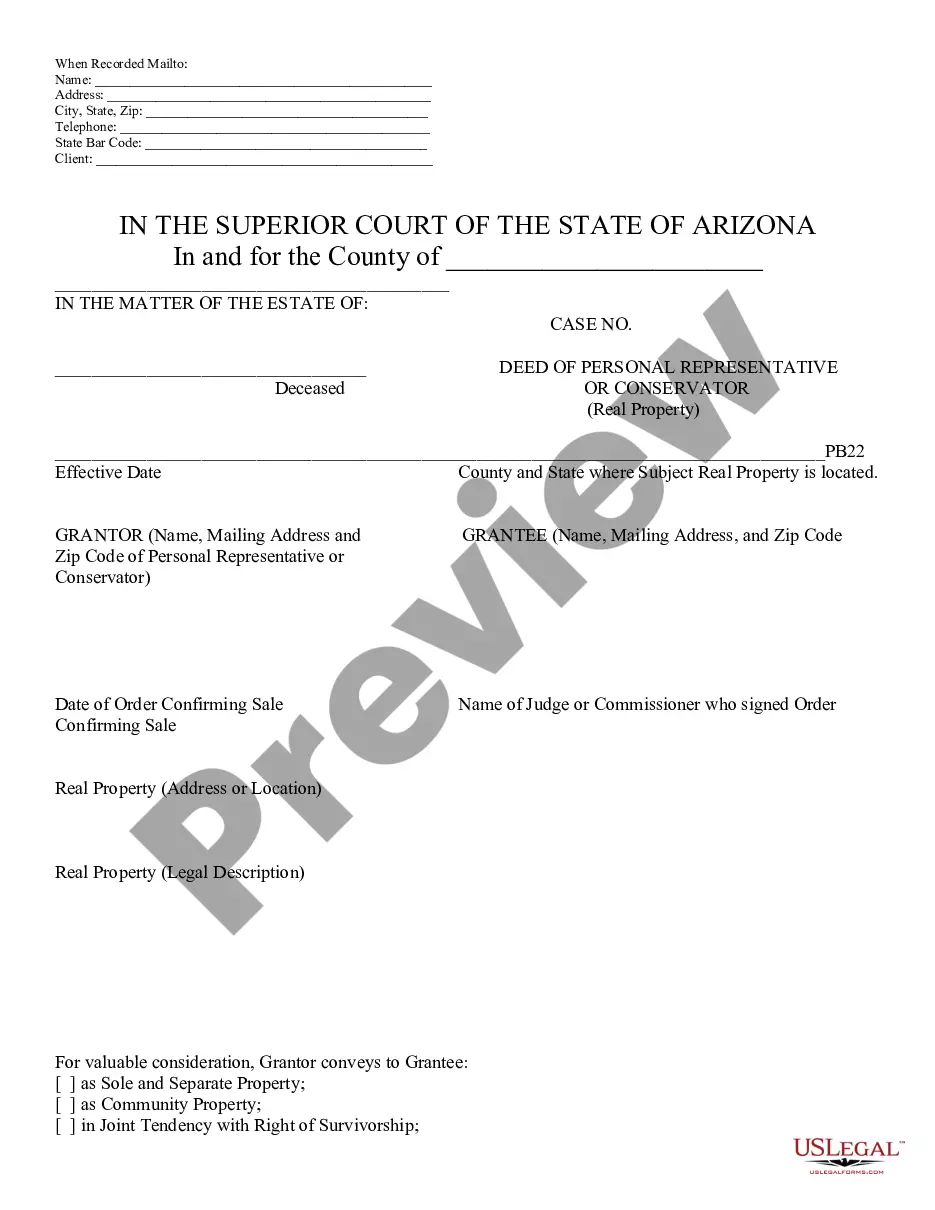

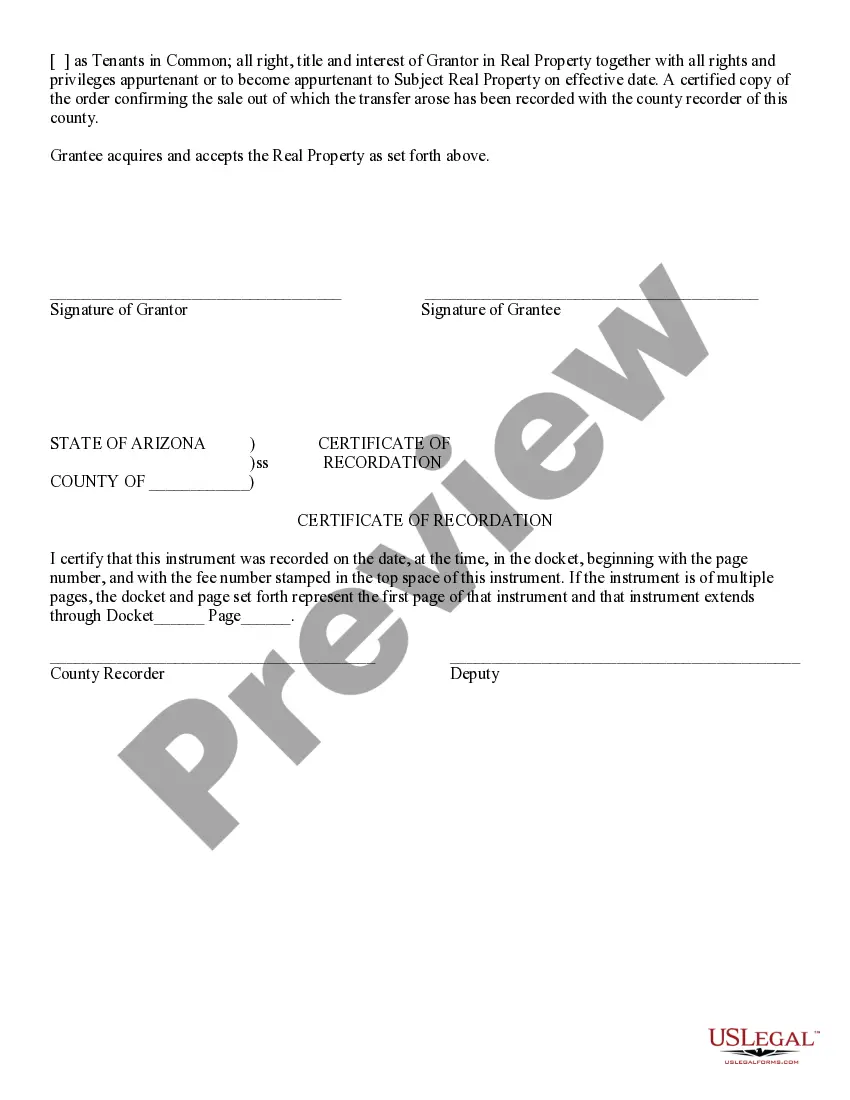

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Personal Rep. or Cons. of Real Property - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Deed Personal Representative Without Probate

Description

How to fill out Deed Personal Representative Without Probate?

How to obtain professional legal documents that adhere to your state laws and create the Deed Personal Representative Without Probate without hiring an attorney.

Numerous online services offer templates for various legal situations and requirements. However, it may require time to ascertain which of the available samples fulfill both your specific needs and legal standards.

US Legal Forms is a trustworthy service that assists you in finding official documents created according to the most recent state law modifications, allowing you to save on legal fees.

