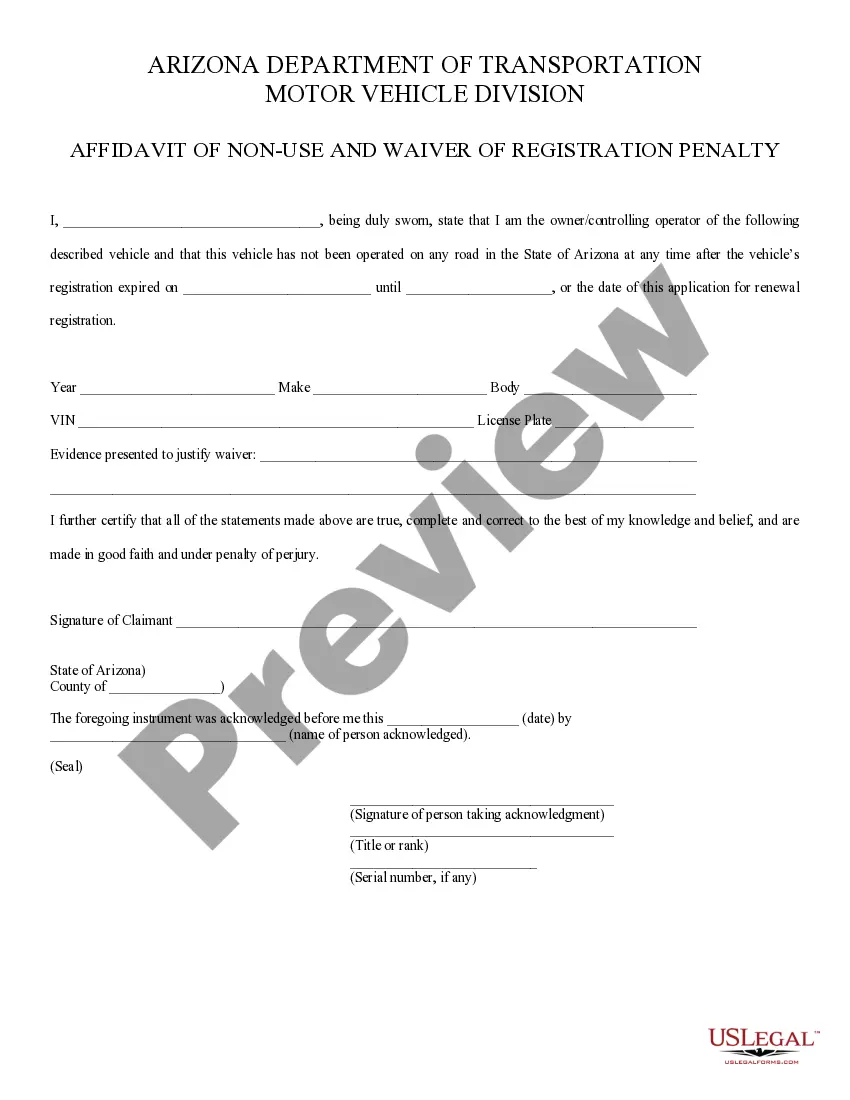

Affidavit Of Non Use Arizona Withholding Form

Description

How to fill out Arizona Affidavit Of Nonuse?

There's no additional justification to waste time searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one place and streamlined their availability.

Our website offers over 85k templates for any business and personal legal situations categorized by state and usage area.

Utilize the Search field above to look for an alternative sample if the current one doesn't suit your needs.

- All forms are expertly drafted and validated for authenticity, so you can trust that you are receiving a current Affidavit Of Non Use Arizona Withholding Form.

- If you are acquainted with our service and already possess an account, make sure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time needed by navigating to the My documents tab in your profile.

- If this is your first time using our service, the process will require a few additional steps.

- Here’s how new users can locate the Affidavit Of Non Use Arizona Withholding Form in our library.

- Carefully read the page content to confirm it includes the sample you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

Registration must be done by completing the Arizona Joint Tax Application, (Arizona Form JT-1), available here. Completing and submitting Arizona Form JT-1 also begins the process of registering the employer for unemployment compensation insurance with the Arizona Department of Economic Security.

2022 Form 140NR Nonresident Personal Income Tax. Return. 2022 Schedule A(NR) Itemized Deduction.

Nonresident Employees Compensation earned by nonresidents while physically working in Arizona for temporary periods is subject to Arizona income tax. However, under Arizona law, compensation paid to certain nonresident employees is not subject to Arizona income tax withholding.

Information for Employers, Employees, and Individuals If the new employee fails to complete Arizona Form A-4 within 5 days of hire, the employer must withhold Arizona income tax at the rate of 2.7% until the employee elects a different withholding rate.

An employer must withhold Arizona income tax from employees whose compensation is for services performed within Arizona. Arizona state income tax withholding is a percentage of the employee's gross taxable wages.