This purpose of this document is to release one of the owners of the property form the obligation of the loan which was used to purchase the property. The party being released will transfer his or her interest in the property to the other owner.

California Deed Of Trust Form 3005

Description

How to fill out California Assumption Of Deed Of Trust, And Release Of One Of Original Borrowers?

How to locate expert legal documents that comply with your state regulations and create the California Deed Of Trust Form 3005 without consulting an attorney.

Numerous services available online provide templates for various legal circumstances and requirements. However, it may require time to determine which of the accessible examples meet both your needs and legal criteria.

US Legal Forms is a reliable platform that assists you in finding official documentation crafted in alignment with the latest updates to state laws, as well as saving you money on legal costs.

If you do not have an account with US Legal Forms, follow the instructions below: Review the webpage you have opened to confirm if the form fits your requirements. Use the form description and preview options if present. If needed, search for another template in the header featuring your state. Click the Buy Now button upon locating the correct document. Choose the most suitable pricing plan, then sign in or register for an account. Select your preferred payment method (by credit card or via PayPal). Adjust the file format for your California Deed Of Trust Form 3005 and click Download. The acquired documents remain yours: you can always access them in the My documents section of your profile. Subscribe to our platform and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not an ordinary online library.

- It is a compilation of over 85,000 validated templates for various business and personal situations.

- All documents are categorized by field and state to expedite and simplify your search.

- Additionally, it integrates with robust tools for PDF editing and electronic signature, enabling users with a Premium subscription to seamlessly complete their documents online.

- Minimum effort and time are required to acquire the necessary documents.

- If you already possess an account, Log In and verify your subscription status.

- Download the California Deed Of Trust Form 3005 using the corresponding button adjacent to the file name.

Form popularity

FAQ

Yes, a deed must be recorded in California to provide public notice of ownership and protect the rights of the property owner. By recording a California deed of trust form 3005, you establish an official record that can prevent challenges to your title. Failure to record the deed may lead to complications, such as disputes over ownership. Therefore, completing and recording your form correctly is essential for legal security.

Yes, trust documents generally need to be recorded in California to provide legal protection. Recording these documents creates a public record that can safeguard your interests in the property. For a trust deed, specifically, using the California deed of trust form 3005 is essential to meet legal requirements. This ensures accuracy and compliance, giving you peace of mind.

Yes, a trust deed must be recorded in California to be enforceable against third parties. Recording puts the public on notice about the property’s legal interests, protecting the beneficiary's rights. To effectively record your trust deed, use the California deed of trust form 3005 and follow the procedures established by your local county recorder's office. This step is crucial for maintaining legal standing.

