199-r

Description

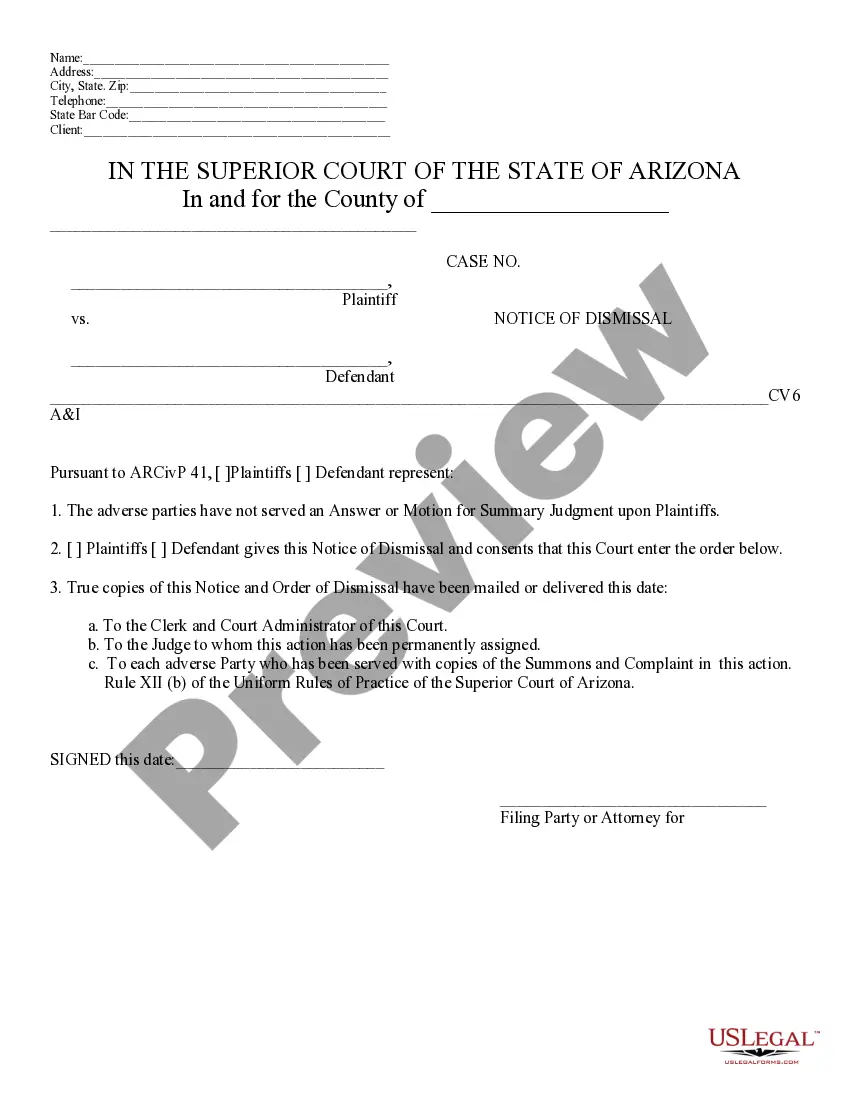

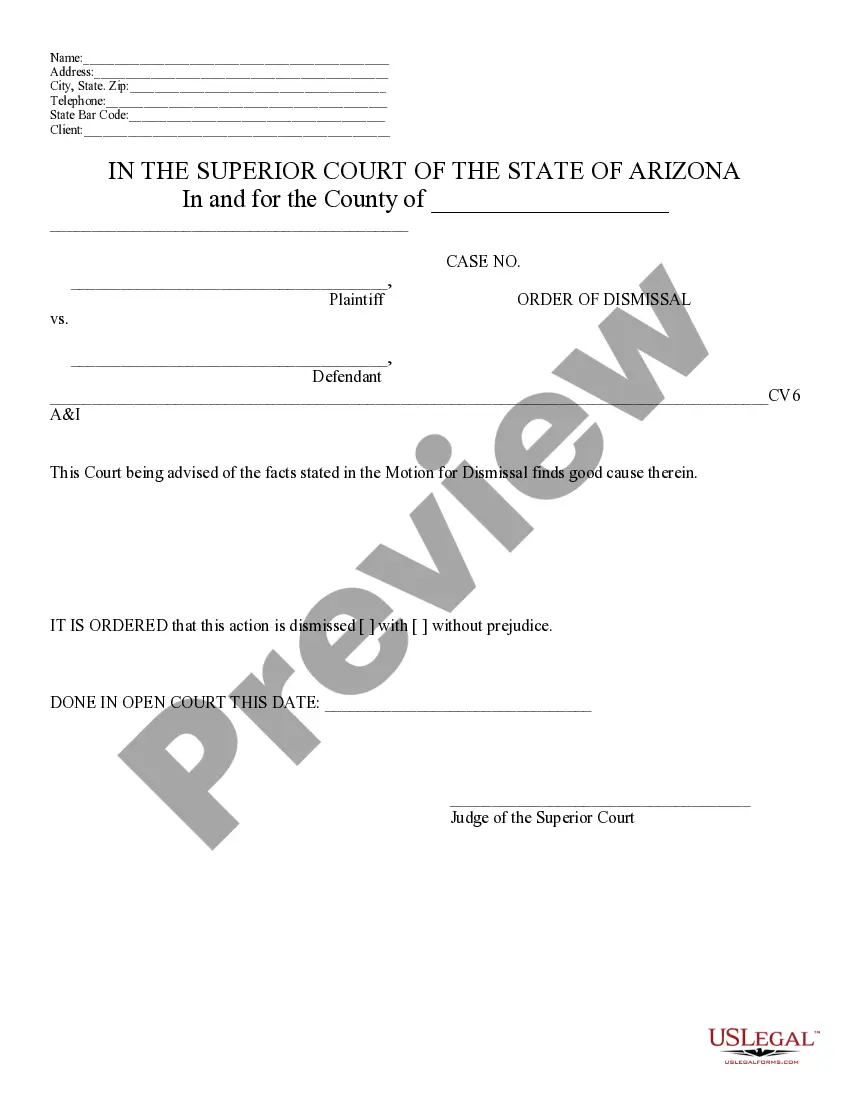

How to fill out Arizona Motion For Dismissal?

Dealing with legal papers and operations can be a time-consuming addition to your entire day. 199-r and forms like it often require that you look for them and navigate the best way to complete them correctly. For that reason, whether you are taking care of financial, legal, or personal matters, having a thorough and convenient online library of forms on hand will help a lot.

US Legal Forms is the number one online platform of legal templates, boasting over 85,000 state-specific forms and a variety of resources to assist you to complete your papers effortlessly. Discover the library of appropriate papers available to you with just one click.

US Legal Forms offers you state- and county-specific forms offered by any time for downloading. Shield your document administration procedures by using a high quality services that allows you to put together any form within a few minutes without having additional or hidden cost. Just log in to your profile, find 199-r and download it straight away from the My Forms tab. You may also gain access to formerly downloaded forms.

Would it be your first time using US Legal Forms? Sign up and set up an account in a few minutes and you will gain access to the form library and 199-r. Then, adhere to the steps below to complete your form:

- Be sure you have the right form using the Review option and reading the form information.

