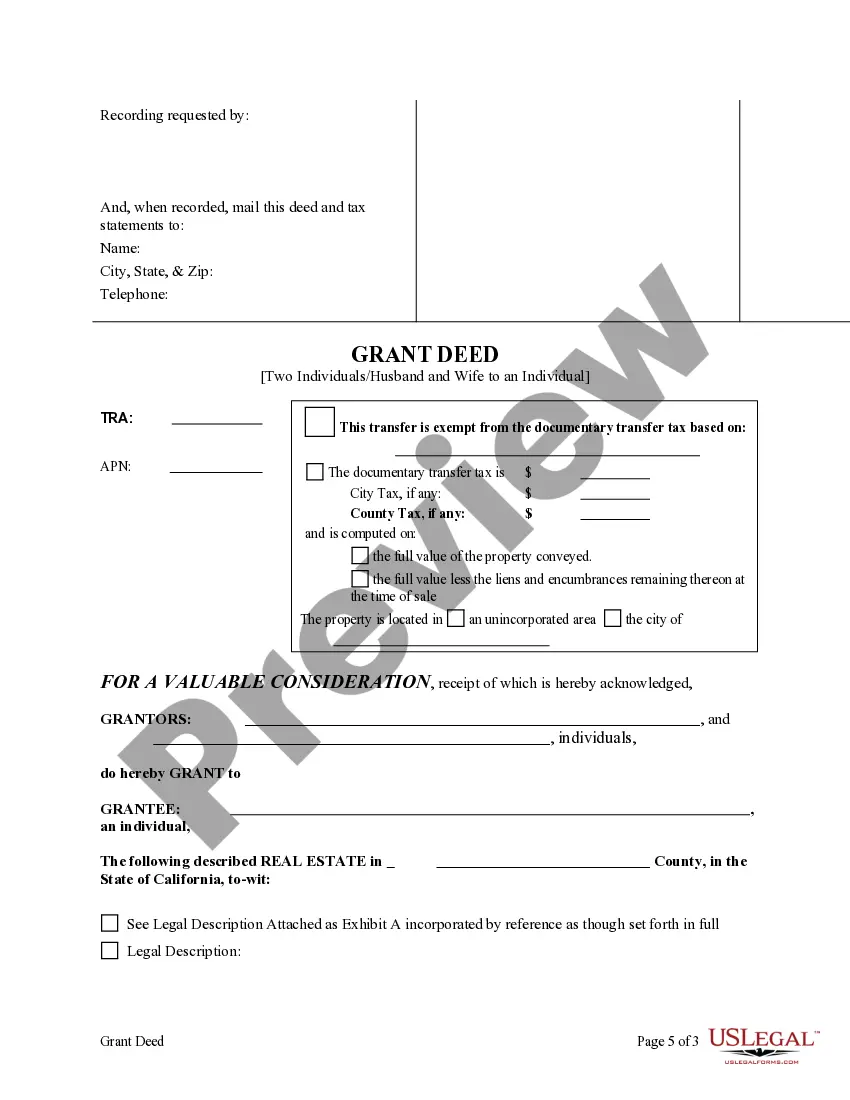

This form is a Grant Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantee is an individual. Grantors convey the property to Grantee subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantee is required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

Estate Lady Bird With A Big Head

Description

How to fill out California Enhanced Life Estate Or Lady Bird Grant Deed From Two Individuals, Or Husband And Wife, To An Individual?

- Log in to your account if you're a returning user. Ensure your subscription is active, and download your requested form by clicking the Download button.

- For new users, start by previewing the form and reading its description to confirm it meets your jurisdiction's requirements.

- If you need a different template, utilize the Search tab to find one that fits your needs.

- Select the document by clicking the Buy Now button, and choose your preferred subscription plan. You'll need to create an account for access.

- Complete the purchase by entering your payment details via credit card or your PayPal account.

- Download and save the completed form to your device, accessible anytime in the My Forms section of your profile.

By using US Legal Forms, you gain access to an extensive library and premium expert assistance, ensuring your legal documents are both precise and sound.

Start utilizing US Legal Forms today to streamline your legal processes. Visit us now to explore our vast resources!

