Deed Lieu To Withdraw

Description

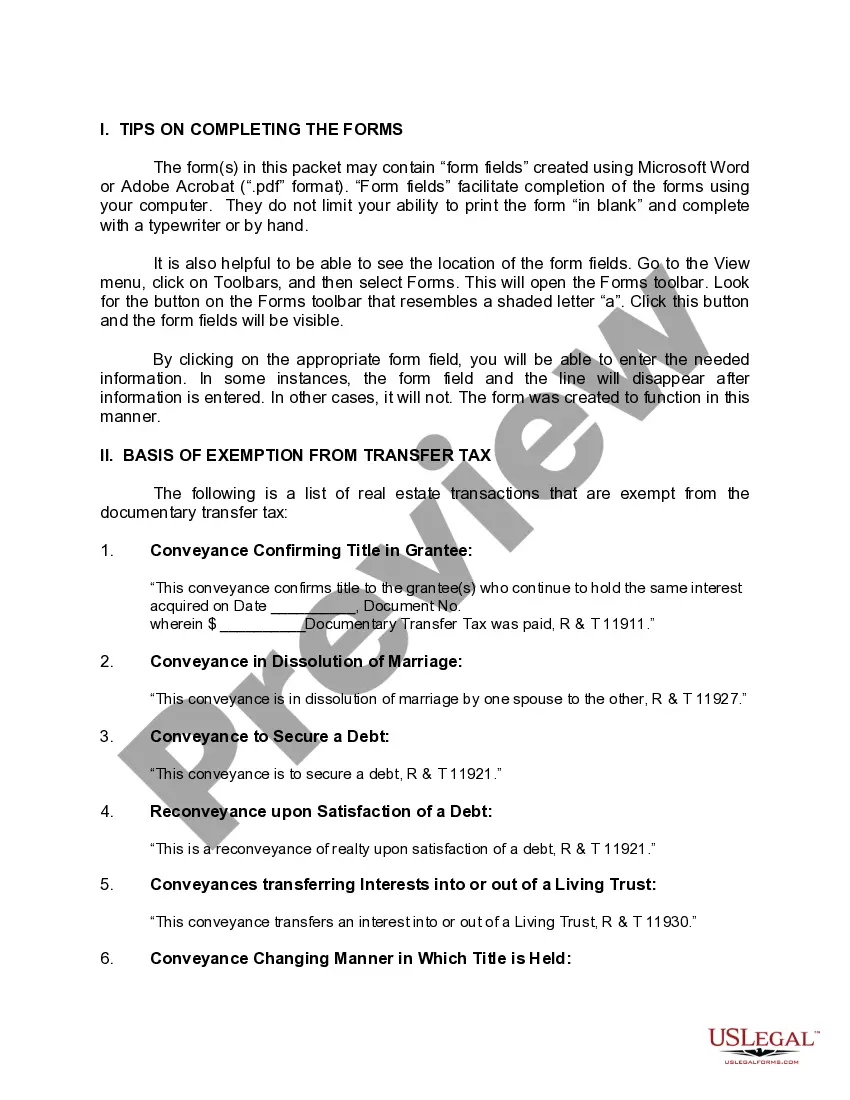

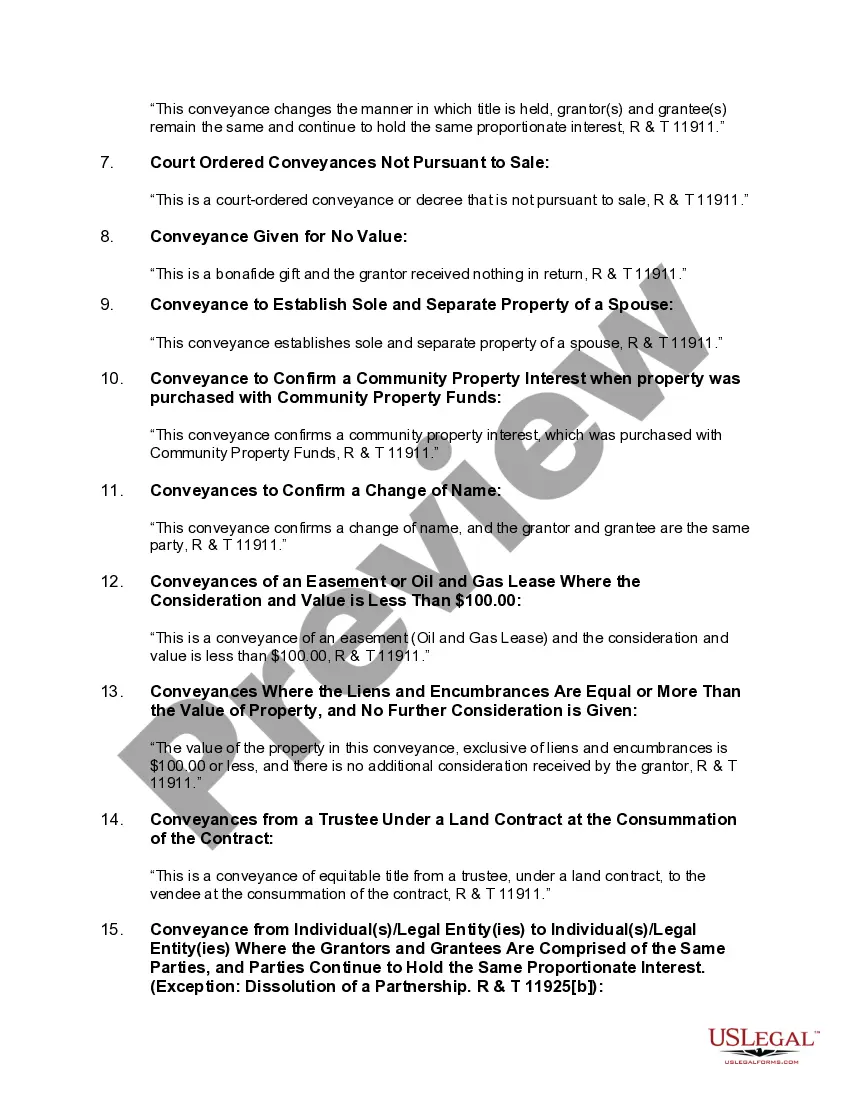

