Repossession Laws In Arizona

Description

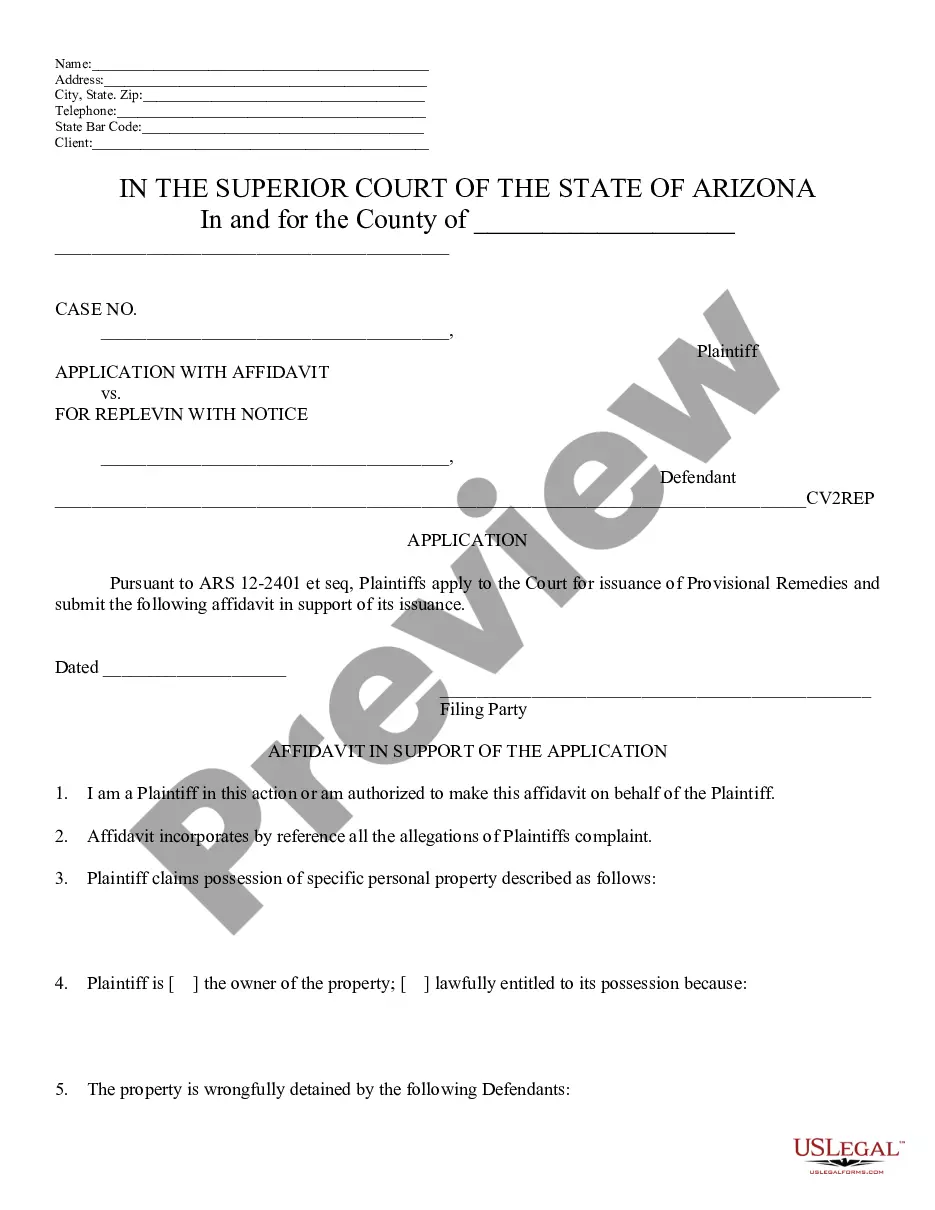

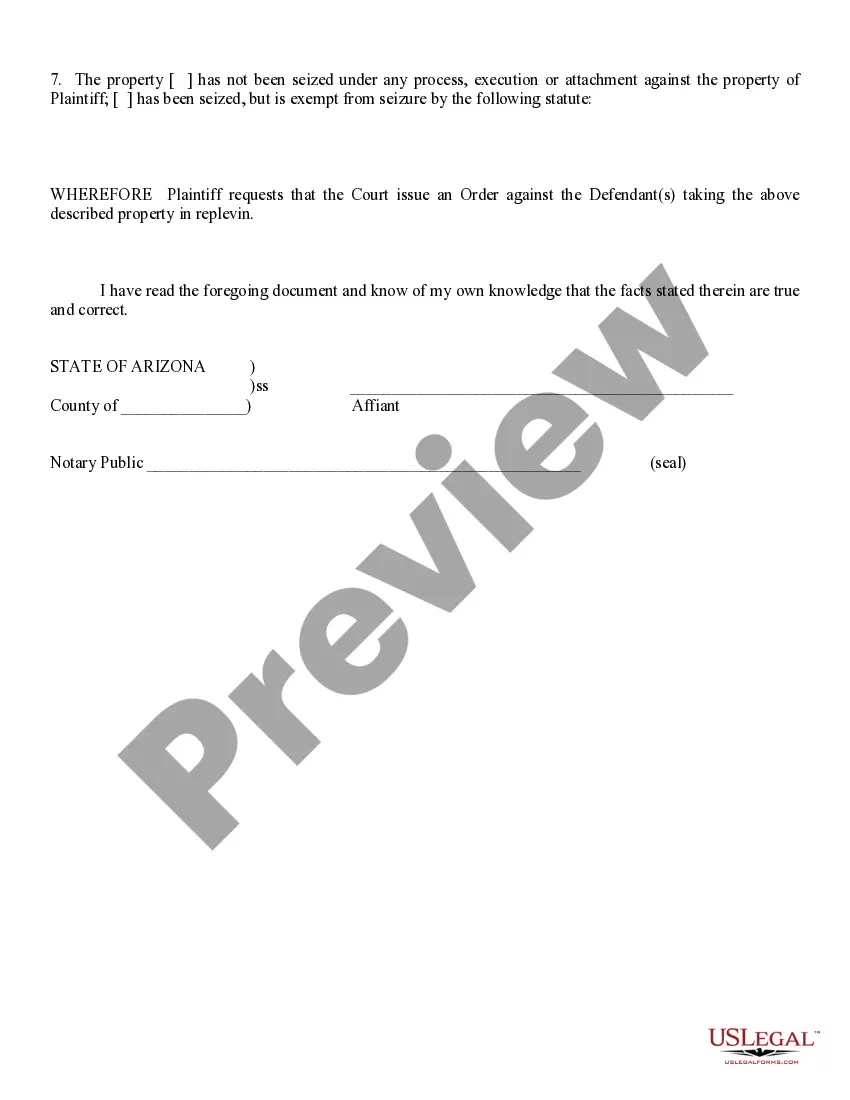

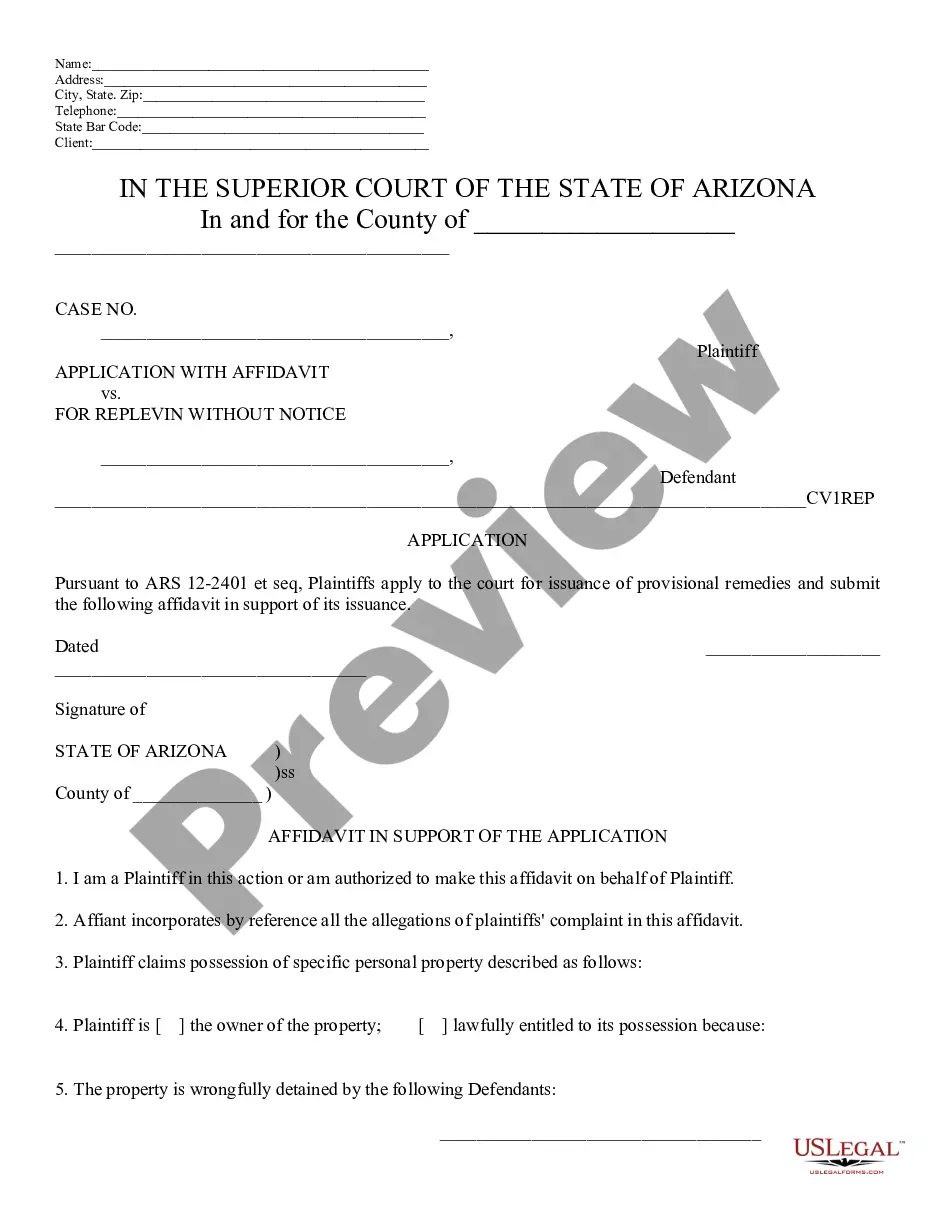

How to fill out Arizona Application With Affidavit For Replevin Or Repossession With Notice?

Using legal document samples that meet the federal and regional regulations is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the appropriate Repossession Laws In Arizona sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and personal scenario. They are easy to browse with all files collected by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when obtaining a Repossession Laws In Arizona from our website.

Getting a Repossession Laws In Arizona is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the guidelines below:

- Analyze the template using the Preview feature or via the text description to ensure it meets your requirements.

- Locate a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Repossession Laws In Arizona and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Statute of Limitations The creditor has 4 years from the time it repossessed your car to sue for a deficiency. If more than 4 years have passed, the statute of limitations has run. If you believe the statute of limitations has run, you should notify the creditor and ask them to dismiss the lawsuit.

In order to do so, they must pay back the full amount that remains on the loan, as well as any late fees that they may have incurred and reasonable expenses from the repossession or storage.

If you are late on a payment, the creditor can choose to accelerate your loan. You will then owe the creditor the entire amount due on the loan. If you can't pay the entire amount due on the loan in a certain time period (usually 10 days), the creditor can then take back, or repossess, the property.

If you are late on a payment, the creditor can choose to accelerate your loan. You will then owe the creditor the entire amount due on the loan. If you can't pay the entire amount due on the loan in a certain time period (usually 10 days), the creditor can then take back, or repossess, the property.

The law states someone first must have missed payments for 90 days. Then a dealership must send a certified letter. If the person fails to pay for 30 days after that, they are guilty of "unlawful failure to return a motor vehicle subject to a security interest."