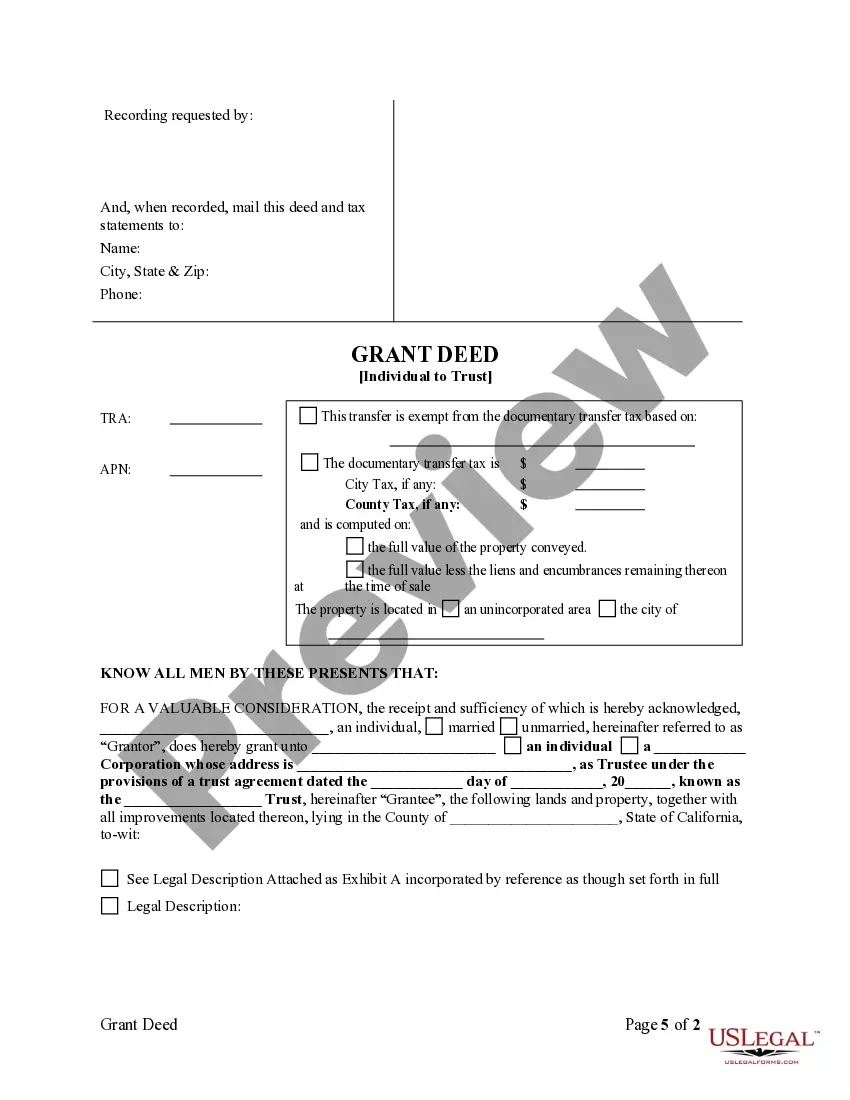

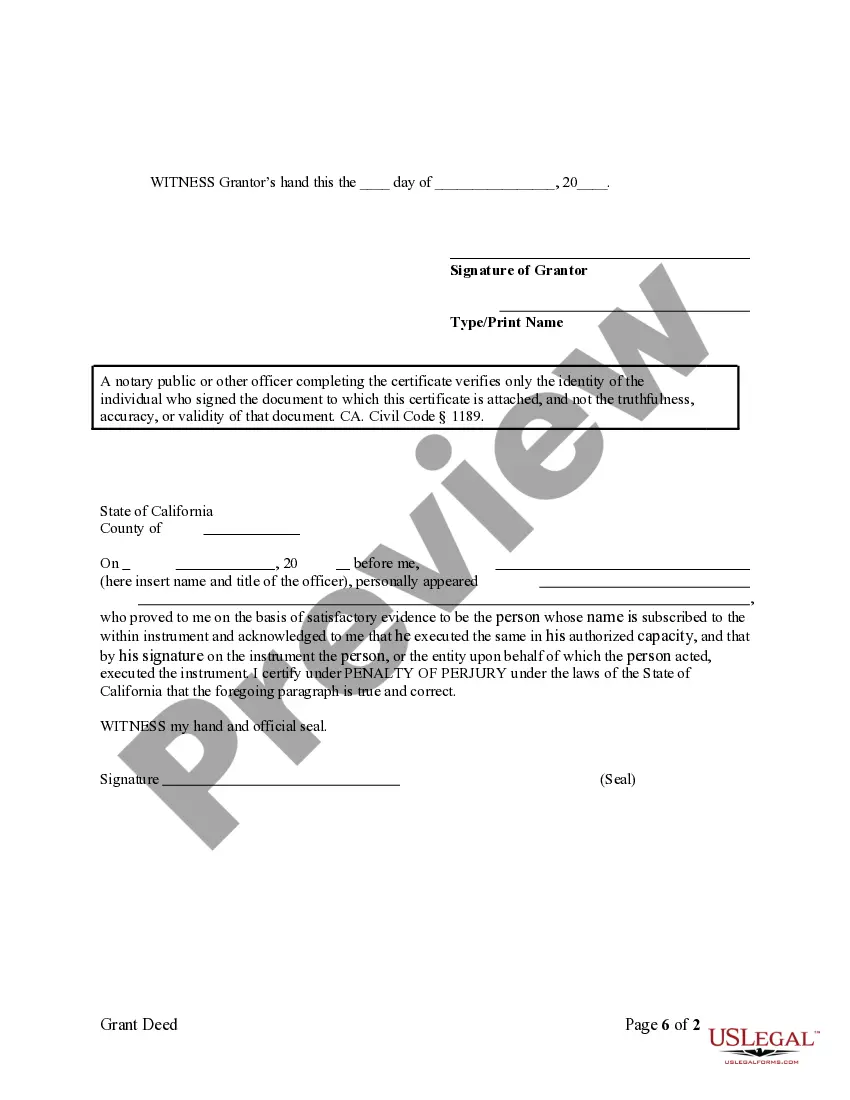

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Trust Deed Transfer Of Property

Description