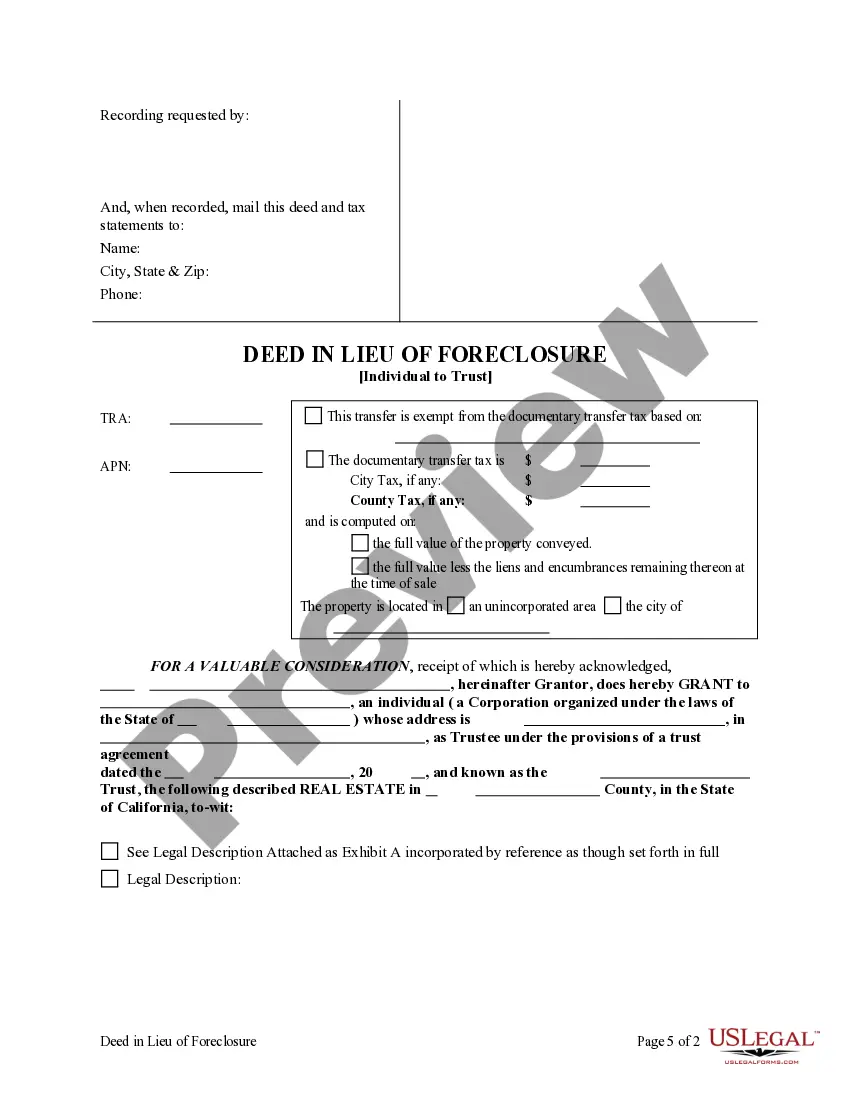

How to fill out California Deed In Lieu Of Foreclosure - Individual To A Trust?

