Llc Registration In California

Description

How to fill out California Limited Liability Company LLC Formation Package?

Utilizing legal document examples that comply with federal and local regulations is crucial, and the internet provides numerous selections to consider.

However, what's the benefit of spending time hunting for the suitable LLC Registration in California template online when the US Legal Forms online repository already possesses such documents consolidated in one location.

US Legal Forms is the most extensive online legal resource with more than 85,000 fillable documents prepared by attorneys for any business and personal situation. They are simple to navigate with all files organized by state and intended use.

All documents you find through US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- Our experts keep up with legal updates, ensuring your form is current and compliant when obtaining an LLC Registration in California from our site.

- Acquiring an LLC Registration in California is fast and straightforward for both existing and new users.

- If you already hold an account with an active subscription, Log In and save the document template you require in the appropriate format.

- If you are new to our site, follow the steps outlined below.

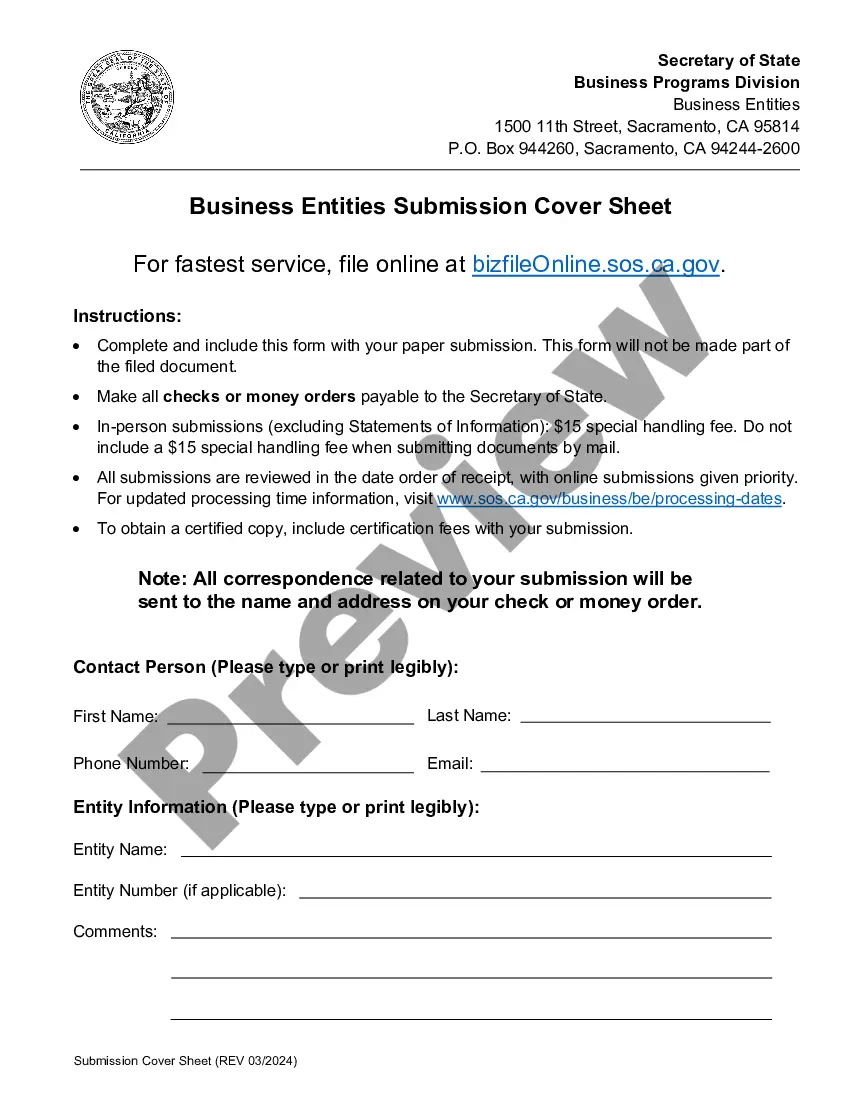

- Review the template using the Preview function or through the textual description to ensure it satisfies your needs.

Form popularity

FAQ

California LLC Fee The CA LLC fee is $85, payable to the secretary of state. In addition, a California LLC fee is also due for the statement of information, a document that must be submitted within 90 days of LLC formation and carries a filing cost of $20.

Your California LLC Articles of Organization can be filed online on the Secretary of State website, mailed in, submitted in person or you can have Incfile file on your behalf for free. The state charges a $5 certification fee to register an LLC in California, along with the $70 filing fee.

Here are the 8 steps you need to take to form an LLC in California. Choose a name for your LLC. File articles of organization. Choose a registered agent. Decide on member vs. manager management. Prepare an operating agreement. File a biennial report. Pay your CA state taxes. Comply with other tax and regulatory requirements.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

Due Dates for First-Year Annual Tax Payment Domestic LLCs have until the 15th day of the 4th month after they file their Articles of Organization with the SOS to pay the first-year annual tax. For the LLC's first year, this is measured from the date the business files its Articles of Organization.