Arizona Child Support Worksheet For 2023

Description

How to fill out Arizona Parent's Worksheet For Child Support?

Creating legal documents from the ground up can occasionally be intimidating.

Certain situations may require extensive research and considerable financial investment.

If you’re looking for a simpler and more economical method of producing the Arizona Child Support Worksheet For 2023 or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

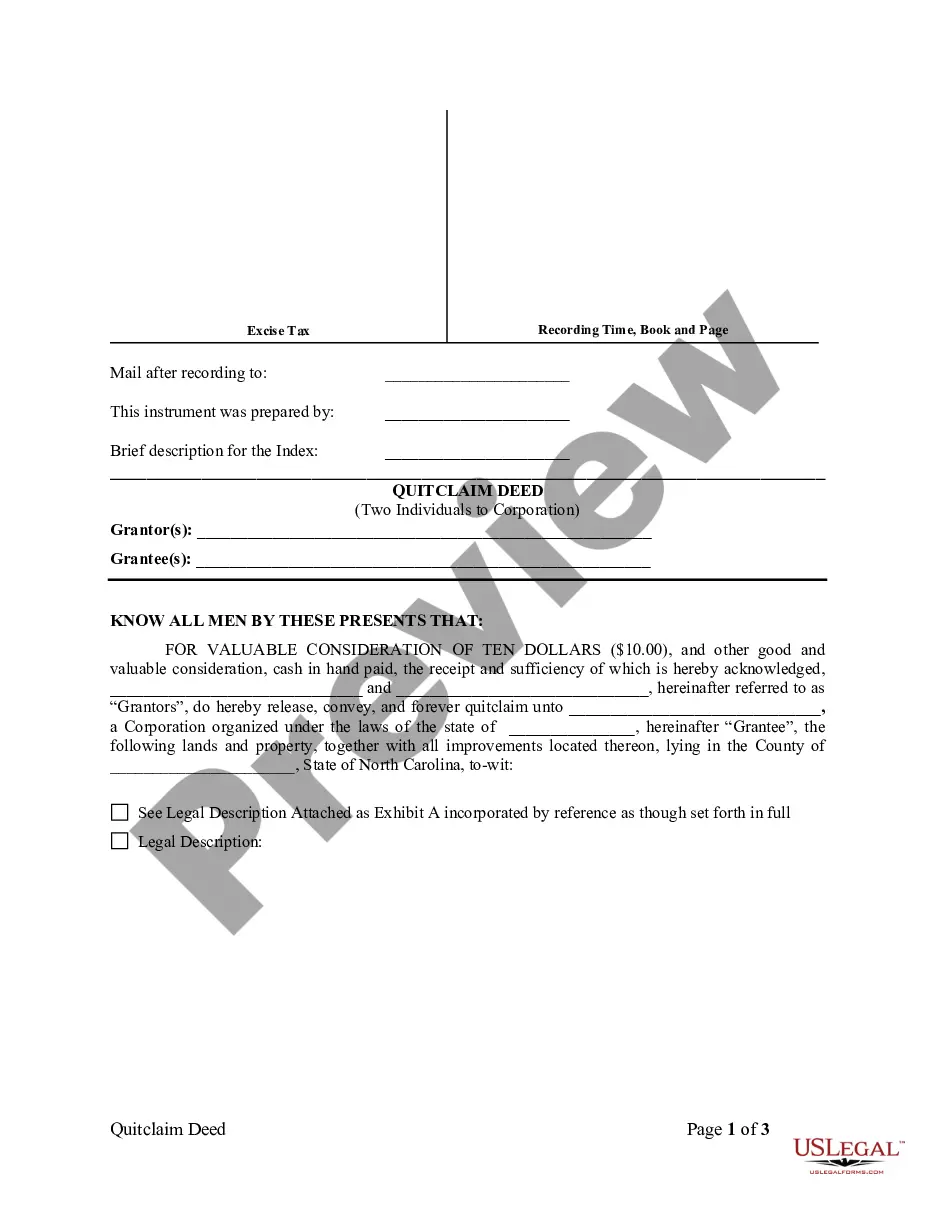

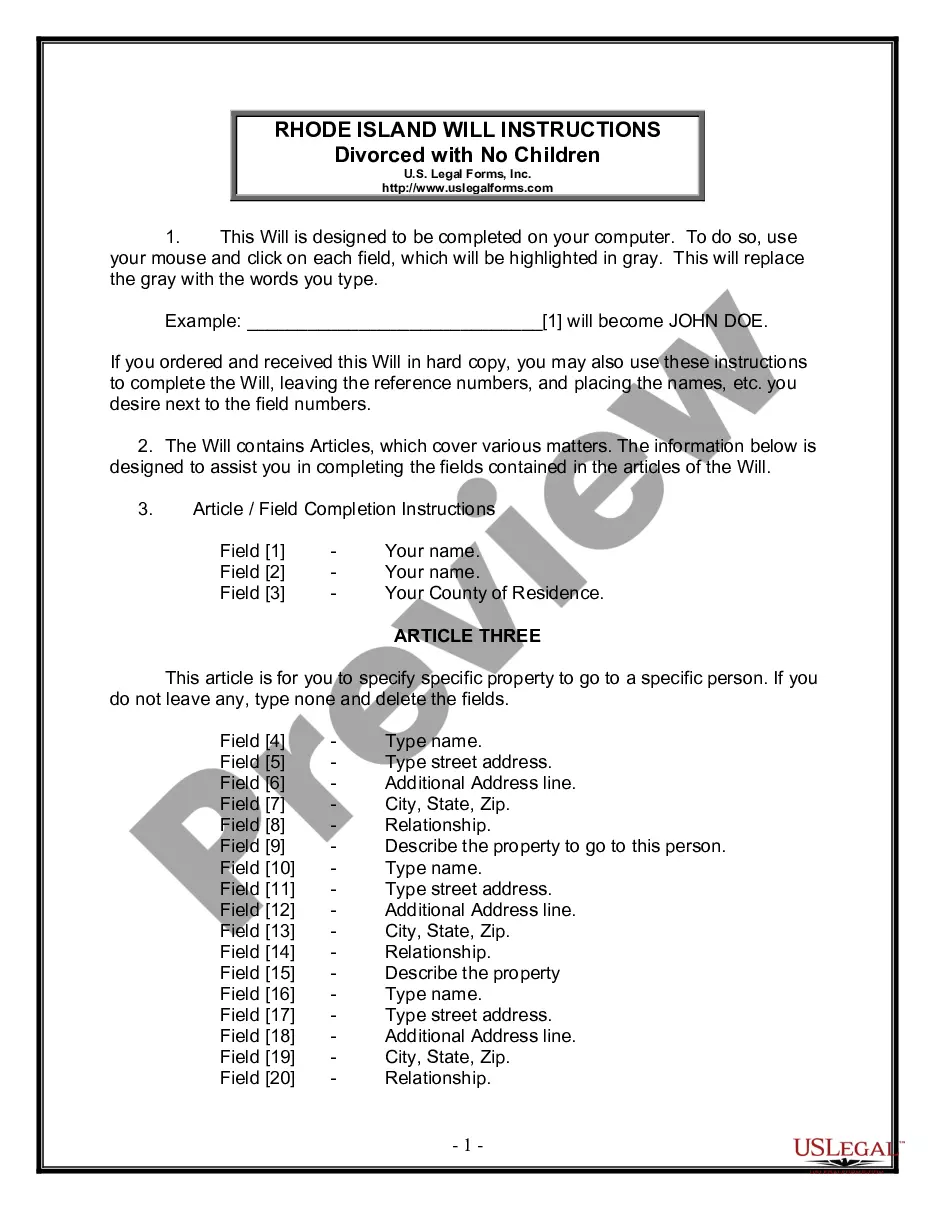

Examine the document preview and descriptions to confirm that you are on the correct form. Verify that the form you select meets the requirements of your state and county. Choose the most appropriate subscription plan to access the Arizona Child Support Worksheet For 2023. Download the form, then complete, certify, and print it. US Legal Forms has a flawless reputation and over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-compliant forms carefully prepared for you by our legal professionals.

- Utilize our website whenever you require dependable services to swiftly find and download the Arizona Child Support Worksheet For 2023.

- If you’re already familiar with our services and have previously created an account with us, simply Log In to your account, choose the form, and download it or re-download it later from the My documents section.

- Don’t have an account? No issue. It takes minimal time to sign up and browse the catalog.

- But before proceeding directly to download the Arizona Child Support Worksheet For 2023, consider these suggestions.

Form popularity

FAQ

In child support court, it’s crucial to communicate effectively and professionally. Avoid making personal attacks or negative comments about the other parent, as this can harm your case. Focus on presenting facts and documentation related to the Arizona child support worksheet for 2023. Resources on US Legal Forms can guide you on appropriate language and strategies to use in court.

