An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, a Non-Probate Affidavit for Collection of Personal Property of Decedent , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s).

Adot Non Probate Affidavit With Lien Release

Description

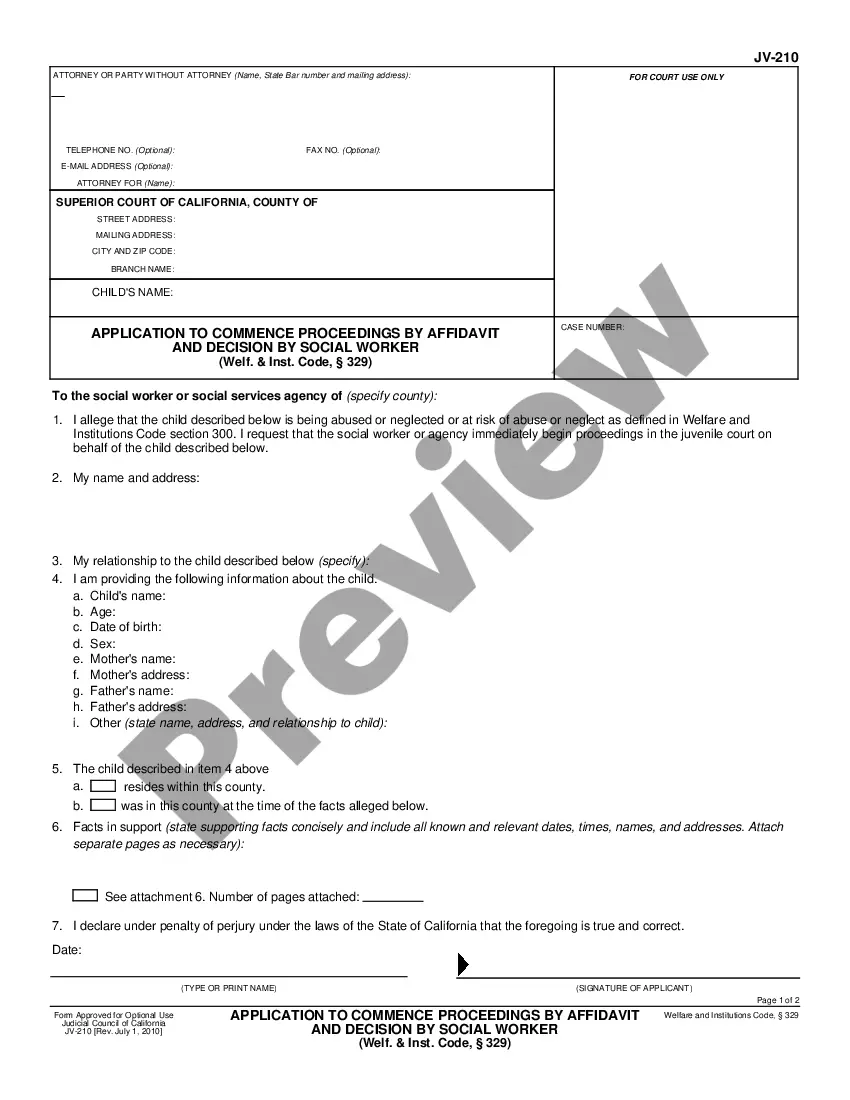

How to fill out Arizona Nonprobate Affidavit For Collection Of Personal Property Of Decedent?

It’s well-known that you cannot instantly become a legal expert, nor can you learn how to swiftly create an Adot Non Probate Affidavit With Lien Release without possessing a specialized expertise.

Assembling legal paperwork is a lengthy process demanding particular education and abilities. So why not entrust the creation of the Adot Non Probate Affidavit With Lien Release to the professionals.

With US Legal Forms, one of the most extensive libraries of legal templates, you can find everything from court papers to templates for internal communication.

- We recognize how essential compliance and observance of federal and state laws and regulations are.

- Hence, on our platform, all forms are locale-specific and current.

- Here’s how you can initiate your experience on our website and obtain the document you need in just minutes.

- Locate the form you require by utilizing the search bar at the top of the page.

- Preview it (if this feature is available) and review the accompanying description to determine whether the Adot Non Probate Affidavit With Lien Release is what you need.

Form popularity

FAQ

The Federal Reserve System is one of several banking regulatory authorities. The Federal Reserve regulates state-chartered member banks, bank holding companies, foreign branches of U.S. national and state member banks, Edge Act Corporations, and state-chartered U.S. branches and agencies of foreign banks.

Provide Montana citizens with a safe and sound system of state-chartered financial institutions. Promote the dual regulatory system that allows state and federal governments to act independently to charter, regulate, and supervise financial institutions for the good of Montanans.

In Montana, a Health Care Power of Attorney is effective upon your signature, without having your signature notarized or witnessed. However, notarization provides proof your signature is genuine should any questions arise from family members and/or health care professionals.

DBFI's mission is "to protect Montana citizens by regulating state-chartered and licensed financial institutions under its supervision" through six goals: Protect Montanans who enter into consumer and residential mortgage loans with non-depository lenders from abuses that may occur in the credit marketplace.

MONTANA DOES NOT REGULATE MONEY TRANSMITTERS Montana does, however, license consumer finance companies and anyone who collects on a consumer loan. Montana also licenses escrow companies.

First Security Bank is a division of Glacier Bank based in Bozeman, Montana. It is the area's largest bank in deposit market share and number of locations.