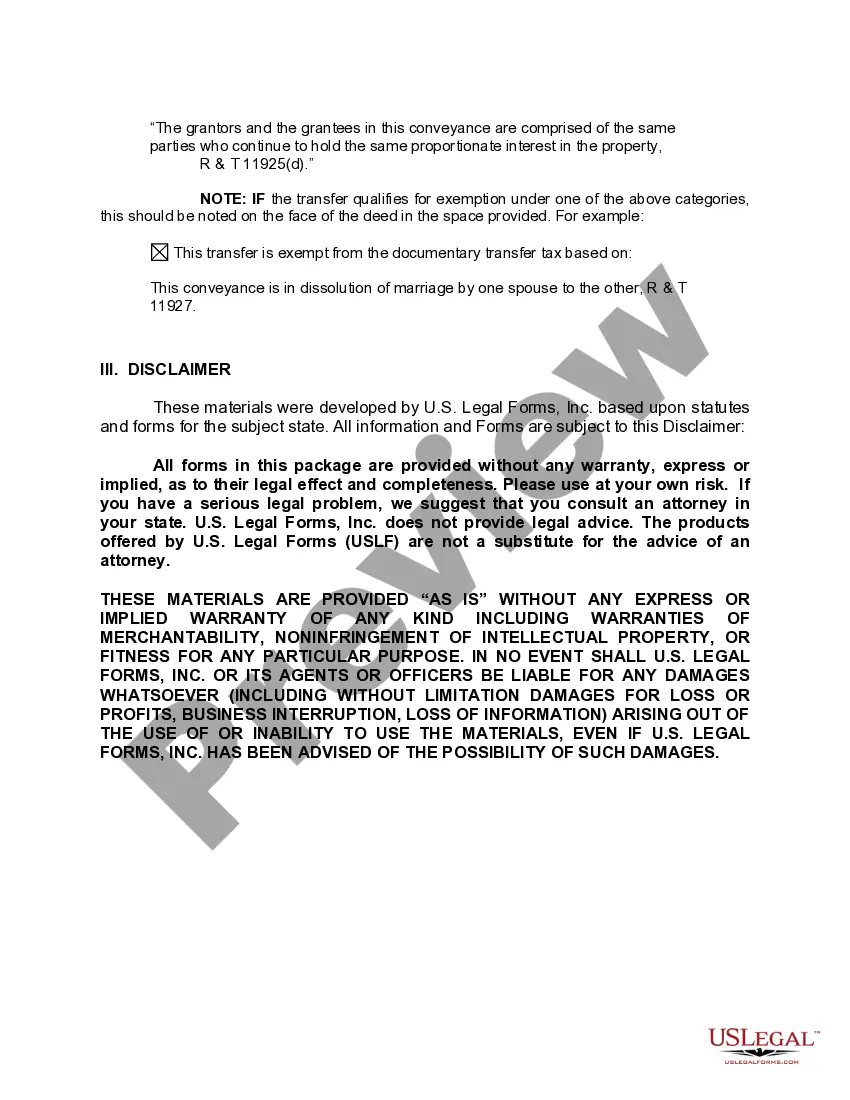

The Deed Lieu To Withdraw you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and state laws. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, easiest and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Deed Lieu To Withdraw will take you only a few simple steps:

- Search for the document you need and check it. Look through the file you searched and preview it or review the form description to verify it suits your requirements. If it does not, use the search bar to find the right one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Select the format you want for your Deed Lieu To Withdraw (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Use the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

A deed in lieu might make sense for you if: ? You're already behind on your mortgage payments or expect to fall behind in the near future. ? You're facing a long-term financial hardship. ? You're underwater on your mortgage (meaning that your loan balance is higher than the home's value).

Disadvantages of a deed in lieu of foreclosure You will have to surrender your home sooner. You may not pursue alternative mortgage relief options, like a loan modification, that could be a better option. You'll likely lose any equity in the property you might have.

If you had high credit scores to begin with, a deed in lieu will cause a bigger fall in your scores than if you started out with low scores. So, if you're one of the few borrowers who hasn't missed many payments?or any payments?before doing a deed in lieu, you'll likely see your scores drop 100 points or more.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.