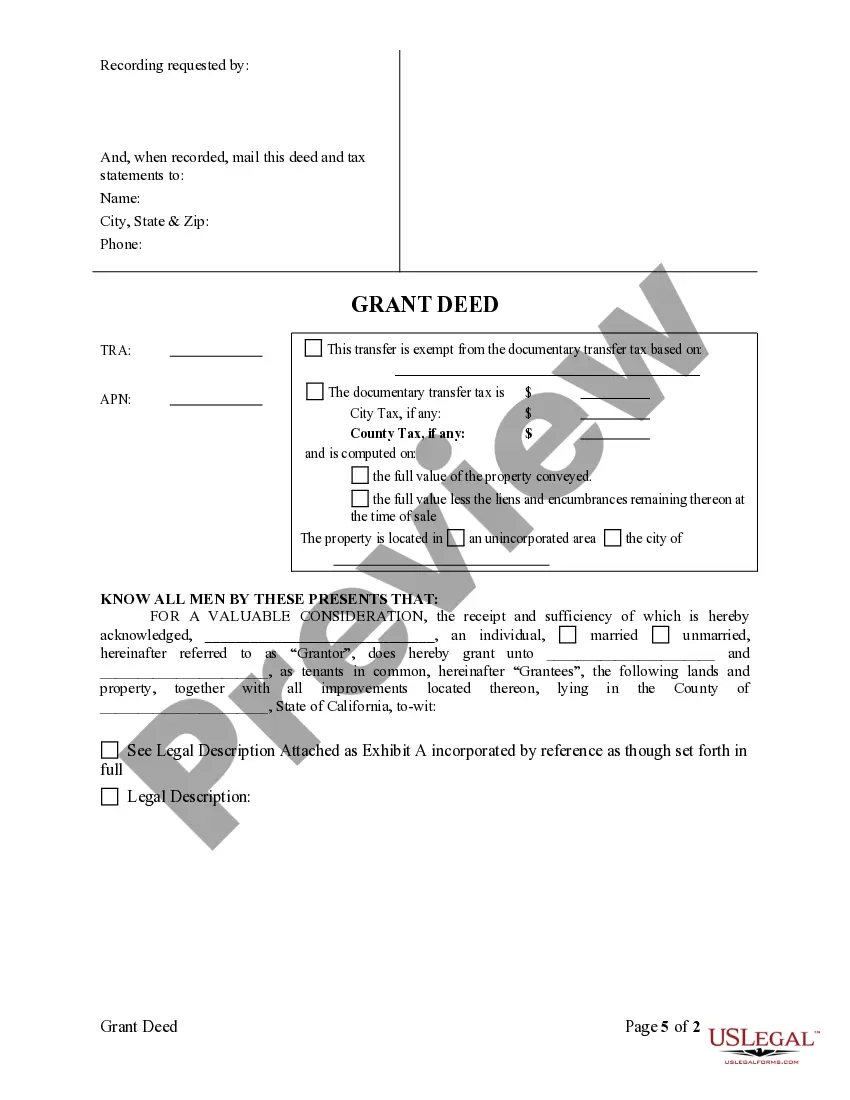

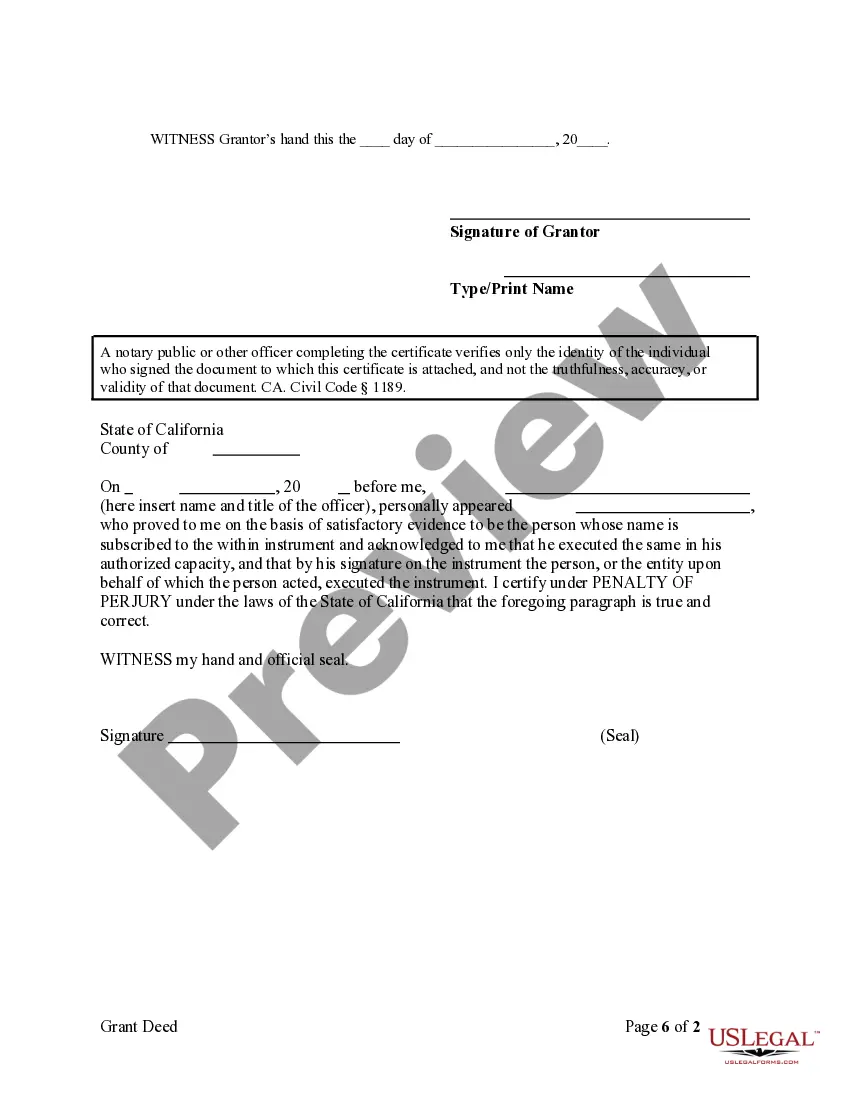

Ca Grant Deed Form With Notary Signature

Description

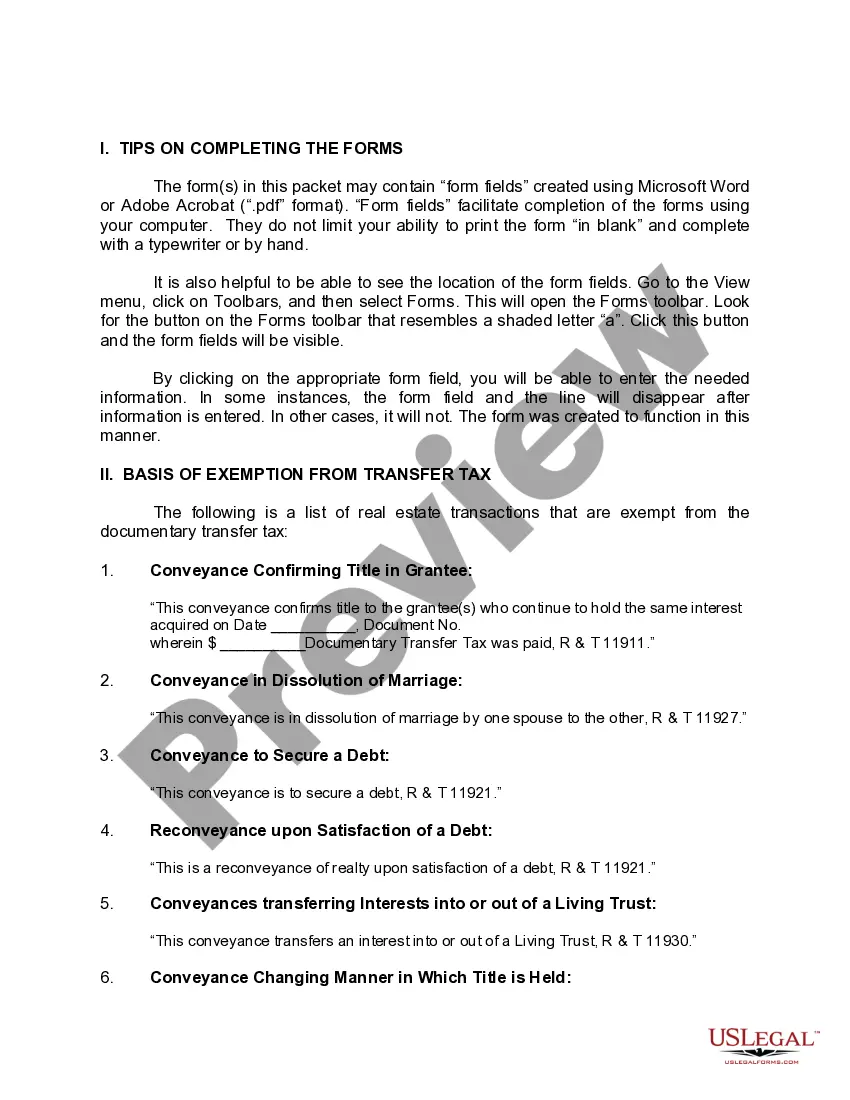

How to fill out California Grant Deed From Individual To Two Individuals As Tenants In Common?

Finding a reliable resource for the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the appropriate legal documents requires precision and meticulousness, which is why it is essential to obtain samples of Ca Grant Deed Form With Notary Signature solely from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and hinder your situation.

Once you have the form on your device, you may edit it using the editor or print it out and complete it manually. Eliminate the complications that come with your legal documentation. Browse through the extensive US Legal Forms collection to discover legal samples, verify their relevance to your situation, and download them without delay.

