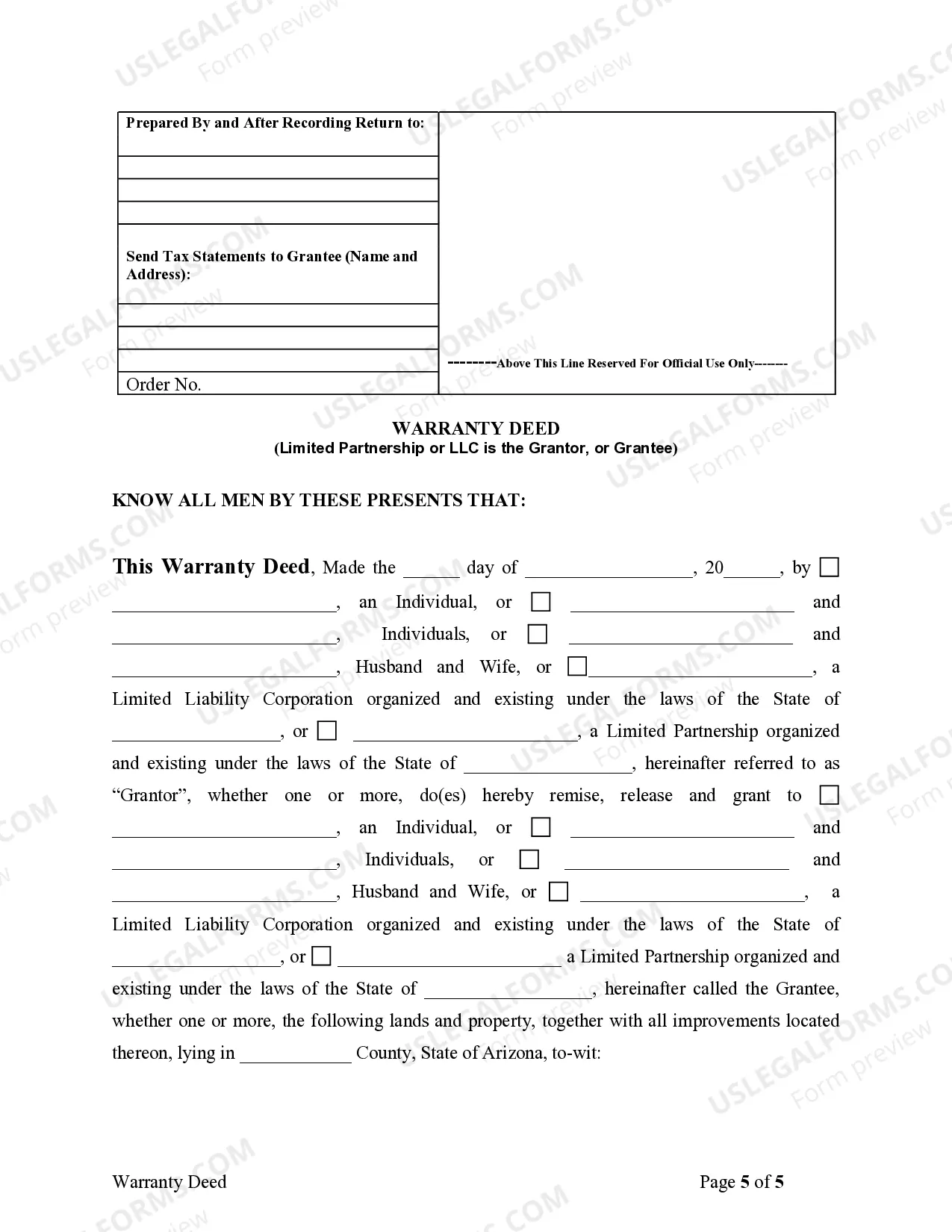

This form is a Warranty Deed where the grantor and/or grantee could be a limited partnership or LLC.

Limited Liability Partnership For Buy To Let

Description

Form popularity

FAQ

Deciding between a partnership and a limited liability partnership for buy to let ultimately depends on your individual goals and circumstances. While a partnership may simplify tax and management structures, an LLP offers the crucial benefit of limited liability, protecting personal assets. Understanding the nature of your business and future aspirations will help guide your decision. Consider consulting platforms like uslegalforms to navigate these options effectively.

One of the benefits of a limited liability partnership for buy to let is that there is no minimum capital requirement. This flexibility allows you to start your business without a significant upfront investment. However, it’s wise to consider your financial plans and ensure you have sufficient resources to operate successfully. Focus on building a strong financial foundation for your LLP.

One disadvantage of a limited liability partnership for buy to let is the complexity of setup and ongoing compliance requirements. While an LLP provides liability protection, it may also involve higher administrative costs and formalities compared to simpler partnership structures. Additionally, members may face taxation at their income level, which could impact overall returns. Be sure to assess these factors when considering your options.

The choice between a partnership and a limited liability partnership depends on various factors. A limited liability partnership for buy to let provides protection from personal liability, which is a significant advantage. Partnerships may be easier to set up, but they expose members to greater financial risk. Evaluate your business model and consult with professionals to make an informed decision.

Choosing between a limited company and a partnership depends on your specific needs. A limited liability partnership for buy to let offers asset protection and flexibility in management. In contrast, partnerships may allow for simpler tax structures but carry greater personal risk. It’s crucial to weigh these factors and consider your long-term goals.

A limited company often provides greater protection for personal assets compared to a partnership. In a limited liability partnership for buy to let, your financial risk is minimized, as personal liability is limited to the investment in the business. Moreover, limited companies can have tax advantages and easier access to funding. This structure can also enhance credibility with lenders and clients.

An LLP agreement should include the name of the partnership, partner identities, and their contributions in terms of capital or assets. Additionally, it should specify how profits will be shared, procedures for adding new partners, and methods for resolving disputes. A comprehensive agreement sets a solid foundation for your Limited Liability Partnership for buy to let, ensuring clarity and compliance.

Drafting an LLP agreement involves outlining the essential elements of your Limited Liability Partnership for buy to let. Start with the partnership name, followed by sections detailing the contributions of each partner, profit distribution, decision-making processes, and dispute resolution methods. You can also refer to resources like uslegalforms to ensure your agreement meets legal requirements.

The default agreement for a Limited Liability Partnership for buy to let is typically a statutory framework set by state laws. This framework outlines the rights and duties of partners if no specific agreement exists. However, having a tailored LLP agreement is recommended to specify unique contributions, responsibilities, and profit distributions.

To form a Limited Liability Partnership for buy to let, you need to choose a unique name and designate a registered office address. Next, complete and file the appropriate forms with the state, along with any required fees. Finally, create an LLP agreement that defines the structure and operations of the partnership, ensuring all partners are in agreement.