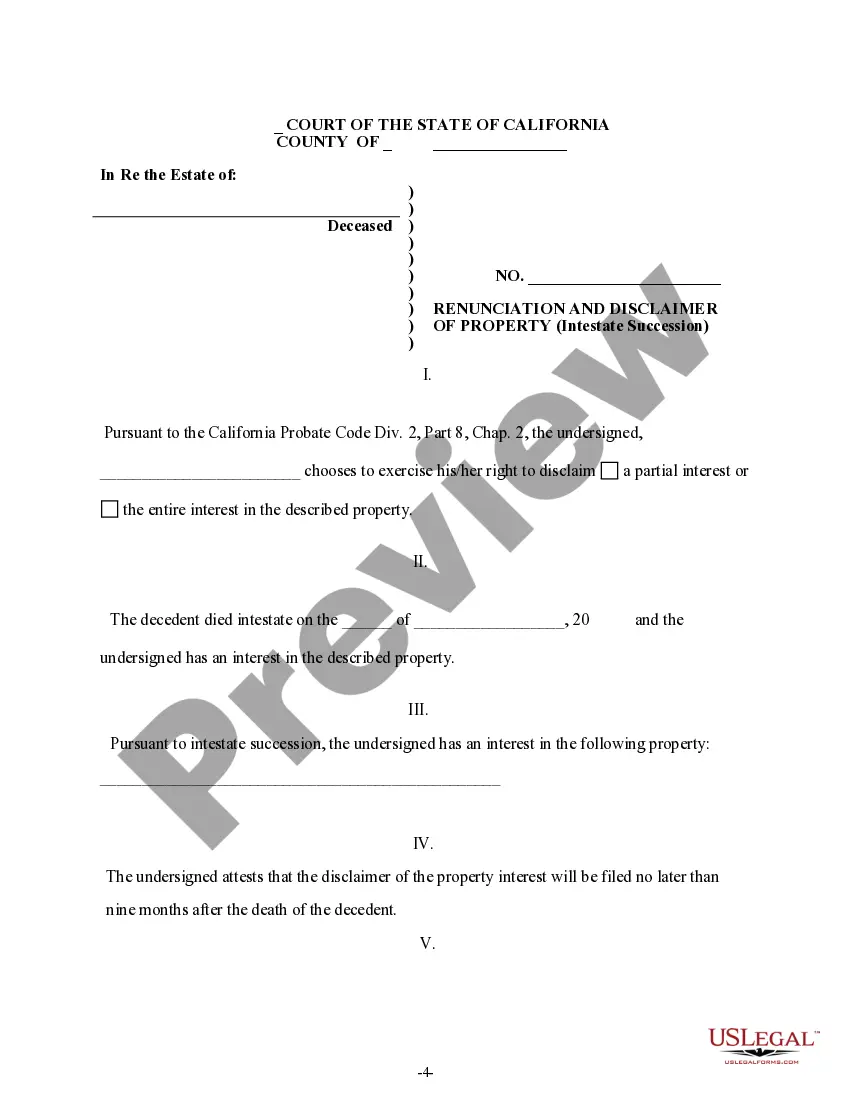

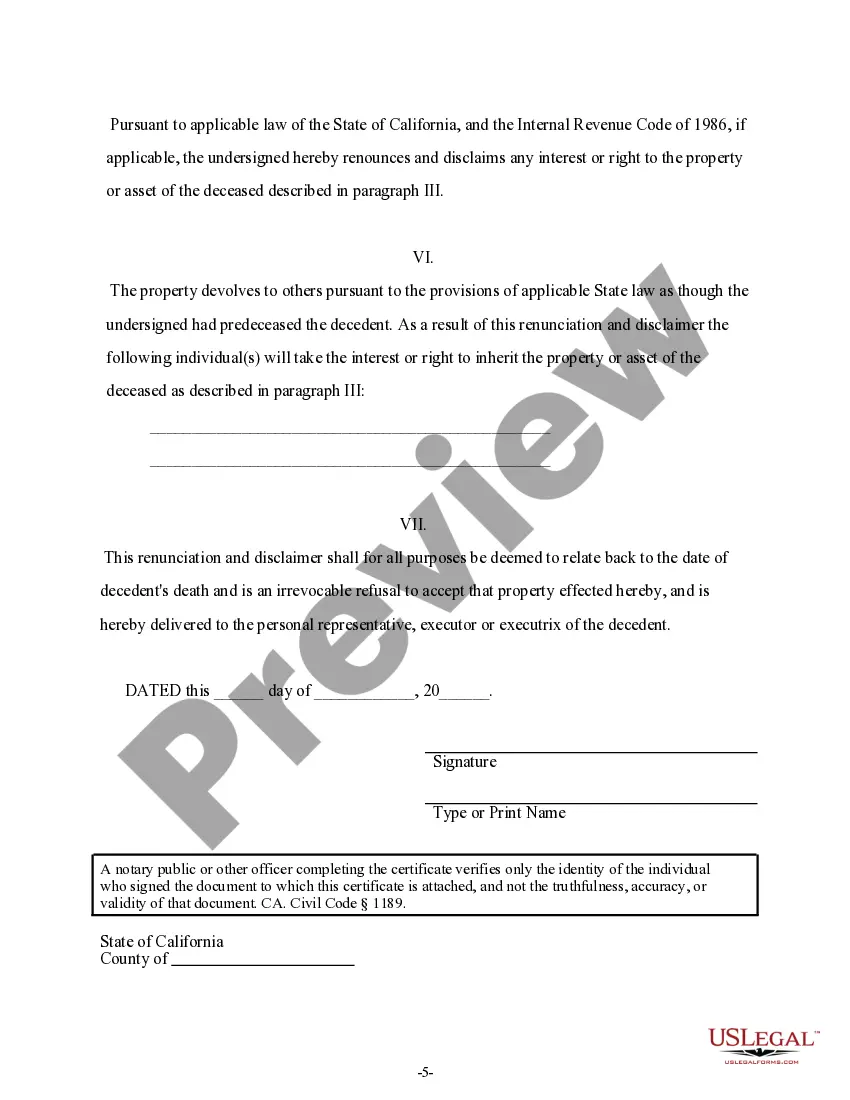

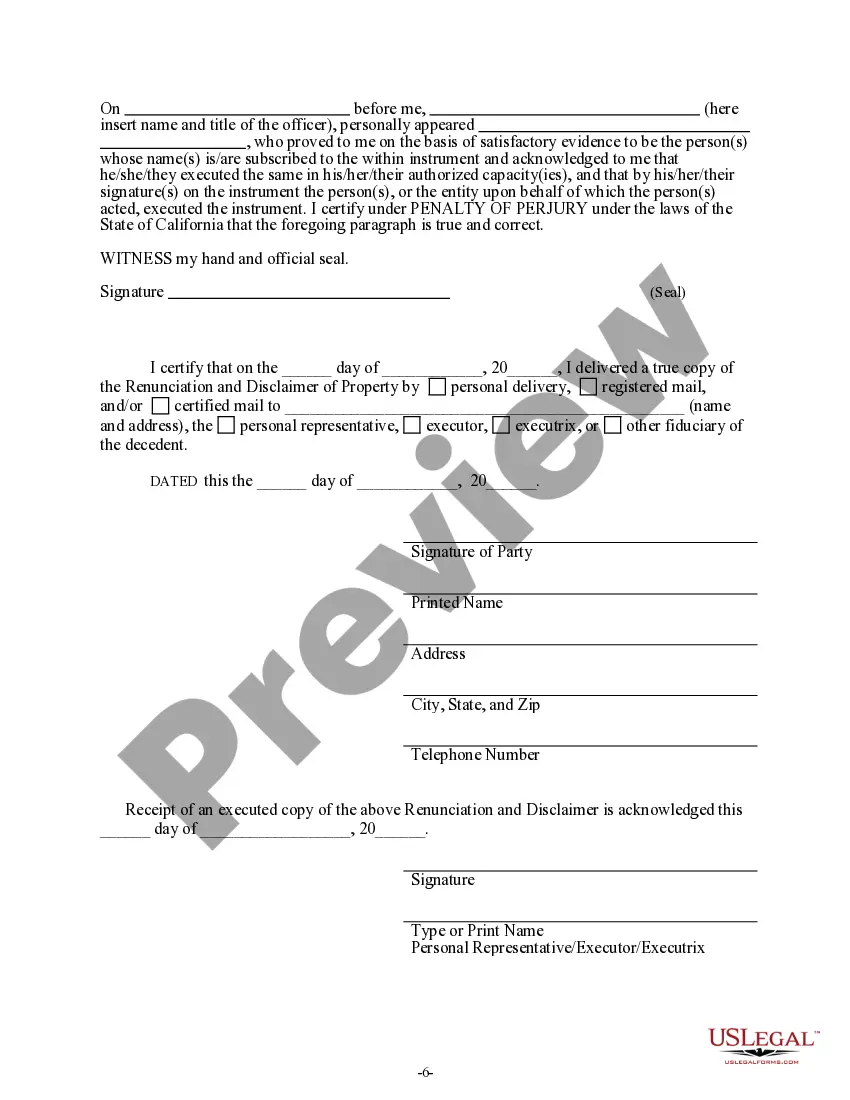

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has decided to disclaim a portion of or the entire interest he/she has in the property. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Sample Disclaimer Of Inheritance Form California For Estate

Description

How to fill out California Renunciation And Disclaimer Of Property Received By Intestate Succession?

