Trust Transfer Deed Without Solicitor

Description

How to fill out California Grant Deed From Individual To Trust?

Legal administration can be perplexing, even for seasoned professionals.

When you are looking for a Trust Transfer Deed Without Solicitor and lack the time to dedicate to finding the appropriate and current version, the process can be overwhelming.

US Legal Forms caters to all your requirements, from personal to commercial documents, all in one location.

Utilize advanced tools to prepare and manage your Trust Transfer Deed Without Solicitor.

Here are the steps to follow after obtaining the form you need: Confirm that this is the correct document by previewing it and reviewing its details.

- Access a valuable resource library of articles, guides, and materials related to your case and needs.

- Save time and effort searching for the documents you need, and use US Legal Forms’ sophisticated search and Review tool to locate the Trust Transfer Deed Without Solicitor.

- For subscribers, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents section to review the documents you have previously saved and manage your folders as desired.

- If this is your first experience with US Legal Forms, create a free account and gain unrestricted access to all the benefits of the platform.

- A comprehensive online form directory could be transformative for anyone aiming to manage these scenarios effectively.

- US Legal Forms is a leading provider in online legal forms, with more than 85,000 state-specific legal documents available to you at any time.

- With US Legal Forms, you have access to state- or county-specific legal and business forms.

Form popularity

FAQ

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

Pricing for Short Form Deed of Trust The cost to prepare and file a Short Form Deed of Trust in California is $375.00* total. The flat rate pricing includes filing fees. *Our flat rate pricing covers filing fees for up to 5 pages and do not include notary fees.

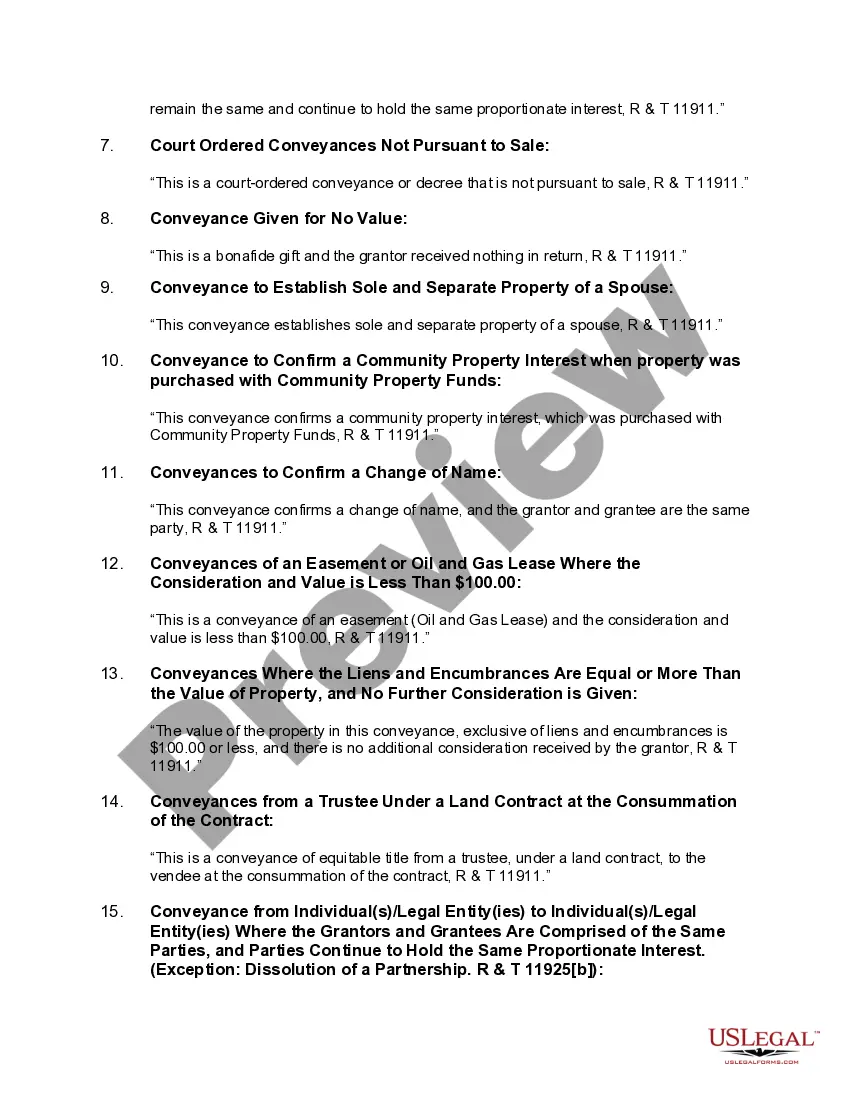

The most common way to transfer property is through a general warranty deed (sometimes called a "grant deed"). A general warranty deed guarantees good title from the beginning of time. A special warranty deed only guarantees good title during the seller's time of ownership.

The most common and reliable way to transfer title of property to someone is through a deed. There are a variety of different deeds, however, when buying or selling you'll typically want a Warranty Deed or Grant Deed.

