Business Failed

Description

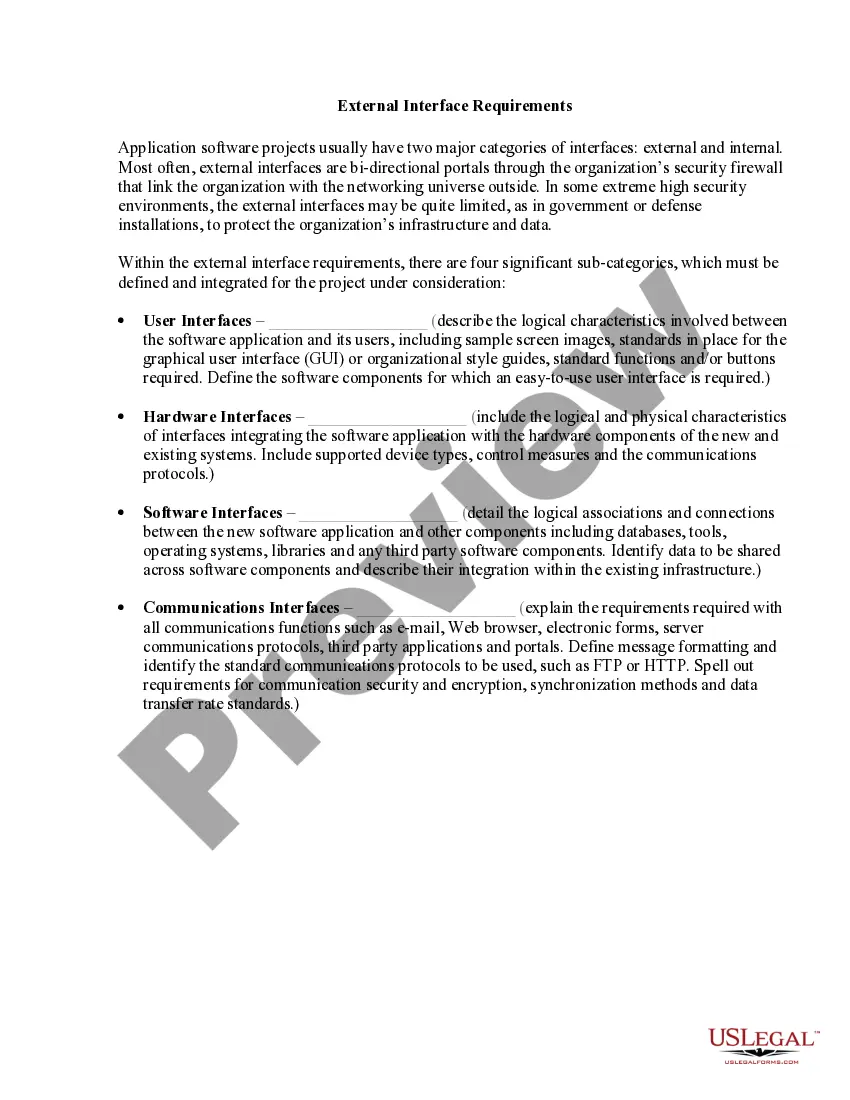

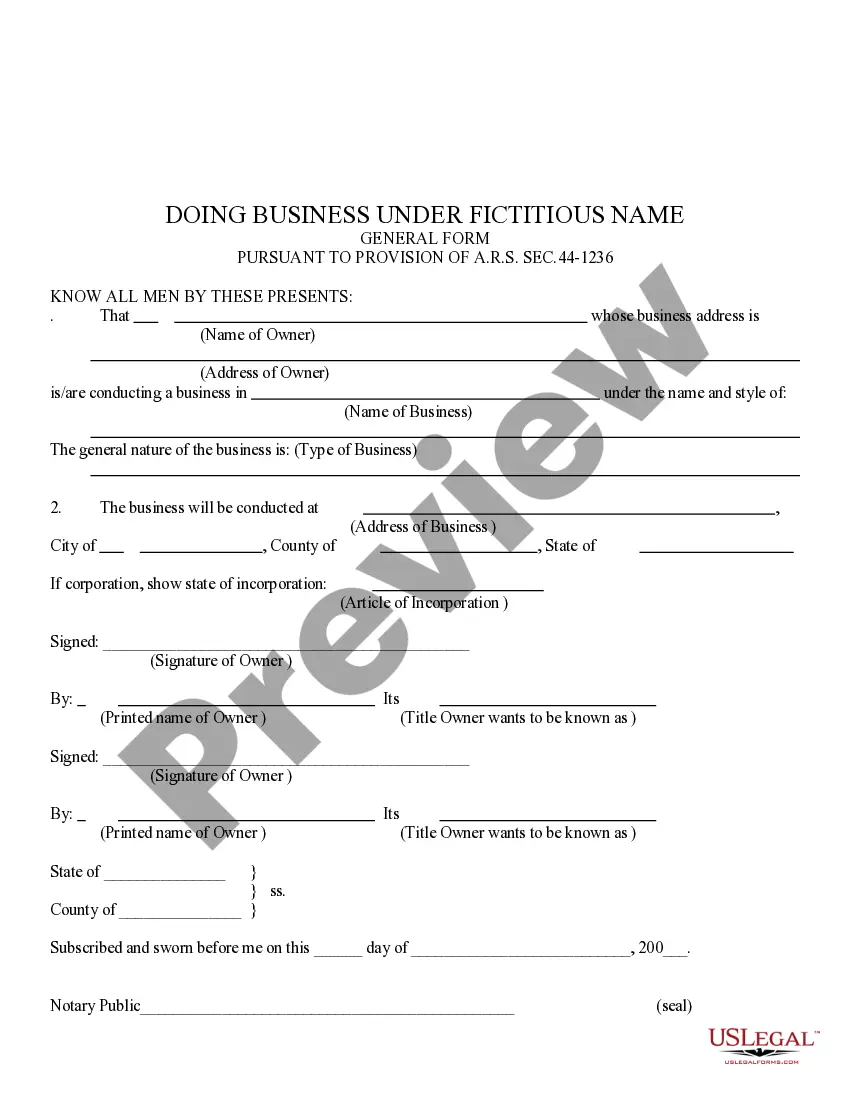

How to fill out Arizona Doing Business Under Fictitious Name?

- If you’re a returning user of US Legal Forms, log into your account and easily retrieve your necessary form template by clicking the Download button. Verify that your subscription is active; if not, simply renew it based on your chosen payment plan.

- For first-time users, begin by using the Prеview mode to check the form's description. Confirm that you select the template that is suitable for your needs and complies with your local jurisdiction.

- If you find discrepancies, utilize the Search tab to locate the correct form template. Once you identify the right document, proceed to the next step.

- Click on the Buy Now button after selecting your preferred template and choose an appropriate subscription plan. To access the library, you’ll need to create an account.

- Finalize your purchase by entering your credit card details or using your PayPal account for payment.

- Download the completed form to your device, allowing you to fill it out and access it anytime from the My Forms section of your profile.

With US Legal Forms, you gain access to a robust collection of over 85,000 editable legal forms, empowering you to handle legal requirements with ease. Moreover, if you need help, premium experts are available to assist you, ensuring that all documents are accurate and legally sound.

Exploring the comprehensive resources of US Legal Forms can greatly enhance your chances of success in future business ventures. Start your journey to informed decision-making today!

Form popularity

FAQ

If you find your business failing, the first step is to assess the situation objectively and identify the root causes. Depending on the findings, you may need to restructure, seek additional funding, or pivot your business model. Utilizing resources like USLegalForms can help you navigate the legal aspects and develop a plan for recovery.

A business is considered failed when it cannot meet its financial obligations or sustain its operations over time. Often, signs of a business failed include a continuous decline in sales, increasing debts, and inability to adapt to market conditions. Recognizing these signs early can help mitigate losses.

