Promissory Note Arizona Form

Description

How to fill out Arizona Installments Fixed Rate Promissory Note Secured By Personal Property?

When you must submit a Promissory Note Arizona Form that adheres to your local state's regulations, there can be numerous options to choose from.

There's no need to inspect each form to verify it meets all the legal requirements if you are a US Legal Forms member.

It is a dependable resource that can assist you in obtaining a reusable and current template on any topic.

Review the proposed page and verify it for alignment with your requirements.

- US Legal Forms is the most extensive online library with a compilation of over 85,000 ready-to-use documents for business and personal legal matters.

- All templates are verified to align with each state's regulations.

- Therefore, when downloading the Promissory Note Arizona Form from our platform, you can be confident that you possess a valid and up-to-date document.

- Retrieving the necessary sample from our platform is extraordinarily straightforward.

- If you already have an account, merely Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and maintain access to the Promissory Note Arizona Form at any time.

- If this is your first time using our library, please adhere to the instructions below.

Form popularity

FAQ

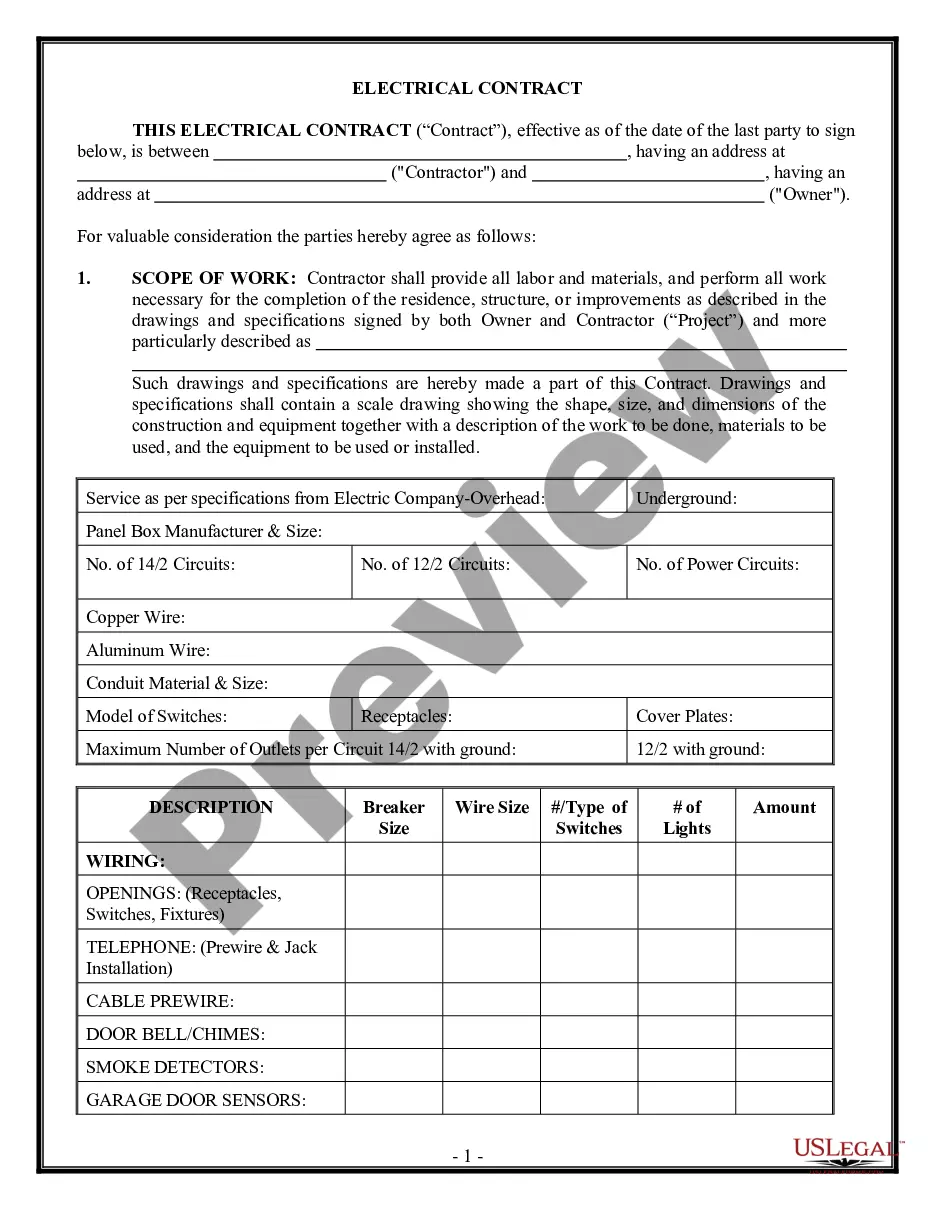

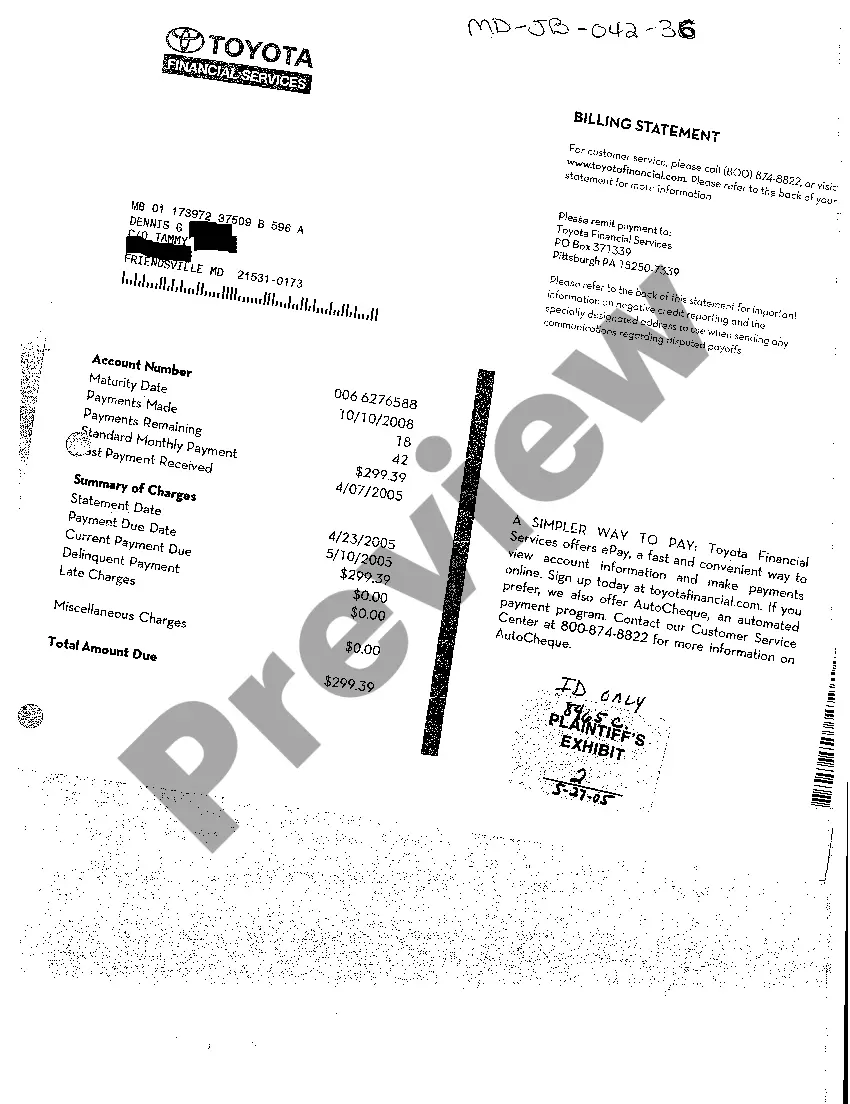

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note is enforceable for up to 6 years after the due date of the payment, according to Arizona state law. If no action has been taken to collect payment prior to 6 years, the statute of limitations has run out and the contract can no longer be enforced through legal action.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.