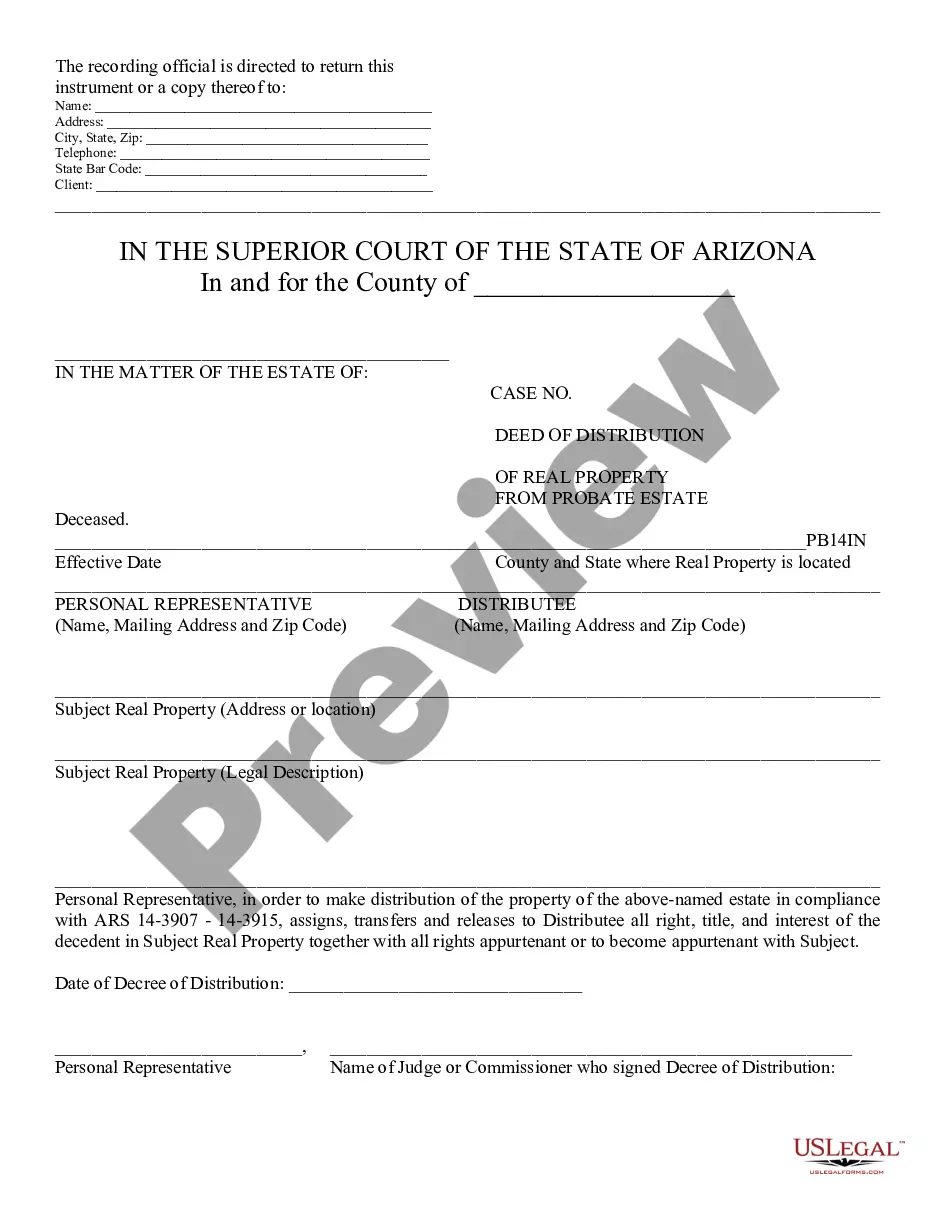

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Distribution of Probate Estate -Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Deed Of Distribution Arizona Without A Trust

Description

How to fill out Arizona Deed Of Distribution Of Probate Estate?

Managing legal documents and processes can be a lengthy addition to your day.

Deed Of Distribution Arizona Without A Trust and similar forms frequently necessitate that you locate them and comprehend how to fill them out correctly.

Therefore, whether you are handling financial, legal, or personal issues, having a comprehensive and functional online directory of forms readily available will significantly help.

US Legal Forms is the leading online platform for legal templates, offering over 85,000 state-specific forms along with a variety of resources that will aid you in completing your documents effortlessly.

Is this your first time utilizing US Legal Forms? Register and create a free account in just a few minutes to gain access to the form directory and Deed Of Distribution Arizona Without A Trust. Then, follow the steps outlined below to complete your form: Ensure you have the correct document by using the Review feature and going through the form details. Click on Buy Now when ready, and select the monthly subscription plan that suits your requirements. Click Download, then fill out, sign, and print the document. US Legal Forms has 25 years of experience helping users manage their legal documents. Obtain the form you require today and streamline any process without difficulty.

- Explore the directory of relevant documents accessible to you with just one click.

- US Legal Forms provides state- and county-specific forms that are available for download at any time.

- Safeguard your documents management processes with a high-quality service that enables you to prepare any form in minutes without extra or hidden fees.

- Simply Log In to your account, find Deed Of Distribution Arizona Without A Trust, and obtain it immediately from the My documents section.

- You can also access previously downloaded documents.

Form popularity

FAQ

There is no requirement to register a trust in Arizona. However, it is advisable to create a trust document that outlines terms clearly. If you want to facilitate the distribution of your assets without the complications of a trust, a deed of distribution in Arizona without a trust could be the right solution for you.