The statistics show that 80% of small businesses fail primarily due to financial mismanagement, lack of planning, and market changes. A business failed often highlights unmet needs in the business model or operational inefficiencies. Early intervention, such as seeking professional advice, can significantly reduce failure rates.

A failed business is often referred to as a 'bankrupt' business or simply 'failed venture'. When a business failed, it typically means that it could not generate enough revenue to cover its expenses. This situation can arise from a variety of factors, including mismanagement or shifts in the market.

Many startups fail due to common issues such as lack of market demand, insufficient funding, and poor management decisions. When a business failed, it often reveals that the founders did not thoroughly validate their ideas or understand their target audience. Addressing these aspects can help avoid downfall.

Yes, you can anonymously report a business to the IRS if you suspect tax fraud or noncompliance. The IRS provides a Whistleblower Office that handles such reports confidentially. If you're concerned about a failed business, using services like USLegalForms can also guide you through the reporting process while ensuring your privacy.

If a business fails to file taxes, it may face penalties and interest on unpaid taxes. In some cases, the IRS could take further action, including liens or levies. Addressing this issue promptly is vital, and tools like USLegalForms can provide you with the resources to manage your tax filings effectively and avoid complications.

To claim a failed business, you should report any losses on your tax return using the proper forms. Clearly outline all income and expenses related to the business to substantiate your claim. Utilizing a service like USLegalForms can guide you through the process, making it simpler and more manageable for you.

Filing taxes on a failed business involves reporting your losses on the appropriate tax forms, typically Schedule C for sole proprietorships. You will need to list your business income and expenses clearly. Remember, accurate records and documentation are crucial, and USLegalForms can assist you in preparing and filing your tax documents correctly.

Yes, you can claim a failed business on your taxes. When you report a loss from your business, it may offset other income you have, potentially lowering your tax liability. It is important to provide proper documentation to support your claims. You might consider using platforms like USLegalForms to help you prepare the necessary paperwork.