needs to file taxes if it generates $400 or more in net income. This requirement ensures that you stay compliant with IRS regulations and options for deductions are available for any legitimate business expenses. Proper documentation of your income stream can aid your financial planning.

For a limited business, any income over $400 typically creates a tax obligation. If your small business earns less than this threshold, you might not owe taxes but should still file returns to document your earnings. Tracking all income is essential for maintaining compliance.

Your LLC must file taxes if it earns $400 or more in net income. If you have a multi-member LLC, it is necessary to file a partnership tax return regardless of income level. Keeping accurate financial records from the outset can simplify this process considerably.

If your limited business is set up as an LLC, you will typically file your personal and business taxes separately. Single-member LLCs are often treated as disregarded entities, allowing you to report business income on your personal tax return. Consulting with a tax professional can clarify your specific requirements.

In the context of a limited business, you do not need to report income under $600 if it is not reported to you by a client. However, it is important to note that all income must be reported to the IRS. Maintaining transparency with your earnings helps in avoiding potential future complications.

As a self-employed individual running a limited business, you generally must file taxes if your net income is $400 or more. However, if your income is under $5000, you may not owe taxes, but you still need to report the income. It is beneficial to keep accurate records and consider filing even for small earnings, as it can establish your business history.

You are considered a limited company when you set up your business in a manner that legally separates it from your personal affairs. This usually involves registering your business with the state as a limited liability entity. By doing so, you create a distinct legal personality for the business, allowing it to own assets, enter contracts, and incur debts independently. Utilizing platforms like US Legal Forms can simplify this process, guiding you through registration and compliance.

A limited company qualifies as a business entity where owners enjoy limited liability. This means that the personal financial risk of the owners is restricted to their investment in the company. Additionally, for a business to be classified as limited, it must be formalized through registration and comply with rules set by the state. Under the structure of a limited business, profits are taxed separately from personal income.

To determine if you are a limited company, check your business registration documents. A limited company typically has 'Limited' or 'Ltd' in its name. Moreover, limited businesses provide owners with limited liability, meaning your personal assets are usually protected from business debts. If your company meets these criteria and is registered with the appropriate state authorities, you operate as a limited company.