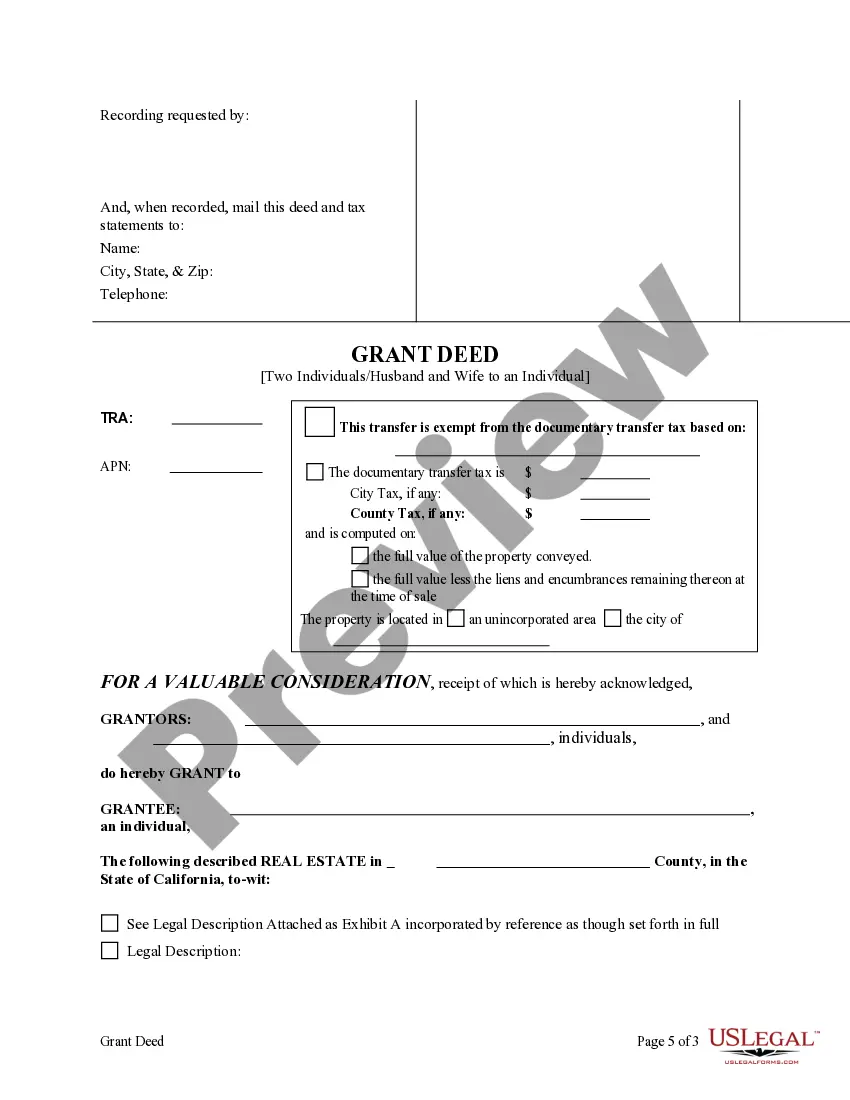

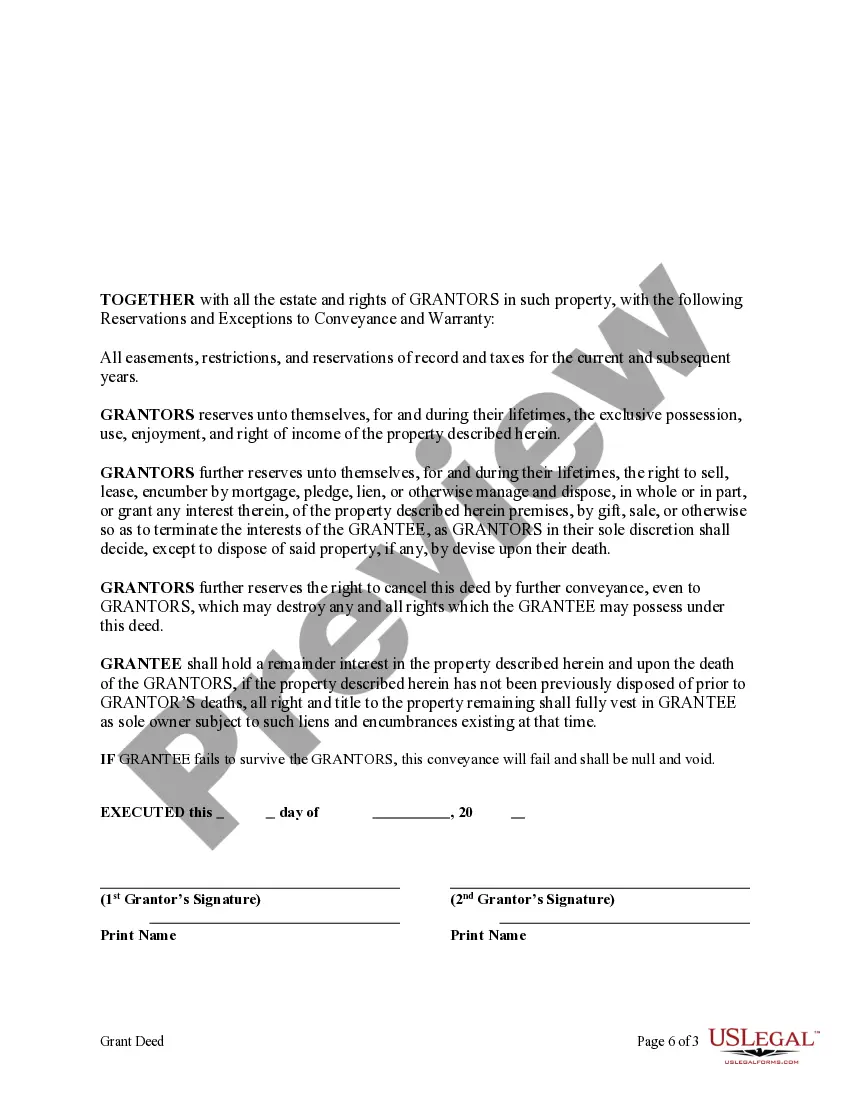

This form is a Grant Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantee is an individual. Grantors convey the property to Grantee subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantee is required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

Enhanced Bird Husband With Money

Description

How to fill out California Enhanced Life Estate Or Lady Bird Grant Deed From Two Individuals, Or Husband And Wife, To An Individual?

- Log in to your US Legal Forms account if you're a returning user and ensure your subscription is active.

- Review the form preview and description to confirm it aligns with your requirements and local regulations.

- If necessary, utilize the search option to find the most suitable template that filled your needs.

- Select the document by clicking 'Buy Now' and choose a subscription plan that works for you. Create an account if you're a new user.

- Complete the purchase by entering your payment details or using PayPal.

- Download the chosen form to your device and access it anytime in the 'My Forms' section of your profile.

With US Legal Forms, you can ensure that your legal documents are not only accurate but also easily editable, tailored to your specific circumstances.

Get started today and experience the convenience of crafting your legal forms seamlessly!

Form popularity

FAQ

Yes, an enhanced life estate deed is often referred to as a ladybird deed. Both allow property owners to retain control over their property during their lifetime while designating a beneficiary to inherit the property directly upon their passing. This arrangement provides flexibility and simplifies transfer processes. For clear guidance on creating such a deed, consider utilizing USLegalForms.