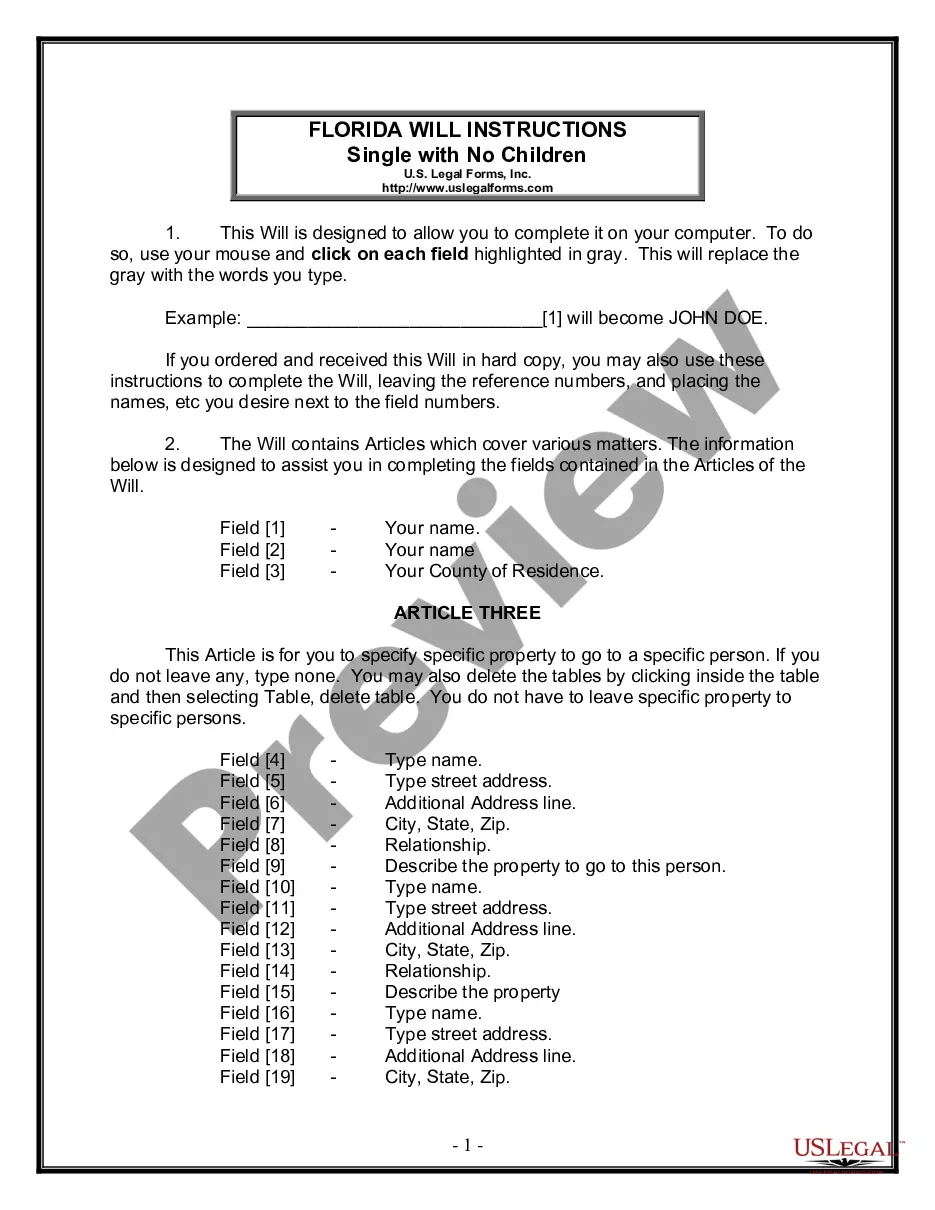

If you do not have an account with US Legal Forms, please follow the instructions below: Review the webpage you've accessed and verify if the form meets your requirements. Utilize the form description and preview options if available. If necessary, search for another sample in the header indicating your state. Click the Buy Now button once you find the appropriate document. Select the most suitable pricing plan, then sign in or register for an account. Choose your preferred payment method (by credit card or via PayPal). Select the file format for your Deed Personal Representative Without Probate and click Download. The acquired documents remain accessible to you: you can always return to them in the My documents tab of your profile. Become a part of our library and prepare legal documents independently like a seasoned legal professional!

- US Legal Forms is not merely a typical online catalog.

- It's a compilation of more than 85,000 verified templates for an array of business and personal situations.

- All documents are organized by category and state to enhance your search efficiency and convenience.

- Moreover, it features robust tools for PDF editing and electronic signatures, enabling users with a Premium plan to swiftly complete their documentation online.

- It requires minimal time and effort to acquire the necessary paperwork.

- If you already possess an account, Log In and ensure your subscription is current.

- Download the Deed Personal Representative Without Probate using the related button next to the file name.

Form popularity

FAQ

To fill out a personal representative deed without probate, begin by obtaining the necessary form specific to your state. Provide details such as the decedent's information, the names of heirs, and the description of the property being transferred. Ensure all signatures are notarized to validate the document. Utilizing a service like US Legal Forms can simplify this process, offering templates and guidance tailored for your needs.

A personal representative is someone designated to settle the affairs of a deceased person. This role involves managing the assets, settling debts, and distributing the remaining Property to heirs. By using a deed personal representative without probate, you can resolve these responsibilities outside the court system, making the process more straightforward and less time-consuming.

A personal representative and an administrator are similar but not identical. A personal representative is a broader term that includes both executors and administrators. Specifically, an administrator is a personal representative appointed when there is no will. Choosing a deed personal representative without probate can provide clarity and simplify the process in such situations.