No, a trust does not need to be recorded in Arizona. This lack of requirement means you can keep trust details private. If you prefer a clear and simple method for asset distribution, consider using a deed of distribution in Arizona without a trust to simplify your estate planning.

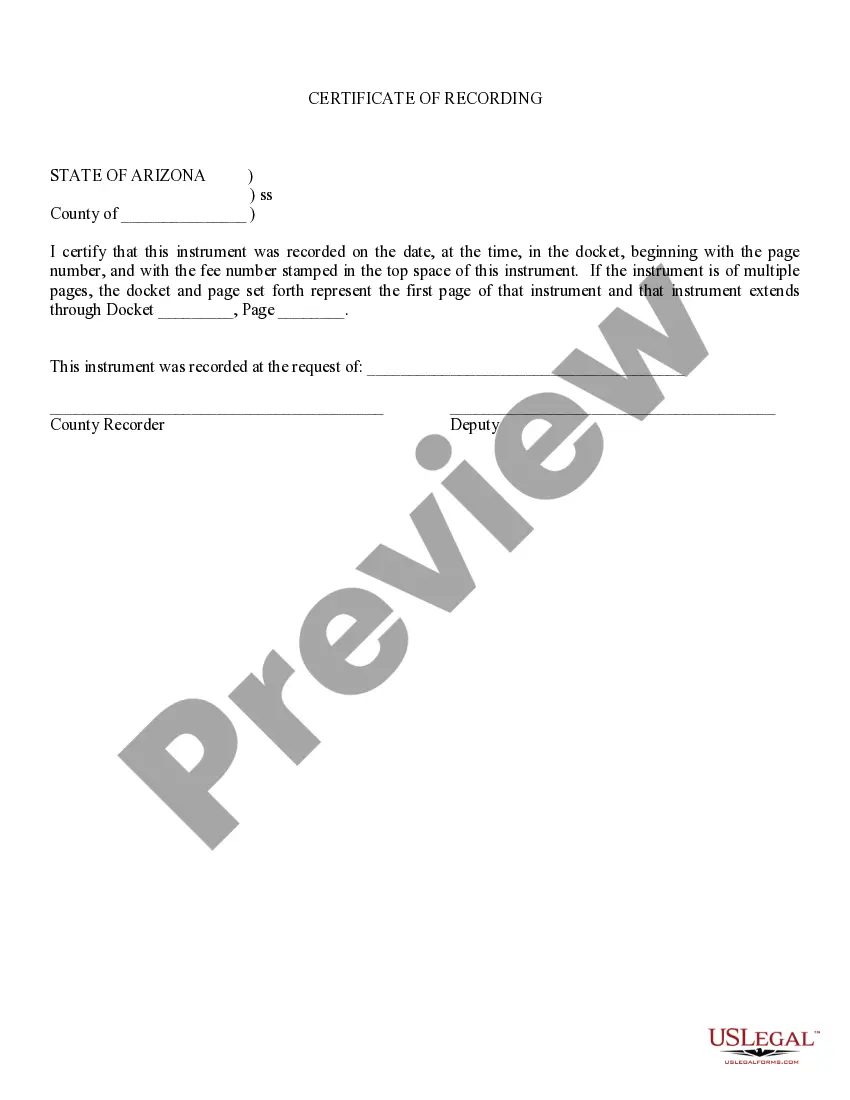

Filing a beneficiary deed in Arizona is a straightforward process. First, fill out the beneficiary deed form, ensuring it meets state requirements. Then, you will need to record it with the county recorder's office where the property is located. This process helps avoid probate, and you can do this without a trust using the deed of distribution in Arizona.

In Arizona, a trust does not need to be formally recorded after its creation. While a trust can hold property titles, it is not required to be recorded like a deed. Instead, many choose to use a deed of distribution in Arizona without a trust to transfer assets seamlessly while avoiding the complexities of recording.

Trusts are not typically public records in Arizona. Generally, only certain documents, such as wills and deeds, become public once filed with the court. If you are considering a deed of distribution in Arizona without a trust, remember that this process can maintain a level of privacy not afforded by a trust.

Filling out a personal representative deed involves multiple steps to ensure accuracy. First, gather all necessary information regarding the estate and the decedent, then complete the Deed of distribution Arizona without a trust by including relevant property details and signatures. Ensure you adhere to state regulations on notarization and record-keeping. For a smoother process, platforms like USLegalForms offer templates and instructions to help you navigate this task with confidence.

You do not necessarily need a lawyer for a TOD deed, but it is wise to consult one, especially if you have concerns about the process. A Deed of distribution in Arizona without a trust requires specific formatting and language to ensure its validity. While you can handle the paperwork independently, a legal expert can provide valuable guidance and help avoid potential mistakes. Utilizing resources like USLegalForms can simplify your experience and make sure everything complies with state laws.

Whether you need a trust in Arizona varies by situation. If your estate includes complex assets or you wish to avoid probate, a Deed of distribution in Arizona without a trust may still serve your needs. Many individuals find that a simple will or direct property transfers work well for their estates. Assessing your financial landscape will guide you in making the right decision.

The choice between a trust and a will in Arizona depends on your individual circumstances. While a trust can manage assets during your lifetime, a claim like a Deed of distribution in Arizona without a trust can also meet your needs efficiently. Trusts often require ongoing management, while wills are simpler but can lead to probate. Understanding these differences helps you choose the best option for your estate plan.

No, you do not need a trust to avoid probate in Arizona. A Deed of distribution in Arizona without a trust can transfer property effectively while bypassing the probate process. This option may save time and reduce costs for heirs. Knowing how to navigate these options ensures your loved ones receive their assets without unnecessary delays.