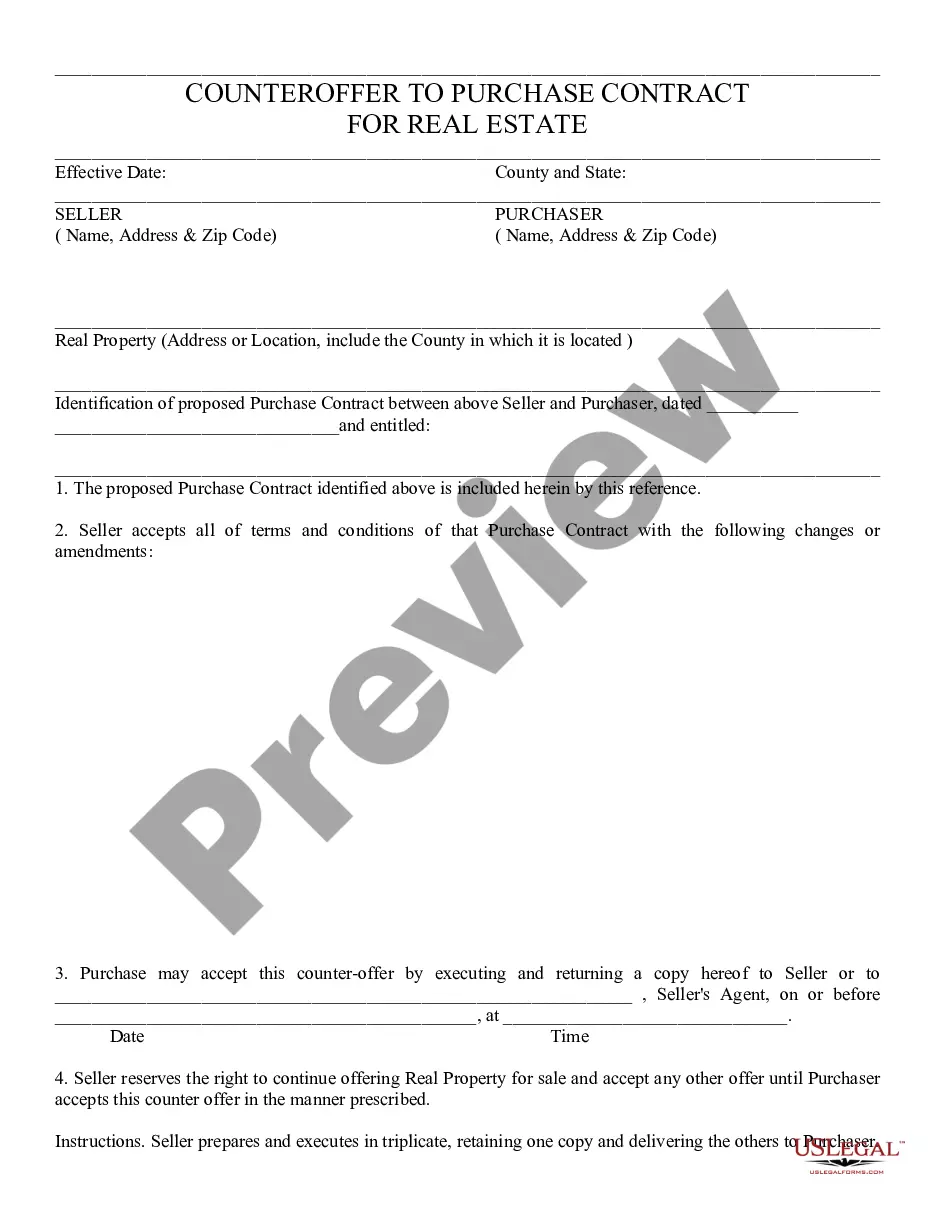

Counter Offer to Purchase 3 - Residential: A Counter Offer is used when the Purchaser and Seller are attempting to reach an acceptable price to both parties. The Purchaser offers an amount for the property in question; the Seller then gives this counter offer which states that he/she accepts the Purchaser's offer with an exception. If the Purchaser agrees to the exception, or counter offer, then he/she must sign the document in front of a Notary Public to accept. This form is available in both Word and Rich Text formats.

Purchase Real Estate Residential With A Business

Description

How to fill out Arizona Counter Offer To Purchase 3 - Residential?

- Access your US Legal Forms account if you’re a returning user; otherwise, create a new account.

- Browse through the extensive library, and use the Preview mode to ensure you select the correct legal form that adheres to your local jurisdiction.

- If you can’t find the document you need, utilize the Search feature to locate a more suitable template.

- Select the chosen document and click 'Buy Now' to choose your preferred subscription plan.

- Complete your purchase by entering payment details using a credit card or PayPal.

- Download your legally binding form to your device, ensuring easy access via 'My Forms' in your profile.

With US Legal Forms, users can enjoy a user-friendly experience that speeds up the process of acquiring legal documents for real estate. Their robust collection of forms and expert assistance ensures your paperwork is both precise and legally compliant.

Ready to streamline your document purchase? Start your journey with US Legal Forms today and secure the essential legal forms you need.

Form popularity

FAQ

Many people opt to use LLCs to buy houses for liability protection and tax advantages. An LLC separates personal and business assets, reducing personal risk in case of legal issues. Furthermore, purchasing real estate residential with a business can provide tax deductions on expenses related to property management, making it a financially sound decision for investors.

Yes, you can live in a home owned by your LLC, but you must ensure that the property is designated for residential use and that rental situations comply with local laws. This arrangement can help you separate your business and personal liabilities effectively. Be aware that living in a home owned by your LLC may have tax implications, so considering advice from a tax professional is critical.