Bond For Deed Real Estate

Description

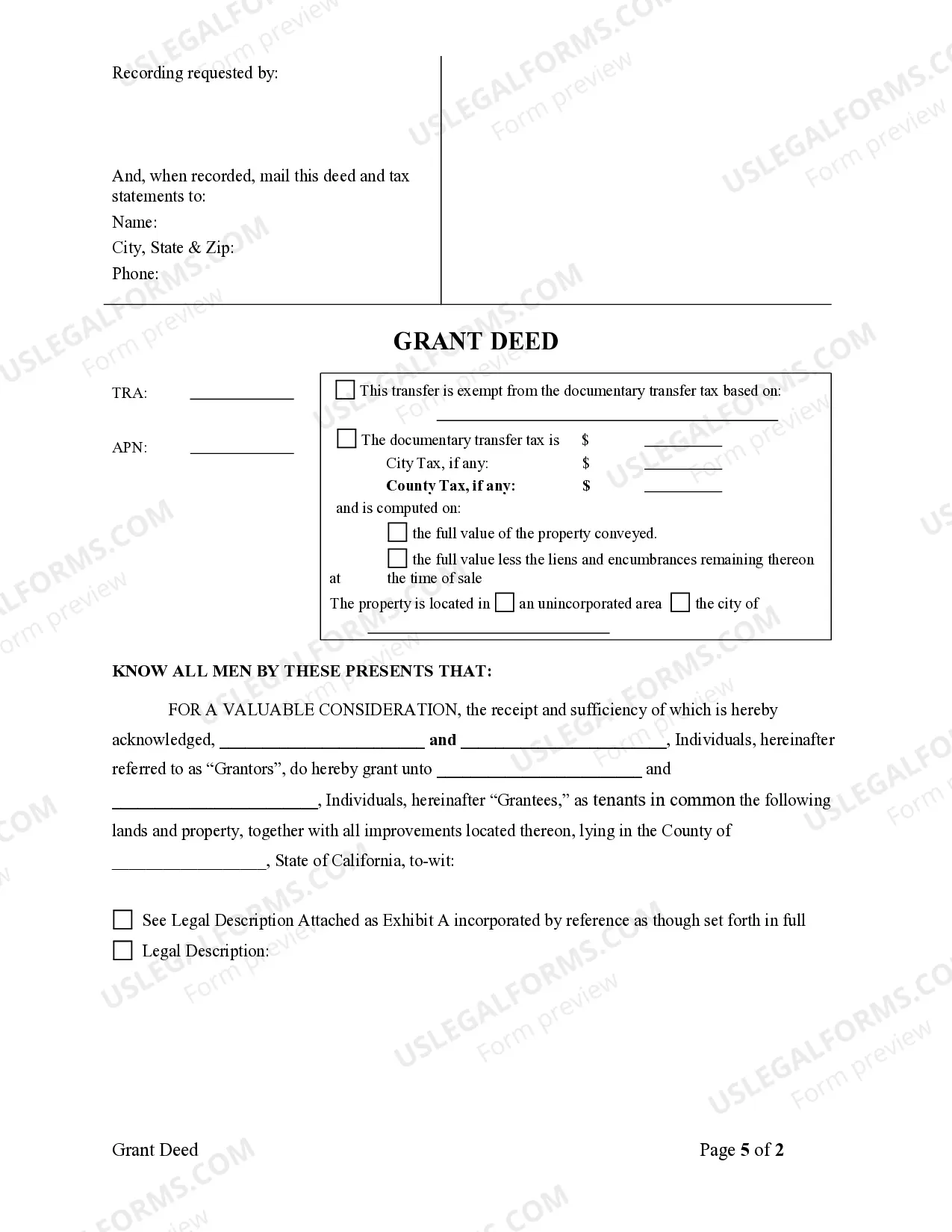

How to fill out California Grant Deed - Two Individuals To Two Individuals?

- Log into your US Legal Forms account if you’re a returning user, ensuring your subscription is active to access your documents.

- If you’re new, begin by reviewing the Preview mode and description of the bond for deed template to ensure it meets your specific needs and adheres to local regulations.

- Utilize the Search function for alternate templates if necessary, guaranteeing that you select the right form.

- Choose your desired subscription plan by clicking on the Buy Now button to proceed with your document purchase.

- Complete your transaction by entering your payment information via credit card or PayPal.

- Download your finalized form directly onto your device or access it any time through the My Forms section of your profile.

By following these steps, you can efficiently obtain your bond for deed real estate document using US Legal Forms. This service not only provides a vast collection of legal forms but also ensures that you have access to expert assistance for form completion.

Start your seamless real estate journey today with US Legal Forms and turn your property dreams into reality!

Form popularity

FAQ

Completing a deed in bond for deed real estate involves drafting the deed to reflect the transaction accurately. You must provide essential information, such as the property's legal description, the grantor and grantee's names, and the date of signing. After signing, you need to record the deed with your local land records office to make the transfer official. Utilizing services from US Legal Forms can help you ensure all requirements are met and that the deed is properly executed.

The average interest rate on a bond for deed real estate can vary widely, typically ranging from 4% to 10% depending on the seller's terms and market conditions. Unlike conventional loans, these rates can be influenced by the buyer's creditworthiness and negotiation skills. Always compare different offers to ensure you get a fair deal.

One disadvantage of a bond for deed real estate contract is the potential for higher interest rates compared to traditional loans. Additionally, if the buyer defaults, the seller may keep all payments made, which can leave the buyer with no equity in the property. It's crucial to weigh these risks carefully before proceeding.

In a bond for deed real estate arrangement, the buyer is typically responsible for paying property taxes. This responsibility usually shifts to the seller if the buyer defaults on the contract. It's essential to clarify tax obligations in your contract to avoid potential disputes later.

Yes, you can write your own land contract, often known as a bond for deed real estate agreement. However, it's crucial to ensure that your document includes all necessary legal elements, such as payment terms and property description. For accuracy and legal protection, consider using a platform like US Legal Forms, which offers templates and guidelines for creating a contract.

Typically, a contract for deed is drafted by a real estate attorney, although sellers and buyers can also create it with proper understanding. It should include all terms and conditions, ensuring clarity for both parties. Utilizing platforms like US Legal Forms can help streamline this process, providing templates and resources for effective contracts.

In real estate, a bond refers to a formal agreement that secures performance on a contract, often relating to payments. It acts as a promise from the buyer to follow through on financial obligations, ensuring both parties fulfill their commitments. This is a fundamental aspect of a bond for deed real estate transaction.

If your name is on the deed, the owner cannot sell the property without your consent, unless they have a legal agreement allowing them to do so. This agreement would typically be outlined in the bond for deed contract. Hence, understanding your rights in such arrangements is crucial.

In a bond for deed arrangement, the buyer makes regular payments to the seller while residing in the property. The seller holds the deed until the buyer fulfills the payment agreement, often detailed in a legally binding contract. This setup allows buyers to gain immediate possession without obtaining traditional financing.

A bond for deed in real estate is a financing arrangement where the seller retains the title to the property until the buyer completes all payments. During this time, the buyer occupies the property and has the right to improve it. This method offers a unique route to homeownership, especially for those who may not qualify for traditional mortgages.