Another common name for a personal representative is 'fiduciary.' This term underscores the representative's role in managing the deceased's estate with care and loyalty. Utilizing a deed personal representative without probate can help expedite the management of the estate and fulfill the fiduciary duties efficiently.

The term used for personal representation is 'executor' or 'administrator', depending on whether there is a will involved. An executor is appointed if a there is a valid will, while an administrator is appointed when there is no will. Using a deed personal representative without probate can streamline the responsibilities involved in overseeing the estate's management.

To remove a deceased person from a deed in Texas, you typically need to prepare and file an affidavit of heirship or a transfer-on-death deed. These documents help clarify ownership and establish that the decedent's interest in the property has transferred to the heirs. It's essential to follow the legal requirements for proper documentation to avoid complications. For assistance with the legal processes involved, US Legal Forms can provide the necessary templates and guidance.

You can transfer a deed without going through probate by using a revocable living trust or a transfer-on-death deed. Both options allow you to specify how your property is managed and transferred after your death. Utilizing these methods helps avoid the complexities and delays associated with probate. For more detailed guidance, consider checking US Legal Forms, which offers comprehensive resources on these options.

In Texas, you can transfer a house without going through probate by using a transfer-on-death deed. This deed allows you to designate a beneficiary who will automatically receive ownership of the property after your passing. To ensure a smooth process, you must properly execute and record the deed according to Texas law. US Legal Forms can guide you through this process, ensuring you fill out the necessary documents accurately.

The best deed to avoid probate is often a transfer-on-death (TOD) deed. A TOD deed allows you to name a beneficiary who will receive the property upon your death without having to go through the probate court. This streamlined process ensures that your property transfers swiftly and efficiently. For further assistance in creating a TOD deed, consider using US Legal Forms as a reliable resource.

The fastest way to transfer a deed is by utilizing a quitclaim deed. This method allows a property owner to convey their interest in the property to another person without warranty of title. By executing this deed, you can effectively change ownership without navigating through a lengthy probate process. If you're acting as a deed personal representative without probate, make sure to file the quitclaim deed with your local county recorder.