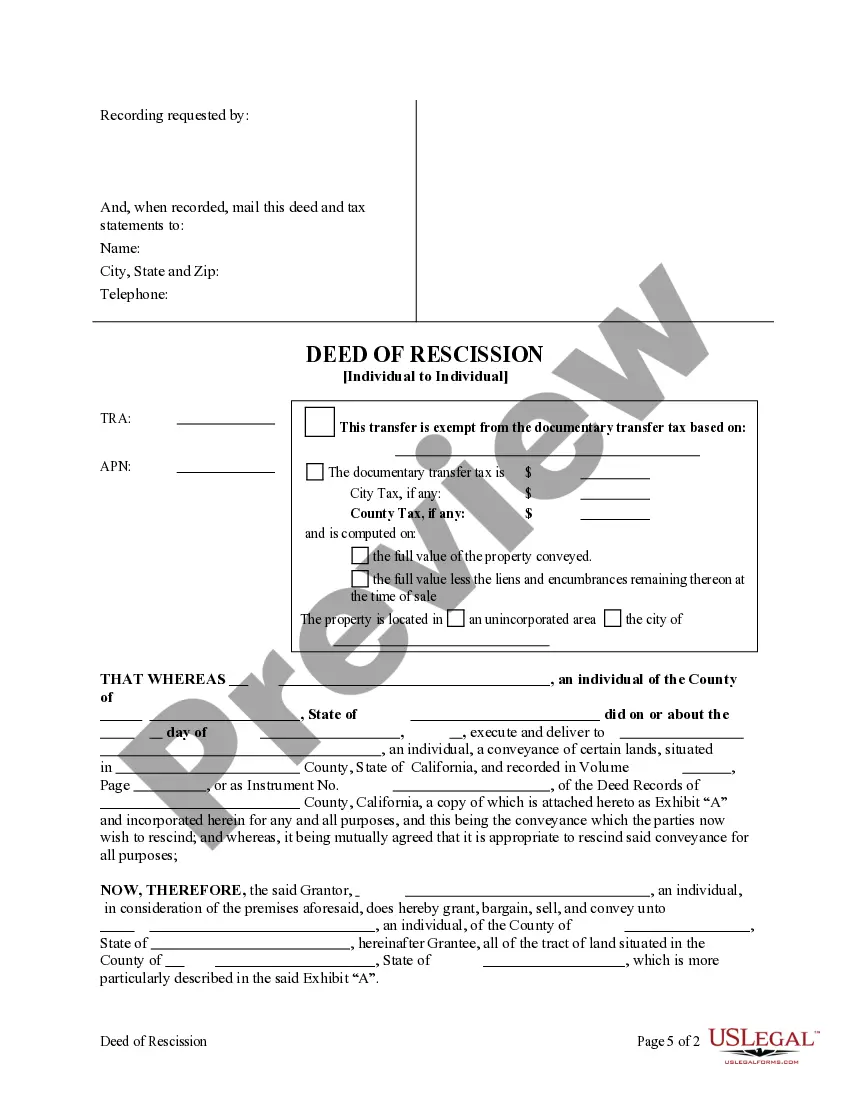

This form is a Deed of Rescission where the Grantor is an individual and the Grantee is an individual. The parties are rescinding or unwinding a prior transfer of the subject property. Grantor conveys and grants the described property to the Grantee. Grantor will defend and warrant the property only as to those claiming by through and under him and not otherwise. This deed complies with all state statutory laws.

California deeds in lieu of foreclosure is a legal process that allows a homeowner to transfer ownership of their property to the lender instead of going through the foreclosure process. It is considered as an alternative to foreclosure and can help both the lender and borrower to avoid the lengthy and costly legal proceedings. This option is beneficial for homeowners who are facing financial hardship and unable to stay current on their mortgage payments. To execute a California deed in lieu of foreclosure, the borrower willingly transfers the property's title to the lender. The lender, in return, agrees to release the borrower from any further mortgage obligations and forgives any remaining debt associated with the property. This arrangement depends on mutual consent and requires both parties to negotiate and sign a legally binding agreement. One of the crucial aspects of California deed in lieu of foreclosure is that the property must have a clear marketable title. This means there should be no other liens or encumbrances on the property, which could potentially hinder the transfer of ownership. Additionally, the property's value should be assessed to determine if it meets the lender's requirements to be accepted through this process. Although California deed in lieu of foreclosure is a general term, there are several types that fall under it. Here are some variations in this process: 1. Traditional Deed in Lieu of Foreclosure: Also known as a standard deed in lieu, this is the most common type of arrangement. It involves the borrower voluntarily transferring the property's ownership to the lender, and in return, the lender forgives the remaining mortgage debt. 2. Cash-for-Keys: This variation involves the lender providing the borrower with a cash incentive to vacate the property voluntarily. In this scenario, the homeowner agrees to hand over the property and move out within a specified time frame, usually leaving the property in good condition. 3. Deed in Lieu with Relocation Assistance: In some cases, the lender may offer additional financial assistance to the borrower for relocation purposes. This could include funds for a security deposit, moving expenses, or temporary housing arrangements. 4. Cooperative Deed in Lieu of Foreclosure: This type of arrangement occurs when the borrower and lender work together to find a new buyer for the property. The homeowner voluntarily transfers the property to the lender, who agrees to market and sell the property, sharing any profits with the borrower after satisfying their debt. California deeds in lieu of foreclosure is a viable option for homeowners facing financial distress and who want to avoid the ramifications of foreclosure. It provides a more amicable solution for both parties involved, allowing a smoother transition of property ownership while protecting the borrower from further financial burdens.