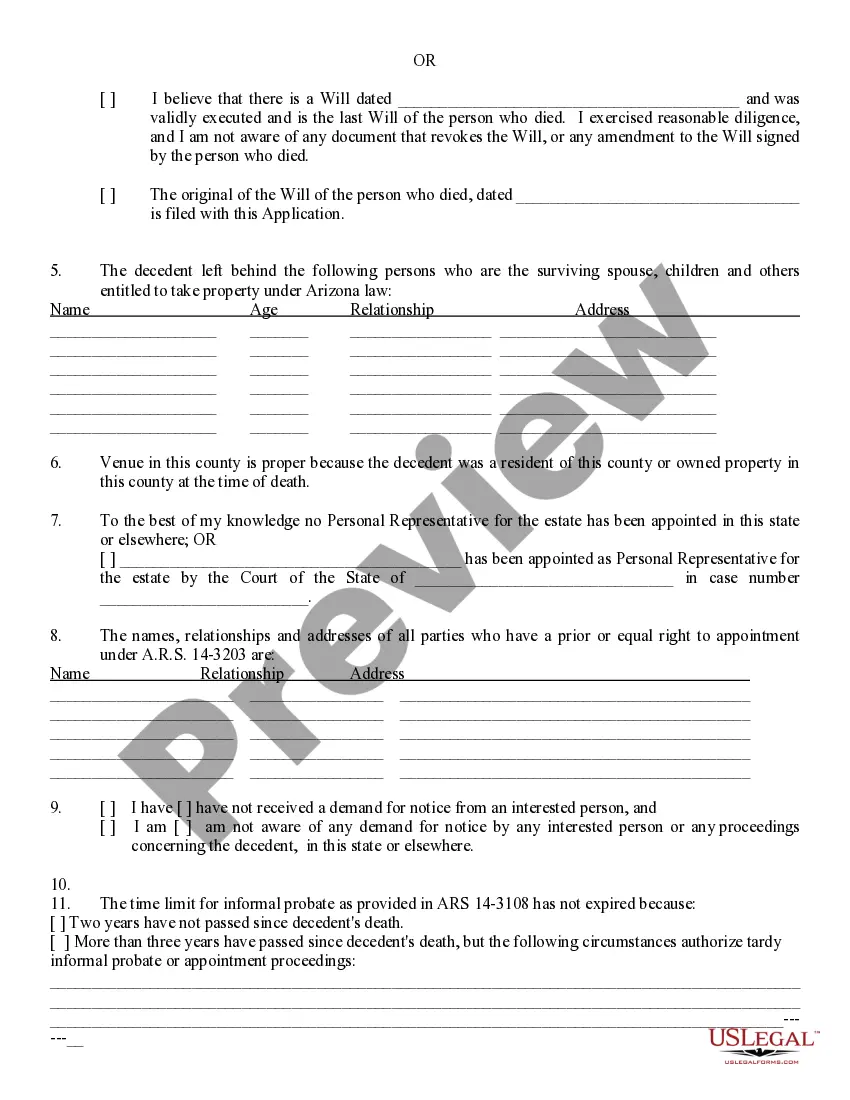

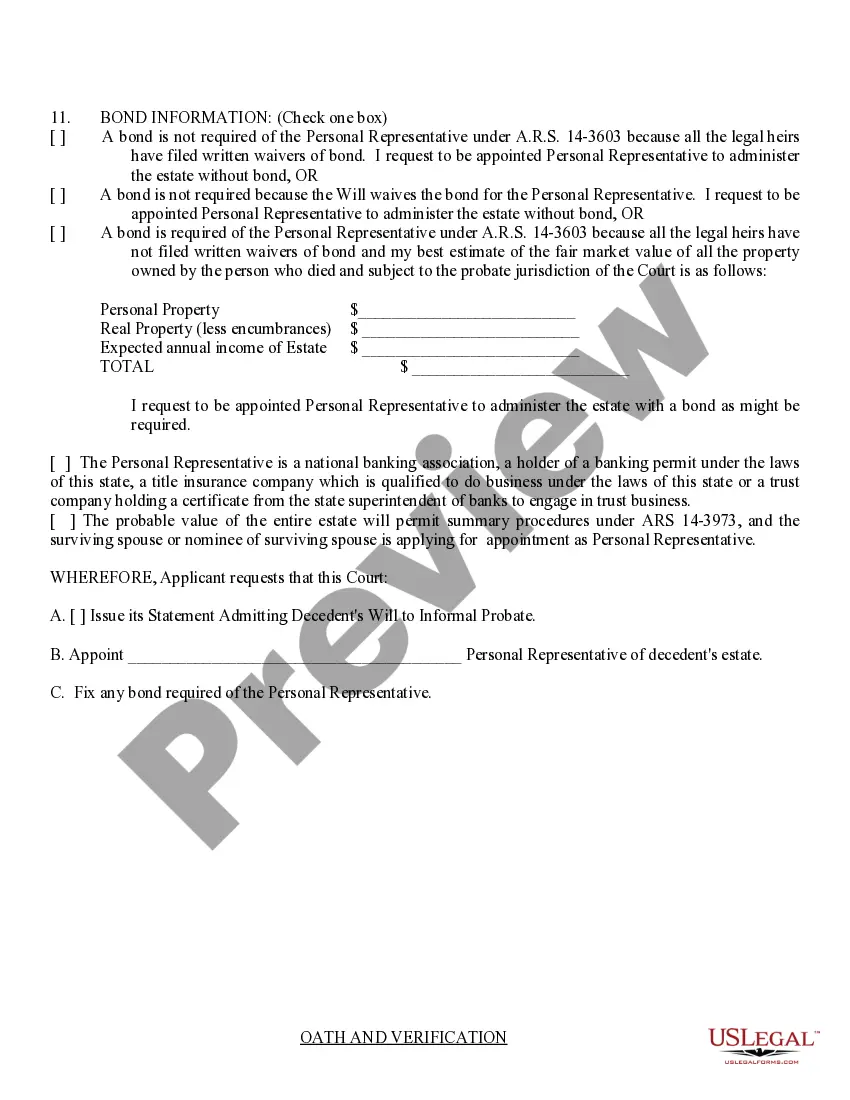

Maricopa County Probate Forms With Notary

Description

How to fill out Arizona Application For Informal Probate Of A Will And Appointment Of Personal Representative?

Locating a reliable venue to obtain the latest and suitable legal templates is a significant part of managing bureaucratic tasks. Identifying the appropriate legal documents requires precision and meticulousness, which is why it is essential to procure Maricopa County Probate Forms With Notary solely from reputable sources, such as US Legal Forms. An incorrect template can squander your time and delay your situation.

With US Legal Forms, you have minimal concerns. You can review and access all the information regarding the document’s applicability and significance for your situation and in your state or county.

Eliminate the hassle associated with your legal documents. Explore the extensive US Legal Forms catalog to find legal templates, verify their significance to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to locate your template.

- Examine the form’s details to ensure it meets the criteria of your state and county.

- View the form preview, if available, to confirm the template is what you need.

- Continue searching and look for the appropriate document if the Maricopa County Probate Forms With Notary does not fit your requirements.

- If you are confident about the form’s pertinence, download it.

- As an authorized user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Select the pricing plan that suits your requirements.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Maricopa County Probate Forms With Notary.

