Az Commercial Lease With Lease Yuma

Description

How to fill out Arizona Commercial Building Or Space Lease?

Finding a go-to place to access the most recent and appropriate legal samples is half the struggle of working with bureaucracy. Finding the right legal files needs accuracy and attention to detail, which is the reason it is important to take samples of Az Commercial Lease With Lease Yuma only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and see all the details concerning the document’s use and relevance for the circumstances and in your state or county.

Take the following steps to complete your Az Commercial Lease With Lease Yuma:

- Utilize the catalog navigation or search field to find your template.

- Open the form’s description to ascertain if it suits the requirements of your state and area.

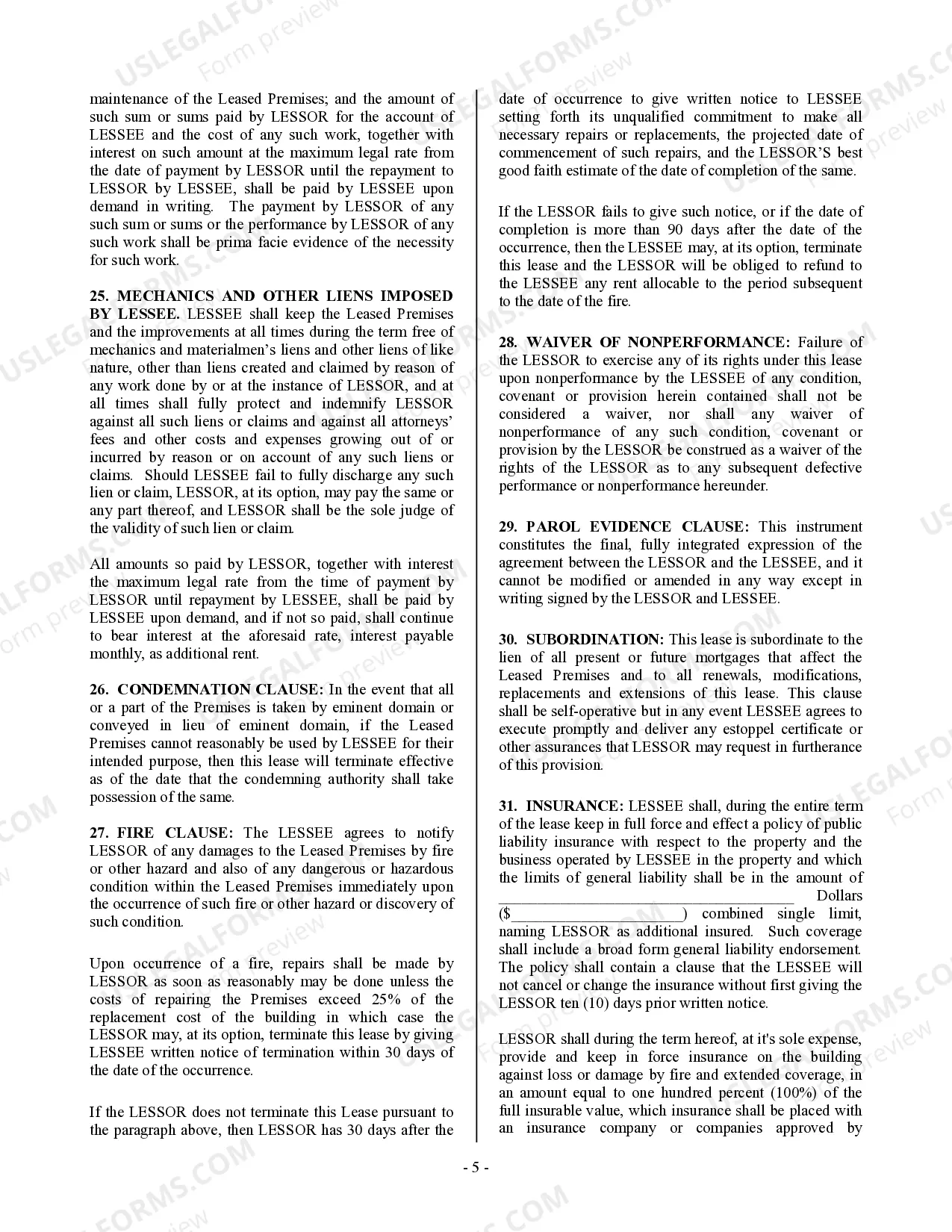

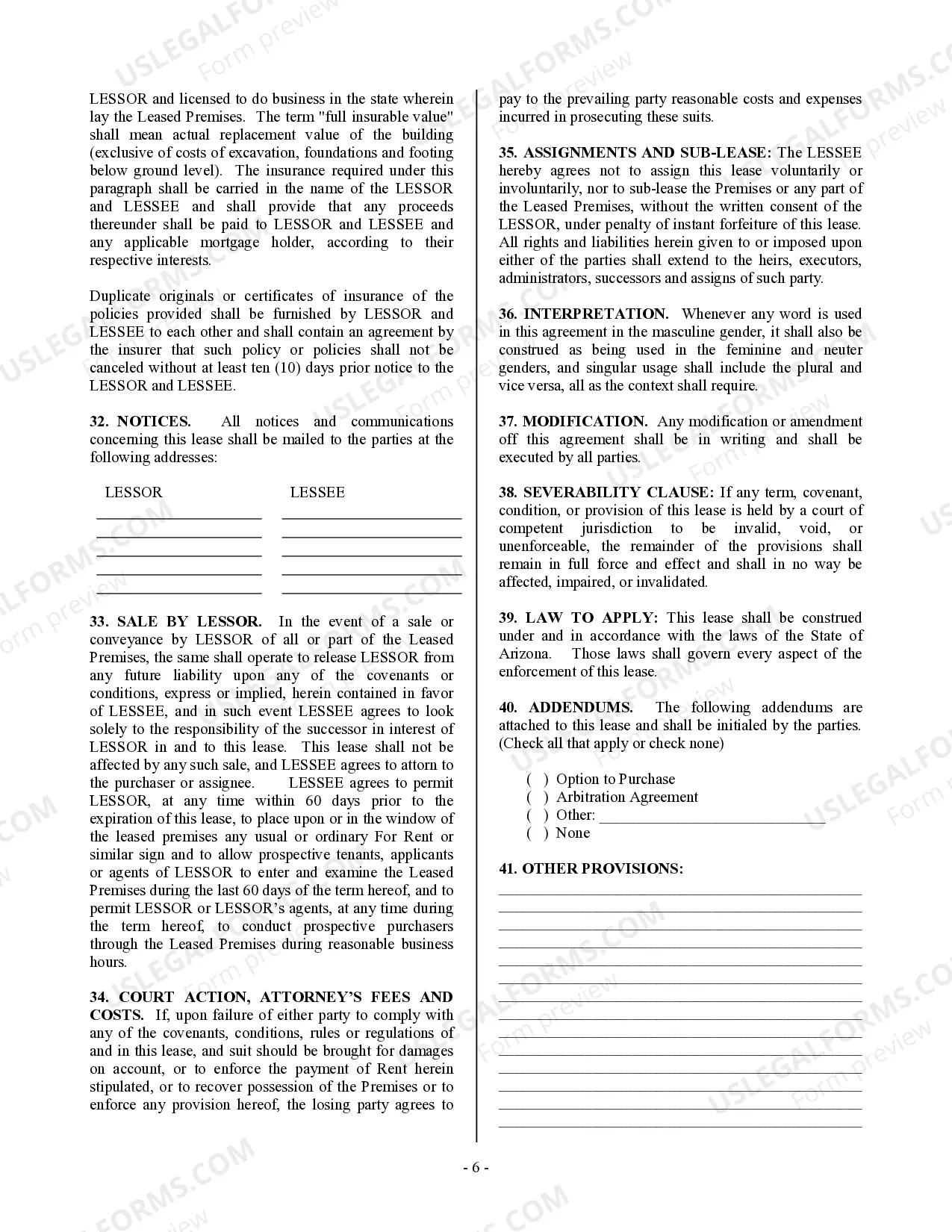

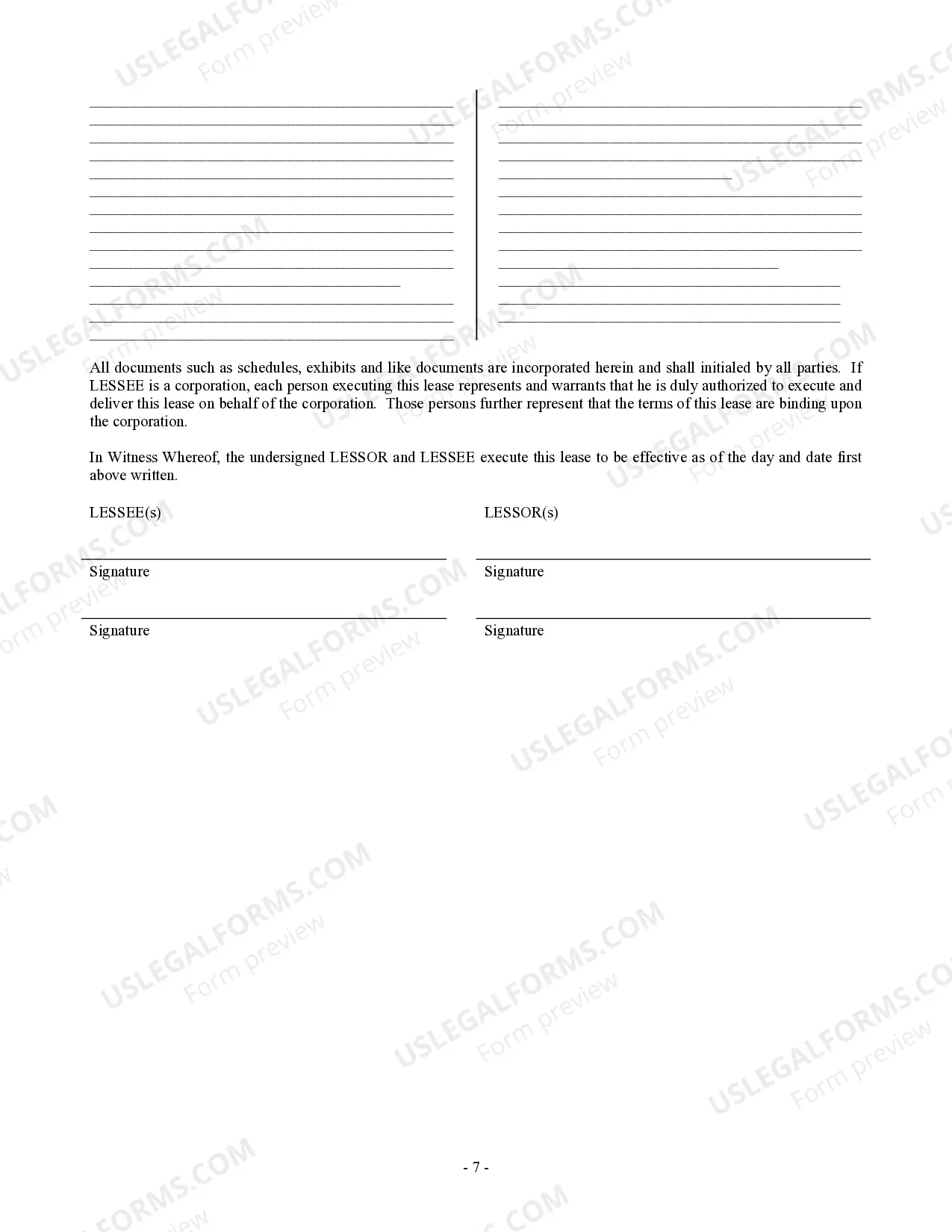

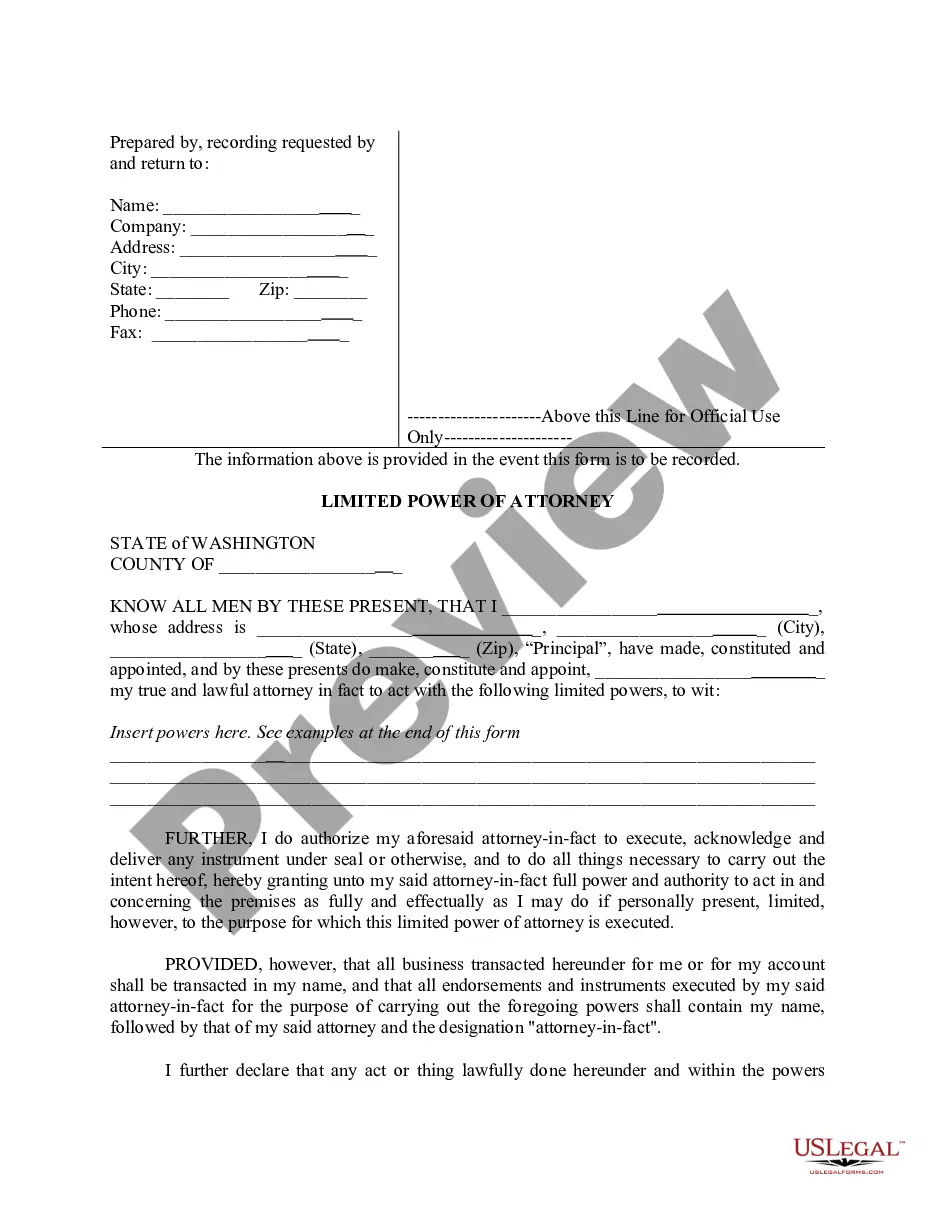

- Open the form preview, if there is one, to ensure the template is definitely the one you are searching for.

- Return to the search and find the right template if the Az Commercial Lease With Lease Yuma does not suit your requirements.

- If you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Choose the pricing plan that suits your requirements.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by picking a transaction method (credit card or PayPal).

- Choose the file format for downloading Az Commercial Lease With Lease Yuma.

- Once you have the form on your gadget, you can change it with the editor or print it and complete it manually.

Get rid of the hassle that comes with your legal documentation. Check out the comprehensive US Legal Forms library where you can find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Answer: Under Arizona law, a landlord may not change the locks on a tenant without first seeking and obtaining a formal eviction from the court. To remove or exclude a tenant from the premises in such a way is explicitly unlawful. A tenant who is locked out of a dwelling may file a complaint with the court.

Once the landlord's consent has been obtained, the tenant and assignee can enter into a deed of assignment to transfer the lease to the assignee. If the lease is registered at the Land Registry the assignee will then need to register the assignment at the Land Registry.

Taxes, Utilities, Insurance, and Other Expenses There are three possible arrangements for commercial leases: gross lease, triple net, and modified-gross lease. In a gross lease, the landlord is responsible for all costs. Furthermore, in a triple-net lease, the tenant is responsible for all costs.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

There are five counties in the state of Arizona that require you to collect and remit county taxes for commercial leases. Those counties are Coconino, Gila, Maricopa, Pima and Pinal.