Arizona Pay Rate

Description

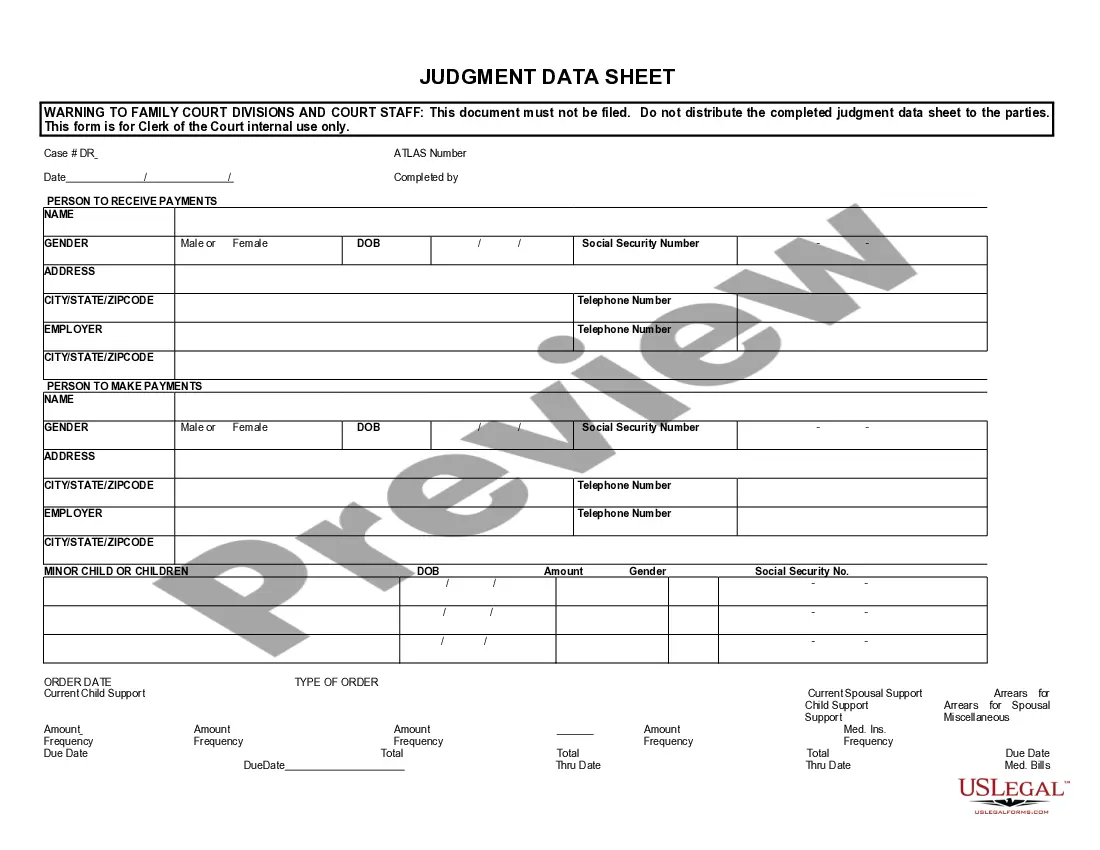

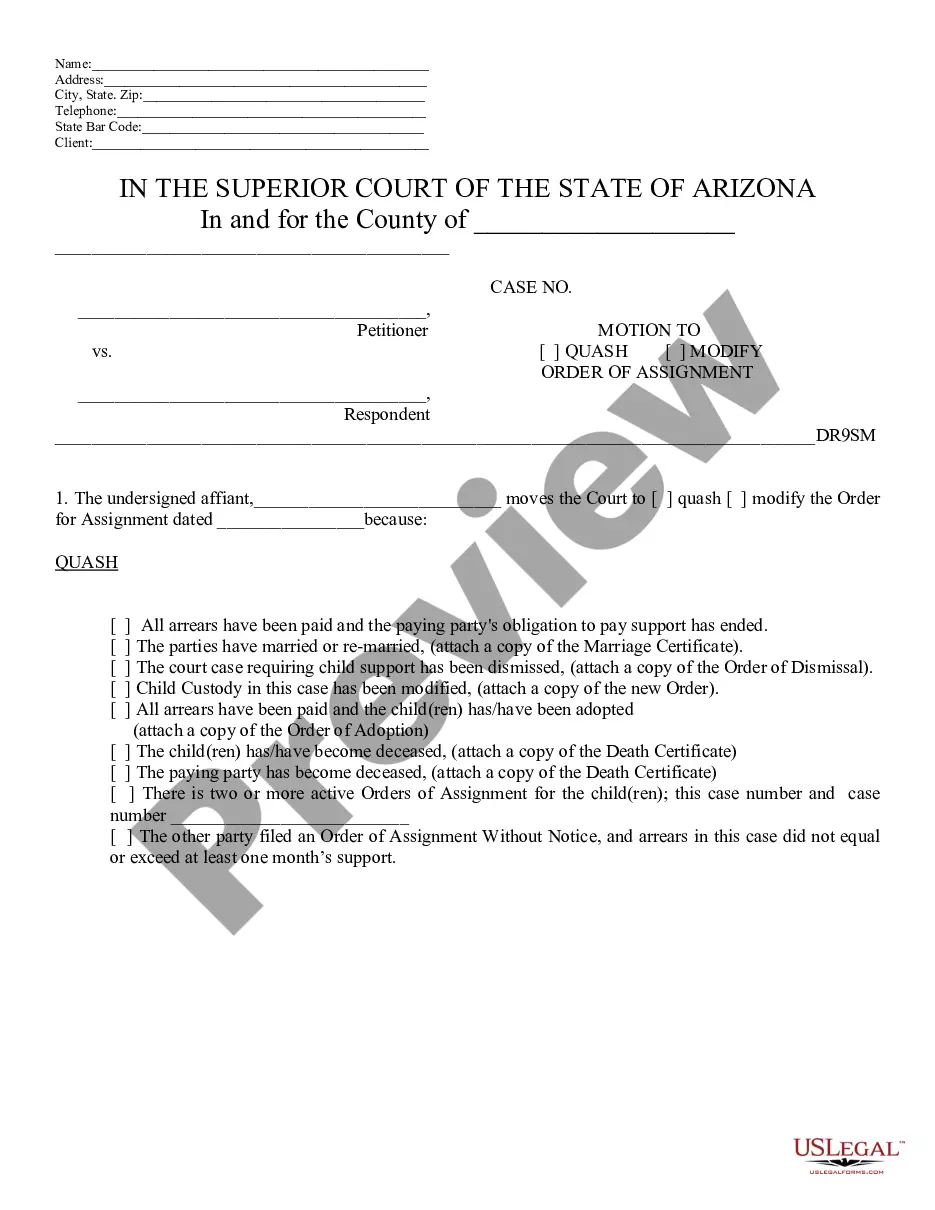

How to fill out Arizona Order To Stop Wage Assign.?

Whether for commercial purposes or personal issues, everyone must handle legal circumstances at some point in their lives.

Filling out legal documents requires meticulous care, beginning with selecting the correct form template. For example, if you choose an incorrect version of an Arizona Pay Rate, it will be rejected upon submission.

Once it is downloaded, you can complete the form using editing software or print it out and fill it out by hand. With a comprehensive US Legal Forms catalog available, you never need to waste time searching for the correct sample online. Utilize the library’s straightforward navigation to find the right form for any occasion.

- Obtain the sample you need by using the search bar or browsing the catalog.

- Review the form’s details to ensure it aligns with your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is not the correct form, return to the search feature to locate the Arizona Pay Rate template you need.

- Download the document when it fits your requirements.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously stored documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Choose the file format you desire and download the Arizona Pay Rate.

Form popularity

FAQ

The research found the optimal income for life satisfaction in North America is $105,000 per year. If your income exceeds that amount, it has been found that whatever you make beyond that level is not associated with greater life satisfaction. In fact, it reduces life satisfaction.

Overview of Arizona Taxes Arizona has an income tax rate between 2.55% and 2.98% and no local income tax.

If you make $105,000 a year living in the region of Arizona, USA, you will be taxed $26,815. That means that your net pay will be $78,185 per year, or $6,515 per month.

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

Arizona state income tax brackets and rates depend on taxable income, tax-filing status and residency status. For the 2022 tax year (taxes filed in 2023), Arizona has two income tax rates: 2.55% and 2.98%. For the 2023 tax year (taxes filed in 2024), Arizona will begin imposing a flat tax rate of 2.5%.