A ladybird deed can help minimize capital gains tax since it allows for a step-up in basis when the property transfers to the beneficiary. The beneficiary essentially takes on the property's value at the time of your death, which can lead to tax savings upon the sale of the property. Therefore, using a ladybird deed offers a strategic advantage for asset preservation. Explore USLegalForms to understand how to leverage this benefit effectively.

While a ladybird deed offers many advantages, one disadvantage is the potential for increased scrutiny during financial aid assessments. Since this deed allows property owners to retain control during their lifetime, it may impact eligibility for Medicaid or other benefits. Understanding these nuances is crucial for effective planning, and consulting with experts can help you navigate the complexities. USLegalForms provides resources to address these concerns.

Setting up a ladybird trust in Florida requires a detailed trust agreement outlining how the assets will be managed and distributed. You should appoint a trustee responsible for overseeing the trust and ensuring the proper execution of its terms. Moreover, assets must be transferred into the trust to enhance protection and efficiency. Using USLegalForms can guide you in creating a clear and effective ladybird trust.

To create a ladybird deed in Florida, you need to be the property owner, which means you must hold the title. Additionally, you should clearly designate the beneficiary who will receive the property after your passing. This deed must be executed, signed, and notarized to be legally valid. Utilizing USLegalForms can make this process simpler, ensuring you meet all requirements effectively.