Trust Transfer Deed With Trust

Description

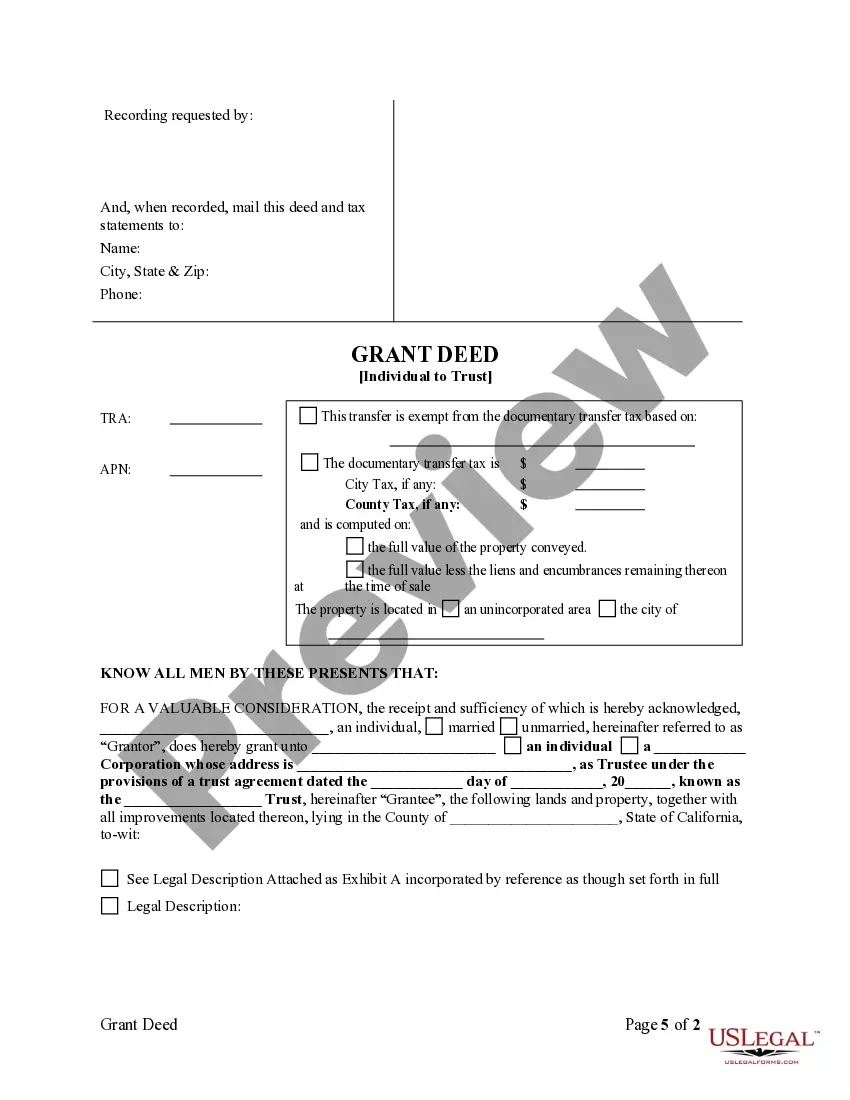

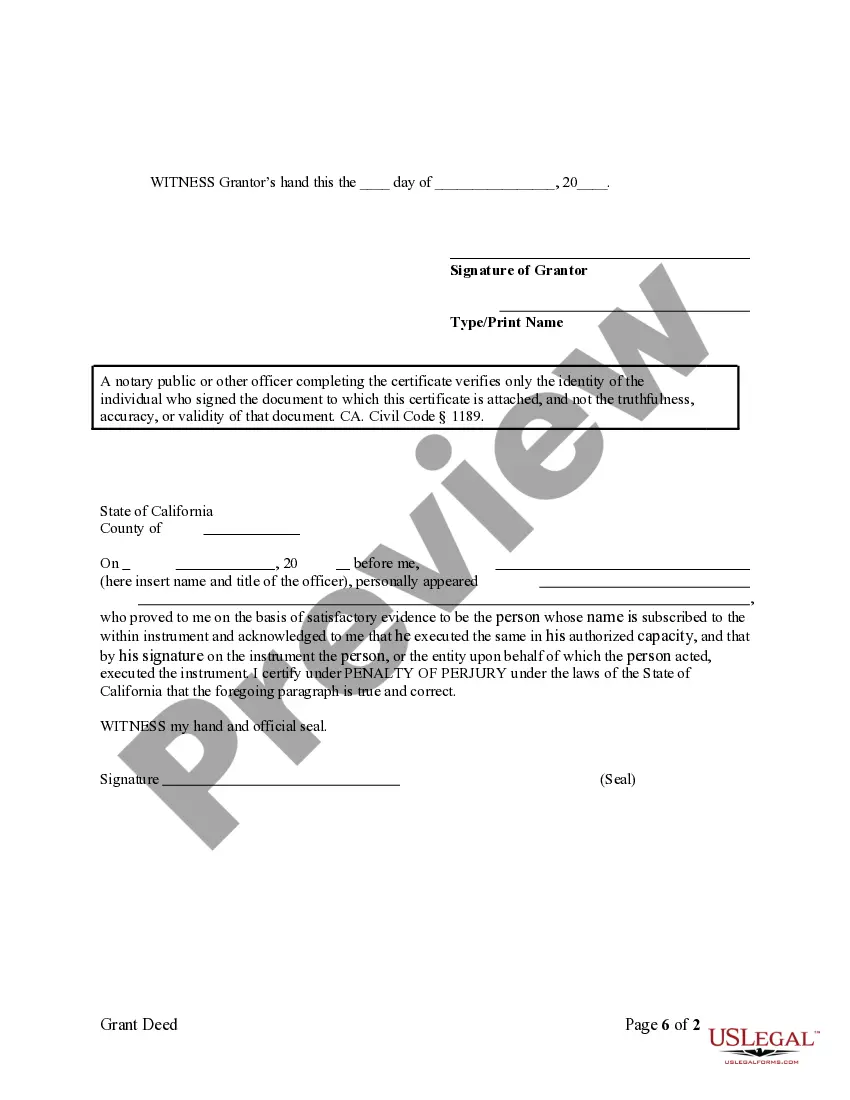

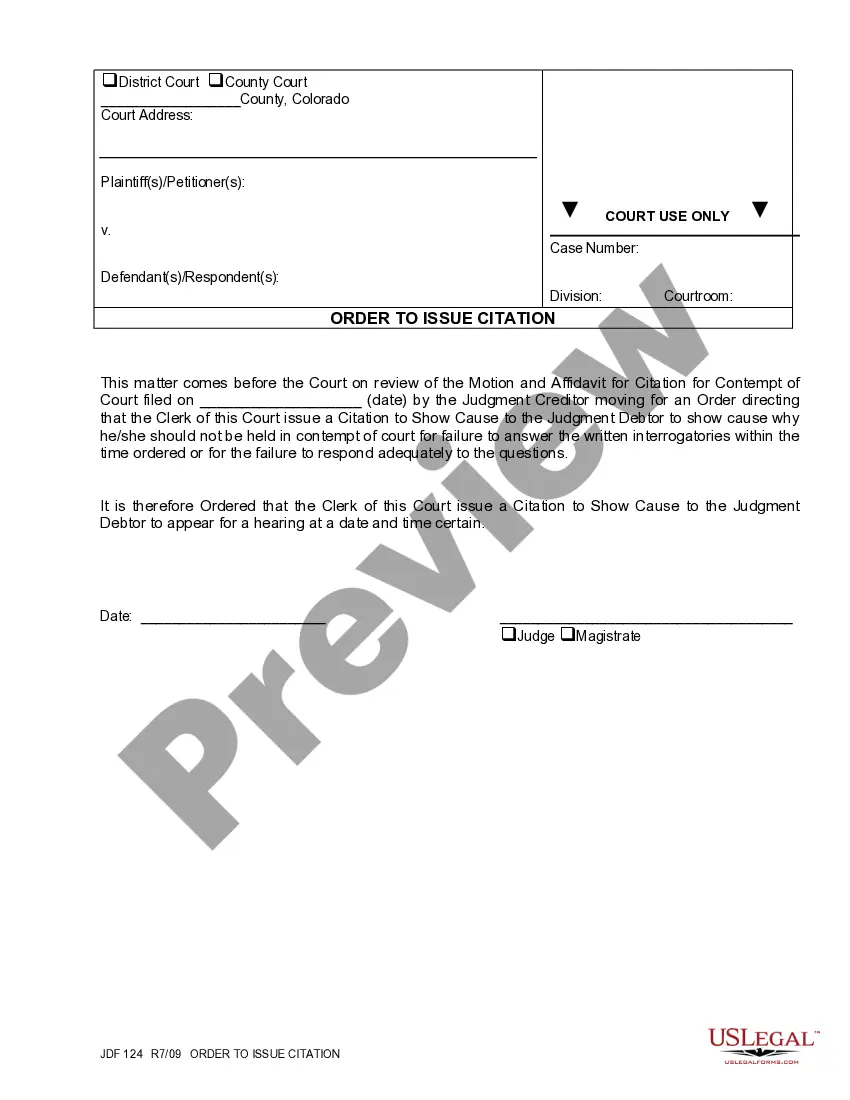

How to fill out California Grant Deed From Individual To Trust?

It’s clear that you can’t transform into a legal specialist in a day, nor can you learn how to swiftly create a Trust Transfer Deed With Trust without possessing a specialized education.

Generating legal documents is an extensive endeavor that necessitates particular training and abilities. So why not entrust the creation of the Trust Transfer Deed With Trust to the experts.

With US Legal Forms, one of the largest legal template repositories, you can discover everything from court documents to models for internal business communication.

You can revisit your documents from the My documents section at any time. If you are a current client, simply Log In and find and download the template from the same section.

Regardless of the intention behind your forms—whether financial, legal, or personal—our platform is here to assist you. Explore US Legal Forms today!

- Recognize the form you require by utilizing the search function located at the top of the website.

- View it (if this choice is available) and examine the accompanying description to ascertain if Trust Transfer Deed With Trust meets your needs.

- Restart your search if you are looking for a different template.

- Create a free account and choose a subscription plan to purchase the template.

- Select Buy now. After the payment is completed, you can access the Trust Transfer Deed With Trust, fill it out, print it, and forward or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

There are many good reasons why trustees might transfer assets from one trust to another of the family's trusts. They might want to separate the diverging interests of different family members.

A revocable trust, sometimes referred to as a living trust, allows for assets to be transferred into a tax-sheltered and legally protected trust while the creator of the trust is still alive. Revocable trusts are flexible, allowing for property and assets to easily be transferred into and out of the trust.

A trust is used to transfer the administration of personal or real property (like a house, shares or bonds) to another person (the trustee). This means that the property no longer belongs to the person who transferred it.

A transfer out of trust can occur when: the trust comes to an end. some of the assets within the trust are distributed to beneficiaries. a beneficiary becomes 'absolutely entitled' to enjoy an asset.

When you signed up for your Trust Deed, you agreed to make monthly payments towards your debts for a set period of time, typically four years. Now these four years are up, any remaining unsecured debt will be automatically written off.