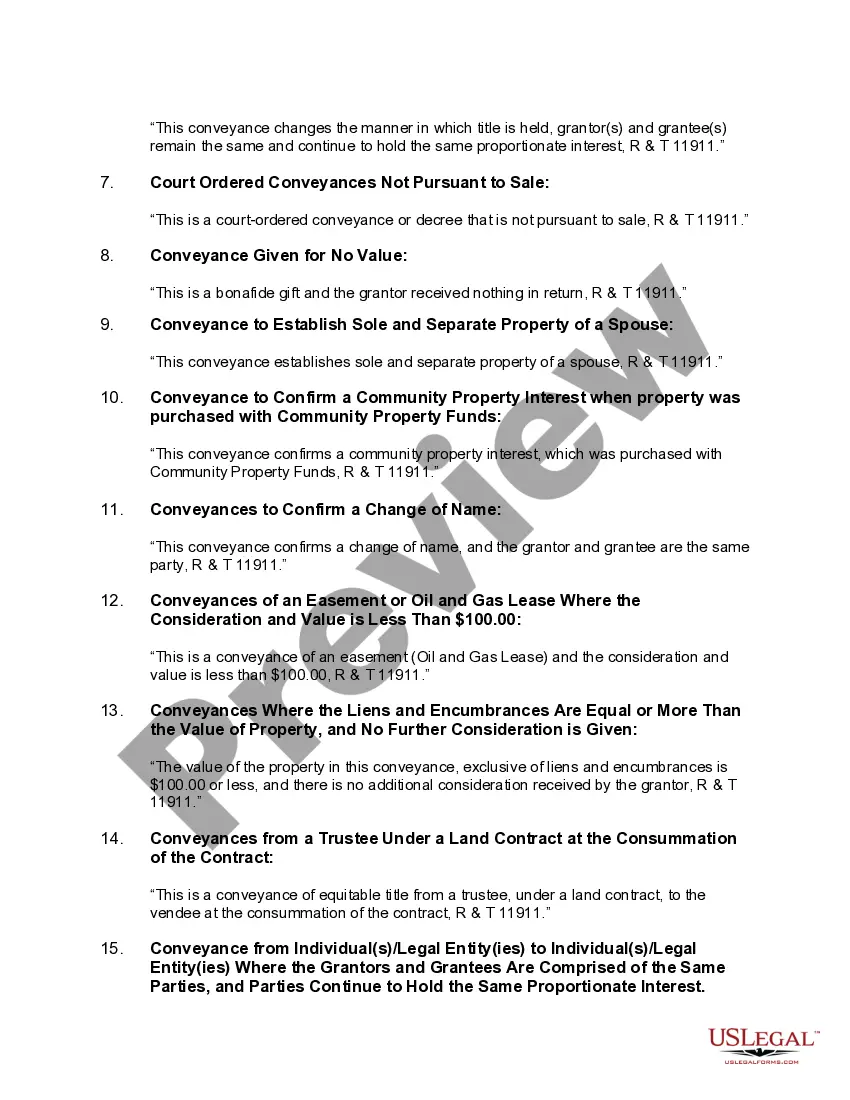

- Utilize the library navigation or search function to find your template.

- View the form’s description to ensure it aligns with the requirements of your state and county.

- Open the form preview, if available, to confirm the template is what you need.

- Return to the search to locate the appropriate template if the Ca Grant Deed Form With Notary Signature does not meet your criteria.

- If you are confident in the form’s relevance, proceed to download it.

- For registered users, click Log in to verify and access your chosen forms in My documents.

- If you lack an account, click Buy now to acquire the form.

- Choose the pricing option that meets your needs.

- Complete the registration to finish your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Ca Grant Deed Form With Notary Signature.

Form popularity

FAQ

Creating a FPOA Choose an agent. An attorney-in-fact or ?agent? is an adult who can make your financial choices when you can't. It is very important to choose someone that you trust. ... Fill out the FPOA form. Read it carefully and initial next to the rights you want your agent to have. ... Sign the form. Sign the form.

An Ohio durable (statutory) durable power of attorney form enables a person (?principal?) to appoint another person (?agent?) whom they trust to handle financial matters on their behalf. The term ?durable? refers to the form remaining legal even if the principal should become mentally handicapped.

A durable financial power of attorney (DFPOA) authorizes the attorney-in-fact to act on behalf of you, the principal, even after you become incapacitated or incompetent. FPOAs are durable by default, unless they specifically provide that they terminate by principal's incapacity.

Creating a FPOA Choose an agent. An attorney-in-fact or ?agent? is an adult who can make your financial choices when you can't. It is very important to choose someone that you trust. ... Fill out the FPOA form. Read it carefully and initial next to the rights you want your agent to have. ... Sign the form. Sign the form.

Pros: Attorney fees to execute a DPOA are generally economical when compared to fees associated establishing a conservatorship for the estate. A DPOA lasts indefinitely. A Durable Power of Attorney is confidential, and the person's reasons for assigning a DPOA do not have to be disclosed to outside parties.

The POA cannot transfer the responsibility to another Agent at any time. The POA cannot make any legal or financial decisions after the death of the Principal, at which point the Executor of the Estate would take over. The POA cannot distribute inheritances or transfer assets after the death of the Principal.

The state of Ohio provides a statutory form POA for financial decisions. It doesn't have a standardized form for a medical POA. In both cases, you can use FreeWill's free online software to create a power of attorney document tailored to your needs. Complete the form, sign it, and then have it notarized or witnessed.

A durable financial power of attorney (DFPOA) authorizes the attorney-in-fact to act on behalf of you, the principal, even after you become incapacitated or incompetent. FPOAs are durable by default, unless they specifically provide that they terminate by principal's incapacity.