Interspousal Transfer Deed Form California

Description

How to fill out California Interspousal Grant Deed From Individual?

Whether for corporate objectives or for personal matters, everyone must confront legal scenarios at some point in their life.

Completing legal documents requires meticulous care, beginning with selecting the right form example. For instance, if you choose an incorrect version of the Interspousal Transfer Deed Form California, it will be rejected upon submission. Thus, it is vital to have a trustworthy provider of legal documents like US Legal Forms.

With an extensive US Legal Forms catalog available, you do not need to waste time looking for the correct example across the internet. Utilize the library’s straightforward navigation to find the suitable form for any situation.

- Locate the example you require using the search box or catalog navigation.

- Review the form’s description to ensure it fits your situation, state, and area.

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search feature to find the Interspousal Transfer Deed Form California example you need.

- Obtain the template when it aligns with your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: either a credit card or PayPal account.

- Pick the file format you prefer and download the Interspousal Transfer Deed Form California.

- Once it is saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

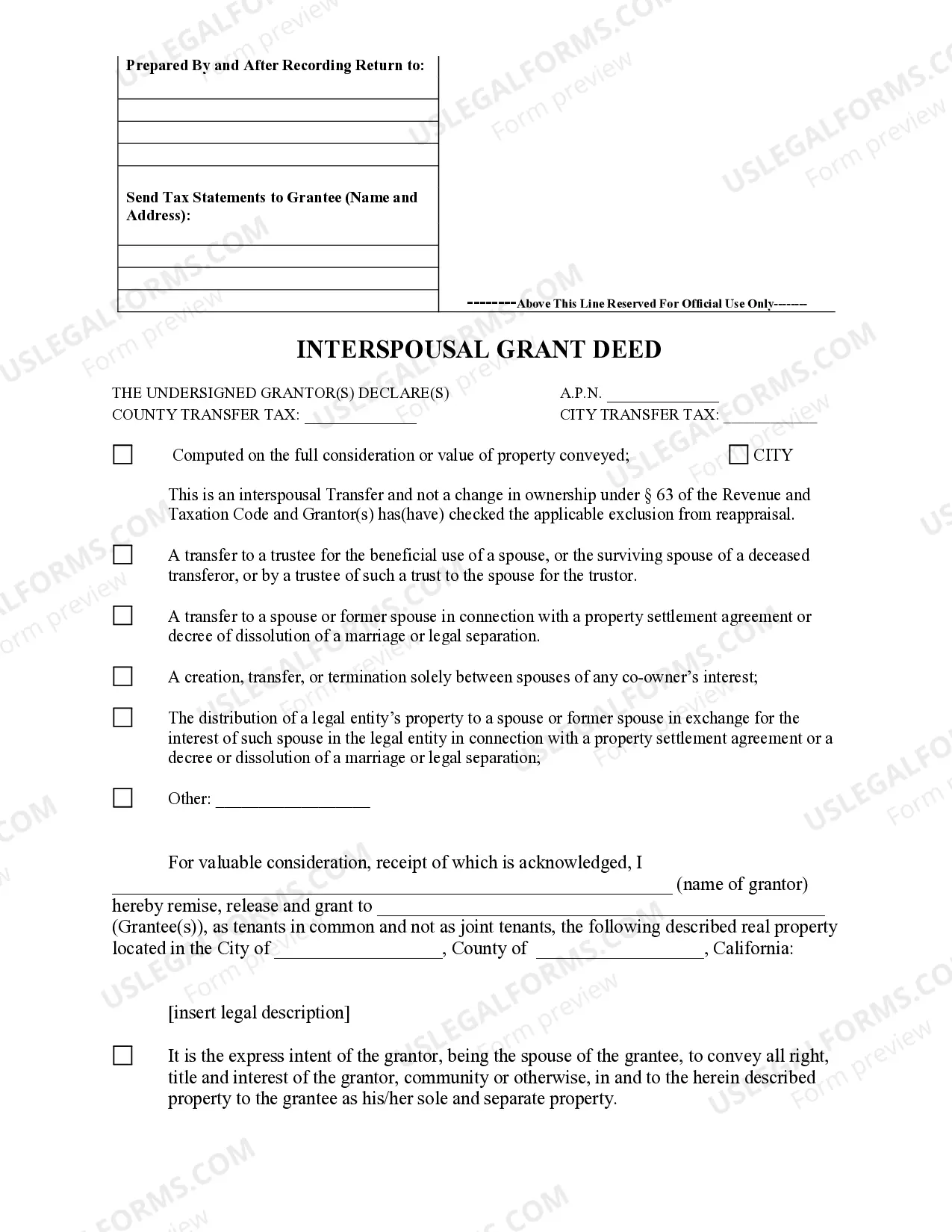

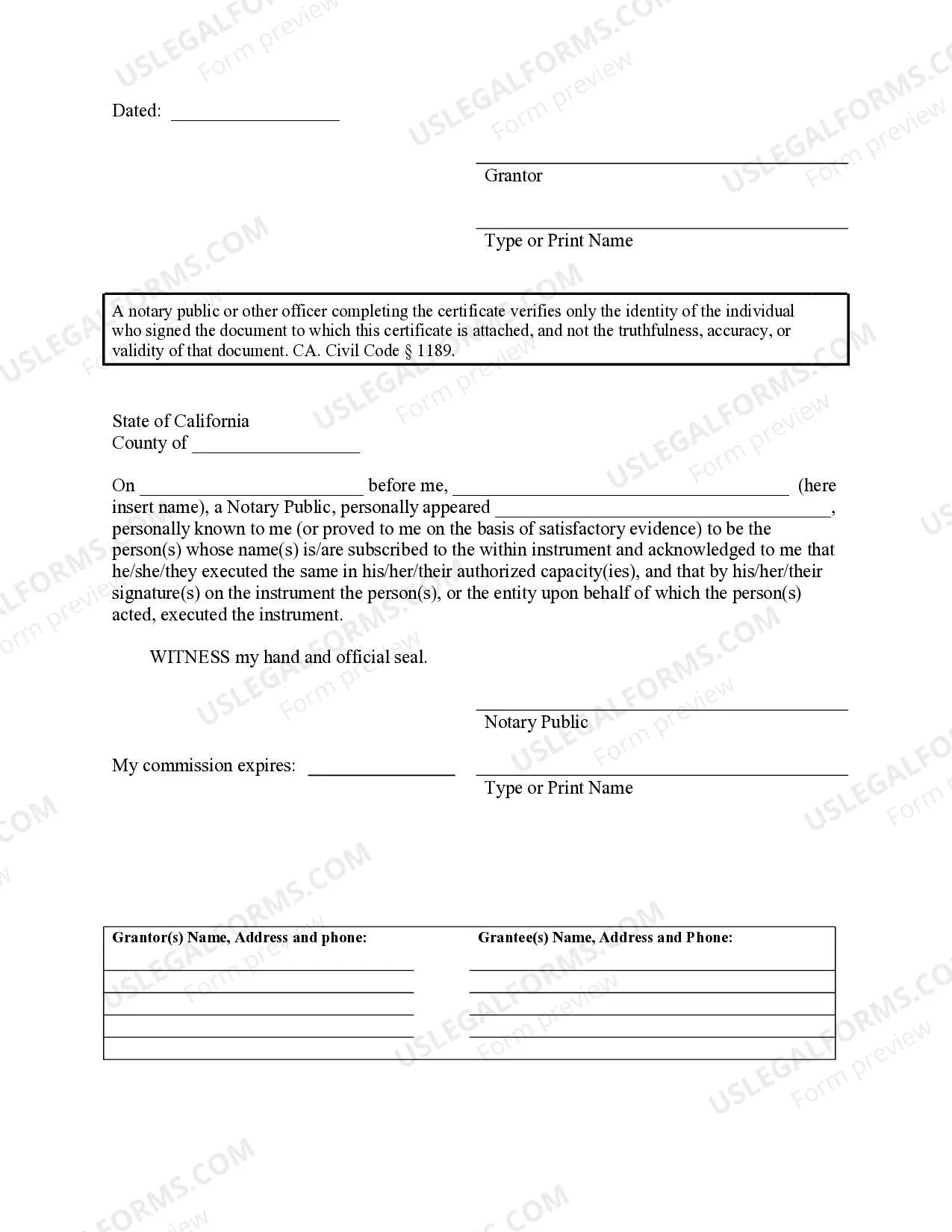

Completing an interspousal transfer deed involves filling out the interspousal transfer deed form California with accurate details about the property and both spouses. Make sure to include property descriptions, sign the document in front of a notary, and keep copies for your records. Once notarized, file it with the county recorder's office to finalize the transfer and solidify ownership rights.

You do not necessarily need a lawyer to add a spouse to a deed using an interspousal transfer deed form California. Many couples successfully complete this process on their own. However, if you encounter complexities or have specific legal concerns, consulting a lawyer can provide personalized guidance and ensure compliance with local regulations.

