Power Of Attorney Form For Irs

Description

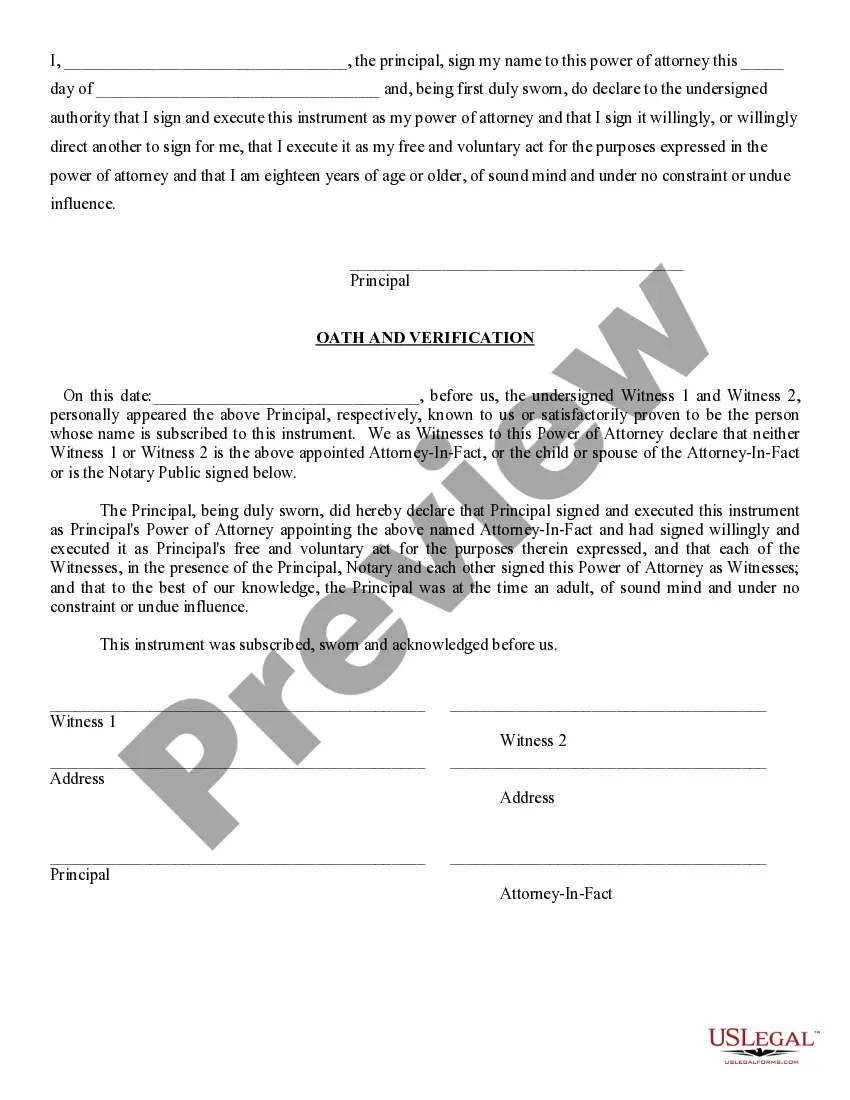

How to fill out Arizona Durable Power Of Attorney?

Legal management might be overwhelming, even for the most knowledgeable experts. When you are interested in a Power Of Attorney Form For Irs and don’t have the a chance to devote looking for the correct and up-to-date version, the processes may be nerve-racking. A robust web form library can be a gamechanger for anybody who wants to handle these situations successfully. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any demands you may have, from individual to enterprise papers, all in one location.

- Utilize advanced tools to finish and handle your Power Of Attorney Form For Irs

- Gain access to a useful resource base of articles, tutorials and handbooks and materials connected to your situation and requirements

Save effort and time looking for the papers you need, and make use of US Legal Forms’ advanced search and Preview tool to get Power Of Attorney Form For Irs and get it. If you have a membership, log in in your US Legal Forms profile, search for the form, and get it. Take a look at My Forms tab to see the papers you previously downloaded and also to handle your folders as you can see fit.

Should it be your first time with US Legal Forms, register an account and have limitless access to all advantages of the library. Listed below are the steps to take after downloading the form you want:

- Validate this is the right form by previewing it and reading its description.

- Ensure that the sample is recognized in your state or county.

- Select Buy Now when you are all set.

- Select a monthly subscription plan.

- Pick the file format you want, and Download, complete, eSign, print and send your document.

Take advantage of the US Legal Forms web library, backed with 25 years of experience and stability. Enhance your daily document management into a easy and user-friendly process today.

Form popularity

FAQ

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.

More In Forms and Instructions Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

Use: Form 2848, Power of Attorney and Declaration of RepresentativePDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information AuthorizationPDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

Your authorization for Power of Attorney is recorded on the Centralized Authorization File (CAF) unless Line 4, Specific Use is checked. The record lets IRS assistors verify your permission to speak with your representative about your private tax-related information.