Trust Transfer Deed Without Warranty

Description

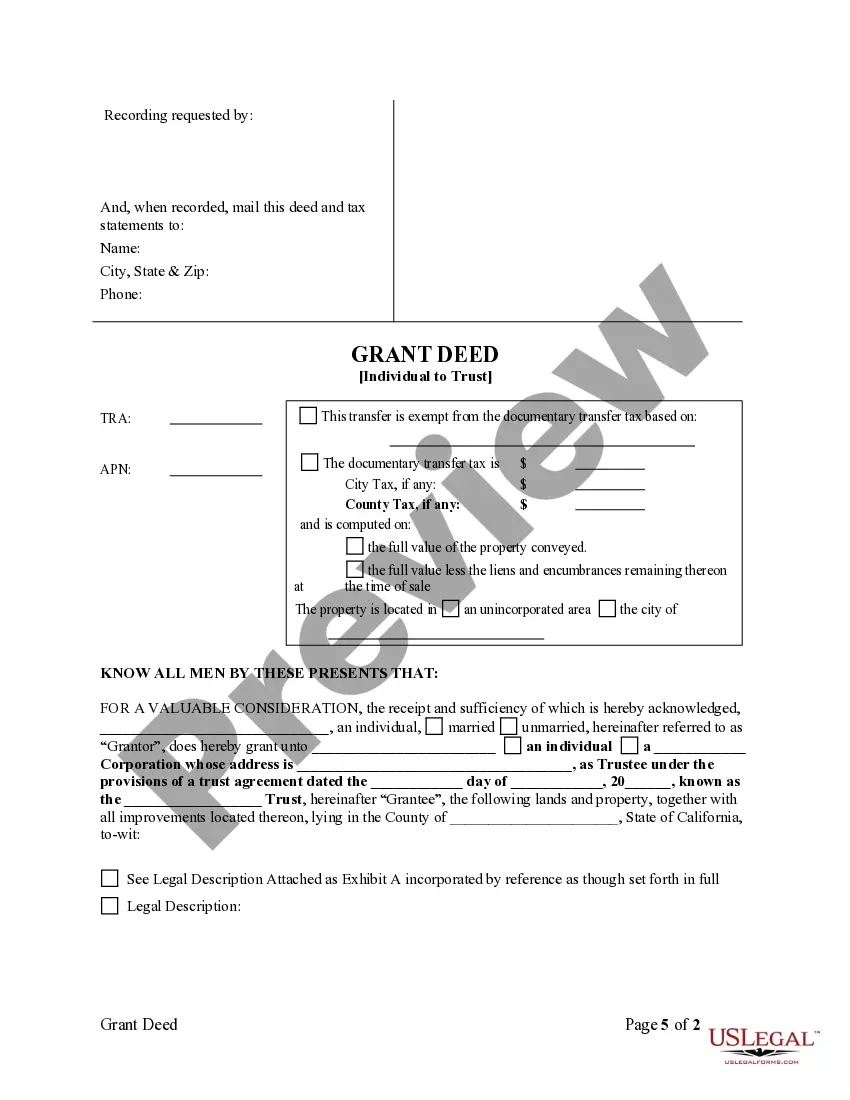

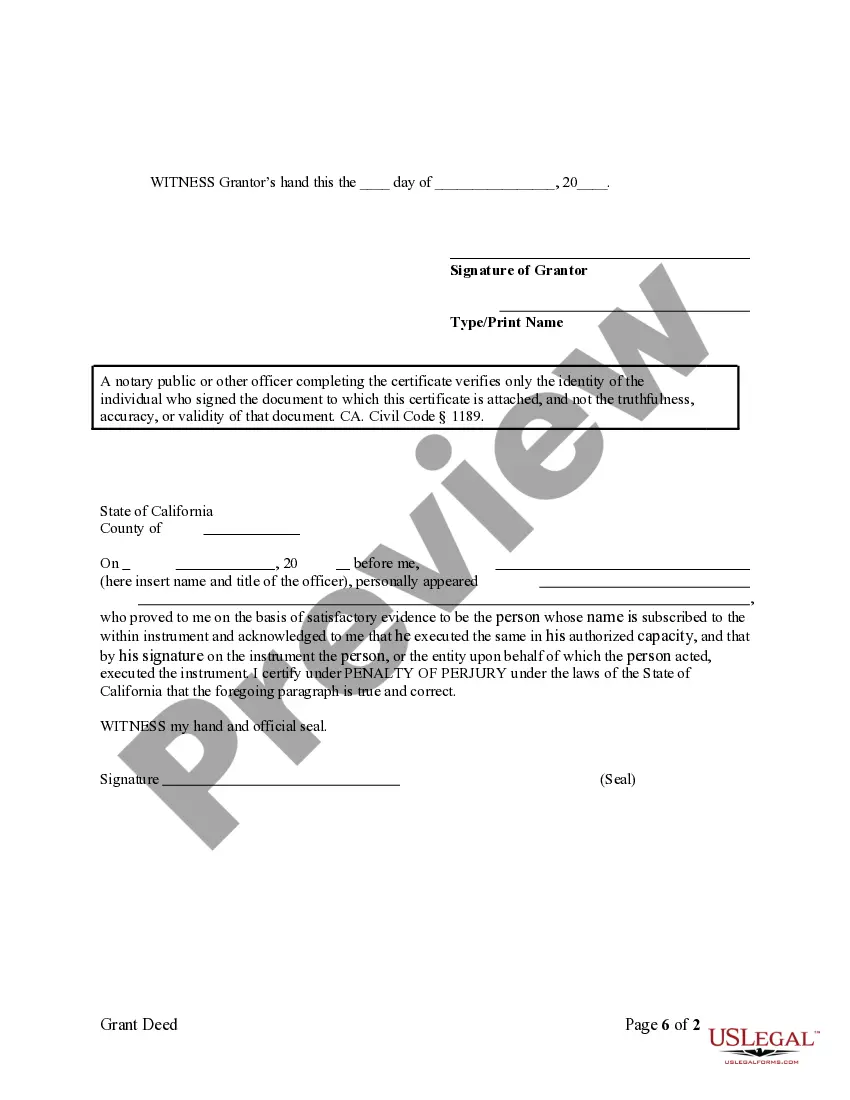

How to fill out California Grant Deed From Individual To Trust?

Legal documents handling can be daunting, even for seasoned experts.

When you are looking for a Trust Transfer Deed Without Warranty and lack the time to dedicate to finding the right and current version, the process may be overwhelming.

US Legal Forms meets any needs you may have, from personal to business documents, all in one location.

Utilize advanced tools to fill out and manage your Trust Transfer Deed Without Warranty.

Here are the steps to follow after acquiring the form you need: Verify it is the correct document by previewing and reviewing its details.

- Access a valuable repository of articles, guides, and resources pertinent to your unique situation and needs.

- Save time and effort in sourcing the forms you require, and take advantage of US Legal Forms’ sophisticated search and Review feature to locate your Trust Transfer Deed Without Warranty.

- If you hold a membership, Log In to your US Legal Forms account, search for the document, and retrieve it.

- Check the My documents tab to view the documents you have previously obtained and organize your files as desired.

- If this is your first time using US Legal Forms, establish a free account and gain unlimited access to the myriad benefits our library offers.

- A robust online form repository can be transformative for anyone looking to manage these matters effectively.

- US Legal Forms stands as a leader in web-based legal documents, offering over 85,000 state-specific legal forms for your convenience.

- With US Legal Forms, you are able to access forms tailored to your state or county requirements.

Form popularity

FAQ

Quitclaim deeds do not contain any implied warranties or covenants. Under a quitclaim deed, the grantor simply transfers its whole interest in the described real estate, but makes no covenant or representation that the grantor in fact has any interest in the subject property.

Texas deeds without warranty It conveys title to the buyer, but there's no warranty against any defects in the title. Thus, a buyer can't sue a seller who used a deed without warranty for any defect in title that appears later on.

A warranty deed ensures a buyer that the property is owned by the seller and is able to be sold without any encumbrances. A deed of trust is used in certain states, and represents a buyer's guarantee with their lender to repay the property loan as scheduled.

This transfer doesn't usually lead to an immediate tax obligation, meaning no tax is levied for merely changing the ownership. However, the trust, which now owns the stock, may become liable for taxes on dividends and capital gains from the stock.

The next major deed in Texas is a deed without warranty (or warranties). This type of deed is pretty self-explanatory?it is a conveyance of real property without any warranties. This type of deed is not advised because it could purport to transfer the entire interest when it actually doesn't.