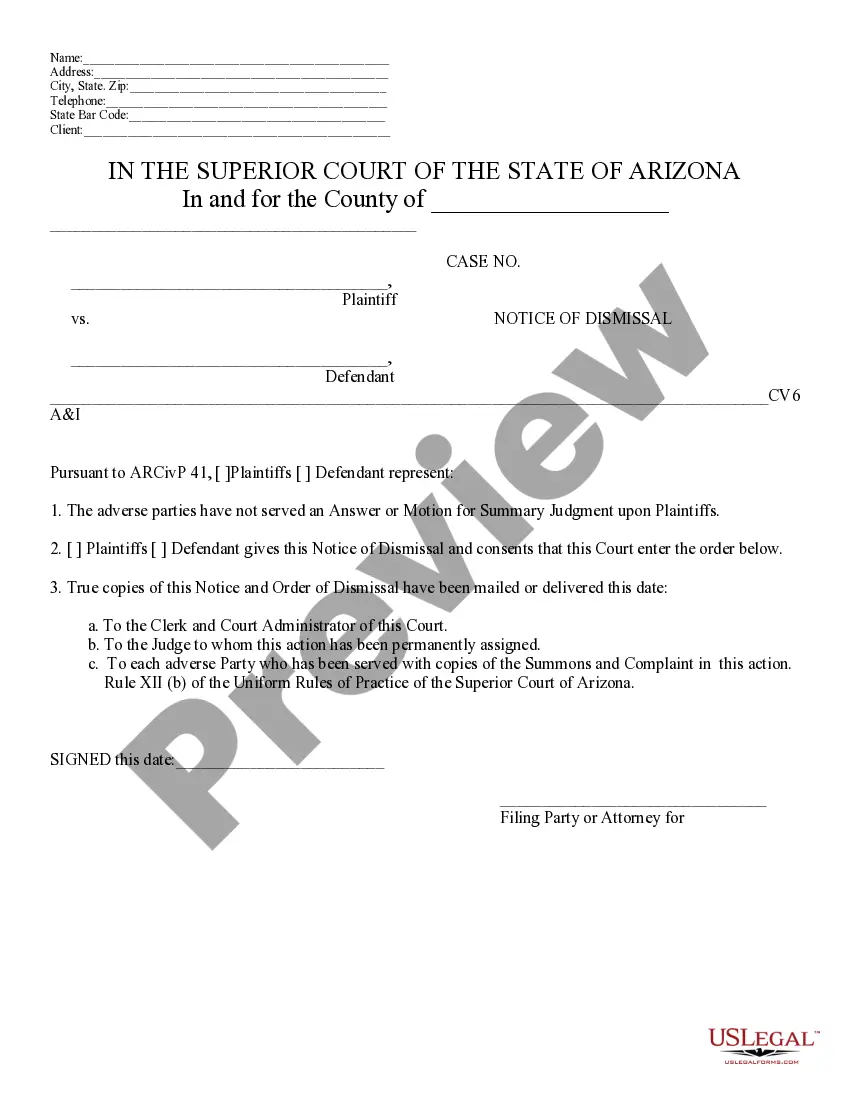

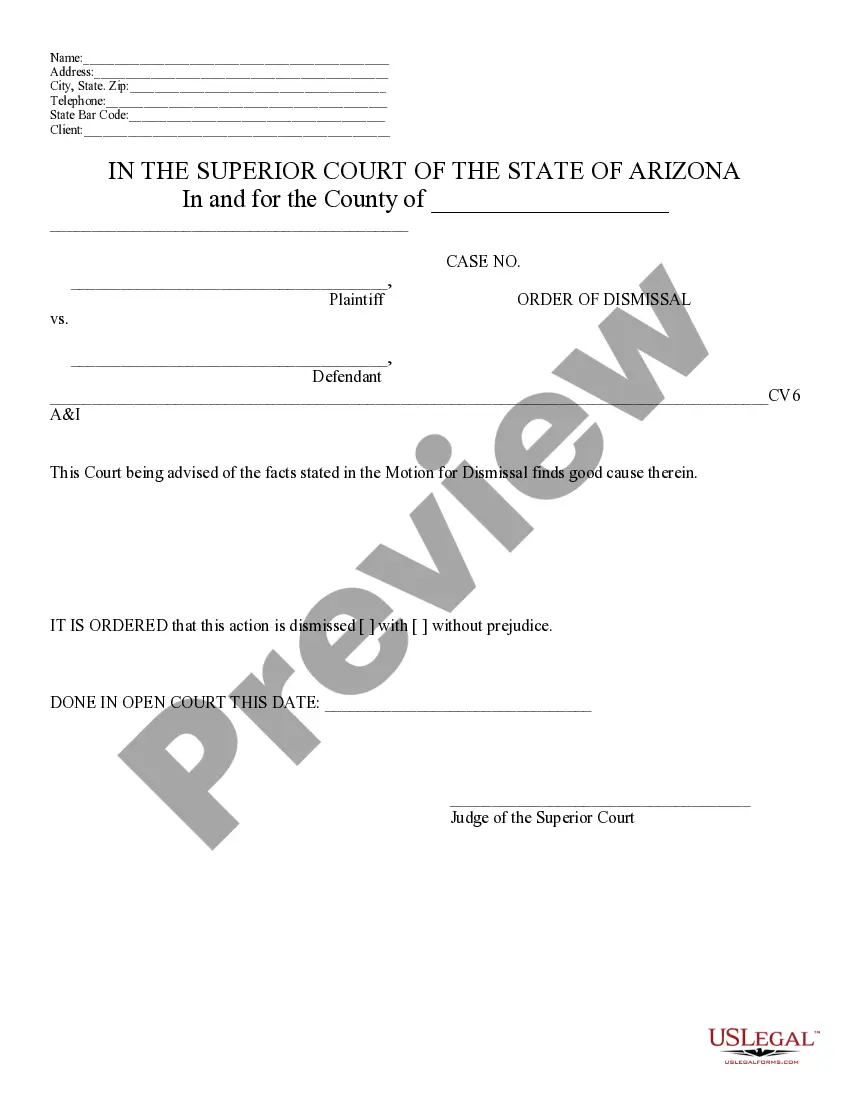

Motion for Dismissal: This is a motion which asks the court to dismiss a particular cause of action. The document must include the reasoning behind wanting the dismissal, as well be signed in front of a Notary Public. Also included, is a sample Order Granting Dismissal. This would be signed by the Judge and filed with the clerk's office. This form is available in both Word and Rich Text formats.

Superior Court Form Arizona Withholding

Description

How to fill out Arizona Motion For Dismissal?

Dealing with legal papers and operations could be a time-consuming addition to your entire day. Superior Court Form Arizona Withholding and forms like it often need you to look for them and understand the best way to complete them effectively. As a result, regardless if you are taking care of financial, legal, or personal matters, using a thorough and hassle-free online library of forms when you need it will greatly assist.

US Legal Forms is the best online platform of legal templates, featuring over 85,000 state-specific forms and numerous resources to assist you to complete your papers effortlessly. Explore the library of appropriate documents available with just one click.

US Legal Forms provides you with state- and county-specific forms offered at any time for downloading. Protect your document management operations with a top-notch service that lets you prepare any form within minutes without any extra or hidden charges. Just log in to your account, find Superior Court Form Arizona Withholding and download it immediately from the My Forms tab. You may also access previously saved forms.

Could it be the first time making use of US Legal Forms? Register and set up up your account in a few minutes and you will get access to the form library and Superior Court Form Arizona Withholding. Then, adhere to the steps below to complete your form:

- Be sure you have found the right form by using the Review option and reading the form description.

- Choose Buy Now once ready, and choose the monthly subscription plan that suits you.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of experience helping consumers manage their legal papers. Obtain the form you need right now and improve any operation without having to break a sweat.

Form popularity

FAQ

The Arizona Department of Revenue has announced that a revised Form A-4 applies effective January 31, 2023, to take into account the new flat tax of 2.5% effective January 1, 2023 under SB 1828. (See EY Tax Alert 2022-1645.)

The new default Arizona withholding rate is 2.0%.

Enter your annual gross taxable wages, the number of paychecks you receive each year, your annual withholding goal, the amount already withheld for this year, the number of paychecks remaining in this year, and select the largest percentage on line 10 that is less than line 9.

To change the amount of Arizona income tax withheld, an employee must complete Arizona Form A-4 and submit to his or her employer to choose a different withholding percentage option. Employees may request to have an additional amount withheld by their employer.

Yes, the employer should then select 2.0% as the default rate. This means by March 2023 the paychecks would have the default rate chosen for them.