The guidelines for child support in Arizona are designed to ensure fair support for children. They take into account each parent's income, the child's needs, and other relevant factors. The Arizona child support worksheet for 2023 outlines these guidelines clearly, helping parents make informed decisions. Accessing this worksheet through US Legal Forms can simplify the process and ensure compliance.

To fill out the Arizona child support worksheet for 2023, start by gathering all necessary financial documents, including income statements and expenses. Next, input your income and any deductions accurately into the worksheet. It's essential to follow the guidelines provided in the worksheet to ensure you capture all relevant information. If you need assistance, US Legal Forms offers easy-to-use templates and resources to help you complete the worksheet correctly.

Because each child support order is unique to every case, there is no set minimum for what a parent must pay.

Child support in Arizona is calculated based on several factors, including: The non-custodial parent's income. The number of children. The children's ages. The amount of time the parent spends with their children. The cost of health insurance. The cost of daycare. Any other extraordinary expenses the child requires.

Generally, the non-custodial parent will be ordered by Arizona court to pay a percentage of his or her gross monthly income to the custodial parent in child support.

Because each child support order is unique to every case, there is no set minimum for what a parent must pay. Instead, the proper amount will be determined by the state's set formula to calculate a fair payment that can properly care for the children involved.

Child support must be withheld, up to 50% of the employee's disposable earnings, before deductions for other withholding orders are taken. The only exception is if a federal tax levy is received before the Order/Notice to Withhold Income for Child Support.