California Limited Llc Formation

Description

How to fill out California Limited Liability Company LLC Formation Package?

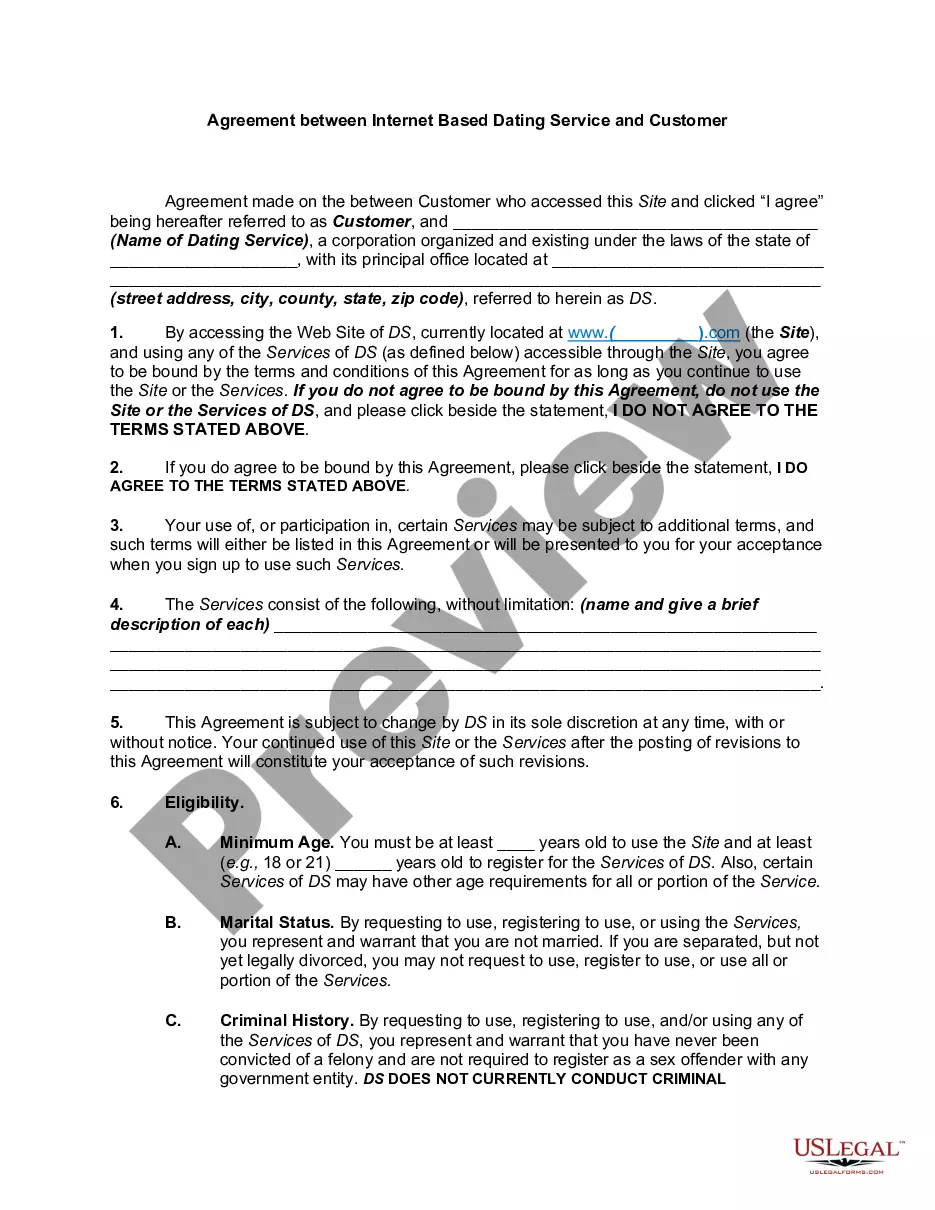

The California Limited Llc Formation showcased on this page is a versatile official template created by expert attorneys in adherence to federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific documents for any corporate and personal situation. It is the quickest, easiest, and most trustworthy method to acquire the paperwork you require, as the service guarantees the utmost level of data security and malware defense.

Select the format you want for your California Limited Llc Formation (PDF, DOCX, RTF) and download the sample onto your device. Complete and sign the document. Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to swiftly and accurately complete and sign your form electronically. Re-download your documents whenever necessary. Access the My documents section in your account to retrieve any forms you have previously downloaded. Register for US Legal Forms to have authenticated legal templates for every situation in life available to you.

- Search for the document you require and examine it.

- Browse the sample you found and preview it or review the form description to confirm it meets your needs. If it doesn't, utilize the search feature to find the correct one. Click Buy Now once you have located the template you desire.

- Register and Log In.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

No, since your California LLC doesn't need to pay the $800 franchise tax for its 1st year, you don't need to file Form 3522. Form 3522 will need to be filed in the 2nd year.

Just go to California's Franchise Tax Board website, and under 'Business,' select 'Use Web Pay Business. ' Select 'LLC' as entity type and enter your CA LLC entity ID. Pay the annual fee for the full calendar year (1/1 to 12/31) using your business bank account.

Due Dates for First-Year Annual Tax Payment Domestic LLCs have until the 15th day of the 4th month after they file their Articles of Organization with the SOS to pay the first-year annual tax. For the LLC's first year, this is measured from the date the business files its Articles of Organization.

California LLC Formation Filing Fee: $70 Filing your articles officially creates your LLC. You can file online, by mail, or in person. If you want your Articles of Organization processed fast, the state offers expedited processing options: 24-hour Expedite for $350, and Same Day Expedite for $750.

Name your California LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... File a statement of information. ... Get an employer identification number. ... Pay the annual franchise tax.