Arizona Garnishment Limits

Description

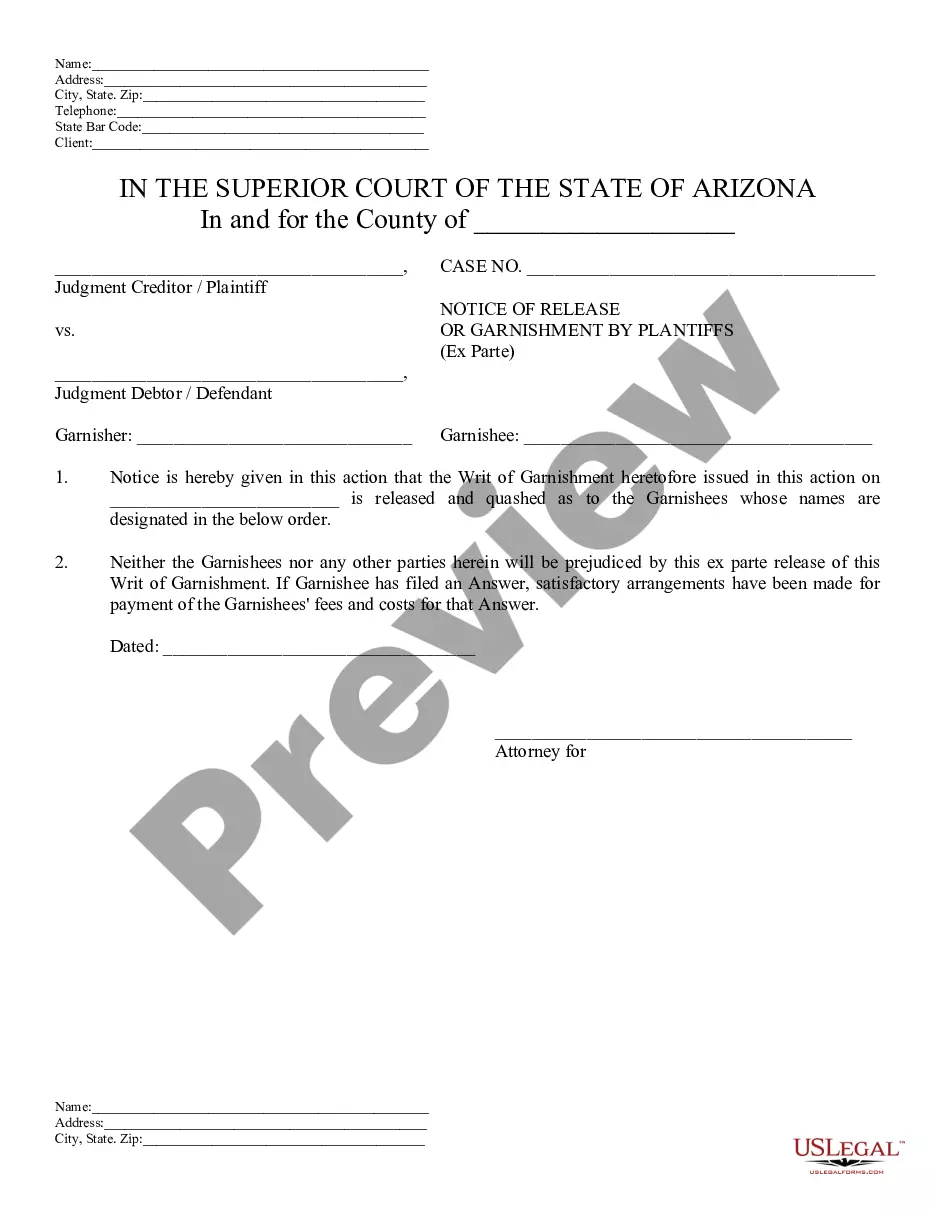

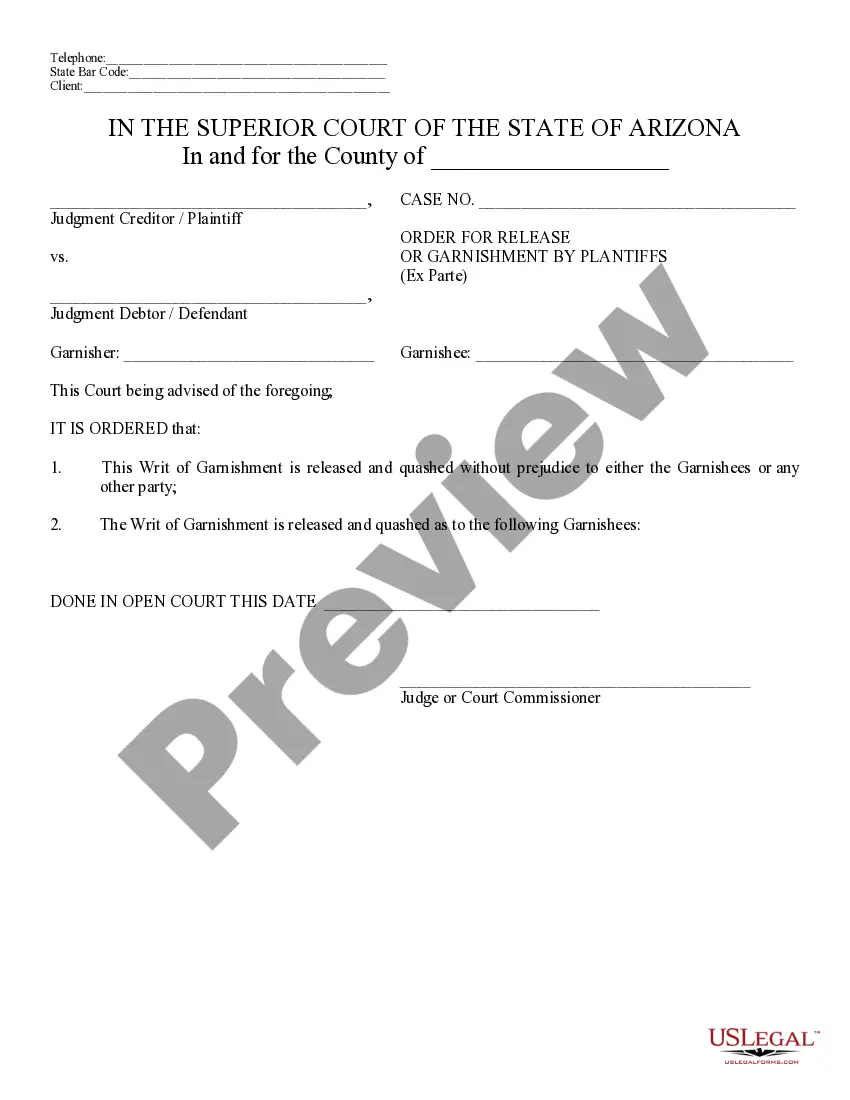

How to fill out Arizona Notice Of Release Of Garnishment And Order?

Drafting legal documents from scratch can sometimes be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more affordable way of preparing Arizona Garnishment Limits or any other documents without jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of over 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-specific forms diligently put together for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can easily find and download the Arizona Garnishment Limits. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and navigate the catalog. But before jumping straight to downloading Arizona Garnishment Limits, follow these recommendations:

- Check the form preview and descriptions to make sure you are on the the document you are looking for.

- Make sure the template you select complies with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Arizona Garnishment Limits.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and transform form completion into something easy and streamlined!

Form popularity

FAQ

You must file a Garnishee's Answer with the Court Clerk within 10 business days after you receive the Writ of Garnishment and Summons. Within 10 business days after you receive the paperwork listed above, fill out a Garnishee's Answer (Earnings)(FORM 6) and file it with the Court Clerk.

Impact on Wage Garnishments ? Medical Debt Before Proposition 209, creditors could garnish up to 25% of a debtor's non-exempt disposable earnings. Now, the law has reduced this maximum limit to 10% of an individual's disposable income or 60 times the highest applicable minimum wage (whichever is less).

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

Limits on Wage Garnishment in Arizona On a weekly basis, the garnishment can't exceed the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for that week surpasses 30 times the federal minimum hourly wage.