Dissolution Dissolve Corporation For 3 Years

Description

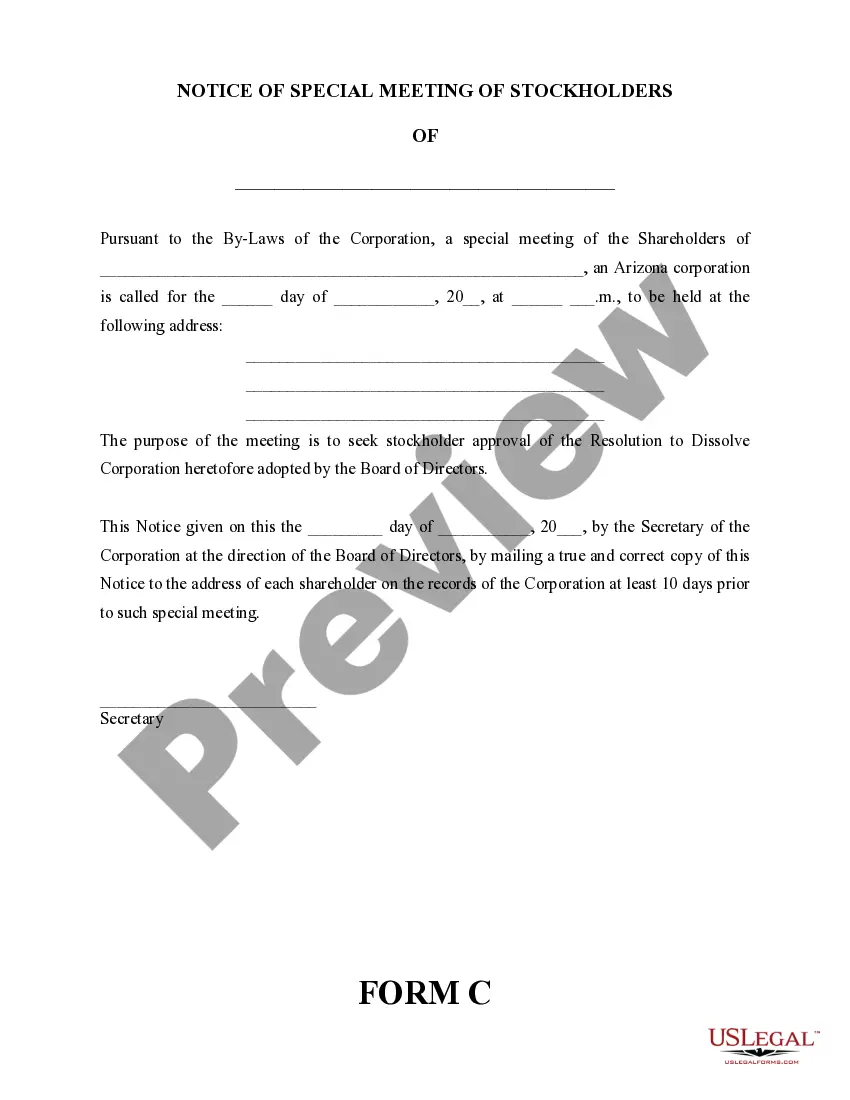

How to fill out Arizona Dissolution Package To Dissolve Corporation?

- Log in to your existing US Legal Forms account and download the required form template by clicking the Download button, ensuring your subscription is active.

- Review the Preview mode and description of the form to confirm it meets your specific needs and adheres to your local jurisdiction's requirements.

- Utilize the Search feature if you need an alternative template or find inconsistencies in your selection.

- Select your document by clicking the Buy Now button and opt for your preferred subscription plan, registering for an account to access their extensive resources.

- Complete your transaction by entering your credit card information or utilizing your PayPal account to finalize the purchase.

- Download your chosen form and save it to your device; you can access it anytime through the My Forms section of your account.

By using US Legal Forms, you benefit from a vast collection of legal templates tailored for individuals and attorneys alike. With over 85,000 fillable and editable forms, you can confidently tackle your legal requirements.

Get started today to ensure a smooth and legally compliant dissolution process. Discover the power of US Legal Forms to assist you in fulfilling your legal obligations!

Form popularity

FAQ

In most cases, once a corporation is dissolved, its shareholders and directors are not personally liable for the corporation's debts. However, this protection can be lost if the corporation continues to operate after dissolution or if the owners didn’t follow proper procedures during the dissolution. Understanding the liabilities that can arise is essential when planning to dissolve a corporation for 3 years. Seeking assistance from platforms like uslegalforms can help clarify these responsibilities.

If a corporation continues to operate after it has been dissolved, it might face significant legal issues. Operating a dissolved corporation can lead to personal liability for debts, as the legal protections of the corporation no longer apply. It's crucial to cease all business activities immediately upon dissolution to avoid complications. To properly stop all operations and adhere to regulations, consider seeking expert advice on how to dissolve a corporation for 3 years.

Once a corporation dissolves, the ownership of its assets transfers based on the corporation’s bylaws or state laws. Typically, any remaining assets are distributed to shareholders after settling debts. However, if not handled properly, unresolved debts can lead to personal liability for the owners. Consulting resources like uslegalforms can provide guidance on how to effectively manage asset distribution when you intend to dissolve a corporation for 3 years.

There are typically three methods for dissolving a corporation: voluntary dissolution, administrative dissolution, and judicial dissolution. Voluntary dissolution occurs when the owners decide to end the business’s operations. Administrative dissolution can happen if the corporation fails to meet legal requirements, and judicial dissolution involves a court order. Understanding these options is essential when considering how to dissolve a corporation for 3 years without complications.

When a corporation dissolves, it ceases all operations and its legal entity is terminated. This process entails settling debts, liquidating assets, and distributing any remaining funds to shareholders. Additionally, it is essential to notify creditors and follow state-specific protocols. Knowing the steps involved in dissolution to dissolve a corporation for 3 years can help prevent personal liability.

After you dissolve your corporation, using the business's bank account is generally not advisable. Once the dissolution is officially filed, the corporation loses its legal status, and access to its accounts may be restricted. You need to settle any outstanding debts and distribute remaining assets before accessing any funds. Keeping track of these obligations is crucial when navigating your dissolution to dissolve a corporation for 3 years.

Dissolution and closing are often confused, but they involve different processes. Dissolving a corporation means legally ending its existence, while closing is simply stopping operations. When you want to officially dissolve, you follow specific legal steps, which can impact your ability to conduct business. Understanding how to dissolve a corporation for 3 years ensures you stay compliant and avoid potential liabilities.

Dissolving a corporation can occur through several methods, such as voluntary dissolution approved by shareholders or statutory dissolution when a corporation fails to comply with state laws. Another method is administrative dissolution, which is initiated by the state for noncompliance with legal requirements. Using a reliable platform like US Legal Forms can streamline this process and ensure you meet all necessary legal steps for the best outcomes over three years.

There are several methods to dissolve a corporation, including voluntary and involuntary dissolution. Voluntary dissolution occurs when shareholders or board members decide to end the corporation, while involuntary dissolution may happen due to a court order or failure to meet state requirements. Regardless of the method, documentation is crucial during the dissolution process to comply with regulations for three years.

Dissolving a corporation does not automatically trigger an audit, but it can raise flags if there are discrepancies in your financial records. The IRS may review your last returns to ensure proper reporting and compliance. To minimize the chances of an audit, keep thorough records and follow all proper procedures when you prepare to dissolve your corporation for three years.