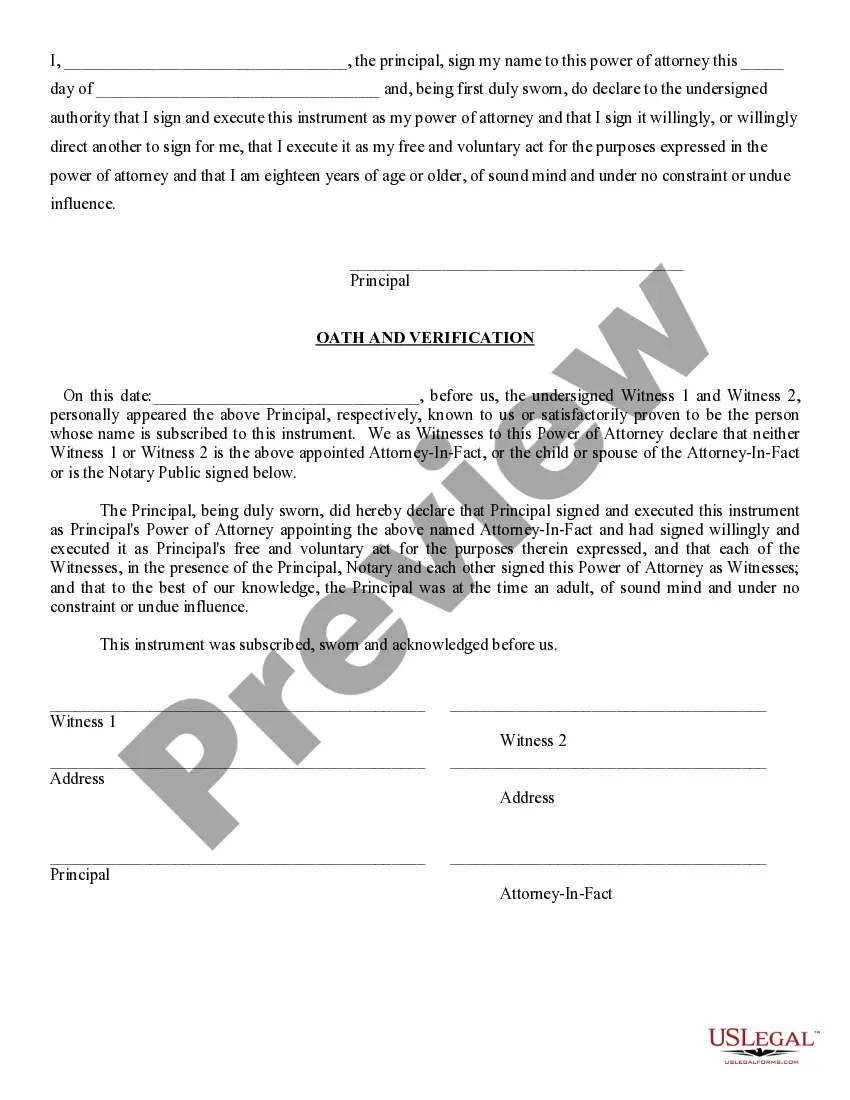

This form is a durable power of attorney. The form provides that the agent of the principal is only authorized to use the principal's funds for the best interest of the principal. If the agent fails to comply with principal's instructions, the agent then may be liable for criminal charges or civil liability.