The interspousal transfer deed in California is a legal document that allows one spouse to transfer their interest in a property to the other spouse, often without tax implications. This deed is commonly used during marriage, separation, or divorce to facilitate property transfers. By using an interspousal transfer deed form California, couples can streamline the transfer process and ensure clarity in ownership.

Filing an interspousal transfer deed in California involves several straightforward steps. First, fill out the interspousal transfer deed form California with the necessary property details and the names of both spouses. Then, have the document signed in the presence of a notary. Finally, submit the signed and notarized deed to the appropriate county recorder's office to make the transfer official.

To file an interspousal transfer deed form California, you need to complete the form accurately. Ensure both spouses sign the document in front of a notary public. After notarization, file the deed with the county recorder's office in the county where the property is located. This process legally transfers your property interests between spouses.

Record the deed and submit the PCOR at the Recorder's Office in the county where the property is located. If you attached the property description (instead of typing it out), be sure to include the attachment when you record the Interspousal Transfer Deed.

If you attached the property description (instead of typing it out), be sure to include the attachment when you record the Interspousal Transfer Deed. 5. Fees: There are two fees: a filing fee (currently $20/first page plus $3/additional page in Sacramento) and a $75 Building Homes and Jobs Act fee.

What is an interspousal transfer deed? Interspousal transfer deeds legally transfer the interest of marital property from one spouse to another. An interspousal transfer deed differs from a quitclaim deed in that the entire interest of the property is transferred to the spouse.

The key difference between an interspousal deed and a quitclaim deed is a liability. In the case of a quitclaim deed, a spouse who chooses to give up their interest in a jointly-owned property may still be held liable for the mortgage or other taxes, liens, claims, and debts associated with the property.

How to Fill Out an Interspousal Transfer Deed Find the current deed for the property. On a computer, or in print, take out a blank Interspousal Transfer Deed. Determine how new owners will take the title. Fill out the new deed.