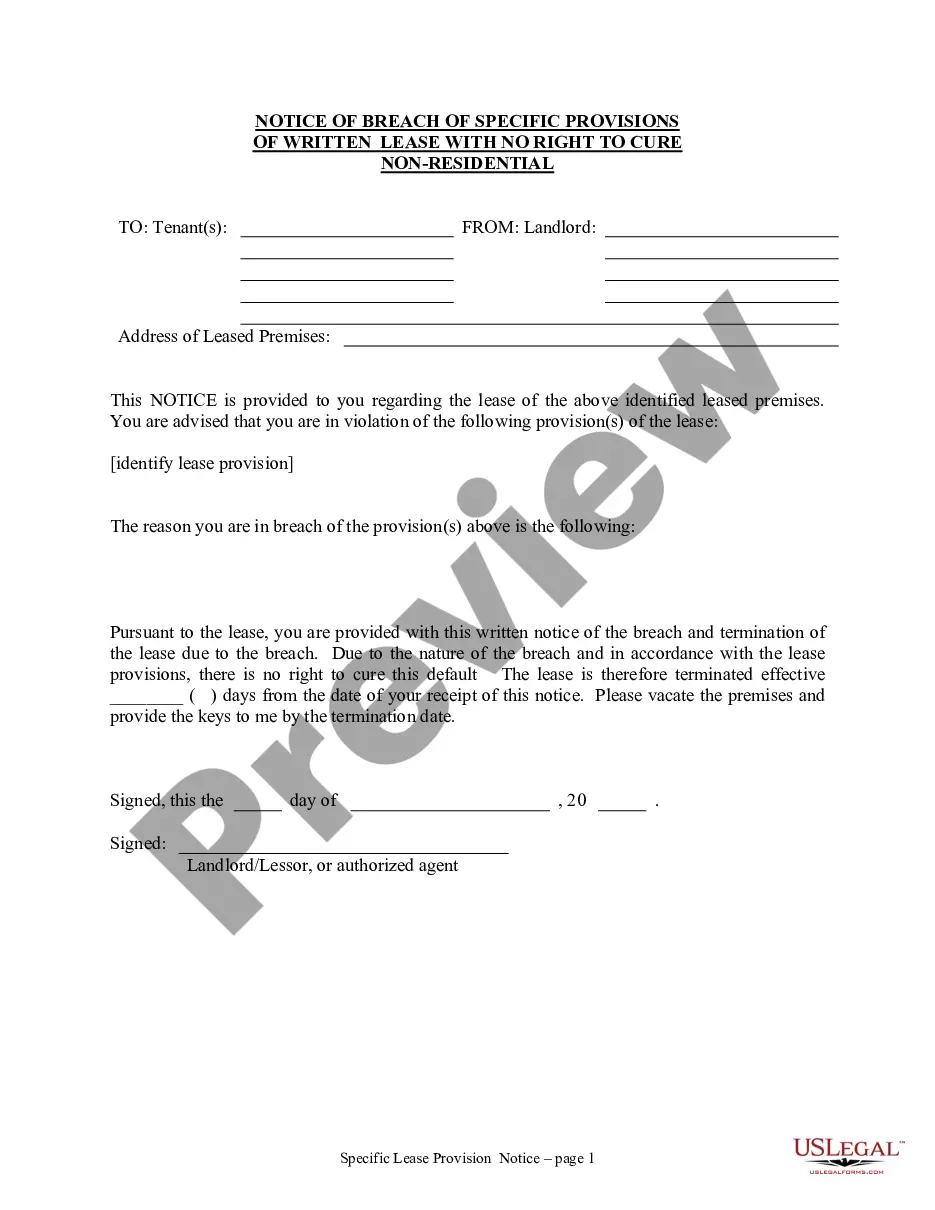

A deed of trust can be deemed invalid in California for several reasons. Common issues include the absence of required signatures, improper notarization, or lack of a legal description of the property. Ensuring your California deed of trust form 3005 is completed accurately helps prevent these pitfalls. Always double-check the details to verify validity.

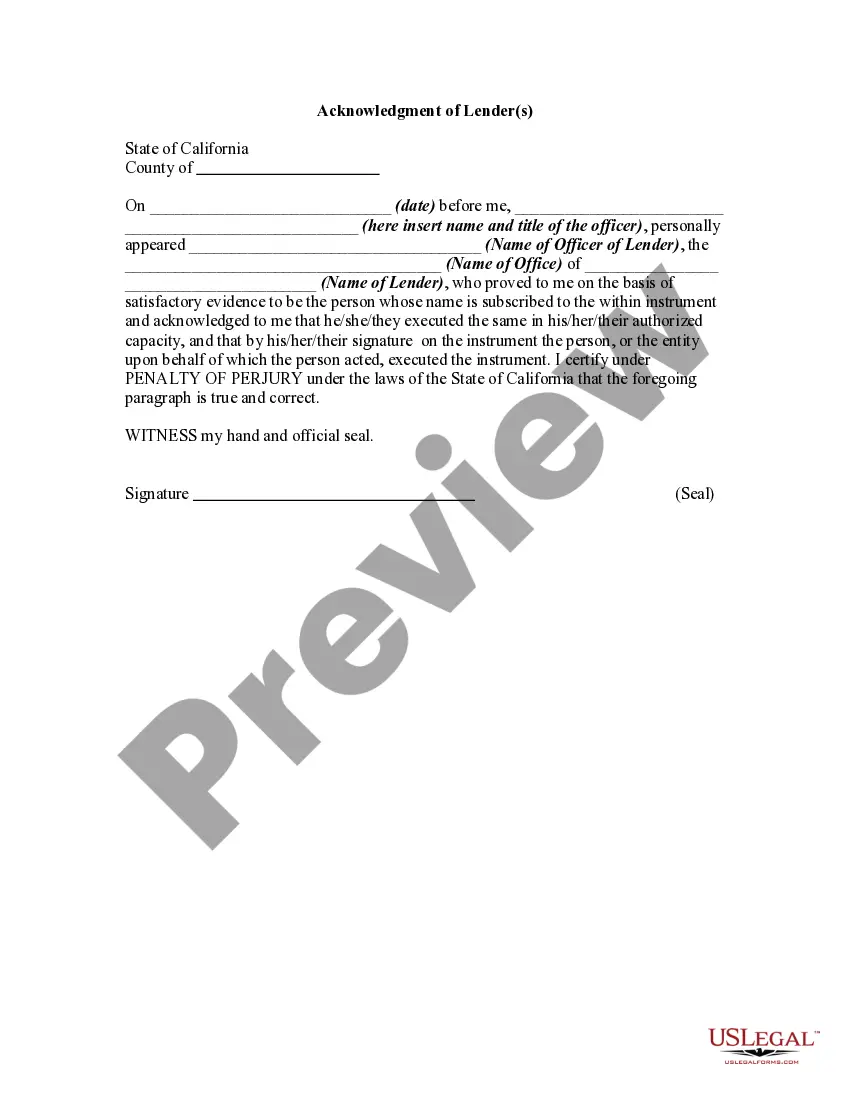

To file a deed of trust in California, you first need to complete the California deed of trust form 3005. After filling out the form, you must sign it in front of a notary public. Finally, you should submit the signed form to the county recorder’s office in the county where the property is located. This process ensures that your deed of trust is legally recognized.

In California, the property within a trust is owned by the trust itself, and the trustee manages it on behalf of the beneficiaries. This arrangement ensures that the properties are protected and benefit the named individuals according to the trust terms. When you are creating a trust, consider using the California deed of trust form 3005 for clarity in ownership and management.

In California, the lender or mortgage company usually holds the deed of trust. This document grants them a security interest in the property. Consequently, it is crucial to accurately complete the California deed of trust form 3005 to clarify ownership and rights.

To create a valid deed of trust in California, certain requirements must be met, including proper identification of the parties involved, a detailed legal description of the property, and notarization. It's also essential to include the necessary information regarding repayment terms and the default process. Using the California deed of trust form 3005 can help ensure all requirements are fulfilled.

In a deed of trust in California, the title to the property is held by a third party, known as the trustee, for the benefit of the lender. This arrangement allows the lender to have a legal claim against the property in case of default. The specific responsibilities of the trustee will be outlined in the California deed of trust form 3005.

To obtain a copy of your deed of trust in California, you can start by visiting your county recorder's office. You can search their online database using your name or property address. If needed, you might also use the California deed of trust form 3005 to request a certified copy directly from the office.