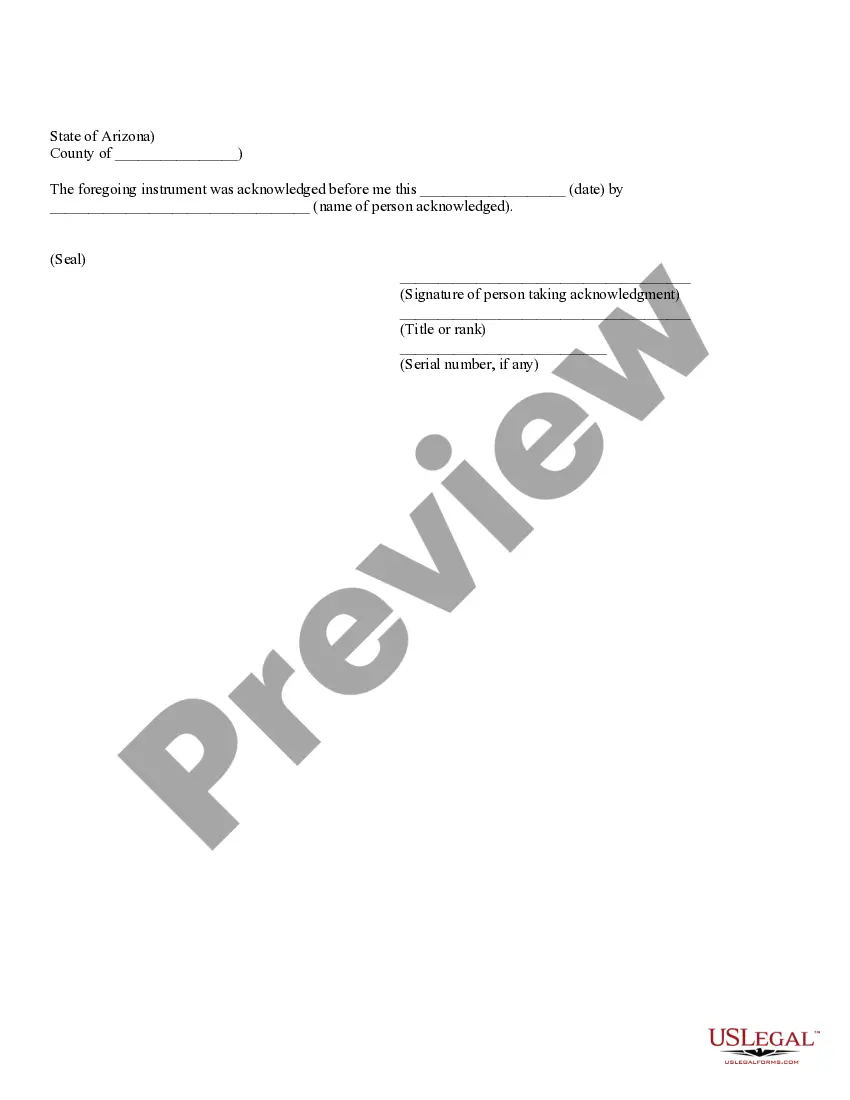

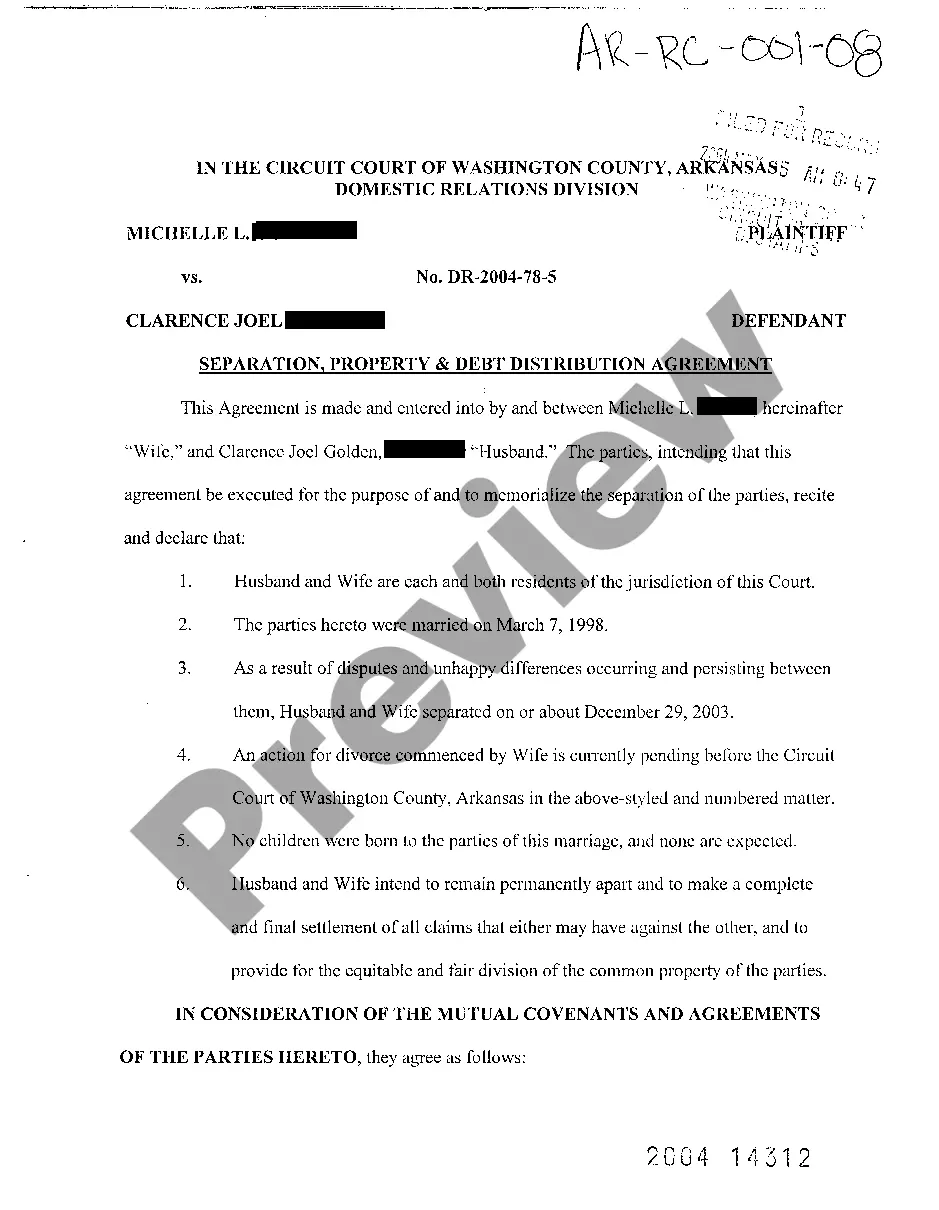

Title: Understanding Power of Attorney Form without Notary: Types and Detailed Descriptions Introduction: A Power of Attorney (POA) form without notary is a legal document that allows an individual (known as the "principal") to grant authority to another person (known as the "agent" or "attorney-in-fact") to act on their behalf in legal, financial, or medical matters. While a notary is typically required to authenticate the POA form, certain circumstances may allow for its use without notarization. Let's dive deeper and explore the different types of Power of Attorney forms without notary. 1. General Power of Attorney: A General Power of Attorney grants broad authority to the agent to handle various tasks on behalf of the principal, such as managing finances, signing contracts, and making financial decisions. It remains in effect until the principal revokes it, becomes incapacitated, or passes away. 2. Limited Power of Attorney: A Limited Power of Attorney specifies and limits the agent's authority to carry out specific tasks or make decisions on behalf of the principal. It is often used for short-term, specific purposes, such as selling property, handling business transactions, or managing a bank account during the principal's absence. 3. Healthcare Power of Attorney: Also known as a Medical Power of Attorney, this form empowers the agent to make medical decisions on behalf of the principal when they are unable to do so. The agent acts as an advocate, ensuring the principal's wishes regarding medical treatment, procedures, and life support are honored. 4. Financial Power of Attorney: A Financial Power of Attorney authorizes the agent to manage the principal's financial affairs, including banking transactions, paying bills, collecting benefits, and filing taxes. It is particularly useful for individuals who anticipate being unable to handle financial matters due to age, illness, or other circumstances. 5. Durable Power of Attorney: A Durable Power of Attorney remains valid even if the principal becomes mentally or physically incapacitated. It provides a seamless transition of authority to the agent to handle the principal's affairs without the need for court intervention. However, some jurisdictions may require notarization for a durable POA form. 6. Non-Durable Power of Attorney: A Non-Durable Power of Attorney ceases to be valid if the principal becomes incapacitated. It is typically used for specific, time-limited purposes, such as authorizing an agent to complete a real estate transaction on the principal's behalf. Conclusion: While some jurisdictions may require a notarized Power of Attorney form for validity, certain situations permit the utilization of POA forms without notary. General, Limited, Healthcare, Financial, Durable, and Non-durable Power of Attorney are a few types that may be implemented without notarization. It is always advisable to consult an attorney or refer to state-specific laws to ensure compliance with legal requirements when creating or utilizing these forms.