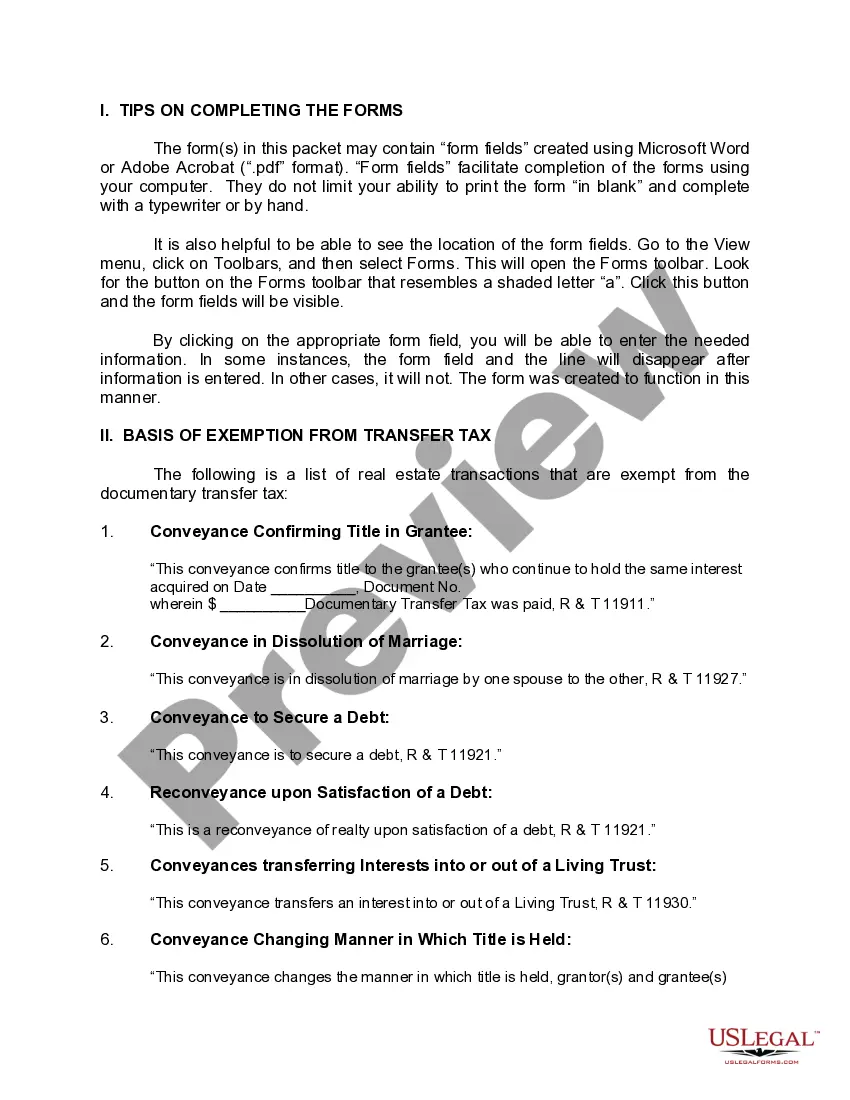

How to fill out California Grant Deed From Individual To Trust?

Handling legal documents can be exasperating, even for experienced professionals.

