Arizona Revocation Trust Az Withholding

Description

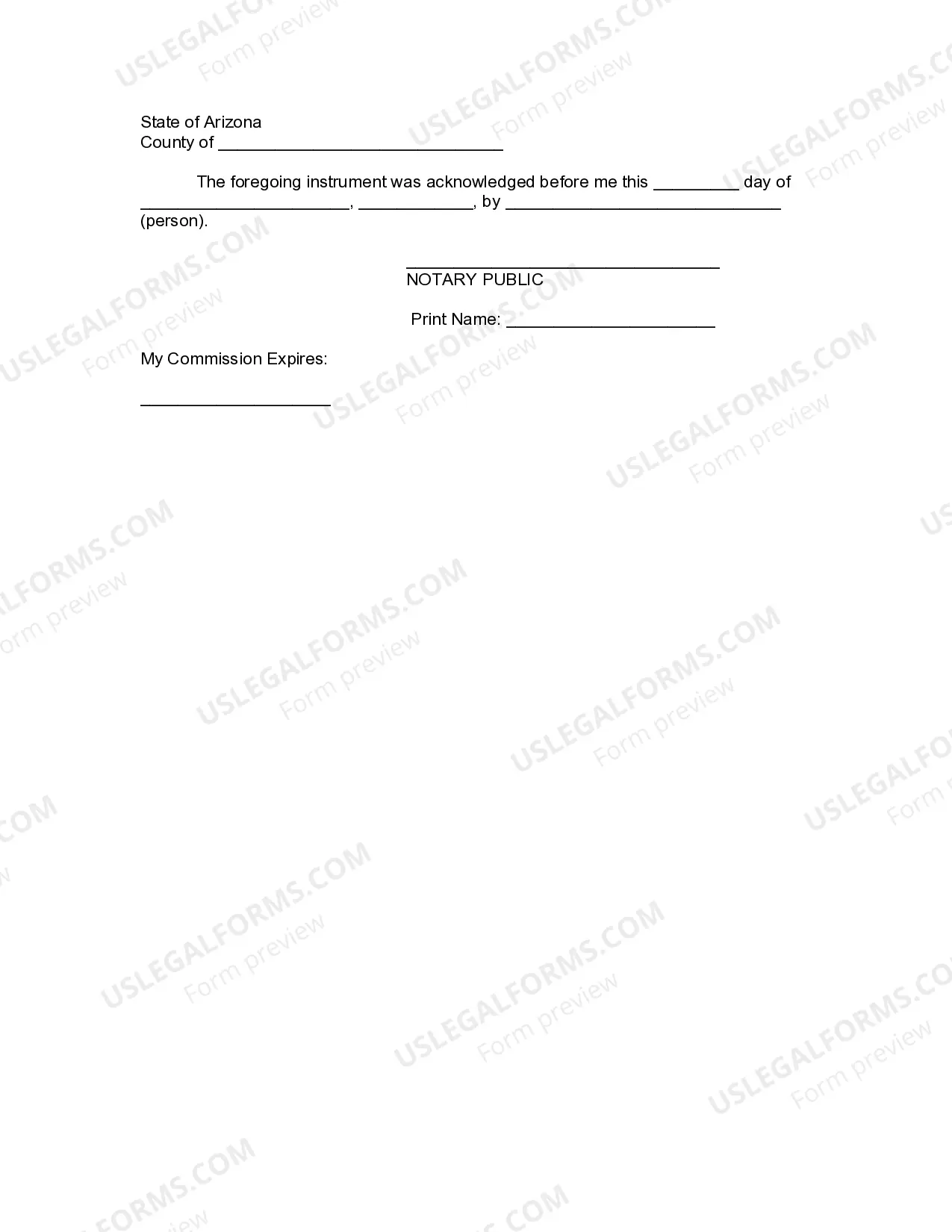

How to fill out Arizona Revocation Of Living Trust?

The Arizona Revocation Trust Az Withholding displayed on this page is a versatile legal template created by expert lawyers in accordance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal experts more than 85,000 authenticated, state-specific documents for any business and personal need. It’s the fastest, easiest, and most dependable method to acquire the documents you require, as the service ensures the utmost level of data privacy and malware protection.

Select the format you prefer for your Arizona Revocation Trust Az Withholding (PDF, DOCX, RTF) and download the sample to your device.

- Search for the document you require and examine it.

- Browse through the document you searched and preview it or review the form description to ensure it meets your needs. If it doesn't, utilize the search feature to locate the appropriate one. Click Buy Now once you have discovered the template you want.

- Select a subscription and Log In.

- Choose the pricing plan that fits you best and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

Yes, the employer should then select 2.0% as the default rate. This means by March 2023 the paychecks would have the default rate chosen for them.

Employers are required by law to withhold employment taxes from their employees. Employment taxes include federal income tax withholding and Social Security and Medicare Taxes.

Employers should withhold half (7.65%) of the 15.3% owed in FICA (Social Security and Medicare) taxes from an employee's gross pay. FICA taxes come in addition to regular federal income taxes, which change depending on your income level. There are seven tax brackets in 2022 and 2023: 12%. 22%, 24%, 32%, 35%, and 37%.

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

To receive a bigger refund, adjust line 4(c) on Form W-4, called "Extra withholding," to increase the federal tax withholding for each paycheck you receive. Tax withholding calculators help you get a big picture view of your refund situation by asking detailed questions.