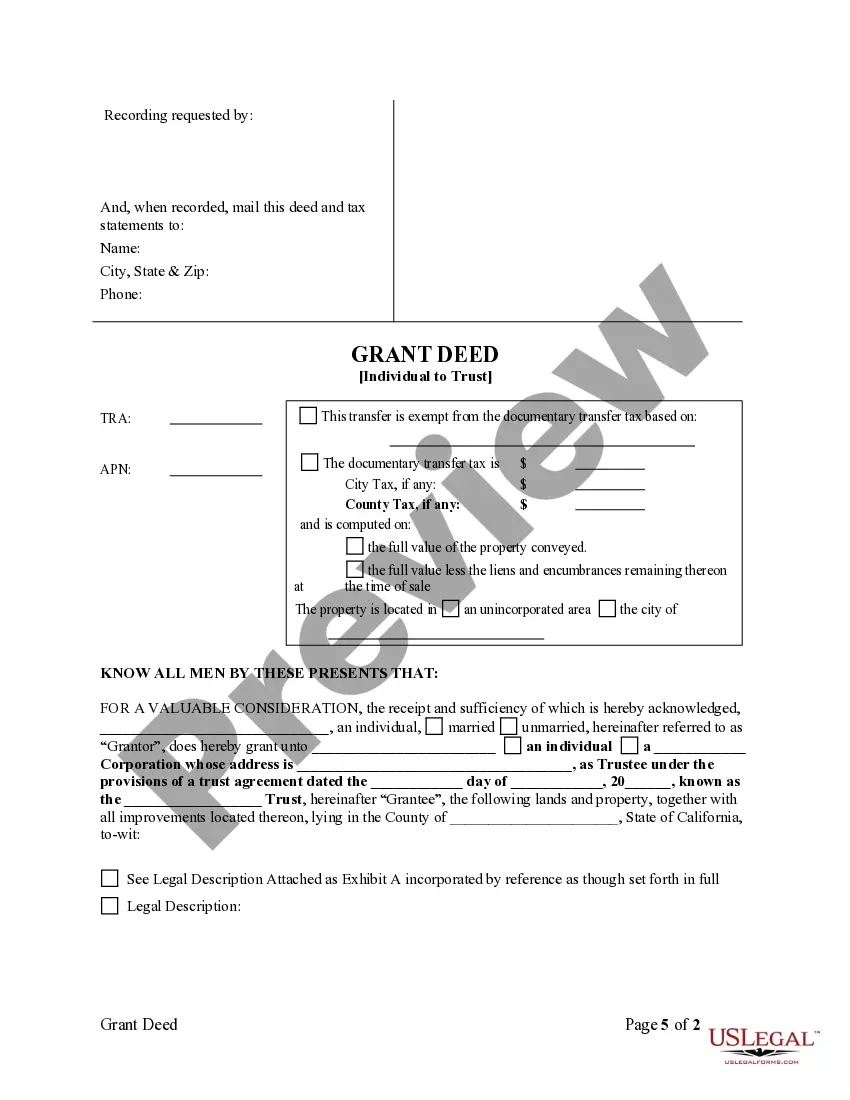

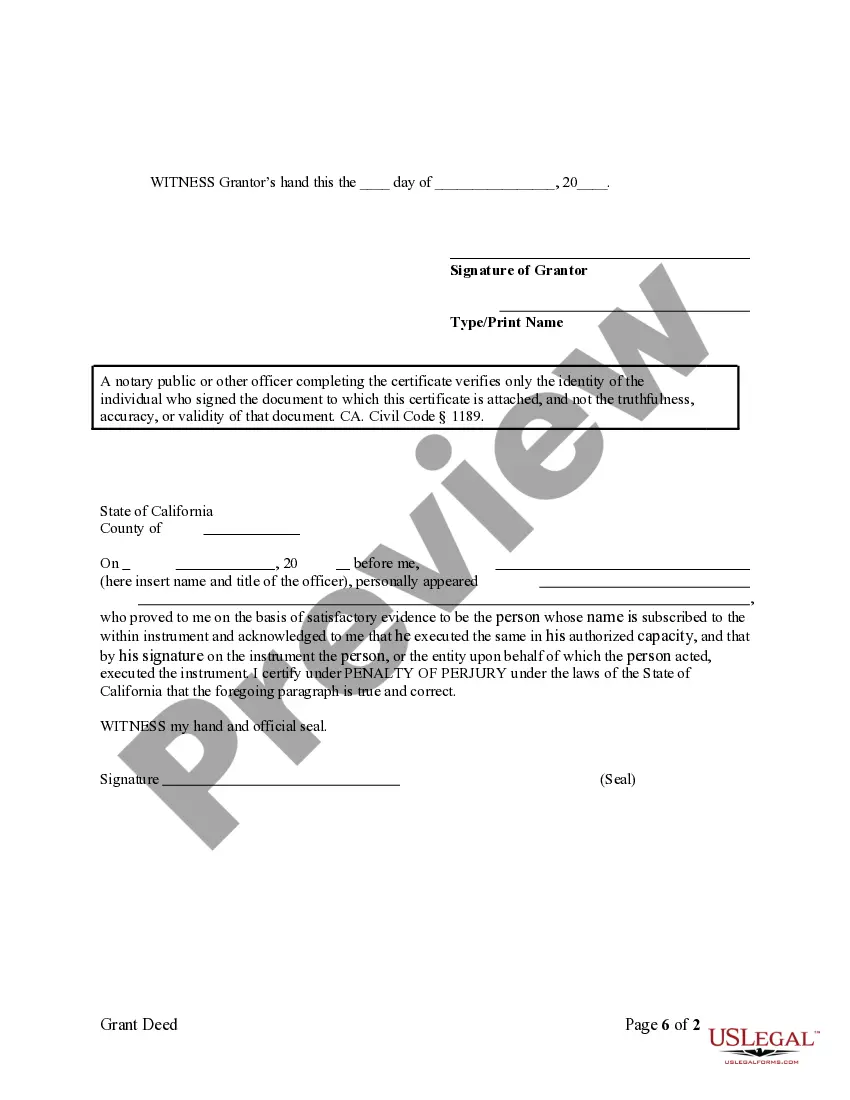

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.