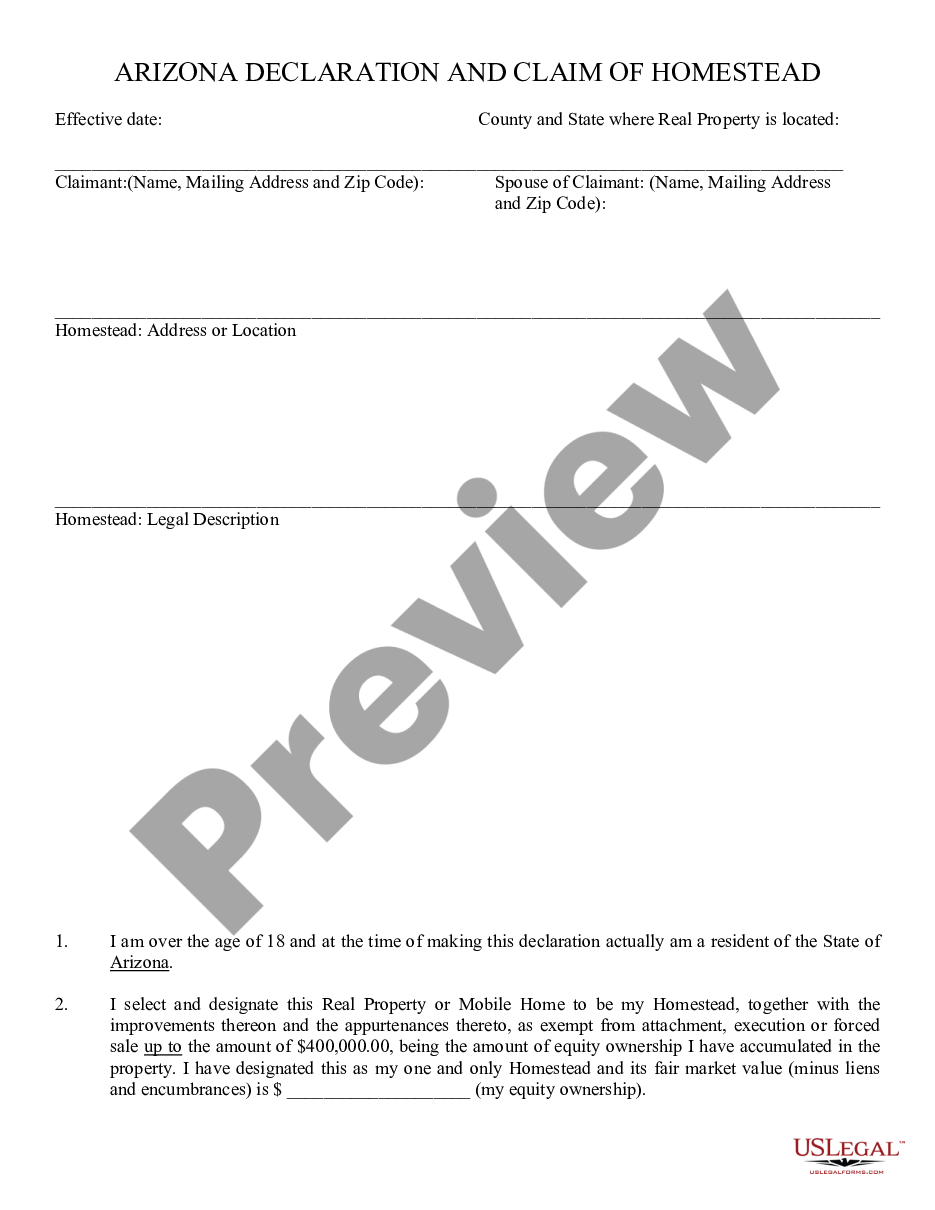

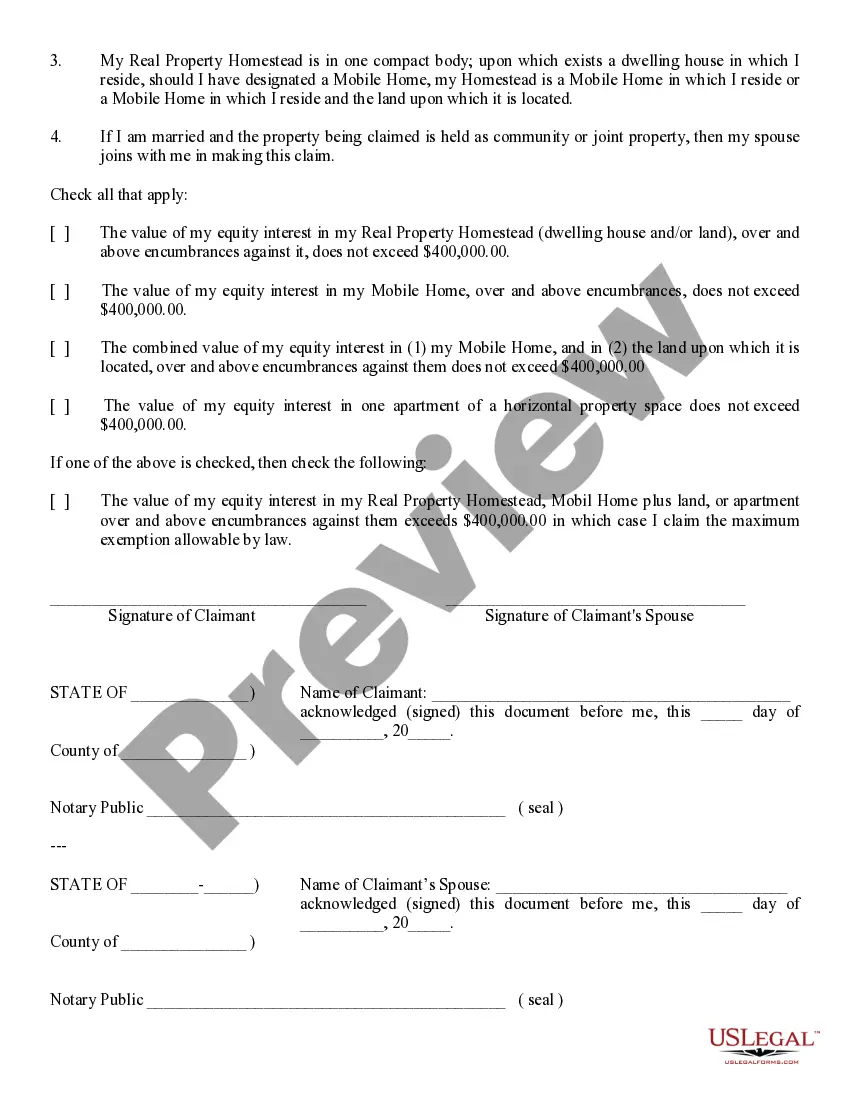

Declaration; Claim of Homestead - Arizona: This form allows for an exemption from the homestead being sold at foreclosure, up to a certain amount in value as provided in the Arizona statutes. This form is signed in front of a Notary Public. It is available for download in both Word and Rich Text formats.

The Arizona homestead exemption application form is an essential document for homeowners in the state who wish to protect their primary residence from creditors. This exemption allows eligible individuals to reduce the taxable value of their property by a specific amount, ultimately lowering their property taxes. The Arizona homestead exemption application form for 2023 is crucial for homeowners hoping to secure these financial benefits. By completing this form accurately and submitting it within the designated filing period, homeowners can ensure they receive the maximum savings allowed by law. Keywords: Arizona, homestead exemption, application form, 2023, homeowners, primary residence, protect, creditors, taxable value, property taxes, financial benefits, filing period, savings allowed by law. In Arizona, there are various types of homestead exemption application forms available for homeowners depending on their unique circumstances: 1. Standard Homestead Exemption: This form is for individuals who own and occupy their primary residence as of January 1, 2023. It allows homeowners to reduce their property's assessed value by a fixed dollar amount, typically up to $3,000. By doing so, they can significantly lower their property tax burden. Keywords: standard homestead exemption, individuals, own, occupy, primary residence, assessed value, fixed dollar amount, property tax burden. 2. Senior Citizen Homestead Exemption: This specific application form caters to senior citizens aged 65 and above. Homeowners who meet the age requirement and reside in their primary residence are eligible to apply for this exemption. The senior citizen homestead exemption provides additional tax relief beyond the standard exemption, which can vary depending on factors such as income and property value. Keywords: senior citizen homestead exemption, aged 65 and above, primary residence, tax relief, standard exemption, income, property value. 3. Disabled Veterans Homestead Exemption: Veterans with a service-connected disability can benefit from the disabled veterans homestead exemption. This form enables eligible veterans to reduce their property's assessed value by a certain percentage, usually ranging from 10% to 100%. The percentage granted depends on the extent of the veteran's disability as determined by the Department of Veterans' Services. Keywords: disabled veterans homestead exemption, service-connected disability, assessed value, percentage, veteran's disability, Department of Veterans' Services. By understanding the different types of Arizona homestead exemption application forms available, homeowners can identify the specific form that applies to their situation. This knowledge ensures they maximize their savings and take advantage of all available tax benefits provided by the state. Keywords: Arizona, homestead exemption, application forms, homeowners, maximize savings, tax benefits, available, state.