If you are looking for a Trust Deed Transfer of Property and lack the time to search for the correct and current version, the process can be arduous.

Access a library of articles, guides, and resources related to your situation and requirements.

Conserve time and effort by using US Legal Forms' enhanced search and Preview function to obtain and download the Trust Deed Transfer of Property.

Make sure the template is accepted in your state or county. Choose Buy Now when you are prepared. Select a monthly subscription plan. Choose your preferred format, then Download, complete, eSign, print, and submit your documents. Experience the US Legal Forms online library, bolstered by 25 years of expertise and reliability. Change your everyday document management into a seamless and user-friendly experience today.

- If you possess a subscription, Log Into your US Legal Forms account, find the form, and download it.

- Check the My documents section to see the documents you have saved and manage your files as desired.

- If this is your initial experience with US Legal Forms, create a free account to gain unlimited access to all the platform's benefits.

- Here are the actions to take after acquiring the form you need.

- Verify it is the correct form by previewing it and reviewing its description.

- Utilize state- or county-specific legal and business documents.

- US Legal Forms fulfills various needs you may have, from personal to business paperwork, all in one location.

- Employ sophisticated tools to complete and manage your Trust Deed Transfer of Property.

Form popularity

FAQ

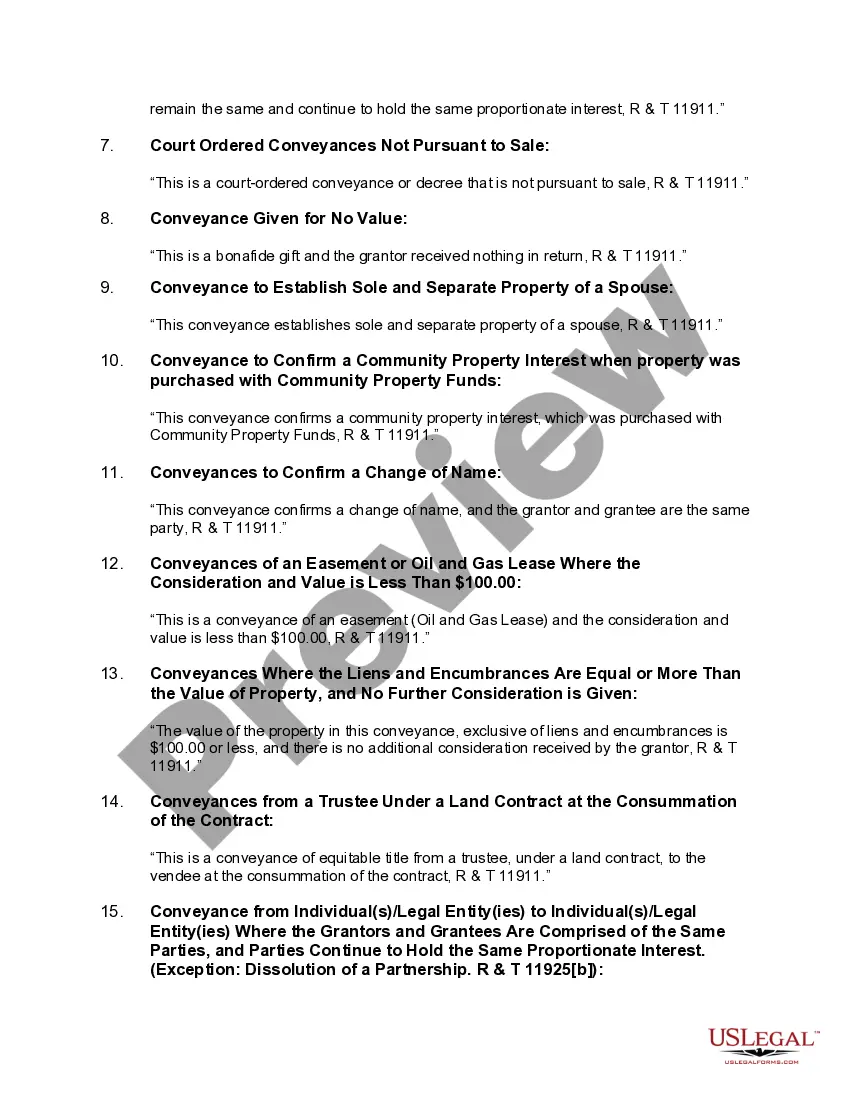

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

To create a living trust in Maryland you create a Declaration of Trust which is a written document. Oral trusts are valid in Maryland but are very difficult to enforce and manage. You sign the Declaration in front of a notary public. Assets are then transferred into the trust to fund the trust.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

For a revocable living trust to take effect, it should be funded by transferring certain assets into the trust. Often people fund a living trust with real estate, financial accounts, life insurance, annuity certificates, personal property, business interests, and other assets.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...