Form popularity

FAQ

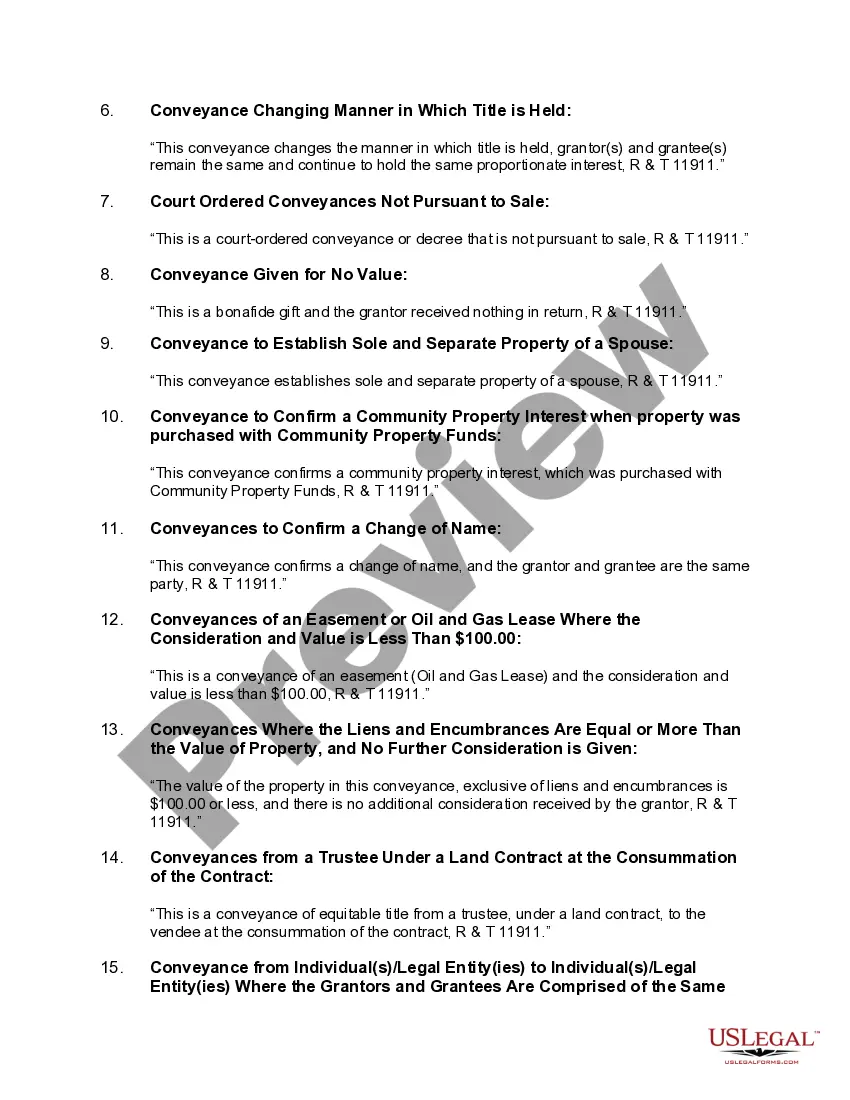

A notable downside of the lady bird deed is the potential for disputes among heirs after your passing. While it simplifies the transfer process, disagreements can arise if heirs feel overlooked or misinformed. Moreover, the estate lady bird with a big head might not cover all your estate planning needs comprehensively. Considering additional estate planning tools may offer a more complete solution.

Lady bird deeds are accepted in several states across the U.S., including Florida, Michigan, and Texas, among others. Understanding the regulations in your state is crucial when dealing with the estate lady bird with a big head. Each state has its nuances, so be sure to do your research or seek legal counsel. Platforms like US Legal Forms can help you navigate the specifics of your state’s laws.

With a properly executed lady bird deed, your home may not be considered part of your assets for Medicaid eligibility, allowing you to retain ownership for life. This aspect highlights the estate lady bird with a big head’s potential in protecting your property. However, it’s essential to understand the rules in your state, as they can vary widely. Consulting a Medicaid expert can provide useful insights.

Choosing between a lady bird deed and a trust depends on your individual circumstances. A lady bird deed allows for easy transfer of property without probate, while a trust can offer more comprehensive estate planning solutions. It's important to consider your goals, especially concerning the estate lady bird with a big head, before deciding. Consulting with an estate planning professional can provide clarity.

One disadvantage of a lady bird deed is that it may not provide the same level of asset protection as a trust. If you face legal issues, the property might still be vulnerable. Additionally, some states have specific regulations that could complicate matters. Therefore, understanding each nuance is vital in the context of an estate lady bird with a big head.

You can create your own ladybird deed, granting you complete control over the property during your lifetime. However, ensure you understand the legal requirements and implications of this estate lady bird with a big head. Using estate planning tools from platforms like US Legal Forms may simplify this process. Professional guidance can help ensure proper execution and validity.

When filling out an estate lady bird with a big head, you should start by entering your name as the grantor and including the complete property description. Specify the beneficiaries, ensuring their names are correct, and decide on the percentage of property ownership if there are multiple beneficiaries. After reviewing the form for accuracy, sign it in the presence of a notary public and two witnesses before filing it with your local office.

One potential downside of an estate lady bird with a big head is that it may not provide as much protection from creditors as other estate planning tools. If you face financial difficulties, creditors might still access the property. Additionally, some beneficiaries may feel limited if they cannot sell or encumber the property until your passing. Understanding these aspects will help you make informed decisions.

In Florida, to create a valid estate lady bird with a big head, you must be the property owner and at least 18 years old. The deed needs to clearly convey the property and identify the beneficiaries. Additionally, it must be signed in front of two witnesses and a notary public. Make sure to comply with Florida’s legal standards to avoid any complications.

To complete an estate lady bird with a big head, you first need to obtain the appropriate form, which is often available online. After filling in your information and the property details, ensure you specify the beneficiaries clearly. It is crucial to sign the deed in front of a notary public to make it legally binding. Finally, file the completed deed with your local property records office to finalize the process.