- Once you have the document on your device, you can edit it using the editor or print it and fill it out by hand.

Form popularity

FAQ

Informal probate is typically used when the value of the estate is less than $75,000 and there are no disputes between the heirs. Formal probate, on the other hand, is typically used when the value of the estate exceeds $75,000 or there are disputes between heirs.

Case initiating documents and subsequent filings for probate case types must be filed in-person, by mail, or via a filing depository box. The ability to eFile probate case documents is currently not available for Maricopa County, but is expected in the near future.

The Probate Process in Arizona Step 1: Read the Decedent's Last Will (if one exists) ... Step 2: Determine the Personal Representative. ... Step 3: Filing with the Probate Court of your County. ... Step 4: Notification to Heirs and Creditors. ... Step 5: Identifying Assets and Debts. ... Step 6: Paying Debts and Taxes.

How to Start Probate for an Estate Open the Decedent's Last Will and Testament. ... Determine Who Will be the Personal Representative. ... Compile a List of the Estate's Interested Parties. ... Take an Inventory of the Decedent's Assets. ... Calculate the Decedent's Liabilities. ... Determine if Probate is Necessary. ... Seek a Waiver of Bond.

Arizona requires probate unless the decedent's assets are all owned by a living trust or they have designated beneficiaries. Perhaps the best way to identify assets that must go through probate is to list the assets that are not subject to probate.