It’s well-known that you cannot become a legal professional overnight, nor can you understand how to swiftly create a Sample Disclaimer Of Inheritance Form California For Estate without possessing a specific skill set.

Drafting legal documents is a lengthy process that demands particular education and expertise. So, why not entrust the preparation of the Sample Disclaimer Of Inheritance Form California For Estate to the experts.

With US Legal Forms, one of the most extensive legal template repositories, you can locate everything from court documents to templates for internal corporate correspondence. We realize how vital compliance and adherence to federal and state legislation are.

Create a free account and select a subscription plan to acquire the template.

Click Buy now. Once the payment is finalized, you can obtain the Sample Disclaimer Of Inheritance Form California For Estate, complete it, print it out, and send or submit it by mail to the required individuals or organizations.

- This is why, on our site, all forms are location-specific and current.

- Start with our platform and obtain the form you require in just minutes.

- Find the document you need using the search bar positioned at the top of the page.

- Review it (if this option is available) and examine the accompanying description to determine if the Sample Disclaimer Of Inheritance Form California For Estate is what you seek.

- If you need any other form, restart your search.

Form popularity

FAQ

To disclaim an inheritance in California, you should use a sample disclaimer of inheritance form California for estate as your template. Ensure that the form is filled out accurately, including your name and details of the inheritance. After completing the form, submit it according to the probate process outlined by California law. This proactive step helps clarify your intentions and ensures compliance with legal requirements.

In California, you can inherit up to $11.7 million from your parents without incurring federal estate taxes as of 2021. This limit can change based on federal tax laws, so it is wise to stay informed. It's essential to contact a tax professional to understand your obligations fully. The sample disclaimer of inheritance form California for estate does not involve tax calculations but may assist in managing your inheritance.

The rules for disclaiming inheritance in California require that you provide a written disclaimer, which should be signed and dated. The disclaimer must also be filed with the probate court or the executor of the estate. Additionally, you must disclaim the inheritance within a specific period, typically nine months from the date of the decedent's death. Utilizing the sample disclaimer of inheritance form California for estate can simplify this process.

To write a letter to disclaim an inheritance, start by clearly stating your intention to disclaim the inheritance. Include your full name, the name of the deceased, and relevant details about the inheritance. Use the sample disclaimer of inheritance form California for estate to guide your writing. This form ensures your letter meets legal requirements and effectively communicates your decision.

To disclaim an inheritance in California, you must submit a written disclaimer within nine months of the date of the decedent's death. It is essential to ensure that the disclaimer complies with California Probate Code section 278. You can use a Sample disclaimer of inheritance form California for estate, which can help simplify the process and ensure all required information is included. After submission, the inheritance will pass as if you had predeceased the decedent, allowing you to renounce your rights without tax implications.

An example of a disclaimer of inheritance can include a beneficiary choosing not to accept shares of a family business that might require their active involvement. Instead, the beneficiary may prefer to allow another family member to take on this responsibility. This decision, documented through a sample disclaimer of inheritance form in California for estate, helps clarify intentions and protect all parties involved.

A beneficiary may choose to disclaim property to avoid incurring debts associated with the inheritance, such as taxes or upkeep costs. Additionally, they might want to direct the inheritance to other family members or beneficiaries who may need it more. Utilizing a sample disclaimer of inheritance form in California for estate allows for a smooth transition while respecting the deceased's wishes.

An example of a disclaimer is a document where a beneficiary formally states they do not wish to accept an inherited property or asset. For instance, a person can use a sample disclaimer of inheritance form in California for estate purposes to decline a valuable piece of real estate. This document must be signed and filed with the relevant court to ensure its legitimacy.

A beneficiary disclaimer is a legal document that allows an individual to refuse their inheritance from an estate. This formal rejection can help beneficiaries avoid tax obligations or protect their financial interests. In California, using a sample disclaimer of inheritance form can streamline this process, ensuring compliance with state laws.

An example of an inheritance disclaimer might read: 'I, Your Name, hereby disclaim my rights to the inheritance from Estate Name. This decision is made voluntarily and without compensation.' You can enhance your disclaimer by using a sample disclaimer of inheritance form California for estate to ensure your intent is clearly conveyed and legally sound.