- Pick Buy Now when all set, and select the monthly subscription plan that is right for you.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of expertise assisting consumers deal with their legal papers. Find the form you want right now and improve any process without breaking a sweat.

Form popularity

FAQ

What do the distribution codes in Box 7 of my 1099-R mean? CodeDefinition1Early distribution, no known exception (in most cases, under age 59½).2Early distribution, exception applies (under age 59½).3Disability26 more rows

You'll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040. The 1099-R form is an informational return, which means you'll use it to report income on your federal tax return. If the form shows federal income tax withheld in Box 4, attach a copy ? Copy B?to your tax return.

The distributions are reported to the taxpayer on Form 1099-R. The taxpayer then reports the amount of the charitable distribution on Form 1040 on the line for IRA distributions and enter zero for the taxable amount. QCD should then be entered next to this line. A QCD is not subject to withholding.

You must file form 5329 on your federal tax return for the year that the full RMD was not taken. The IRS can waive part or all of this tax if you can show that any shortfall in the amount of distributions was due to reasonable error and you are taking reasonable steps to remedy the shortfall.

"T" informs the IRS that the holding period was not met, but the distribution is exempt from the penalty for early withdrawal because it has been paid to a beneficiary. The initial withdrawn contributions are tax-free; however, distributed earnings are taxable.